CLOSED

GET A PIECE OF ZALAT PIZZA

The Next Great Pizza Chain!

$1,998,054.33 Raised

REASONS TO INVEST

TEAM

Khanh Nguyen, Zalat Call Sign: “MORPHEUS” • Founder & CEO, Board Member

Read More

Dennis Minchella, Zalat Call Sign: “Mr. Wolf” • Chief Operating Officer

Read More

Adrian Saide-Jacaman, Zalat Call Sign: “007” • Chief Financial Officer

Read More

THE PITCH

A Unique Brand Positioned to Conquer the Pizza Space

Investing in Zalat Pizza offers a unique opportunity to be part of a rapidly evolving brand that excels in crafting exceptional, New York style pizzas, recognized by many as best-in-class for their taste and uniqueness. Zalat’s streamlined operating model, characterized by compact stores and low operating costs, ensures financial efficiency and scalability, while the significantly reduced construction costs result in some of the industry's highest cash-on-cash returns. Open late hours, Zalat caters to a wide customer base, serving an eclectic menu that appeals to diverse palates. Employees (called “Zealots”), who are all stock option holders, are engaged and committed to the brand's success. Lastly, Zalat's loyal and fanatical customer base underpins its strong growth prospects. Zalat’s managment is positioning the company for long-term success.

*Appearance by Zalat Pizza on “Best of” lists may not be representative of the experience of all customers and is not a guarantee of future performance or success.

Zalat Pizza is led by a seasoned management team with a combined 50+ years of experience in the restaurant industry. Khanh Nguyen, Zalat’s innovative founder and CEO started his first restaurant in 2011 following a successful career as a corporate attorney and tech entrepreneur. His executive team’s experience ranges from new restaurant concept creation, to driving multi-unit growth to IPO, to operating hundreds of restaurants over many brands. Zalat believes that our senior leadership coupled with a strong and experienced restaurant operations team provides Zalat with the foundation to become a top national brand.

*Press coverage and Awards won by Zalat Pizza may not be representative of the experience of all customers and is not a guarantee of future performance or success.

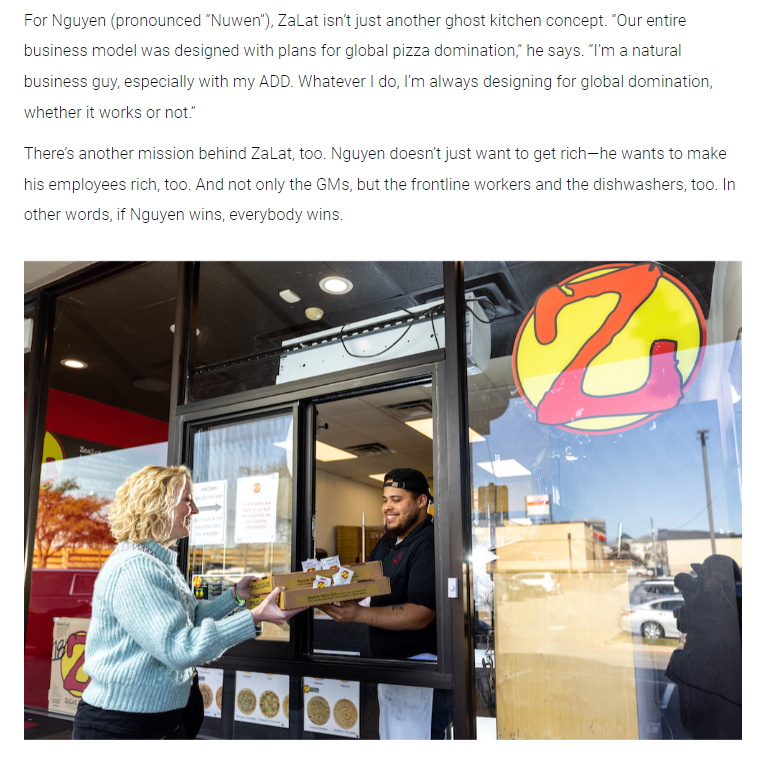

PMQ Magazine featured Zalat Pizza as the cover story for its March 2022 print issue. In 2021, Zalat Pizza was chosen by the prestigious Nation’s Restaurant News as one of five restaurant brands that they’re “betting will become household names.” Prior NRN Hot Concept Winners include Raising Canes, PF Chang’s, Shake Shack, Panda Express, Velvet Taco, and Dave’s Hot Chicken. (Source)

our business model

Best of Class Product at Scale

As restaurant concepts grow, most start sacrificing top-tier quality for the sake of higher profits and/or multi-unit food consistency. This paves the path to the inevitable result of “mediocre chain food.” At Zalat, we believe that we have demonstrated the ability to maintain our best-of-class product at mass scale by increasing employee engagement (we call it GAS for “Give-A-Shit” factor) through stock options ownership and extreme daily focus on food execution. We currently sell more than 1.5 million pizzas per year, yet are still considered by many as one of the “best pizzas in the city.”

1. Our Zealots: Zalat believes that giving everyone a slice of the pie makes the pie even bigger, so the company gives stock options to all employees (including all frontline cooks and cashiers) who are affectionately known as “Zealots”. Zalat Pizza's secret weapon is its ability to produce food excellence at mass scale.

2. Our Pizzas: Zalat’s pizza menu was designed to beat the national chains on the classics while offering an unrivaled selection of unique, delicious, and craveable specialty pizzas. Zalat only uses 100% all beef pepperoni and believes that its Pepperoni Masterclass, Zealot Supreme, MeatZa, Pineapple Express, and Margherita pizzas are one of the best versions of those traditional pizzas among all multi-unit pizza chains. Along with the best classic pizzas, Zalat offers a delicious specialty pizza line that we believe are not found anywhere else:

- The Pho Shizzle tastes like a bowl of Vietnamese Pho noodle soup. Swirls of Sriracha and Hoisin and garnished with fresh cilantro and basil.

- The Elote pizza, with its lemon pepper reduction and authentic Valentina sauce, tastes like the iconic Elote Mexican street corn.

- Bacon, cheddar, blue cheese ranch, jalapenos, and chives combine in a symphony of flavors on the Loaded Notato, designed to taste like a loaded baked potato.

- The Sweet Revenge brings a unique balance of spicy, sweet, savoriness with bacon onion jam and house-made hot honey, topped with fresh basil.

- The popular Drunken Masterclass was designed specifically for the changes in one’s palate after a few drinks.

Our Low New Store Construction Costs: Zalat Pizza focuses on converting 2nd generation restaurant spaces that are on average 1,600 sq. ft., which allows for more cost-effective development and efficient operations. Our new stores average less than $175k to convert and equip, which is on the extreme low end for the entire restaurant industry. Because our stores are basically just a pizza line with a service window, they can often pay for themselves within the first year, well below the industry average (see graph below).

Our Very Late Hours: Zalat is known for our very late hours. We stay open up to 4am on the weekends at many locations. We are beloved by the after-party crowd and members of the service industry because our best of class pizzas are still available to them after their work shifts. Offering our level of quality during the hours when the competition is mostly fast food hamburgers is a strategic advantage of our model.

Our High 3PD Volume: Zalat is built for the modern era of 3rd party deliveries (3PD). Recognizing the unlimited sales potential and efficiency of outsourcing deliveries to a 3rd party, we were a very early adopter and have engineered the core of our business model around 3PD sales. While most restaurant chains consider 3PDs a necessary evil because of the high cost, Zalat is built at its core to be economically agnostic between direct sales and indirect 3PD marketplace sales. We’ve positioned our business model to take on high 3PD sales volume without materially impacting our profit margins.

Our Fanatical Customers: Zalat Pizza’s unique offering in the marketplace has engendered an almost unprecedented level of customer enthusiasm and support for the brand (with over 135,000 loyalty program members), as evidenced by Zalat’s fanatical online comments and reviews. To reciprocate the love and support that our customers have for Zalat, we searched for a way to allow our customers to buy into our mission as shareholders. This StartEngine campaign is our way of saying thank you to our amazing customers. As shareholders, our customers (and future customers) can now directly support the company that shares the wealth with its frontline workers.

*These testimonials may not be representative of the experience of other customers and is not a guarantee of future performance or success.

*These testimonials may not be representative of the experience of other customers and is not a guarantee of future performance or success.

THE MARKET & OUR TRACTION

Growth Potential in the Thousands of Units

In 2023, the pizza industry is estimated to be $47 billion in the US alone (Source | Source). With so many pizza eaters, and Zalat’s ability to offer a best-in-class product through a unique, efficient operating model, Zalat believes that it has the right foundation to become a dominant national player. Scalability is achieved by leveraging low-cost build outs, efficient operations, and a higher-than-average AUV.

In 2022, during the pandemic, Zalat managed to double in size. And the same year, Zalat’s sales grew to $22.3 million, up from $15.3 million the previous year. Zalat has also signed a pilot project with Kroger grocery stores to open two in-store Kroger units in the Houston area. (Source)

why invest

Restaurant Industry Investors Rejoice

At the core of Zalat’s mission are three key objectives: to make the best pizzas in the universe, to create customers for life, and to make its front-line Zealots wealthy through stock option ownership. Zalat is truly more than just another pizza restaurant concept, it’s a pizza industry revolution.

Invest now and support the pizza chain that shares the wealth with its dedicated team of Pizza Zealots!

ABOUT

HEADQUARTERS

10830 N. Central Expy, Suite 175

Dallas, TX 75231

WEBSITE

View Site

TERMS

Overview

PRICE PER SHARE

DEADLINE

Jun. 22, 2025 at 5:52 PM UTC

VALUATION

Breakdown

MIN INVESTMENT

MAX INVESTMENT

OFFERING TYPE

Maximum Number of Shares Offered subject to adjustment for bonus shares

PRESS

ALL UPDATES

01.03.24

Only $86k Left!!!

While we officially have $105k left, there is another approximately $20k of sales pending funds clearance. Assuming those funds clear, that leaves us at about $86k remaining to reach our campaign goal!! Given the quick movement, we wanted to update everyone who's been following our campaign in case you're still interested in becoming a Zalat Investomer!!

If you have not had a chance to read up on us, the following article is a great overview of our business. PMQ (the premier pizza industry magazine) did a cover story on Zalat Pizza in March 2022.

You can find the article here: https://www.pmq.com/zalat/

01.03.24

Zalat's "Best of" Lists for 2023!!!

Zalat had a massive New Years Eve!!!

We broke all of our sales records this past weekend. On New Years Eve alone, we sold over 9 thousand pizzas and sent out 3,323 deliveries over the 3rd party delivery platforms (UberEats, DoorDash, Grubhub, PostMates).

It is Zalat's mission to become a national chain while never giving up on our mission of making the Best Takeout Pizzas in the Universe!! We are refusing to succumb to chain restaurant mediocrity as we scale in size.

We take a lot of pride in the fact that we are still mentioned on many "best of" lists despite the massive volume of pizzas that we sell. Here are some listings from 2023:

Our StartEngine campaign is closing soon!!! There are only 7 days left, and we are less than $188k away from our goal!!!

Invest today to support our mission of Making the Best Takeout Pizzas in the Universe, Making Customers 4 Life, and Sharing the Wealth with our Frontline Pizza Zealots!!!

12.29.23

Only 11 Days Left!!! Watch the New Podcast!

12.22.23

Final Stretch: 18 Days Left in Our Campaign

As we approach the final stretch of our campaign, we urge you not to miss out on this opportunity. Over 1300 investors have seized the moment and decided to become Zalat Pizza "Investomers". This is a testament to the confidence and trust they have in our vision of scaling a national pizza brand that makes the Best Takeout Pizzas in the Universe!! Invest now and be a part of our exciting journey.

12.20.23

Zalat Plans to Start Franchising

When restaurant groups grow nationally, there are two main pathways: via building and managing company-owned stores or through franchising. Most national pizza chains are franchises. Domino's, Pizza Hut, Papa John's, Little Caesars, Marco's, Papa Murphy's have all grown under the franchise model.

All of Zalat Pizza's current 31 units are company owned. Given the high-touch and greater difficulty level of selling a top-tier, best-of-class pizza, our strategy was to operate under the company-owned model until we were able to drive out operational efficiencies and simplifications that would allow us to easily replicate and produce pizzas at our high-quality level. We have accomplished this.

8 months ago, we began a project called "Zalat 2.0" at one of our suburban units in Dallas. Zalat 2.0 is a new store model that incorporates all of our accumulated best practices in store layout and design, software, and equipment. Our 2.0 model pilot has had incredible results: best customer ratings in the company for pizza quality and customer service while also achieving materially lower labor costs and higher sales and profits. All of our new stores are now opening under the 2.0 design. We believe that we are now able to grow under a franchise model without sacrificing the quality of our pizzas. The major advantage of being able to grow through franchising is that it will greatly accelerate our growth.

We plan to continue to open company-owned stores where it makes strategic sense for us to do so (inexpensive spots in our current cities that are too good for us to pass up for instance). We plan to supplement our growth with franchise units, with the goal of identifying and signing larger development agreements with operators with experience in building and managing large franchisee portfolios.

Below: We met with franchise attorneys last Friday and have begun the work of creating our franchising legal documents and will begin pulling together our franchising operating manuals. We have had immediate, high-level interest from groups looking to buy Zalat franchises.

REWARDS

JOIN THE DISCUSSION

0/2500

Cole Ramsey

3 months ago

Everyone needs to go on FaceBook to the Zalat pizza insider and call out Morpheus Zalat the CEO and demand answers

Show more

0

0

Ruben Castillo

4 months ago

Any update when we can start trading shares? Been over a year since I’ve invested. No one is answering any questions.

Show more

1

0

Michael Grant

5 months ago

Any update?

2

0

Donald Stroud

5 months ago

When is this stock public and tradeable??? Who is the Zalat Representative that is supposed to be answering these questions? George Dounis is AWOL...

Show more

0

0

steven page

6 months ago

Any updates?

1

0

Garrick Thornton

10 months ago

Is there a Discord link to this Community?

2

0

steven page

a year ago

Any updates on this?

0

0

George Dounis

a year ago

For any investors who are having issues with their free pizza promo codes, please email investomers@zalatpizza.com or support@zalatpizza.com so our team can assist you. You can also email for any general questions you may have. Thanks!

Show more

6

0

Benjamin Lo

a year ago

Anyone's pizza promo code actually work? Mine aren't...

2

0

HOW INVESTING WORKS

Cancel anytime before 48 hours before a rolling close or the offering end date.

WHY STARTENGINE?

REWARDS

We want you to succeed and get the most out of your money by offering rewards and memberships!

SECURE

Your info is your info. We take pride in keeping it that way!

DIVERSE INVESTMENTS

Invest in over 200 start-ups and collectibles!

FAQS

With Regulation A+, a non-accredited investor can only invest a maximum of 10% of their annual income or 10% of their net worth per year, whichever is greater. There are no restrictions for accredited investors.

With Regulation Crowdfunding, non-accredited investors with an annual income or net worth less than $124,000 are limited to invest a maximum of 5% of the greater of those two amounts. For those with an annual income and net worth greater than $124,000, they are limited to investing 10% of the greater of the two amounts.

StartEngine makes it easy to invest using your retirement funds. You can open a self-directed IRA account through Equity Trust, a trusted provider fully integrated with our platform. This integration allows for a fast, secure, and seamless investing experience, and includes a special offer on annual feesexclusively for StartEngine investors.

Already have a self-directed IRA with another provider? You can still invest on StartEngine, but please note that the process will be manual and may take longer to complete.

To get started, simply visit our IRA page for more information and step-by-step instructions.

At the close of an offering, all investors whose funds have “cleared” by this time will be included in the disbursement. At this time, each investor will receive an email from StartEngine with their Countersigned Subscription Agreement, which will serve as their proof of purchase moving forward.

Please keep in mind that a company can conduct a series of “closes” or withdrawals of funds throughout the duration of the campaign. If you are included in that withdrawal period, you will be emailed your countersigned subscription agreement and proof of purchase immediately following that withdrawal.

StartEngine assists companies in raising capital, and once the offering is closed, we are no longer involved with whether the company chooses to list shares on a secondary market or what occurs thereafter. Therefore, StartEngine has no control or insight into your investment after the close of the live offering. In addition, we are not permitted to provide financial advice. You may want to contact a financial professional to discuss possible investment outcomes.

For Regulation Crowdfunding, investors are able to cancel their investment at any point throughout the campaign up until 48 hours before the closing of the offering. Note: If the company does a rolling close, they will post an update to their current investors, giving them the opportunity to cancel during this timeframe. If you do not cancel within this 5-day timeframe, your funds will be invested in the company, and you will no longer be able to cancel the investment. If your funds show as ‘Invested’ on your account dashboard, your investment can no longer be canceled.

For Regulation A+, StartEngine allows for a four-hour cancellation period. Once the four-hour window has passed, it is up to each company to set their own cancellation policy. You may find the company’s cancellation policy in the company’s offering circular.

Once your investment is canceled, there is a 10-day clearing period (from the date your investment was submitted). After your funds have cleared the bank, you will receive your refund within 10 business days.

Refunds that are made through ACH payments can take up to 10 business days to clear. Unfortunately, we are at the mercy of the bank, but we will do everything we can to get you your refund as soon as possible. However, every investment needs to go through the clearing process in order to be sent back to the account associated with the investment.

Both Title III (Regulation Crowdfunding) and Title IV (Reg A+) help entrepreneurs crowdfund capital investments from unaccredited and accredited investors. The differences between these regulations are related to the investor limitations, the differing amounts of money companies are permitted to raise, and differing disclosure and filing requirements. To learn more about Regulation Crowdfunding, click here, and for Regulation A+, click here.

Kartavya Sharma

3 months ago

I haven't been getting the pizza promo codes in 2025. The investomer email is unresponsive, as is the Zalat facebook chat. Someone from Zalat responded to one of my facebook posts and claiming they emailed me on Mar 8. This is not true, there is no response in my inbox or spam folders. Anyone else having issues with their promo codes?

Show more

2

0