CLOSED

GET A PIECE OF GIFT OF COLLEGE

Let's end student loan debt

Show more

REASONS TO INVEST

TEAM

Wayne Weber • CEO

Wayne has been a higher education savings advocate at the forefront of providing simple and streamlined solutions for families and employers to help save and pay for college and eliminate the unbearable burden of student loan debt. In 2008, he developed GiftofCollege.com – a leading crowdfunding platform aimed at eradicating student debt and helping Americans save for higher education. Its suite of products includes Gift of College Gift Cards (available online and at over 3000 retailer locations including select Target, Save Mart, Lucky, and H-E-B stores) and Gift of College At-Work, an employee benefit program offering payroll deduction and employer match technology.

To learn more about the Gift of College platform or student loan repayment/college savings as an employee benefit, contact: wayne@giftofcollege.com

Read More

Patricia Roberts • COO

Patricia is also a motivational speaker and writer and holds a B.A. in Philosophy and Political Science from Duquesne University and a J.D. from Brooklyn Law School.

Read More

Dr. Kristine Sickels • CMO

Throughout her marketing career, Kristine has led the marketing strategy for an impressive portfolio of global consumer brands such as Rubbermaid, Crockpot, Mr. Coffee, Oster, Calphalon, and more. She is an advocate for innovation and communication approaches grounded in consumer insights.

Kristine is the CEO and Founder of a marketing consulting agency where she brings executive level thinking and partnership to small & medium sized businesses. Operating as a virtual CMO, she works with brands such as Kimball International, Jess Ekstrom, Nexus Project, to help them grow their businesses with great marketing. She focuses on organizational and personal branding, strategy, innovation along with coaching & mentorship.

Kristine is also the Co-Founder, Director, Corporate Secretary & Chief Marketing Officer of Gift of College Inc. College loan debt has become the number one form of consumer debt in the US. Gift of College helps students and families save for college tuition, taking away the stress and worry of college loan debt.

Kristine holds a Bachelor of Science in Marketing from Indiana University; a Master of Business Administration from the University of Michigan’s prestigious Ross School of business; and a Doctor of Business Administration from Georgia State University.

Read More

ABOUT

HEADQUARTERS

24005 Ventura Boulevard

Calabasas, CA 91302

WEBSITE

View Site

TERMS

Overview

PRICE PER SHARE

DEADLINE

Aug. 1, 2025 at 6:15 AM UTC

VALUATION

Breakdown

MIN INVESTMENT

MAX INVESTMENT

OFFERING TYPE

Maximum Number of Shares Offered subject to adjustment for bonus shares

PRESS

ALL UPDATES

04.03.21

Notice of Funds Disbursement

[The following is an automated notice from the StartEngine team].

Hello!

As you might know, Gift of College has exceeded its minimum funding goal. When a company reaches its minimum on StartEngine, it's about to begin withdrawing funds. If you invested in Gift of College be on the lookout for an email that describes more about the disbursement process.

This campaign will continue to accept investments until its indicated closing date.

Thanks for funding the future.

-StartEngine

12.29.20

GiftCards.com shouts out Gift of College as a unique gift card to give this holiday season

GiftCards.com shares its 2020 round-up of anything-but-ordinary gift cards—and our Gift of College card made the list!

12.11.20

Gift of College CEO featured in Medium - Authority Magazine

5 Things I Wish Someone Told Me Before I Became CEO

Get a behind-the-scenes look at Gift of College and CEO Wayne Weber's vision for a debt-free future in Authority Magazine.

12.08.20

Gift of College selected for ADP Health and Wealth Bundle

Gift of College is excited to have been selected to be part of the Health and Wealth bundle from ADP Marketplace, providing a new way for employers to engage their workforce. And in our initial launch we added over a dozen new companies to our growing list of clients.

Learn more at adp.com/TakeCareofYourpeople

ADP Marketplace is a digital HR storefront that allows clients to create a highly customized, fully integrated HR ecosystem, with ADP® and third-party solutions. With hundreds of HR apps available, ADP Marketplace is the first and largest digital storefront for HR buyers today.

12.03.20

Gift of College Featured in Forbes again this Holiday Season

"Studies and trends have found that younger generations value experiences over material possessions. Kids don’t need fancy gifts; they need something that means something and adds real value to their lives." Proud to be featured in this excellent article from Forbes!

Forbes Press: Why You Should Give the Gift of College This Holiday Season

12.01.20

Press Release: Online 529 Education Gifting Programs Fulfill Families’ Ecommerce Needs for the Holidays

This holiday season 529 Education Gifting Programs like GiftofCollege.com are meeting the needs of families and friends looking to ecommerce channels for holiday gifts from the comfort of their homes. Having grown in availability and popularity over the last several years, online gifting tools, crowdfunding platforms, and e-gift cards make higher education savings as convenient as online shopping for material gifts, according to members of the *College Savings Foundation.

We are proud to be featured by the College Savings Foundation:

*The College Savings Foundation (CSF) is a Washington, D.C.- based not-for-profit organization helping American families achieve their education savings goals.

11.25.20

Partner Spotlight: Innovetive Petcare

Innovetive Petcare, a veterinary management company of 21 animal practices across six states gives its employees a sense of security towards their education. Launching last March, every new mother and father employed by Innovetive Petcare receives a Gift of College gift card with an initial contribution to start their own 529 college savings plan.

“Innovetive Petcare wanted to partner with Gift of College to blaze the trail for other employers in the veterinary industry and create a movement to alleviate the student loan epidemic and lessen the emotional, professional, and financial stressors faced by veterinarians,” said Malia Rivera, Vice President of Innovetive Petcare. “By partnering with Gift of College, Innovetive Petcare employees can create automatic payroll deductions, they can easily pay down their student loans and contribute to their 529 college savings account.”

11.24.20

Notice of Material Change in Offering

[The following is an automated notice from the StartEngine team].

Hello! Recently, a change was made to the Gift of College offering. Here's an excerpt describing the specifics of the change:

Gift of College removed Dan Schatt as board member

When live offerings undergo changes like these on StartEngine, the SEC requires that certain investments be reconfirmed. If your investment requires reconfirmation, you will be contacted by StartEngine via email with further instructions.

11.18.20

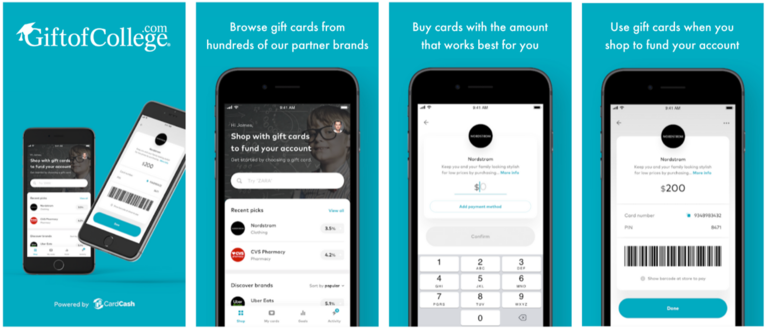

Buy Gift Cards AND Pay Down Your Student Loans

Have you explored our new app, Cashback for College?

Shop with Cashback for College and receive cashback to save or pay for college when you purchase gift cards at popular merchants like Walmart, CVS, Home Depot, Bed Bath & Beyond, Sephora, Foot Locker, and many more.

Earnings can be directed into any 529 college savings plan, student loan or 529 ABLE account via GiftofCollege.com.

“Our mission is to help families take control of their financial futures by making it easy to contribute to a college savings plan account or pay down student debt,” said Wayne Weber, CEO and founder, Gift of College. “Finding small and simple savings solutions that are already a part of everyday life can add up in a big way. When it comes to saving for college, every dollar counts.”

Available for both iOS and Android.

https://apps.apple.com/us/app/cashback-for-college/id1474130975

https://play.google.com/store/apps/details?id=com.riseapps.cardcash.giftofcollege&hl=en_US

11.12.20

Gift of College Helps Families Just Like the Limas

Gift of College believes everyone deserves an education and a future without student loan debt and that families don’t need to go it alone. Since 2008 Gift of College has helped thousands of individuals just like you save millions for advanced education and pay down their student loan debt faster. We are inspired by stories of how Gift of College has helped individuals and families plan for a better future.

MEET THE LIMAS --- a family of 5 who started using Gift of College in 2014 when their first two children were little. They’ve consistently received contributions from their family as gifts for holidays and other special occasions. When planning birthday and other celebrations, they always remember to include the shareable GiftofCollege.com profile link in invitations. Every year the kids receive almost $500 college savings contributions each from friends and extended family.

Gift of College is honored to help families just like the Limas, but they aren’t the only ones. Each one of you has a story of determination to create a future without student loan debt. It’s inspiring.

Hear what the Limas have to say about Gift of College:

Thank you for reviewing our company and for your questions.

REWARDS

Venture Club

Venture Club Members earn 10% bonus shares on top of this and all eligible investments for an entire year. Not a member? Sign up at checkout ($275/year).

$500

Tier 1

Invest $500 and receive a $25 Gift of College Gift Card.

$1,000

Tier 2

Invest $1,000 and receive a $75 Gift of College Gift Card.

$2,500

Tier 3

Invest $2,500 and receive a $100 Gift of College Gift Card.

$5,000

Tier 4

Invest $5,000 and receive a $100 Gift of College Gift Card and 5% bonus shares.

$10,000

Tier 5

Invest $10,000 and receive a $100 Gift of College Gift Card and 10% bonus shares.

JOIN THE DISCUSSION

0/2500

Wesley Jackson

4 years ago

When do you plan to send out the gifts for investors?

1

0

Bryan Edwards

4 years ago

Admittedly I am concerned or if not simply confused. This seems to be a forward looking product to solve a future issue instead of primary payback of the said $1.6T US. Not bad, but existing debt is a primary concern and re-programming of future intent secondary. Aside, are the gift cards tax deductible for the purchaser or does whomever redeems to their account gain the tax benefit?

Show more

1

0

Michael Williams

4 years ago

Do the gift cards accrue interest?

1

0

Dana Carstensen

4 years ago

Yes there's an incredible amount of student loan debt but from what I've read 529 plans designed for money to be saved and spent on qualified expenses such as tuition and books as one moves along in education to avoid the collection of debt. I cannot find anything that says that money in a 529 plan can be spent making monthly payments to a loan servicers contracted by the U.S. Department of Education. If money in a 529 plan can't be used to make payments to loan servicers then I don't see how it's a solution to the $1.6 trillion bucket of debt.

Show more

1

0

Kelly Washington

5 years ago

Where are you with making your giftcards available at more locations? You used to be in Barnes in Noble but no longer. Are there any plans to get into a location like Kroger and their other brand stores? Office supply stores, schoool supply stores or even college campus stores? There just aren't any options for your $500 giftcards where I live and sometimes I want to make a bigger purchase on one card versus having to buy multilpes that are only $50 or $100 each.

Show more

1

0

Kelly Washington

5 years ago

Are your giftcards offered through any credit card company reward programs? Also, when does your CF campaign end?

Show more

1

0

Steven Leinard

5 years ago

Thank you for answering my questions. I invested today. Sorry but I cannot tell you my employer, non disclosures etc forbid me from discussing them publically but you should have my information now if you would like to e-mail me. There is a huge untapped market for this and I believe you will do well. I am new to crowdfunding so my investment was small (hundreds). However, if there is an avenue to learn more about the company and how investors may eventually see a return, more details on your long term plan, I would be open to investing more (10's of thousands) but I'm generally a mutual fund guy. I need to see it to believe it 🙂

Show more

1

0

Steven Leinard

5 years ago

I love it and wish my employer would participate. But do the major 401k companies like Fidelity, Vanguard etc offer similar services for 529 employer plans? If so, it seems like it would be alot easier and probably more cost effective for the company to go with whoever is already handling their employee's 401k's and that would keep everything in one place to simplify for their employees as well. If say Fidelity can do the same thing, why use Gift of College instead?

Show more

1

0

Kelly Washington

5 years ago

On your time line it mentions a partnership with Discover. Can you give details on that partnership and how the program works?

Show more

1

0

HOW INVESTING WORKS

Cancel anytime before 48 hours before a rolling close or the offering end date.

WHY STARTENGINE?

REWARDS

We want you to succeed and get the most out of your money by offering rewards and memberships!

SECURE

Your info is your info. We take pride in keeping it that way!

DIVERSE INVESTMENTS

Invest in over 200 start-ups and collectibles!

FAQS

With Regulation A+, a non-accredited investor can only invest a maximum of 10% of their annual income or 10% of their net worth per year, whichever is greater. There are no restrictions for accredited investors.

With Regulation Crowdfunding, non-accredited investors with an annual income or net worth less than $124,000 are limited to invest a maximum of 5% of the greater of those two amounts. For those with an annual income and net worth greater than $124,000, they are limited to investing 10% of the greater of the two amounts.

StartEngine makes it easy to invest using your retirement funds. You can open a self-directed IRA account through Equity Trust, a trusted provider fully integrated with our platform. This integration allows for a fast, secure, and seamless investing experience, and includes a special offer on annual feesexclusively for StartEngine investors.

Already have a self-directed IRA with another provider? You can still invest on StartEngine, but please note that the process will be manual and may take longer to complete.

To get started, simply visit our IRA page for more information and step-by-step instructions.

At the close of an offering, all investors whose funds have “cleared” by this time will be included in the disbursement. At this time, each investor will receive an email from StartEngine with their Countersigned Subscription Agreement, which will serve as their proof of purchase moving forward.

Please keep in mind that a company can conduct a series of “closes” or withdrawals of funds throughout the duration of the campaign. If you are included in that withdrawal period, you will be emailed your countersigned subscription agreement and proof of purchase immediately following that withdrawal.

StartEngine assists companies in raising capital, and once the offering is closed, we are no longer involved with whether the company chooses to list shares on a secondary market or what occurs thereafter. Therefore, StartEngine has no control or insight into your investment after the close of the live offering. In addition, we are not permitted to provide financial advice. You may want to contact a financial professional to discuss possible investment outcomes.

For Regulation Crowdfunding, investors are able to cancel their investment at any point throughout the campaign up until 48 hours before the closing of the offering. Note: If the company does a rolling close, they will post an update to their current investors, giving them the opportunity to cancel during this timeframe. If you do not cancel within this 5-day timeframe, your funds will be invested in the company, and you will no longer be able to cancel the investment. If your funds show as ‘Invested’ on your account dashboard, your investment can no longer be canceled.

For Regulation A+, StartEngine allows for a four-hour cancellation period. Once the four-hour window has passed, it is up to each company to set their own cancellation policy. You may find the company’s cancellation policy in the company’s offering circular.

Once your investment is canceled, there is a 10-day clearing period (from the date your investment was submitted). After your funds have cleared the bank, you will receive your refund within 10 business days.

Refunds that are made through ACH payments can take up to 10 business days to clear. Unfortunately, we are at the mercy of the bank, but we will do everything we can to get you your refund as soon as possible. However, every investment needs to go through the clearing process in order to be sent back to the account associated with the investment.

Both Title III (Regulation Crowdfunding) and Title IV (Reg A+) help entrepreneurs crowdfund capital investments from unaccredited and accredited investors. The differences between these regulations are related to the investor limitations, the differing amounts of money companies are permitted to raise, and differing disclosure and filing requirements. To learn more about Regulation Crowdfunding, click here, and for Regulation A+, click here.

Hitesh Gupta

2 years ago

Hello, Could you share any latest developments within the company? Haven't heard anything since 2021 (the time when I made the investments). Thanks!

Show more

0

0