CLOSED

GET A PIECE OF WALLABING, INC.

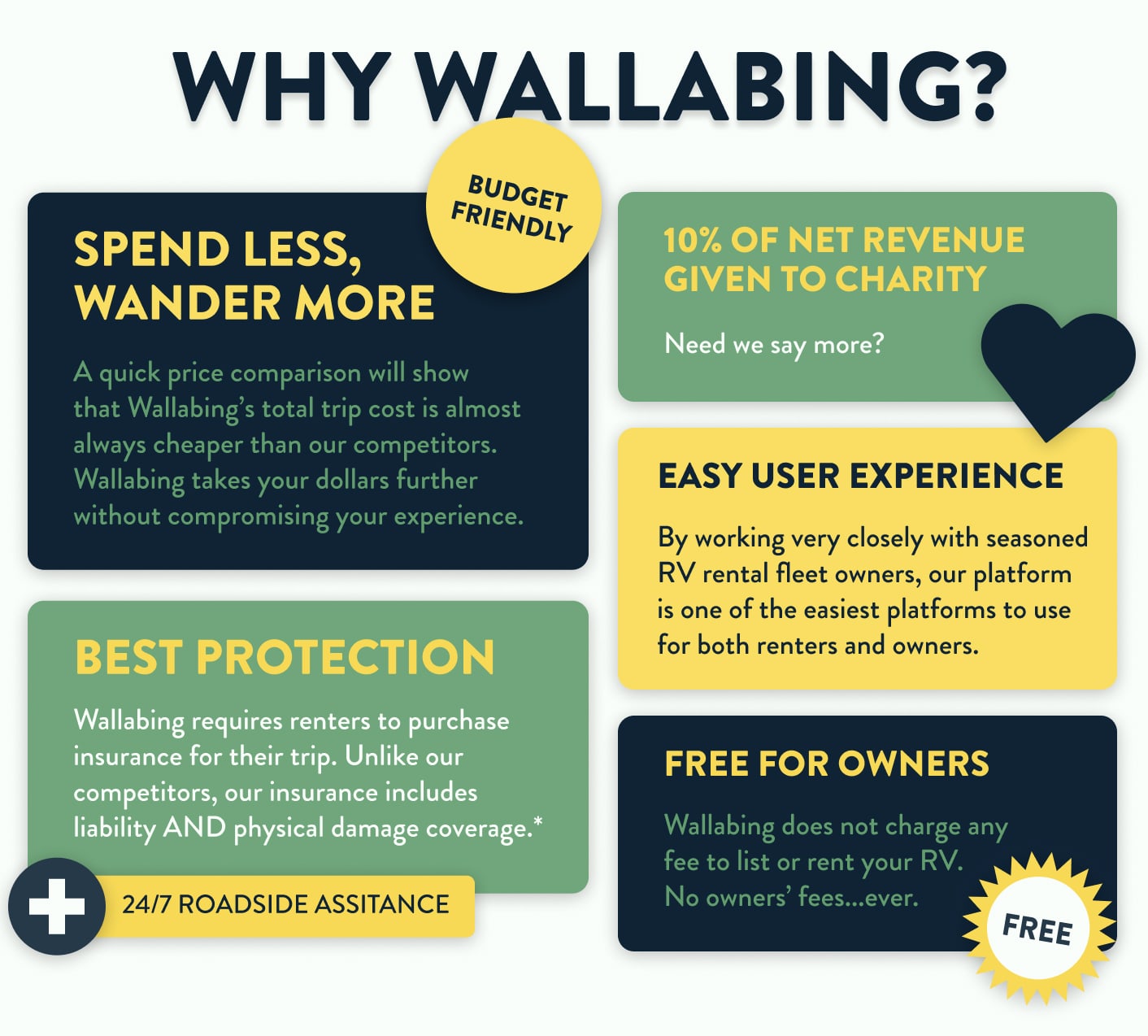

Spend Less, Wander More

Show more

REASONS TO INVEST

TEAM

Jason Carlson • Founder and CEO

After earning a degree in Finance, and working in asset management and consulting, I realized I wanted to get back to that spirit of adventure that was instilled in me by my parents. When I started my own family, I was eager to show them the wonders that an RV adventure could bring. They fell in love just as I did and that was the true foundation of Wallabing. From there it took a few years to marry my expertise and educational background with the desire I had to instill that same sense of curiosity and exploration in each and every client to create the product we have today. Every day since then has been a different and challenging adventure on it’s own.

Read More

Mary Carlson • Founder and Chairman of the Board

As for me, after becoming both fifth and seventeenth in the country with horseback riding and graduating from SMU, I started my own horse business, where I trained and showed young horses to be sold. Shortly after that, I was invited to work in my family’s office and learn the ropes of commercial real estate investment. Observing many of the risks that my dad took, I knew that I had to take some of my own if I was going to achieve similar success.

The opportunity to take such a chance revealed itself through my husband and I’s love of renting RV’s. We then considered applying our real estate principles to owning a fleet of rental RVs. In the process however, we saw the opportunity to build a marketplace instead—the ultimate rental portfolio. We hope that you will join us on this awesome adventure! Let’s Wallabing!

Read More

Alexandra Arbuckle Johnson • COO

Read More

*Market information provided by the RV Industry Association & AOWanders.com (source, source, source)

the pitch

Calling all wanderlusters! Wallabing is a new online platform created to make RV travel safe, simple, and seamless. Through our website and mobile app, listing rentals is free for RV owners and easy to book for travelers who want to head out on their next adventure without hassle. We take care of all the important details, so that all you have to do is get out your roadmap and go.

Taking Vacation Rental On The Road

Wallabing is ready to lead the way towards a new frontier of hospitality. Our peer-to-peer marketplace makes RV rental streamlined and straightforward for renters and owners alike by eliminating hidden fees and doing all the heavy lifting behind the scenes. On the Wallabing platform, you’ll find RVs of all sizes and sleep capacities, plus experience enhancing amenities like kayaks and camping chairs, customizable for any excursion.

For vehicle owners listing is free and easy, and for travelers we keep pricing transparent, so you know exactly what you’ll pay before you book. Meanwhile, the Wallabing team takes care of back end logistics – including comprehensive insurance, roadside assistance, DMV checks, and payment processing – ensuring that the entire process is easy and convenient for our users.

The Problem & Our Solution

Transforming The RV Travel Experience With Customer Support At Every Turn

The sharing economy is relatively new to the RV space, yet Wallabing believes there is still plenty of opportunity for innovation. Despite the growing popularity of RVs and outdoor travel, industry experts cite that there are over 54M idle RVs at any given time, worldwide. As we see it, this new way to view the world has yet to be fully embraced because consumers lack an easy-to-use marketplace that isn’t overly complicated by confusing fee structures and a lack of customer service.

(source)

So Wallabing set out to build a platform that brings owners and their customers together, creating a 5-star experience for all involved. We allow RV owners to list for free and set their own rate, which in turn keeps prices low for our renters. In fact, in side-by-side comparisons, we are finding that Wallabing offers the best value to travelers compared to nearly every other competitor on the marketplace.

1.) RVIA, "65 Million Americans Plan To Go RVing This Year" (source)

2.) GoRVing, RV Owner Demographic Profile

3/4.) RVshare, "RV Rental Interest in 2021" (source)

5.) GoRVing, RV Owner Demographic Profile

6.) Verified Market Research, "United States RV Rental Market Size" (source)

Whether you want to go to the beach, tailgate at the stadium, explore national parks, visit a new city, amplify your concert and convention experience, or just start driving and see where the journey takes you, Wallabing makes it easy to choose your own adventure.

The Market & Our Traction

Growing Coast-To-Coast With More Expansion On The Horizon

Wallabing’s five-year goal is to have 150K RVs on our site – and on the road! We are proud to report that in just six months, we have accomplished increasing our inventory by 682%. The platform currently offers listings in 26 U.S. states, has 164 consultants ready to assist owners and renters in 32 states, and is experiencing continued growth week after week, with minimal marketing outreach.

In order to further build out our marketplace and increase inventory, Wallabing has developed a responsive business model, lowering our service fee, while keeping modest customer acquisition costs. With the additional runway that investor funding will provide, we anticipate exponentially expanding our user base through targeted marketing, which will allow us to pass even more additional savings on to our customers.

Why Invest

Join Us On The Journey To Build A Go-To Travel Brand

Imagine planning a vacation without the stress of finding a place to stay. At Wallabing, we want more people to experience all that RV travel has to offer, enjoying limitless adventures and complete freedom to roam. With this in mind, we built our platform to provide affordable, accessible booking, as well as an equitable revenue stream for owners with wheels to spare.

In a short amount of time and with limited resources we’ve been able to accomplish a lot, and now we’re eager to get the word out to the millions of RV-ers who don’t know about Wallabing just yet. Your investment helps us go the extra mile, and we can’t wait to welcome you aboard!

ABOUT

HEADQUARTERS

2705 Broken Bow Cir

Plano , TX 75093-3395

WEBSITE

View Site

TERMS

Overview

PRICE PER SHARE

DEADLINE

Jun. 9, 2025 at 7:45 AM UTC

VALUATION

Breakdown

MIN INVESTMENT

MAX INVESTMENT

OFFERING TYPE

Maximum Number of Shares Offered subject to adjustment for bonus shares

ALL UPDATES

05.01.23

Wallabing hits the press!

Wallabing launched a press release and PR campaign last Monday (4/24/23). As you saw in our previous update, Wallabing was featured on Yahoo! Finance almost immediately, but the good news doesn't stop there.

Only one week later (as of 5/1/2023), our PR campaign has reached a global audience of more than 117.7 million people. Hello, world! Meet Wallabing.

Some of the other publications include Markets Insider, RV Business, Tech Times, and Dallas Innovates. Wallabing has been officially introduced to the market and won't stay a best-kept secret for long. If you haven't already, the time to invest is now!

04.27.23

Wallabing makes the news!

Check out our feature on Yahoo! Finance. Now is your chance to invest before time runs out!

04.21.23

JH Nemechek Wins Again!

Wallabing's official partner, John Hunter Nemechek, placed 1st place this past weekend in Martinsville and is now ranked 1st in points for the entire Xfinity Racing Series. Plus, since the beginning of March, our listings have increased by roughly 7%. Our partnership is already paying dividends and attracting attention to Wallabing, so if you haven't already invested, the time is now. GO!

03.31.23

Marketing Campaigns

The Wallabing word is officially hitting the streets – for the first time EVER! This week, we signed contracts with two marketing companies who will collectively focus on traditional PR as well as state of the art AI and technology deployment, with a reach in excess of 90 million people! Invest today to become an owner of Wallabing before Wallabing becomes THE name for peer-to-peer RV rentals.

03.01.23

John Hunter Nemechek Wins!

Congratulations to our official Nascar partner, John Hunter Nemechek, for his first win of the season! And more great news – we increased our total listings by 9% MORE over the weekend. If you haven’t invested yet, the time is now!

02.21.23

Wallabing Growth

As you know, we partnered with John Hunter Nemechek, Driver of the No. 20 Toyota Supra for Joe Gibbs Racing in the Nascar Xfinity Series. John Hunter’s first race was this past weekend and after a neck-and-neck finish, he placed 2nd! We can’t wait to see what he does next.

Since launching our crowdfund through StartEngine and announcing our partnership with John Hunter, we have experienced a 10% increase in new RV listings and have gained many new investors. Let’s continue to capitalize on this growth. We would be thrilled for you to join our journey as an investor, if you haven’t already, and please share with others you think might be interested.

02.16.23

John Hunter's (Wallabing's NASCAR partner) Social Media Reach & 1st Race of 2023

As you know, Wallabing has partnered with John Hunter Nemechek, Driver of the No. 20 Toyota Supra for Joe Gibbs Racing in the Nascar Xfinity Series. John Hunter will post regularly about Wallabing, and he already has a very strong social media presence. In 2023 alone, his Instagram has reached over 33 million people, his Tik Tok account (that was launched just a few weeks ago) has over 45 million views, and he has thousands of followers on both Facebook and Twitter. Our partnership with John Hunter exponentially increases Wallabing’s introduction to market by reaching tens of millions of people!

Be sure to watch John Hunter’s first race of the season on FS1 this Saturday at 5:00 p.m. EST and look for the Wallabing logo on his helmet. With your support, we can continue to cultivate and grow other opportunities just like this.

02.14.23

Wallabing Partners with Nascar Driver John Hunter!

We are thrilled to announce Wallabing has partnered with John Hunter Nemechek, Driver of the No. 20 Toyota Supra for Joe Gibbs Racing in the 2023 Nascar Xfinity Series! Wallabing has provided an amazing Wallabing wrapped RV and our logo will be featured on his helmet. RVing and Nascar go together like PB&J, and we can’t wait to introduce, “John Hunter, Powered by Wallabing,” to the Nascar fanbase.

Don’t miss John Hunter’s regular Wallabing posts throughout racing season by following him on here on Instagram, Facebook, and Twitter!

REWARDS

10%

Stack Venture Club & Rewards!

Members get an extra 10% shares in addition to rewards below!

Venture Club

Venture Club Members earn 10% bonus shares on top of this and all eligible investments for an entire year. Not a member? Sign up at checkout ($275/year).

$500

Tier 1

Invest $500+ and receive 2% bonus shares plus 1 transferable coupon where Wallabing waives its nightly fee.

$1,000

Tier 2

Invest $1000+ and receive 5% bonus shares plus 2 transferable coupons where Wallabing waives its nightly fee.

$2,500

Tier 3

Invest $2500+ and receive 7% bonus shares plus 3 transferable coupons where Wallabing waives its nightly fee.

$5,000

Tier 4

Invest $5000+ and receive 10% bonus shares plus 4 transferable coupons where Wallabing waives its nightly fee.

JOIN THE DISCUSSION

0/2500

Kyle Fishman

2 years ago

1. What is your total addressable market? 2. What's your end game? (acquisition, IPO, etc.)?

1

0

Daniel Hunt

2 years ago

What does "peer to peer' mean? Why use such an insider term?

1

0

Patrick Hall

2 years ago

Which charity-(ies) receive the 10% net revenue?

1

0

HOW INVESTING WORKS

Cancel anytime before 48 hours before a rolling close or the offering end date.

WHY STARTENGINE?

REWARDS

We want you to succeed and get the most out of your money by offering rewards and memberships!

SECURE

Your info is your info. We take pride in keeping it that way!

DIVERSE INVESTMENTS

Invest in over 200 start-ups and collectibles!

FAQS

With Regulation A+, a non-accredited investor can only invest a maximum of 10% of their annual income or 10% of their net worth per year, whichever is greater. There are no restrictions for accredited investors.

With Regulation Crowdfunding, non-accredited investors with an annual income or net worth less than $124,000 are limited to invest a maximum of 5% of the greater of those two amounts. For those with an annual income and net worth greater than $124,000, they are limited to investing 10% of the greater of the two amounts.

At the close of an offering, all investors whose funds have “cleared” by this time will be included in the disbursement. At this time, each investor will receive an email from StartEngine with their Countersigned Subscription Agreement, which will serve as their proof of purchase moving forward.

Please keep in mind that a company can conduct a series of “closes” or withdrawals of funds throughout the duration of the campaign. If you are included in that withdrawal period, you will be emailed your countersigned subscription agreement and proof of purchase immediately following that withdrawal.

StartEngine assists companies in raising capital, and once the offering is closed, we are no longer involved with whether the company chooses to list shares on a secondary market or what occurs thereafter. Therefore, StartEngine has no control or insight into your investment after the close of the live offering. In addition, we are not permitted to provide financial advice. You may want to contact a financial professional to discuss possible investment outcomes.

For Regulation Crowdfunding, investors are able to cancel their investment at any point throughout the campaign up until 48 hours before the closing of the offering. Note: If the company does a rolling close, they will post an update to their current investors, giving them the opportunity to cancel during this timeframe. If you do not cancel within this 5-day timeframe, your funds will be invested in the company, and you will no longer be able to cancel the investment. If your funds show as ‘Invested’ on your account dashboard, your investment can no longer be canceled.

For Regulation A+, StartEngine allows for a four-hour cancellation period. Once the four-hour window has passed, it is up to each company to set their own cancellation policy. You may find the company’s cancellation policy in the company’s offering circular.

Once your investment is canceled, there is a 10-day clearing period (from the date your investment was submitted). After your funds have cleared the bank, you will receive your refund within 10 business days.

Refunds that are made through ACH payments can take up to 10 business days to clear. Unfortunately, we are at the mercy of the bank, but we will do everything we can to get you your refund as soon as possible. However, every investment needs to go through the clearing process in order to be sent back to the account associated with the investment.

Both Title III (Regulation Crowdfunding) and Title IV (Reg A+) help entrepreneurs crowdfund capital investments from unaccredited and accredited investors. The differences between these regulations are related to the investor limitations, the differing amounts of money companies are permitted to raise, and differing disclosure and filing requirements. To learn more about Regulation Crowdfunding, click here, and for Regulation A+, click here.

Timothy huckaby

2 years ago

What are your net margins? What is your yoy growth yearly from the previous year and monthly avg growth? What are your operating coast? What other ways do you plan to market your business? What would you like overall to get your margins gross and net too and talk about how you plan on getting thier? What other streams of cash flow or revenue are you looking into or would like to do? Do you plan on doing more influence marketing social proof.. etc seriously thinking of investing to help you all out great concept I see value. What is your burn rate currently? I believe you all will be very successful and surprise alot of people. Thanks so much.

Show more

1

0