CLOSED

GET A PIECE OF WORTHPOINT

Discover. Value. Preserve.

$254,210.32 Raised

REASONS TO INVEST

TEAM

William Hermann Seippel • Founder, Board Member and CEO

Read More

William Neal McAtee • CFO, Board Member

Neal earned a bachelor’s degree in mathematics and economics from Rhodes College and a master’s degree in business administration with a concentration in finance and accounting from the Owen Graduate School of Management at Vanderbilt University. He has held the Chartered Financial Analyst professional designation from the CFA Institute since 1992.

Read More

Antoine S Lyseight • Chief Technology Officer

Antoine is a veteran of information technology and a leader in software development and product delivery with a significant focus in systems integration, point-of-sale (POS), and e-Commerce architecture, as well as end-to-end high-volume websites and applications. He has deep experience with multiple programming languages and processes and has consulted for Fortune 500 companies such as Home Depot, IHG, Turner Broadcasting, and Autotrader.com, as well as many technology startups and growth-phase companies on major revenue-generating projects.

In addition to his software engineering background, Antoine has trained and managed development teams while being responsible for working with executive stakeholders for product development, project management, and quality assurance of all products. He studied computer engineering at the Georgia Institute of Technology and graduated with a bachelor’s degree in business administration with a focus on entrepreneurship from Georgia State University.

Read More

*Market information provided by PRN Newswire (source)

The PITCH

Buy Better, Sell Smarter

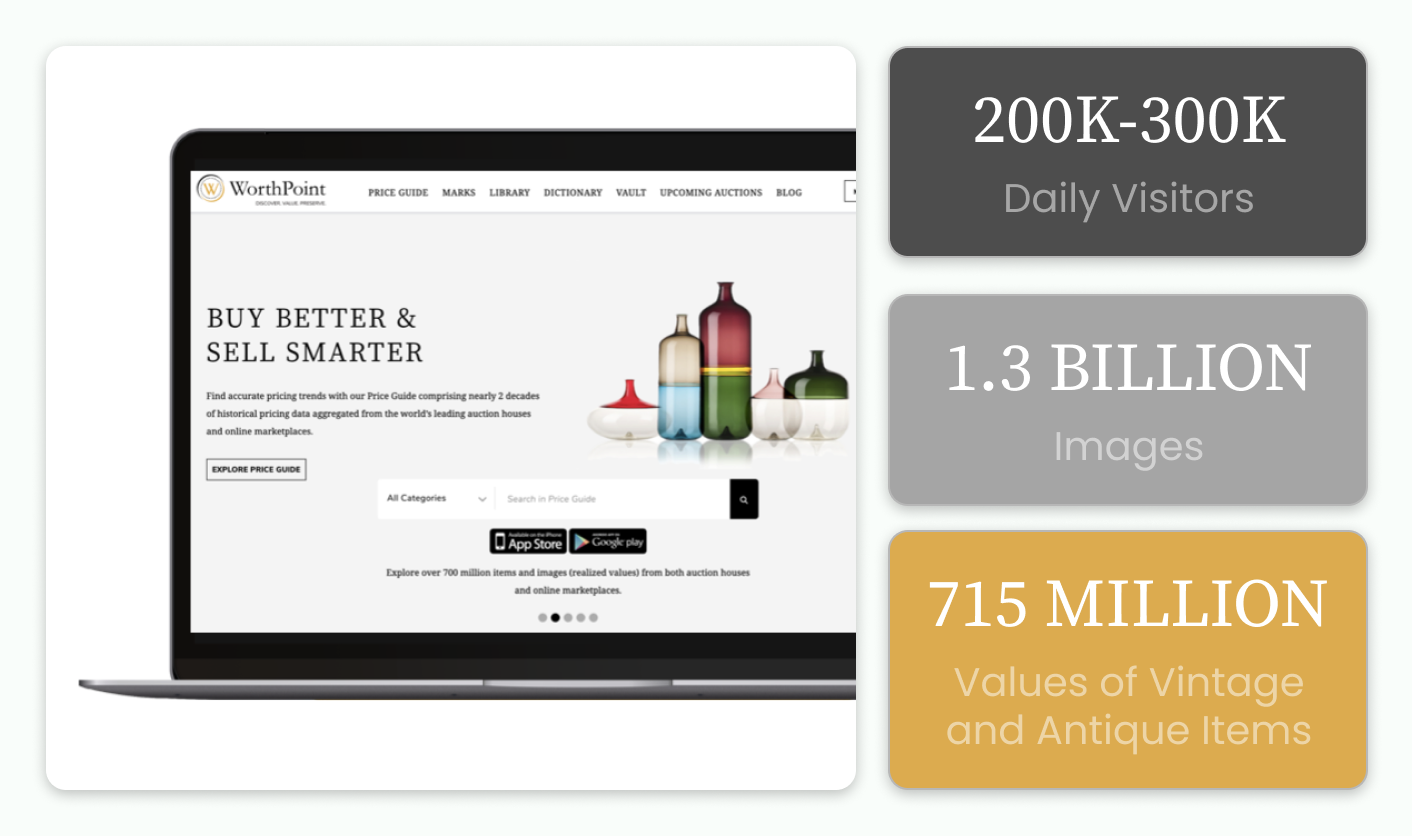

WorthPoint is believed to be one of the world's largest sources of how to value fine art, antiques, and collectibles. This popular site, which brings 200,000 to 300,000 visitors to its platform daily, contains 1.3 billion images and more than 715 million values of vintage and antique items. The Price Guide is enhanced by the company’s Dictionary of more than 8,000 articles and a visual database of more than 227,000 identifiable marks, autographs, patterns, and symbols. This industry-leading suite of services allows buyers and sellers to figure out what an item is, what it’s worth, and what price is reasonable for sale. WorthPoint believes it is the only outside company to share a long-lasting, close working relationship with eBay, the world’s largest e-commerce marketplace for secondhand goods. The company has had eBay as a partner since its founding in 2007.

WorthPoint is backed by a strong leadership team that includes CEO and founder Will Seippel, who has over 25 years of financial and operational experience, a lifetime passion in antiques and collectibles, and a history of structuring complex transactions that have raised $5 billion in capital. Seippel is joined by CFO Neal McAtee, who has been recognized five times as an All-Star Analyst in The Wall Street Journal for his stock-picking ability, and VP of Editorial Content and Public Relations Eric Bradley, who has 25 years of experience in fine art, antiques, and collectibles, authored 12 reference books and buying guides, and has been quoted in The Wall Street Journal and The New York Times.

The Problem & Our Solution

An Even Playing Field

For centuries, fair market values of fine art, antiques, and collectibles were controlled by auction houses and private dealers. This business model kept buyers in the dark about fair pricing. WorthPoint, however, believes that pricing transparency is good for buyers and sellers, as it evens the playing field between the two.

Today, WorthPoint is believed to offer more fair market pricing data than any other company. With more than 715 million prices and 1.3 billion images from both eBay and auction houses, WorthPoint has an extensive database for discovering, valuing, learning about, and preserving collectibles and valuables.

Buyers and sellers can use WorthPoint's Price Guide to find accurate pricing trends from nearly two decades of historical pricing data. Site visitors can also access a digital Library of more than 15,000 books, guides, and catalogs covering topics from comic books to sterling silver and a database of 227,000 makers’ marks, autographs, patterns, and symbols to identify items and uncover their history, value, and authenticity.

The Market & Our Traction

A Growing Collection In A Growing Market

WorthPoint’s number of annual subscriptions has experienced exponential growth during the past few years and now makes up 20% of the company’s subscription revenue—an impressive improvement from 12% just a few years ago. The Online Auction Market value is set to grow by USD 1.90 billion, progressing at a CAGR of 9.7% between 2021 and 2026 (source). Additionally, the market and customer base continue to grow as approximately 10,000 Baby Boomers turn 65 each day and enter the age group most likely to have an estate sale (source). The National Estate Sales Association (NESA) estimates $100 million of revenue is generated nationally each month from estate sales (source). As CEO Will Seippel says, "Art and collectibles are fundamentally an economic asset.”

*These testimonials may not be representative of the experience of other customers and are not a guarantee of future performance or success.

According to UnivDatos Markets Insights, the collectibles market grew to $360 billion in 2020 and is expected to continue at a compound annual growth rate of 4% until 2028 (source). In 2022, collectors paid record prices for collectibles, such as an original iPhone that sold for $63,000 and a 1952 Topps Mickey Mantle baseball card that sold for $12.6 million

Why Invest

Grow With Us

As the market grows, and items from younger generations become classics, WorthPoint’s database continues to expand. The company is currently working on building WorthPoint Indices, which will use its database of more than 700 million realized auction prices to create an index-linked investment product that statistically measures price trends. WorthPoint is also launching the WorthPoint Vault, a user-generated digital database that helps subscribers organize valuables, inventory, and collections and track their values over time. This service will help price, sell, and archive items of emotional and historical significance documented through photographs, family histories, and video. WorthPoint will also be enhancing its mobile app with the option to visually search for items sold and listed in its pricing database.

Experience the power of pricing transparency—invest in WorthPoint today.

ABOUT

HEADQUARTERS

5 Concourse Parkway NE, Suite 2900

Atlanta, GA 30328

WEBSITE

View Site

TERMS

WorthPoint

Overview

PRICE PER SHARE

$12

DEADLINE

Oct. 24, 2023 at 6:59 AM UTC

VALUATION

$45.31M

FUNDING GOAL

$15K - $5M

Breakdown

MIN INVESTMENT

$492

MAX INVESTMENT

$999,996

MIN NUMBER OF SHARES OFFERED

1,250

MAX NUMBER OF SHARES OFFERED

416,666

OFFERING TYPE

Equity

SHARES OFFERED

Series A-2 Preferred Stock

Maximum Number of Shares Offered subject to adjustment for bonus shares

*Maximum Number of Shares Offered subject to adjustment for bonus shares. See Bonus info below.

Investment Incentives and Bonuses*

Time-Based Perks

Friends and Family

Invest within the first 72 hours and receive 15% bonus shares.

Super Early Bird

Invest within the first week and receive 10% bonus shares.

Early Bird Bonus

Invest within the first two weeks and receive 5% bonus shares.

Volume-Based Perks

Tier 1 | $500+

Invest $500+ and receive a free annual subscription for 1 YR, Price Guide Premium. (value $259.99)

Tier 2 | $1,000+

Invest $1,000+ and receive a free annual subscription for 1 YR, All Access (value $449.99)

Tier 3 | $5,000+

Invest $5,000+ and receive a free annual subscription for 5 YRS, All Access (value $2,249.95)

Tier 4 | $10,000+

Invest $10,000+ and receive a free annual subscription for 10 YRS, All Access (value $4,499.99) + 5% bonus shares.

Tier 5 | $25,000+

Invest $25,000+ and receive a free annual subscription for 25 YRS, All Access (value $11,249.75) + 10% bonus shares.

Tier 6 | $50,000+

Invest $50,000+ and receive All Access for Legacy/Forever + 15% bonus shares.

*In order to receive perks from an investment, one must submit a single investment in the same offering that meets the minimum perk requirement. Bonus shares from perks will not be granted if an investor submits multiple investments that, when combined, meet the perk requirement. All perks occur when the offering is completed.

The 10% StartEngine Owners' Bonus

WorthPoint Corporation will offer 10% additional bonus shares for all investments that are committed by investors that are eligible for the StartEngine Crowdfunding Inc. OWNer's bonus.

This means eligible StartEngine shareholders will receive a 10% bonus for any shares they purchase in this offering. For example, if you buy 100 shares of Series A-2 Preferred Stock at $12.00 / share, you will receive 110 shares of Series A-2 Preferred Stock, meaning you'll own 110 shares for $1,200. Fractional shares will not be distributed and share bonuses will be determined by rounding down to the nearest whole share.

This 10% Bonus is only valid during the investor's eligibility period. Investors eligible for this bonus will also have priority if they are on a waitlist to invest and the company surpasses its maximum funding goal. They will have the first opportunity to invest should room in the offering become available if prior investments are canceled or fail.

Investors will receive the highest single bonus they are eligible for among the bonuses based on the amount invested and time of offering elapsed (if any). Eligible investors will also receive the Owner’s Bonus in addition to the aforementioned bonus.

ALL UPDATES

06.05.24

WorthPoint WHires VP of Fin-Tech Indices Products

WorthPoint, the world’s largest pricing source for valuing art, antiques, and collectibles, announced today that Alan Kruml has joined the company as Vice President of Fin-Tech Indices Products. His addition to the WorthPoint team ushers in a new era for the company, which is developing products and services tailored to help consumers and financial institutions manage collections as economic assets.

“Alan was instrumental in starting WorthPoint in 2007, and his role will revolutionize how the company’s industry-leading database and expertise will reach new markets in the financial technology sector,” said Will Seippel, founder and CEO of WorthPoint. “Initiatives such as the WorthPoint Indices are the first product of their kind to further the evolution of financial services and advance collectors’ financial outcomes.”

The WorthPoint Indices is the industry’s first and most comprehensive index-linked investment product to measure price trends statistically. Proprietary software analyzes 800+ million fair market prices paid over the last 17 years to track market fluctuations across limitless collecting categories and individual investment-grade objects. Additionally, WorthPoint will publish a monthly index-focused newsletter tracking and explaining historic price fluctuations in key collecting areas.

The service complements the firm’s Vault collection management product. The Vault enables subscribers to curate custom inventories of valuable objects through photographs, purchase history, provenance, and more. The Vault’s proprietary WorthScore function tracks and reports an object’s real-time market value based on more than 800 million Price Guide entries.

Both WorthPoint Indices and the WorthPoint Vault solve longtime challenges for financial service industries—ranging from wealth management to trust administration, insurance, and appraisers—by elevating the security and worth of the collectors’ valuables, which are considered a facet of their total wealth.

Before joining WorthPoint, Kruml was the Chief Operating Officer of Winbourne Consulting in Arlington, Virginia. In that role, he was responsible for business operations and was a program manager for various technology-based solutions, primarily in the public safety area.

His previous employment has included positions as Chief Information Officer, consulting, and customer service roles in both large and small business venues. He has a BS from Benedictine University and an MBA from the University of Chicago.

Kruml’s extensive domain experience began as a child. He has been an avid collector since grade school and is an active buyer on eBay, CTBids, and MaxSold, as well as at shows and shops. His interests range from coins and currency to stamps, militaria, and objets d’art. When not engaged in corporate projects, he supplements staffing at a large coin and jewelry store in Northern Virginia.

About WorthPoint Corporation

WorthPoint is the world’s largest pricing source to value art, antiques, and collectibles, with access to 800+ million prices realized and 2+ billion images. Its WorthPoint Insider newsletter reaches over 130,000 subscribers weekly, the largest active audience in a $360 billion global marketplace.

In addition to its Price Guide, WorthPoint provides a database of over 257,000 Marks, an 18,000-volume reference Library, and over 8,700 Dictionary articles. These industry-leading research and data tools provide market pricing transparency and allow collectors and resellers to buy and sell more efficiently. More than 200,000 users visit WorthPoint.com daily, and the mobile app—now with visual search recognition—is available for iOS and Android.

Subscribe to the monthly WorthPoint Indices newsletter and the weekly WorthPoint Insider newsletter.

Media Contact: Eric Bradley

Vice President, Public Relations

470-580-1238

10.23.23

Less Than 8 Hours to Invest

Time is running out. We are closing the ability to invest in WorthPoint TODAY–less than 8 hours from now.

WorthPoint is one of the largest sources of data used to value, research and identify art, antiques, and collectibles.

We appreciate you following our offering and look forward to you making an investment.

Only 8 hours left—invest while you still have the chance! Join now.

10.23.23

The Close Is Here 🔔

Investors, friends, and members of the WorthPoint community-

The data and services WorthPoint provides are needed now more than ever. To this end, we have achieved a lot of “firsts” in the antiques and collectibles industry:

✅ the first to have hundreds of millions of fair market values sourced from across the marketplace

✅ the first to introduce a curated visual search for arts, antiques, and collectibles

✅ the first to create an index-linked investment product that statistically measures price trends

This strategic growth is directed by a fast-changing industry and our customers, who expect cutting-edge technology. We focus on customer needs, and that philosophy has helped us grow and face economic tailwinds head-on. We are committed to remaining the best resource of its kind for current and future subscribers.

There are only a few hours left for our crowdfunding campaign on StartEngine. We are asking everyone to come together and help push our funding forward so that we can achieve more for our industry. Your investments will move us into position to continue developing revolutionary products—these are the first of many. Join us

Thank you,

Will Seippel

WorthPoint Founder & CEO

10.23.23

Less Than 18 Hours to Invest

Time is running out. We are closing the ability to invest in WorthPoint on Monday–less than 18 hours from now.

WorthPoint is one of the largest sources of data used to value, research and identify art, antiques, and collectibles.

We appreciate you following our offering and look forward to you making an investment.

Only 18 hours left—invest while you still have the chance! Join now.

10.22.23

Less Than 32 Hours to Invest

Time is running out. We are closing the ability to invest in WorthPoint on Monday–less than 32 hours from now.

WorthPoint is one of the largest sources of data used to value, research and identify art, antiques, and collectibles.

We appreciate you following our offering and look forward to you making an investment.

Only 32 hours left—invest while you still have the chance! Join now.

10.22.23

Less Than 40 Hours to Invest

Time is running out. We are closing the ability to invest in WorthPoint on Monday–less than 40 hours from now.

WorthPoint is one of the largest sources of data used to value, research and identify art, antiques, and collectibles.

We appreciate you following our offering and look forward to you making an investment.

Only 40 hours left—invest while you still have the chance! Join now.

10.22.23

Less Than 51 Hours to Invest

Time is running out. We are closing the ability to invest in WorthPoint on Monday–less than 51 hours from now.

WorthPoint is one of the largest sources of data used to value, research and identify art, antiques, and collectibles.

We appreciate you following our offering and look forward to you making an investment.

Only 51 hours left—invest while you still have the chance! Join now.

10.21.23

Less Than 62 Hours to Invest

Time is running out. We are closing the ability to invest in WorthPoint on Monday–less than 62 hours from now.

WorthPoint is one of the largest sources of data used to value, research and identify art, antiques, and collectibles.

We appreciate you following our offering and look forward to you making an investment.

Only 62 hours left—invest while you still have the chance! Join now.

10.21.23

Less Than 80 Hours to Invest

Time is running out. We are closing the ability to invest in WorthPoint on Monday–less than 80 hours from now.

WorthPoint is one of the largest sources of data used to value, research and identify art, antiques, and collectibles.

We appreciate you following our offering and look forward to you making an investment.

Only 80 hours left—invest while you still have the chance! Join now.

10.13.23

Reason to Invest #3

Reason #3 to Invest in WorthPoint:

WorthPoint’s CEO, Will Seippel, is a lifelong collector and a power seller on eBay. He has over 25 years of financial and operational experience and played a leading role in transactions that have raised $5 billion in capital.

Will founded WorthPoint under this principle: "Art and collectibles are fundamentally an economic asset.” And as older generations are beginning to pass down and sell off their things, the data and tools WorthPoint offers is becoming increasingly important.

“A historic transfer of wealth is taking place in America as $84 trillion is projected to be passed on to future generations through 2045,” says Will. “Millions of families will face the same problem: ‘What is the fair market value of our fine art, heirlooms, and precious objects, and how do we maximize their full value?’ WorthPoint solves this problem with its unparalleled products and resources.”

Only 10 Days Left—invest while you still have the chance! Join now.

REWARDS

10%

Stack Venture Club & Rewards!

Members get an extra 10% shares in addition to rewards below!

Venture Club

Venture Club Members earn 10% bonus shares on top of this and all eligible investments for an entire year. Not a member? Sign up at checkout ($275/year).

$500

Tier 1

Invest $500+ and receive a free annual subscription for 1YR, Price Guide Premium. (value $259.99)

$1,000

Tier 2

Invest $1,000+ and receive a free annual subscription for 1 YR, All Access (value $449.99)

$5,000

Tier 3

Invest $5,000+ and receive a free annual subscription for 5 YRS, All Access (value $2,249.95)

$10,000

Tier 4

Invest $10,000+ and receive a free annual subscription for 10 YRS, All Access (value $4,499.99) + 5% bonus shares.

$25,000

Tier 5

Invest $25,000+ and receive a free annual subscription for 25 YRS, All Access (value $11,249.75) + 10% bonus shares.

$50,000

Tier 6

Invest $50,000+ and receive All Access for Legacy/Forever + 15% bonus shares.

JOIN THE DISCUSSION

0/2500

James Higginbottom

2 years ago

How do I receive the Worthpoint subscription after investing? It is my understanding that Worthpoint will contact investors once the investment has been funded. It has been funded, but I still haven't heard anything. Did I miss something? Thanks!

Show more

1

0

Gem Tanzillo

2 years ago

Hi Guys. Long time fan. I am exceedingly astonished by all of the functionality and additions you've pioneered or rolled out smooth as butta too many times to count. lol. Being equally as passionate about the stuff and the things, the tales and the history- is no small feat. Thanks all you do. Wish I could invest more. - Gem

Show more

1

0

Brine Navarrete

2 years ago

So when one makes a purchase through your website, they are just essentially buying it through E-bay? You are working as a 2nd party charging a subscription fee on use your sight? I'm not sure i understand why charge a subscription fee? unless it comes with other benefits that will insure my future purchases, auctions and bids.

Show more

1

0

Katharine Jablonsky

2 years ago

How do I receive the Worthpoint subscription after I invested?

1

0

Christopher Zusin

2 years ago

What is the structure of the 18.75% debt instrument with Espresso Capital? It appears to operate like a $12m line of credit w/$7.6m having already been leveraged. I have read the Form C and, given the credit card level interest rate, I believe the mgmt discussion to be wholly inadequate in defining the path forward for what looks to be an extraordinarily expensive debt instrument - a roughly $1.5m/yr interest expense at the present balance. As an engineering manager, I can confidently state that the interest expense alone could pay for a literal team of devs to improve the product if translated into an operating expense. Given the limited traction of this Reg CF raise ($185k as of this post), does the company have alternate sources of capital (or debt at more reasonable terms) to tackle this problem?

Show more

2

0

Odette Heller

2 years ago

Hello. I would like to know if you become an investor will we have free subscription to Worthpoint.com and free access to look up collectibles and any type of assistance needed? Also do you think the investors will start getting paid for investing? Thanks

Show more

1

0

Richard Koch

2 years ago

I see your mention of subscription customers, is the service offered to professionals only? If someone were to inherent 'ol Aunt Mildred's "Ming" vase, could they come to you for an estimate of a single piece? Or is this more geared for auction sites to set prices? I'm having trouble with who the end user would be.

Show more

1

0

Kyle Pestano

2 years ago

Isn't 1-2x CY revenue a typical valuation standard for your industry? Can you explain the reasoning behind a 4.5x multiple?

Show more

1

0

Kyle Pestano

2 years ago

I see a significant jump in Operating Expenses.. why is this and what are you currently doing to fix this? When is debt coming due? Concerned with the amount of liquidity on hand and your current burn rate. Can you speak to how you'll manage this?

Show more

1

0

HOW INVESTING WORKS

Cancel anytime before 48 hours before a rolling close or the offering end date.

WHY STARTENGINE?

REWARDS

We want you to succeed and get the most out of your money by offering rewards and memberships!

SECURE

Your info is your info. We take pride in keeping it that way!

DIVERSE INVESTMENTS

Invest in over 200 start-ups and collectibles!

FAQS

With Regulation A+, a non-accredited investor can only invest a maximum of 10% of their annual income or 10% of their net worth per year, whichever is greater. There are no restrictions for accredited investors.

With Regulation Crowdfunding, non-accredited investors with an annual income or net worth less than $124,000 are limited to invest a maximum of 5% of the greater of those two amounts. For those with an annual income and net worth greater than $124,000, they are limited to investing 10% of the greater of the two amounts.

At the close of an offering, all investors whose funds have “cleared” by this time will be included in the disbursement. At this time, each investor will receive an email from StartEngine with their Countersigned Subscription Agreement, which will serve as their proof of purchase moving forward.

Please keep in mind that a company can conduct a series of “closes” or withdrawals of funds throughout the duration of the campaign. If you are included in that withdrawal period, you will be emailed your countersigned subscription agreement and proof of purchase immediately following that withdrawal.

StartEngine assists companies in raising capital, and once the offering is closed, we are no longer involved with whether the company chooses to list shares on a secondary market or what occurs thereafter. Therefore, StartEngine has no control or insight into your investment after the close of the live offering. In addition, we are not permitted to provide financial advice. You may want to contact a financial professional to discuss possible investment outcomes.

For Regulation Crowdfunding, investors are able to cancel their investment at any point throughout the campaign up until 48 hours before the closing of the offering. Note: If the company does a rolling close, they will post an update to their current investors, giving them the opportunity to cancel during this timeframe. If you do not cancel within this 5-day timeframe, your funds will be invested in the company, and you will no longer be able to cancel the investment. If your funds show as ‘Invested’ on your account dashboard, your investment can no longer be canceled.

For Regulation A+, StartEngine allows for a four-hour cancellation period. Once the four-hour window has passed, it is up to each company to set their own cancellation policy. You may find the company’s cancellation policy in the company’s offering circular.

Once your investment is canceled, there is a 10-day clearing period (from the date your investment was submitted). After your funds have cleared the bank, you will receive your refund within 10 business days.

Refunds that are made through ACH payments can take up to 10 business days to clear. Unfortunately, we are at the mercy of the bank, but we will do everything we can to get you your refund as soon as possible. However, every investment needs to go through the clearing process in order to be sent back to the account associated with the investment.

Both Title III (Regulation Crowdfunding) and Title IV (Reg A+) help entrepreneurs crowdfund capital investments from unaccredited and accredited investors. The differences between these regulations are related to the investor limitations, the differing amounts of money companies are permitted to raise, and differing disclosure and filing requirements. To learn more about Regulation Crowdfunding, click here, and for Regulation A+, click here.

Sofia Ardiles

a year ago

I am still wondering how when I will receive my subscription for the year. I want to make sure I am not missing something because I have not heard from anyone.

Show more

1

0