GET A PIECE OF CANCERVAX

A Revolutionary Way to Treat Cancer

Show more

REASONS TO INVEST

Previously raised $5.6 million in venture and crowdfunding. Our novel pre-clinical technology disguises cancer cells to look like well-immunized diseases, such as measles, and “tricks” the body into killing them with precision.

A world-class science team that has created multiple successful drugs that have gone to market.

A purpose-driven company with huge market potential. According to the World Health Organization, cancer is the second leading cause of death globally and was responsible for 10 million deaths in 2023. According to a 2024 report from Statista, the global cancer immunotherapy market will grow from $83 billion in 2023 to $231 billion by 2031.*

*Market projections are inherently uncertain and actual results may vary significantly.

TEAM

Byron Horton Elton • President, CEO and Principal Accounting Officer

Read More

George Edwin Katibah, PhD • Chief Scientific Officer

Read More

Adam Grant, PhD • Principal Scientist

Read More

the pitch

CancerVax is a pre-clinical biotech company developing a Universal Cancer Treatment Platform designed to target and eliminate cancer cells while leaving healthy cells unharmed. Our technology harnesses artificial intelligence to DETECT, MARK, and KILL cancer cells by disguising them as known pathogens, like measles, to trigger a natural immune response. With a seasoned scientific team and promising early-stage research, we envision a future where treating cancer will be as simple as getting a shot.

We have assembled a world-class team of experienced cancer scientists and advisors to help develop our novel cancer technology.

Our Development Partners

the problem & OUR SOLUTION

Cancer remains one of the deadliest diseases worldwide, claiming 10 million lives in 2023 alone (source: WHO). Traditional treatments like chemotherapy, radiation, and surgery come with severe side effects and inconsistent success rates. Despite advancements in immunotherapy, current therapies struggle to generate a strong or lasting immune response, leaving patients with limited options.

The Problem

The body’s immune system is very good at killing foreign pathogens, such as the measles virus. Unfortunately, it’s not very good at killing cancer cells, because cancer cells were originally healthy cells. This is why cancer grows undetected by the immune system and is so hard to treat.

Our Solution

CancerVax is pioneering a novel approach that tricks the immune system into identifying and attacking only cancer cells. Our technology forces cancer cells to produce proteins that mimic those of well-immunized diseases, like measles or chickenpox. The immune system, already trained to fight these diseases, then rapidly eliminates the disguised cancer cells. This innovative method leverages AI-powered detection and a two-step targeting system, providing a precise and potentially more effective treatment.

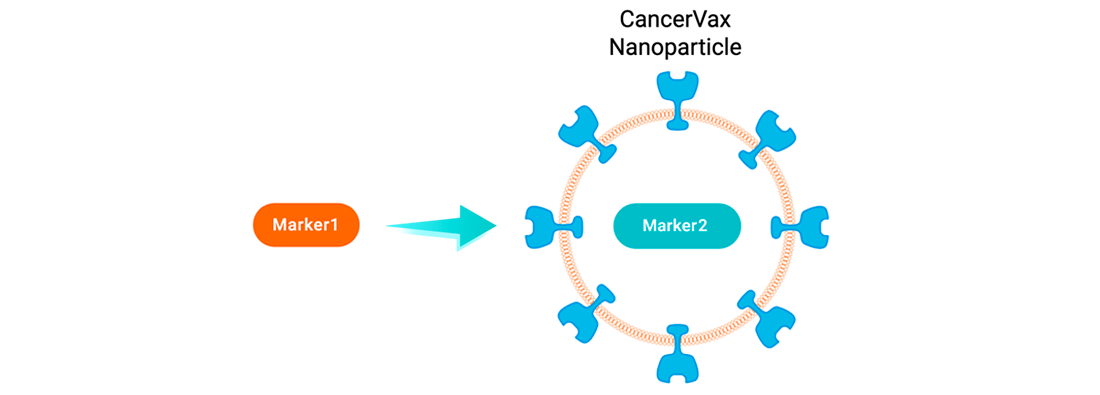

Our technology is packaged into a nanoparticle that is programmed to seek out only cancer cells and uses a novel 2-step strategy to precisely detect cancer cells.

- Step 1 - Detect cell surface markers outside the cell (Marker1)

- Step 2 - Detect cancer genetic signatures inside the cell (Marker2)

*The graphics shown represent the Company's pre-clinical technology; FDA clearance is required before market use and may never be obtained.

Breakthrough Technology

*The graphics shown represent the Company's pre-clinical technology; FDA clearance is required before market use and may never be obtained.

*The graphics shown represent the Company's pre-clinical technology; FDA clearance is required before market use and may never be obtained.

*The graphics shown represent the Company's pre-clinical technology; FDA clearance is required before market use and may never be obtained.

the market & our Early-Stage Validation

Cancer is the second leading cause of death globally, with 1.95 million new cases diagnosed in the U.S. in 2023 (American Cancer Society). The global cancer immunotherapy market is projected to grow from $83 billion in 2023 to $231 billion by 2031 (Statista), reflecting increasing demand for innovative treatment options.

*Market projections are inherently uncertain and actual results may vary significantly.

Our Early-Stage Validation

CancerVax is a pre-clinical biotech company with successful in-vitro test results. Our nanoparticle-based cancer vaccine technology is being developed in collaboration with leading scientific teams and biotech partners, including Flashpoint Therapeutics and Cytiva. We believe we are on track to complete animal studies by Q1 2026, marking a crucial step toward clinical trials.

We are developing a novel Universal Cancer Treatment Platform designed to be customizable as off-the-shelf injections to treat many types of cancer. Powered by artificial intelligence, our revolutionary approach DETECTS, MARKS, and KILLS only cancer cells using the body’s immune system. Other immunotherapies have had limited success trying to “teach” the immune system how to recognize cancer cells. Our approach is to make cancer cells look like a common disease that it already recognizes, such as measles, and “trick” the body into killing these “disguised” cancer cells.

We envision a day when treating cancer will be as simple as getting a shot – it’s a better way to treat cancer.

Competitors & What Makes Us Different

Current cancer treatments rely on surgery, chemotherapy, and radiation, which attack both cancerous and healthy cells, causing severe side effects. In contrast, modern immunotherapies like Keytruda (Merck) and Opdivo (Bristol Myers Squibb) attempt to activate the immune system but often produce only short-lived or weak responses.

What Makes Us Different

CancerVax’s approach stands apart by not just stimulating the immune system but actively disguising cancer cells as a known pathogen. This method allows the immune system to respond immediately and aggressively, potentially leading to more effective and longer-lasting results than traditional immunotherapies.

Achievements & Recognition

- CancerVax’s novel approach has been recognized by top cancer researchers and has attracted a world-class advisory board of leading scientists in oncology, immunology, and nanotechnology.

- Our development partners, including Flashpoint Therapeutics and Cytiva, are leaders in advanced cancer research and drug delivery systems.

- Early lab results have successfully validated our Smart mRNA technology in actual cancer cells, marking a significant milestone toward clinical trials.

why invest

CancerVax is developing a novel and promising approach to cancer treatment that will harness the body’s immune system to eliminate only cancer cells. With a global cancer market valued in the hundreds of billions, a strong scientific team, and early-stage validation, CancerVax presents a unique opportunity to be part of a potential breakthrough in cancer treatment.

Be part of the future of cancer treatment. Invest in CancerVax today.

THE OFFERING MATERIALS MAY CONTAIN FORWARD-LOOKING STATEMENTS AND INFORMATION RELATING TO, AMONG OTHER THINGS, THE COMPANY, ITS BUSINESS PLAN AND STRATEGY, AND ITS INDUSTRY. THESE FORWARD-LOOKING STATEMENTS ARE BASED ON THE BELIEFS OF, ASSUMPTIONS MADE BY, AND INFORMATION CURRENTLY AVAILABLE TO THE COMPANY’S MANAGEMENT. WHEN USED IN THE OFFERING MATERIALS, THE WORDS “ESTIMATE,” “PROJECT,” “BELIEVE,” “ANTICIPATE,” “INTEND,” “EXPECT” AND SIMILAR EXPRESSIONS ARE INTENDED TO IDENTIFY FORWARD-LOOKING STATEMENTS, WHICH CONSTITUTE FORWARD LOOKING STATEMENTS. THESE STATEMENTS REFLECT MANAGEMENT’S CURRENT VIEWS WITH RESPECT TO FUTURE EVENTS AND ARE SUBJECT TO RISKS AND UNCERTAINTIES THAT COULD CAUSE THE COMPANY’S ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE CONTAINED IN THE FORWARD-LOOKING STATEMENTS. INVESTORS ARE CAUTIONED NOT TO PLACE UNDUE RELIANCE ON THESE FORWARD-LOOKING STATEMENTS, WHICH SPEAK ONLY AS OF THE DATE ON WHICH THEY ARE MADE. THE COMPANY DOES NOT UNDERTAKE ANY OBLIGATION TO REVISE OR UPDATE THESE FORWARD-LOOKING STATEMENTS TO REFLECT EVENTS OR CIRCUMSTANCES AFTER SUCH DATE OR TO REFLECT THE OCCURRENCE OF UNANTICIPATED EVENTS.

ABOUT

HEADQUARTERS

1633 W Innovation Way, Floor 5

Lehi, UT 84043

WEBSITE

View Site

TERMS

CancerVax

Overview

PRICE PER SHARE

$2.10

DEADLINE

Sep. 2, 2025 at 6:59 AM UTC

VALUATION

$81.54M

FUNDING GOAL

$10K - $1.23M

Breakdown

MIN INVESTMENT

$525

MAX INVESTMENT

$1,234,999.50

MIN NUMBER OF SHARES OFFERED

4,761

MAX NUMBER OF SHARES OFFERED

588,095

OFFERING TYPE

Equity

SHARES OFFERED

Common Stock

Maximum Number of Shares Offered subject to adjustment for bonus shares

*'Maximum number of shares offered subject to adjustment for bonus shares. See Bonus info below.

Investment Incentives & Bonuses*

Loyalty Bonus

As a previous investor or subscriber at CancerVax, you qualify for additional 20% bonus shares

Time-Based Perks

Early Bird 1: Invest $525+ within the first 2 weeks | 10% bonus shares

Early Bird 2: Invest $1,000+ within the first 2 weeks | 12% bonus shares

Early Bird 3: Invest $5,000+ within the first 2 weeks | 15% bonus shares

Early Bird 4: Invest $10,000+ within the first 2 weeks | 20% bonus shares

Early Bird 5: Invest $25,000+ within the first 2 weeks | 25% bonus shares

Early Bird 6: Invest $50,000+ within the first 2 weeks | 30% bonus shares

Mid-Campaign Perks (Flash Perks)

Flash Perk 1: Invest $2,500+ between day 35 - 40 and receive 8% bonus shares

Flash Perk 2: Invest $2,500+ between day 60 - 65 and receive 8% bonus shares

Amount-Based Perks

Tier 1 Perk: $1,000+ - Receive 5% bonus shares

Tier 2 Perk: $2,500+ - Receive 7% bonus shares

Tier 3 Perk: $5,000+ - Access to exclusive investor webinar + 10% bonus shares

Tier 4 Perk: $10,000+ - Conference call with the CEO + 15% bonus shares

Tier 5 Perk: $25,000+ - Private virtual meeting with the CEO and the Principal Scientist + 20% bonus shares

Tier 6 Perk: $50,000+ - Private lunch with the CEO and Science Team (Travel and Lodging Not Included) + 25% bonus shares

*In order to receive perks from an investment, one must submit a single investment in the same offering that meets the minimum perk requirement. Bonus shares from perks will not be granted if an investor submits multiple investments that, when combined, meet the perk requirement. All perks occur when the offering is completed.

Crowdfunding investments made through a self-directed IRA cannot receive non-bonus share perks due to tax laws. The Internal Revenue Service (IRS) prohibits self-dealing transactions in which the investor receives an immediate, personal financial gain on investments owned by their retirement account. As a result, an investor must refuse those non-bonus share perks because they would be receiving a benefit from their IRA account.

The 10% StartEngine Venture Club Bonus

CancerVax will offer 10% additional bonus shares for all investments that are committed by investors that are eligible for the StartEngine Venture Club.

This means eligible StartEngine shareholders will receive a 10% bonus for any shares they purchase in this offering. For example, if you buy 100 shares of Common stock at $2.10/ share you will receive 110 shares of Common Stock, meaning you'll own 110 shares for $210. Fractional shares will not be distributed and share bonuses will be determined by rounding down to the nearest whole share.

This 10% Bonus is only valid during the investor's eligibility period. Investors eligible for this bonus will also have priority if they are on a waitlist to invest and the company surpasses its maximum funding goal. They will have the first opportunity to invest should room in the offering become available if prior investments are canceled or fail.

Investors will receive the highest single bonus they are eligible for among the bonuses based on either the amount invested or the time of offering elapsed (if any). Eligible investors will also receive the Venture Club bonus and the Loyalty Bonus in addition to the aforementioned bonus.

Irregular Use of Proceeds

NEW UPDATES

06.09.25

CancerVax Targets Rare Liver Cancers with AI

We just made a bold move. CancerVax has announced a new research initiative focused on rare, aggressive liver cancers with stem cell-like characteristics. This direction is informed by recent AI-supported findings that identified potentially unique genetic markers.

These cancers are among the hardest to treat and have some of the worst outcomes. But we’ve identified a distinct “Marker2” signature, making them perfect candidates for our Smart mRNA platform that detects, marks, and kills only cancer cells.

Why this matters: Expanding to liver cancers (alongside pancreatic) shows the power and flexibility of our Universal Cancer Treatment approach. One platform. Many cancers. Huge potential.

We’re now creating new nanoparticles and preparing for in vitro and in vivo testing. More updates coming soon as we push closer to a world where fighting cancer is as simple as getting a shot.

JOIN US ON THE FRONT LINES

This Reg CF offering is made available through StartEngine Primary, LLC. This investment is speculative, illiquid, and involves a high degree of risk, including the possible loss of your entire investment.

ALL UPDATES

06.05.25

CancerVax Achieves Major Milestone!

MAJOR MILESTONE: CancerVax Creates Cell-Targeting Nanoparticle

Big news! We’ve just achieved a major milestone—our team successfully created a nanoparticle that can precisely target cancer cells using a biomarker we call “Marker1.”

This is Step 1 of our breakthrough 2-step Universal Cancer Treatment. Step 2? Delivering our proprietary Smart mRNA (Marker2), which tricks cancer cells into looking like viruses—activating the immune system to destroy them while sparing healthy cells.

Why it matters: Lab tests confirmed our nanoparticles can now be manufactured at scale. This is a key proof point for our targeted, safer, and potentially more effective approach to treating cancer.

We’re now combining Marker2 Smart mRNA into these Marker1 nanoparticles to begin full therapeutic testing. This brings us one step closer to a world where treating cancer is as simple as getting a shot.

INVEST NOW TO BE PART OF THIS BREAKTHROUGH →

https://investment.startengine.com/cancervax/landing-page

This Reg CF offering is made available through StartEngine Primary, LLC. This investment is speculative, illiquid, and involves a high degree of risk, including the possible loss of your entire investment.

06.04.25

Meet our Chief Scientific Officer, Dr. Katibah!

Why did CancerVax choose Dr. George Katibah to serve as its Chief Scientific Officer?

Dr. George Katibah is an expert in the discovery, development, and translation of novel therapies across diverse therapeutic modalities. He has a deep background in immunology and the tumor microenvironment with a broad therapeutic domain expertise, including oncology, immunology, personalized medicine, and infectious diseases.

Dr. Katibah was on teams that developed the first-in-human drug candidates, including small molecule STING agonists and the personalized cancer neoantigen vaccine. He has Co-authored more than 16 scientific papers and is an inventor on 3 issued U.S. patents and multiple pending applications.

Dr. Katibah was formerly Director of Discovery Biology at RAPT Therapeutics and formerly Senior Scientist and Head of Biochemistry at Aduro Biotech. He received his B.S. in Plant Sciences from the University of California, Santa Cruz and received his PhD in Molecular and Cell Biology from the University of California, Berkeley.

Byron Elton, CEO of CancerVax said, "We couldn’t be more thrilled to welcome Dr. George Katibah to our team as our Chief Scientific Officer! George originally served as an advisor, and we quickly realized how valuable he could be in leading the development of our novel cancer treatment technology. George’s immediate focus will be on our pre-clinal development efforts, and he will help get us through animal studies and beyond. We look forward to his leadership.”

When asked why Dr. Katibah decided to join CancerVax, he said: “I am very excited about joining CancerVax and the opportunity to serve as the company’s Chief Scientific Officer. Our approach is novel. Our proprietary method to accurately detect cancer, mark it by forcing cancer cells to express common pathogen proteins, and then kill these cancer cells by inducing pre-existing immune response, has never been done in this way. What makes this approach very promising is that many of the individual steps in our technology have been successfully researched, and we are now combining these steps in a completely novel way. We look forward to releasing data on our research as we reach significant milestones.”

A link to the full press release can be found here!

This Reg CF offering is made available through StartEngine Primary, LLC. This investment is speculative, illiquid, and involves a high degree of risk, including the possible loss of your entire investment.

06.03.25

CancerVax Scientists Featured on Podcast

CancerVax Scientists Featured on Cytiva’s “Discovery Matters” Podcast Discussing Universal Cancer Vaccine Platform

Dr. George Katibah and Dr. Adam Grant describe the features and progress of the Company’s revolutionary technology

Lehi, Utah – June 3rd, 2025 – CancerVax, Inc., the developer of a breakthrough universal cancer treatment (UCT) platform that will use the body’s immune system to fight cancer, today announced that two of its lead scientists, Dr. George Katibah and Dr. Adam Grant, were recently featured on Cytiva’s influential podcast series, Discovery Matters. The episode highlights CancerVax’s revolutionary approach to immunotherapy and its mission to create a therapy that can universally target and destroy cancer cells.

In the episode titled: “104. Vaccines: Inverse v traditional”, host Dodi Axelson explores how CancerVax’s technology is designed to “disguise” cancer cells as common pathogens, such as measles, enabling the body’s immune system to recognize and eliminate them effectively. Dr. Katibah and Dr. Grant explain how their universal cancer treatment platform operates through a highly targeted two-step process that detects and marks cancer cells while sparing healthy tissue.

“The immune system is really good at fighting diseases it’s seen before, like measles or chickenpox,” said Dr. Katibah. “We’re taking advantage of that by teaching cancer cells to mimic those threats. It’s not about retraining the immune system; it’s about showing cancer in a language the immune system already understands.”

During the conversation, the scientists emphasize how this universal strategy could overcome many of the limitations facing personalized cancer vaccines and current immunotherapies. Rather than building an immune response from scratch for each patient, CancerVax leverages the body’s existing defenses, allowing for faster and potentially more effective treatments.

Dr. Grant adds, “What’s most exciting about our universal cancer treatment platform is the potential precision of our Smart mRNA technology. Our Smart mRNA is designed to be turned on in cancer cells and turned off in healthy cells. This cancer specificity can be a huge leap forward to improving patient outcomes while significantly reducing harmful side effects.”

The interview also touches on the company’s recent milestones, including successful in-vitro validation of its Smart mRNA in multiple cancer cell lines and the ongoing development of a candidate therapy for pancreatic ductal adenocarcinoma (PDAC).

The Discovery Matters podcast is produced by Cytiva, a global leader in life sciences.

Listen to the podcast starting at the CancerVax segment here:

https://www.youtube.com/watch?v=Pmg9profy2g&t=1203s

About CancerVax

CancerVax is a pre-clinical biotech company developing a novel Universal Cancer Treatment platform that will be customizable, as an injection, to treat many types of cancer. Our innovative approach DETECTS, MARKS, and KILLS only cancer cells. By making cancer cells look like well-immunized common diseases such as measles or chickenpox, we intend to use the body’s natural immune system to easily kill the cancer cells. We look forward to the day when treating cancer will be as simple as getting a shot – a better way to fight cancer. To learn more, please visit www.CancerVax.com

Forward-Looking Statements

This press release may contain “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations, and assumptions regarding the future of our business, plans and strategies, projections, anticipated events and trends, the economy, and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks, and changes in circumstances that are difficult to predict, many of which are outside our control. Our actual results and financial condition may differ materially from those in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. Any forward-looking statement made by us in this release is based only on information currently available to us and speaks only as of the date it is made. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments, or otherwise.

Press Contact: CancerVax, Inc. Tel: (805) 356-1810 communications@CancerVax.com

This Reg CF offering is made available through StartEngine Primary, LLC. This investment is speculative, illiquid, and involves a high degree of risk, including the possible loss of your entire investment.

06.02.25

CancerVax launches new funding campaign!

We're excited to announce that our Reg CF funding campaign on StartEngine is now live! Click here to invest!

As a valued follower of CancerVax, you qualify for our exclusive Early Bird investment rewards! This means you could earn bonuses of up to 25% on your investment!

As an example, if someone invests $5,000 and is also a Venture Club Member they could earn: Early Bird Bonus (15%) + Venture Club Bonus (10%). This would total 25% in bonuses!

→ View Our Campaign to learn more! https://www.startengine.com/offering/cancervax

This Reg CF offering is made available through StartEngine Primary, LLC. This investment is speculative, illiquid, and involves a high degree of risk, including the possible loss of your entire investment.

REWARDS

10%

Stack Venture Club & Rewards!

Members get an extra 10% shares in addition to rewards below!

Venture Club

Venture Club Members earn 10% bonus shares on top of this and all eligible investments for an entire year. Not a member? Sign up at checkout ($275/year).

$525

Early Bird 1

Invest $525+ within the first 2 weeks | 10% bonus shares

06

Days

08

Hours

47

Minutes

01

Seconds

$1,000

Early Bird 2

Invest $1,000+ within the first 2 weeks | 12% bonus shares

06

Days

08

Hours

47

Minutes

01

Seconds

$1,000

Tier 1 Perk

$1,000+ - Receive 5% bonus shares

$2,500

Tier 2 Perk

$2,500+ - Receive 7% bonus shares

$5,000

Early Bird 3

Invest $5,000+ within the first 2 weeks | 15% bonus shares

06

Days

08

Hours

47

Minutes

01

Seconds

$5,000

Tier 3 Perk

$5,000+ - Access to exclusive investor webinar + 10% bonus shares

$10,000

Early Bird 4

Invest $10,000+ within the first 2 weeks | 20% bonus shares

06

Days

08

Hours

47

Minutes

01

Seconds

$10,000

Tier 4 Perk

$10,000+ - Conference call with the CEO + 15% bonus shares

$25,000

Early Bird 5

Invest $25,000+ within the first 2 weeks | 25% bonus shares

06

Days

08

Hours

47

Minutes

01

Seconds

$25,000

Tier 5 Perk

$25,000+ - Private virtual meeting with the CEO and the Principal Scientist + 20% bonus shares

$50,000

Tier 6 Perk

$50,000+ - Private lunch with the CEO and Science Team (Travel and Lodging Not Included) + 25% bonus shares

$50,000

Early Bird 6

Invest $50,000+ within the first 2 weeks | 30% bonus shares

06

Days

08

Hours

47

Minutes

01

Seconds

JOIN THE DISCUSSION

0/2500

HOW INVESTING WORKS

Cancel anytime before 48 hours before a rolling close or the offering end date.

WHY STARTENGINE?

REWARDS

We want you to succeed and get the most out of your money by offering rewards and memberships!

SECURE

Your info is your info. We take pride in keeping it that way!

DIVERSE INVESTMENTS

Invest in over 200 start-ups and collectibles!

FAQS

With Regulation A+, a non-accredited investor can only invest a maximum of 10% of their annual income or 10% of their net worth per year, whichever is greater. There are no restrictions for accredited investors.

With Regulation Crowdfunding, non-accredited investors with an annual income or net worth less than $124,000 are limited to invest a maximum of 5% of the greater of those two amounts. For those with an annual income and net worth greater than $124,000, they are limited to investing 10% of the greater of the two amounts.

At the close of an offering, all investors whose funds have “cleared” by this time will be included in the disbursement. At this time, each investor will receive an email from StartEngine with their Countersigned Subscription Agreement, which will serve as their proof of purchase moving forward.

Please keep in mind that a company can conduct a series of “closes” or withdrawals of funds throughout the duration of the campaign. If you are included in that withdrawal period, you will be emailed your countersigned subscription agreement and proof of purchase immediately following that withdrawal.

StartEngine assists companies in raising capital, and once the offering is closed, we are no longer involved with whether the company chooses to list shares on a secondary market or what occurs thereafter. Therefore, StartEngine has no control or insight into your investment after the close of the live offering. In addition, we are not permitted to provide financial advice. You may want to contact a financial professional to discuss possible investment outcomes.

For Regulation Crowdfunding, investors are able to cancel their investment at any point throughout the campaign up until 48 hours before the closing of the offering. Note: If the company does a rolling close, they will post an update to their current investors, giving them the opportunity to cancel during this timeframe. If you do not cancel within this 5-day timeframe, your funds will be invested in the company, and you will no longer be able to cancel the investment. If your funds show as ‘Invested’ on your account dashboard, your investment can no longer be canceled.

For Regulation A+, StartEngine allows for a four-hour cancellation period. Once the four-hour window has passed, it is up to each company to set their own cancellation policy. You may find the company’s cancellation policy in the company’s offering circular.

Once your investment is canceled, there is a 10-day clearing period (from the date your investment was submitted). After your funds have cleared the bank, you will receive your refund within 10 business days.

Refunds that are made through ACH payments can take up to 10 business days to clear. Unfortunately, we are at the mercy of the bank, but we will do everything we can to get you your refund as soon as possible. However, every investment needs to go through the clearing process in order to be sent back to the account associated with the investment.

Both Title III (Regulation Crowdfunding) and Title IV (Reg A+) help entrepreneurs crowdfund capital investments from unaccredited and accredited investors. The differences between these regulations are related to the investor limitations, the differing amounts of money companies are permitted to raise, and differing disclosure and filing requirements. To learn more about Regulation Crowdfunding, click here, and for Regulation A+, click here.

PREVIOUSLY CROWDFUNDED

MIN INVEST

VALUATION

Most Momentum

Top 15 in amount raised last 72 hours

What does this badge mean? See here

Aaron Drabkin

17 hours ago

A couple of questions. How did you come to the valuation amount? Was that validated by any traditional VCs? Does this round have a lead investor? If so, who?

Show more

0

0