PittMoss

Invest Now

Raised

$31,500

Days Left

Closed

Business Description

A Platform Soil Technology Redefining Sustainable Agriculture Markets

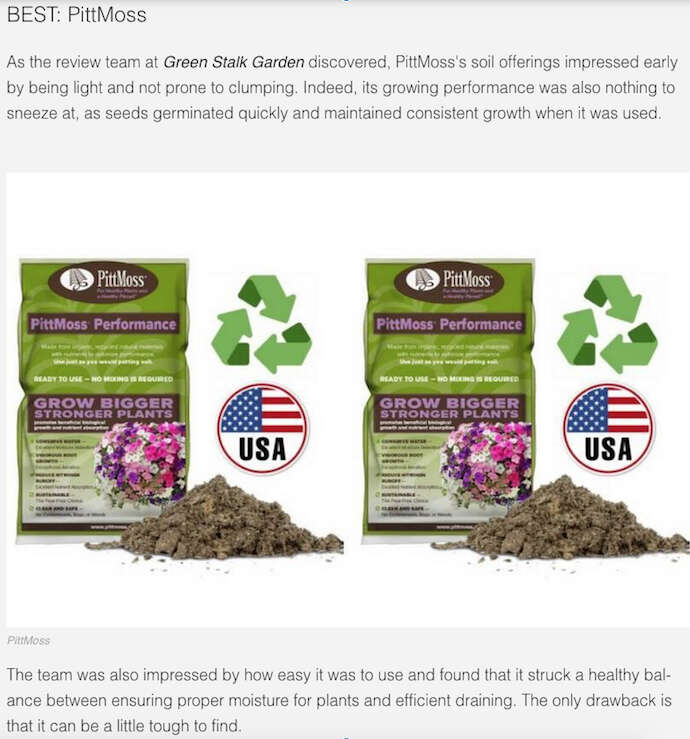

PittMoss already makes the best soils on the market (as recognized by Better Homes and Gardens). The fact that all of the company’s soils are made from sustainably sourced, recycled products, help reduce carbon emissions and water use, and can be made locally and less expensively than alternatives are what really set this company apart…

The other major difference between PittMoss and other soil brands is that its patented technology can be used instead of peat moss by every other soil brand in the world. This means today’s competitors can become tomorrow’s customers!

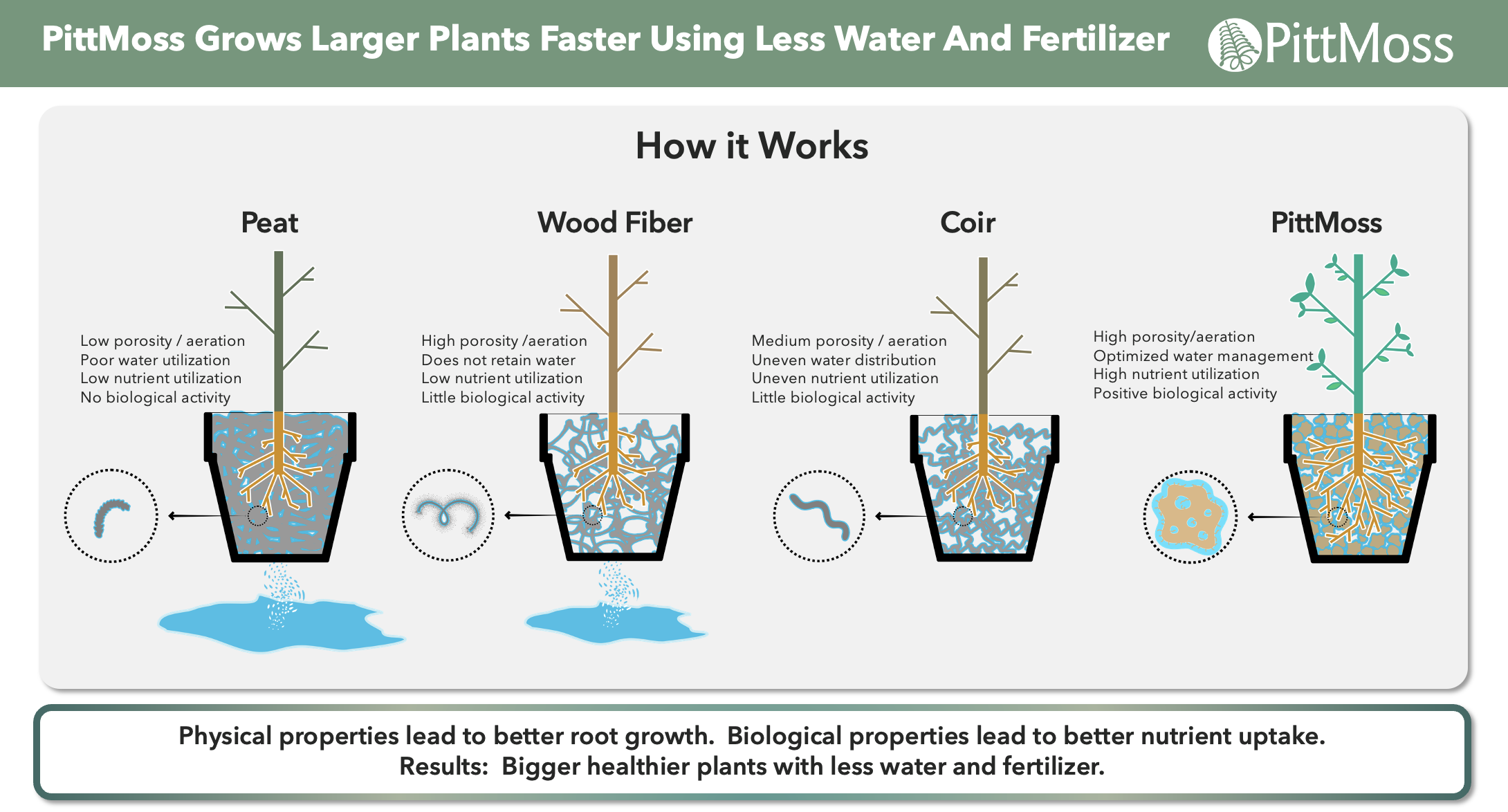

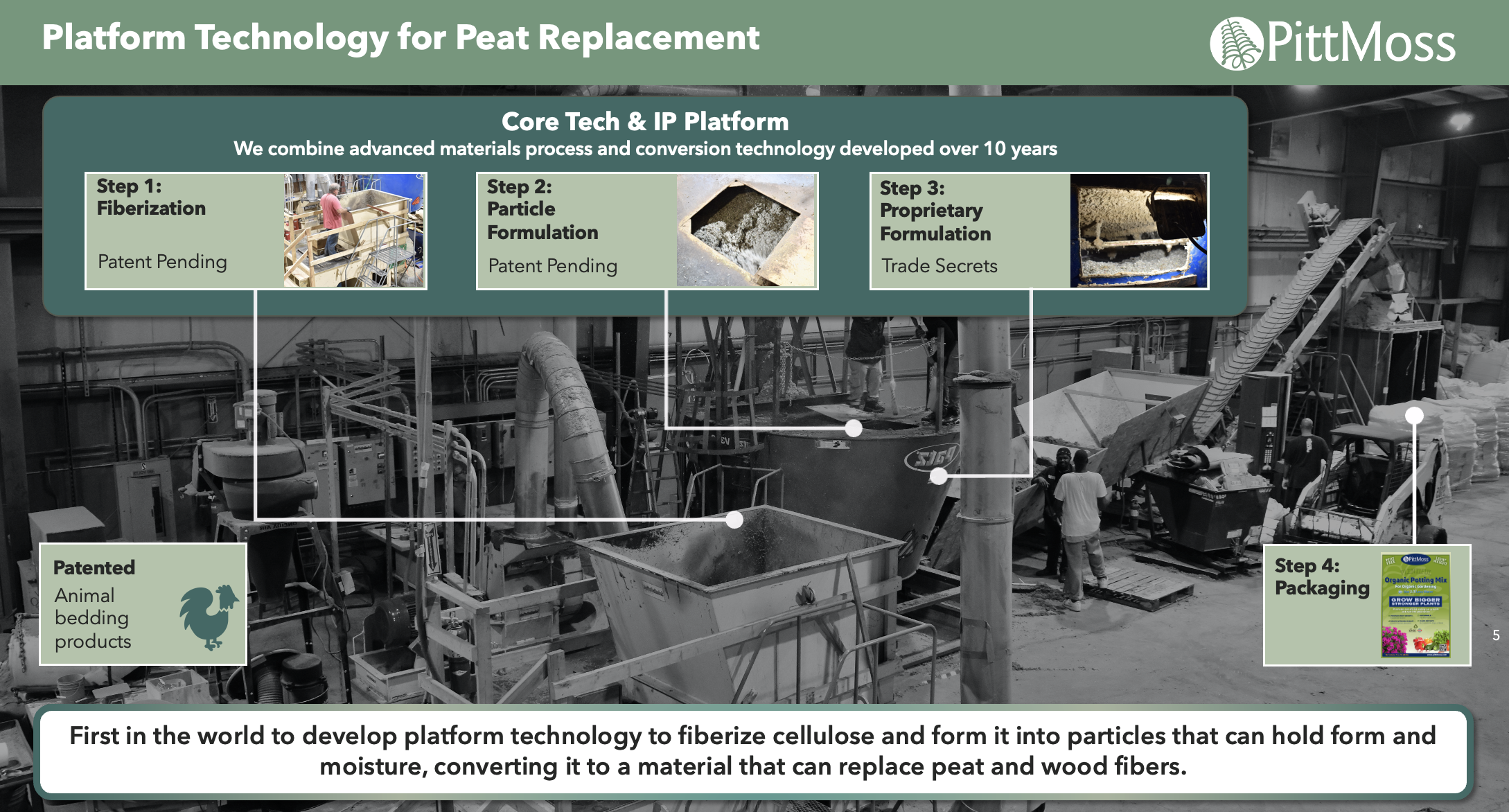

PittMoss is made from recycled fibers specifically engineered to provide optimal management of applied resources, such as water and fertilizer. PittMoss’s proprietary process utilizes lignocellulose fiber from paper waste to provide solutions to both the soil treatment and manufactured soils industries. PittMoss technology transforms lignocellulosic fiber waste into a substrate that can be used for potting soil, agriculture, soil treatment and a host of other applications. It can be used alone or integrated with other substrates, ingredients, and nutrients to create a variety of products that service a host of related industries.

PittMoss is not only more sustainable than other products (As recognized by Good Company Ventures), but also outperforms competitors and provides numerous quantifiable benefits to growers. PittMoss increases the time between watering plants, and it also manages water more efficiently by allowing plants to take up water when needed. This is much better for the planet than the constant over-watering that is required with peat-, coir-, and wood fiber-based soils. PittMoss uses resources more efficiently by keeping water, fertilizer, and air available for plants as they need it, reducing labor and input costs for growers while producing better plants.

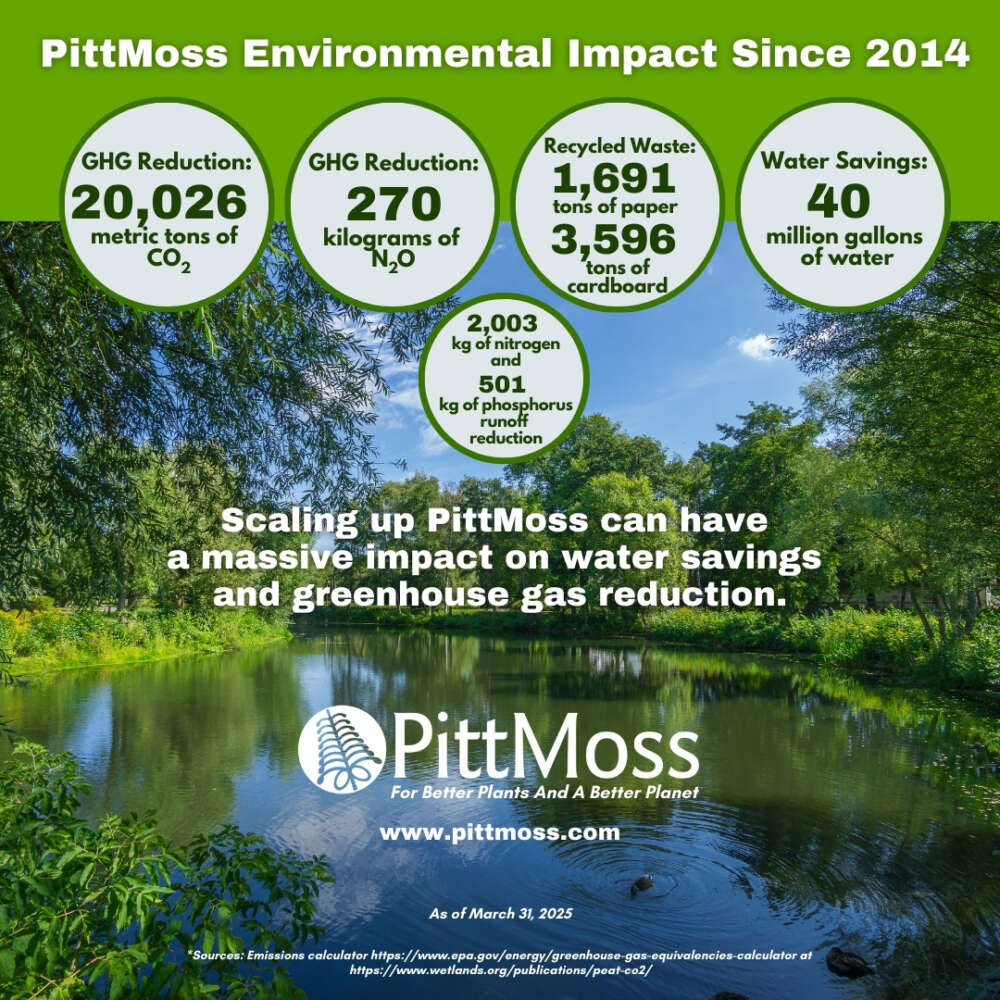

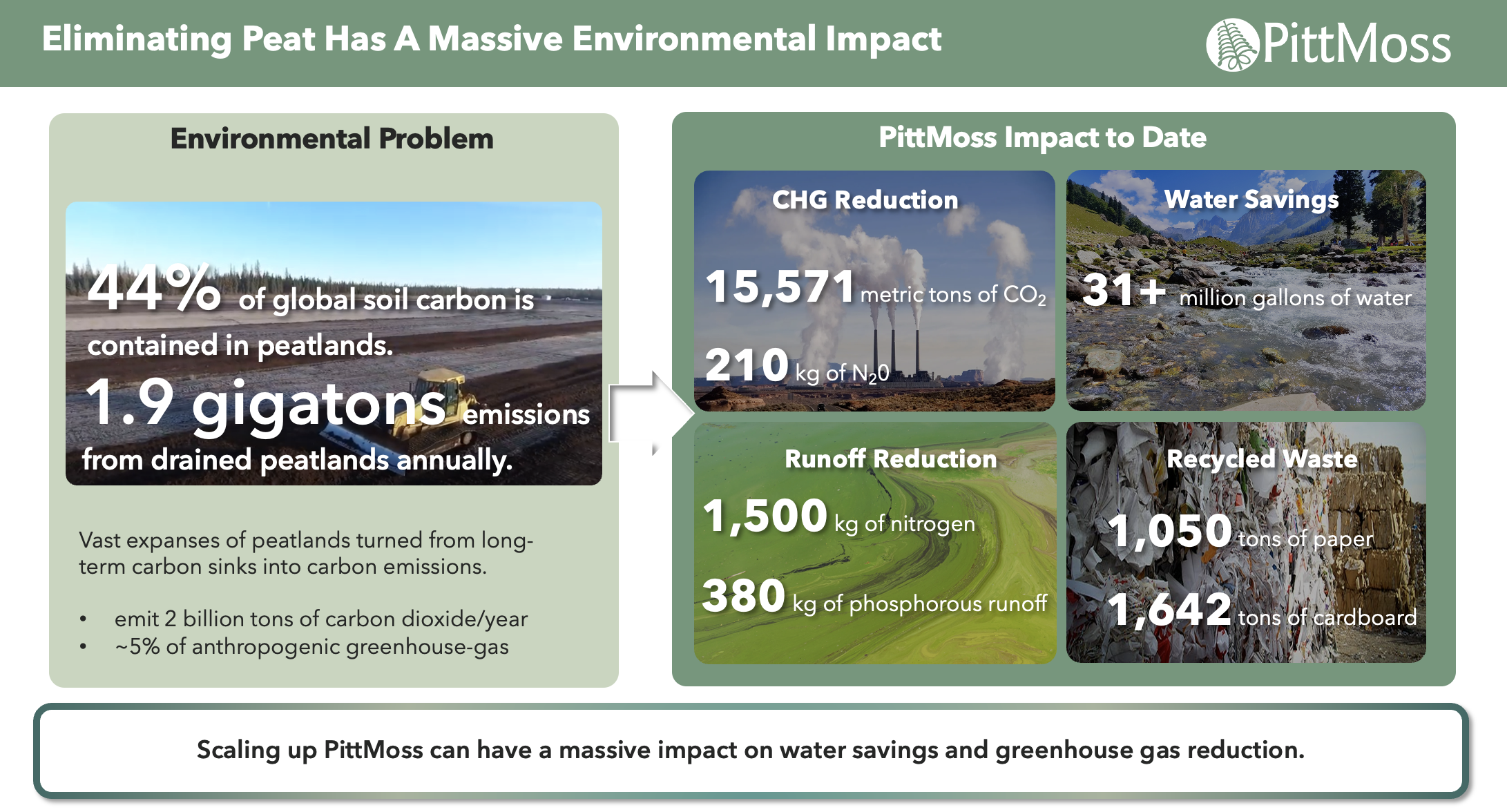

PittMoss absorbs and releases nutrients back into the root system to grow bigger and stronger plants in less time while reducing dependency on peat-based products. By the end of 2022, our PittMoss soil products prevented the emission of more than 15,000 metric tons of CO₂ and saved over 31 million gallons of fresh water.

What does a savings of 15,000 metric tons of CO₂ look like in other contexts? Here’s a few examples:

1. 2,012,680 miles driven by an average passenger vehicle

2. 893,732 pounds of coal burned

3. 91,269 gallons of gasoline consumed

4. 33,158 propane cylinders used

5. 276 tons of waste recycled instead of landfilled

Vision and Strategy

Locally made soils in every major US market that work better, are better for the planet, and are less expensive for growers!

Soil made from recycled materials in local markets is a truly disruptive idea because other alternatives are mined or harvested thousands of miles away and transportation costs alone (let along environmental costs) makes it a no-brainer to use this revolutionary product. Just as important, every other soil brand could use PittMoss as raw material instead of peat moss, coco coir and other materials.

Why mine peat in Canada and ship it halfway across the continent when it’s possible to make much better soils from local waste materials? PittMoss’s goal is to manufacture, at scale, an alternative to deleterious, unsustainable products such as peat moss while broadening our ability to serve larger soil treatment and agricultural projects. To do this, the company must build additional manufacturing sites to reduce cost structure and meet unit economic models.

PittMoss is in the business of recovering local waste products and upcycling them for resale within the same market, completing the circular economy. PittMoss utilizes patented technology to transform paper waste into a host of value-added products, from potting soil to animal bedding, and then distributes them into the same locales. Right now, PittMoss is replacing peat moss with locally sourced alternatives that provide better value and better performance while beneficially reusing what would otherwise be waste products. The ultimate vision of PittMoss is to bring sustainable substrate manufacturing to the United States and abroad. Currently, the US is the number one importer of peat moss. The PittMoss model delivers substrates manufactured using local waste while preserving peatlands and bringing a circular economy model to substrate manufacturing.

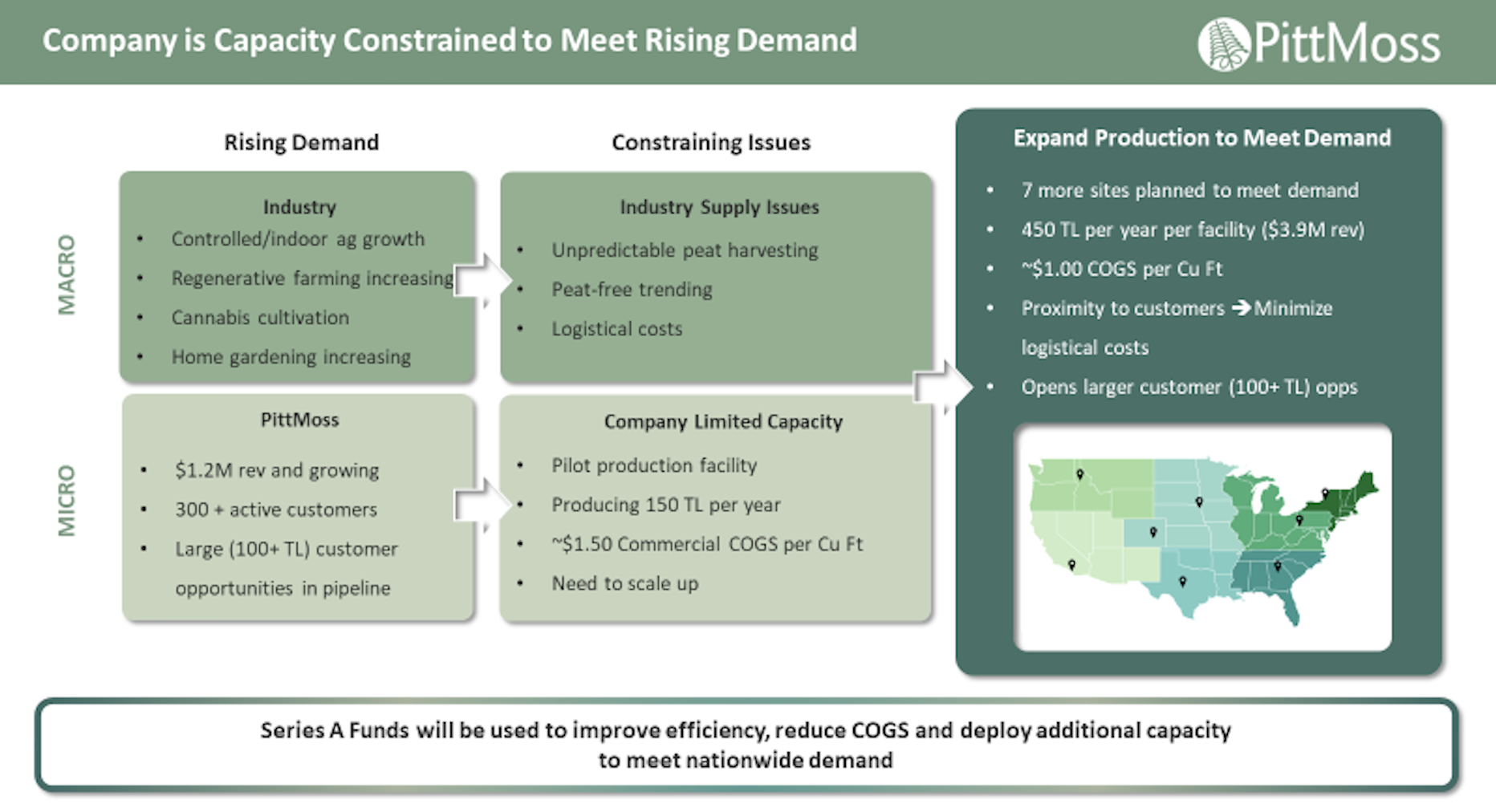

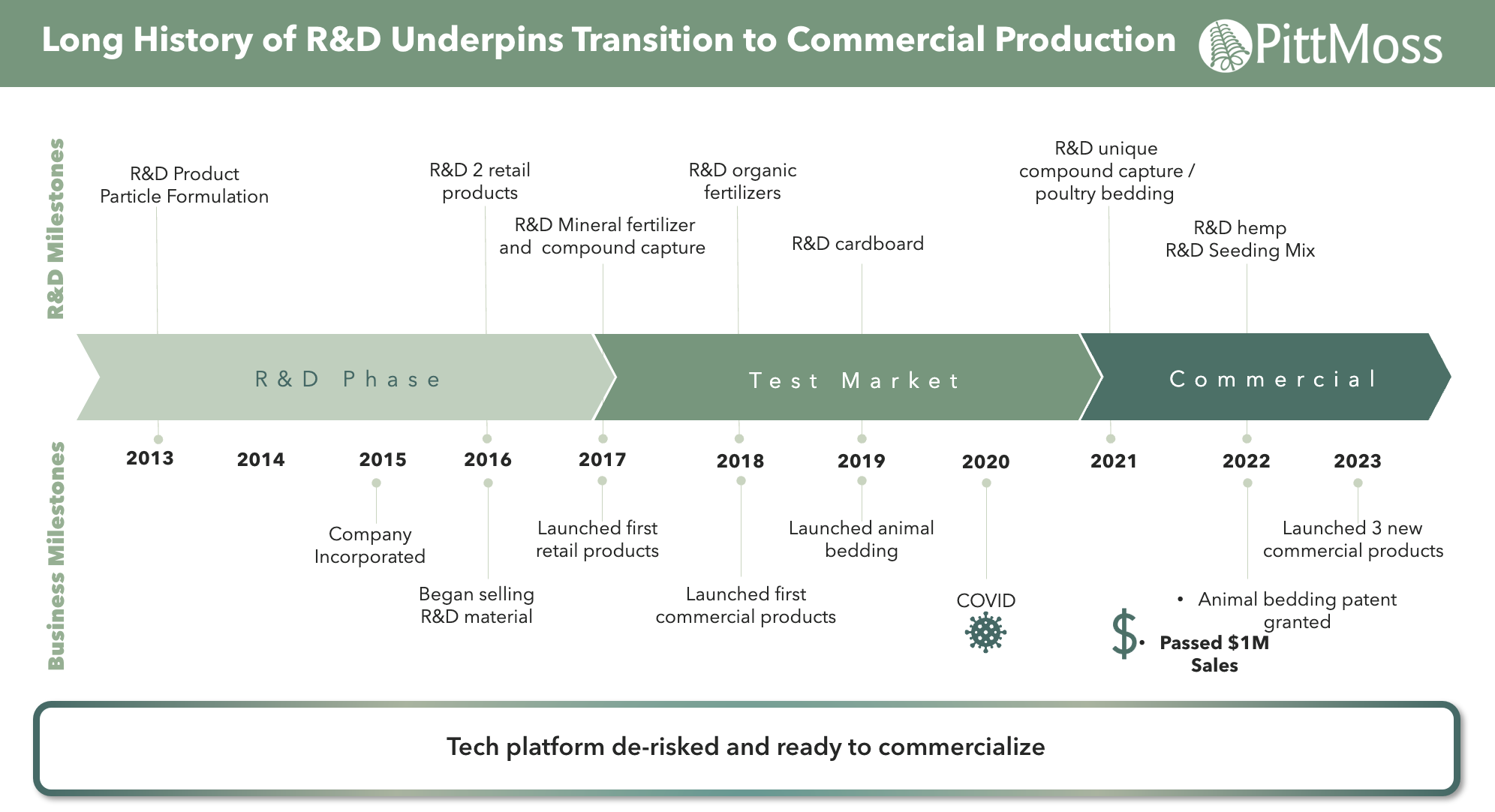

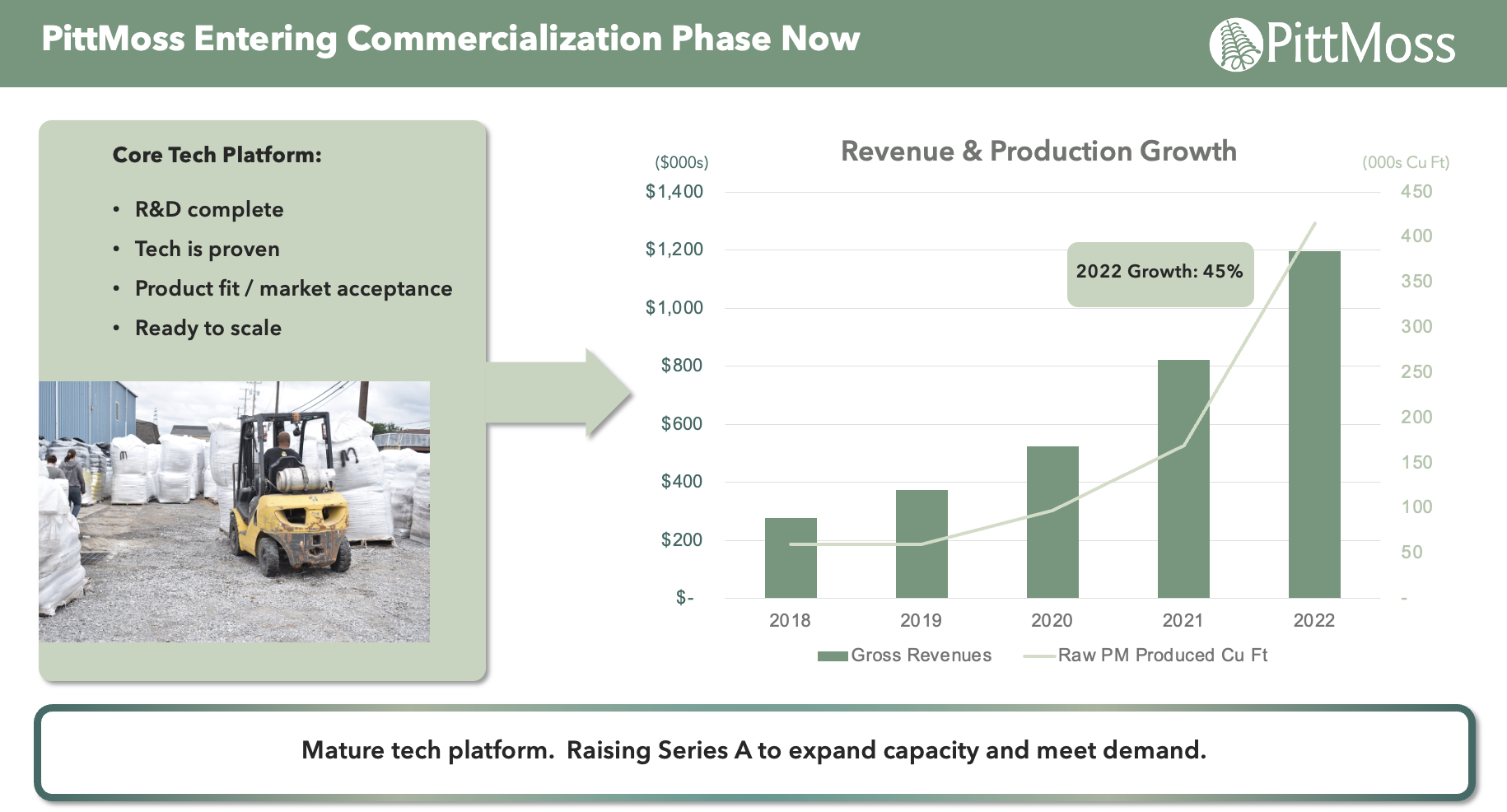

With a long history of R&D, patent development, and creation of revolutionary, protected formulas, PittMoss has recently entered the commercialization phase and is ready to leverage efficiencies to dramatically lower costs.

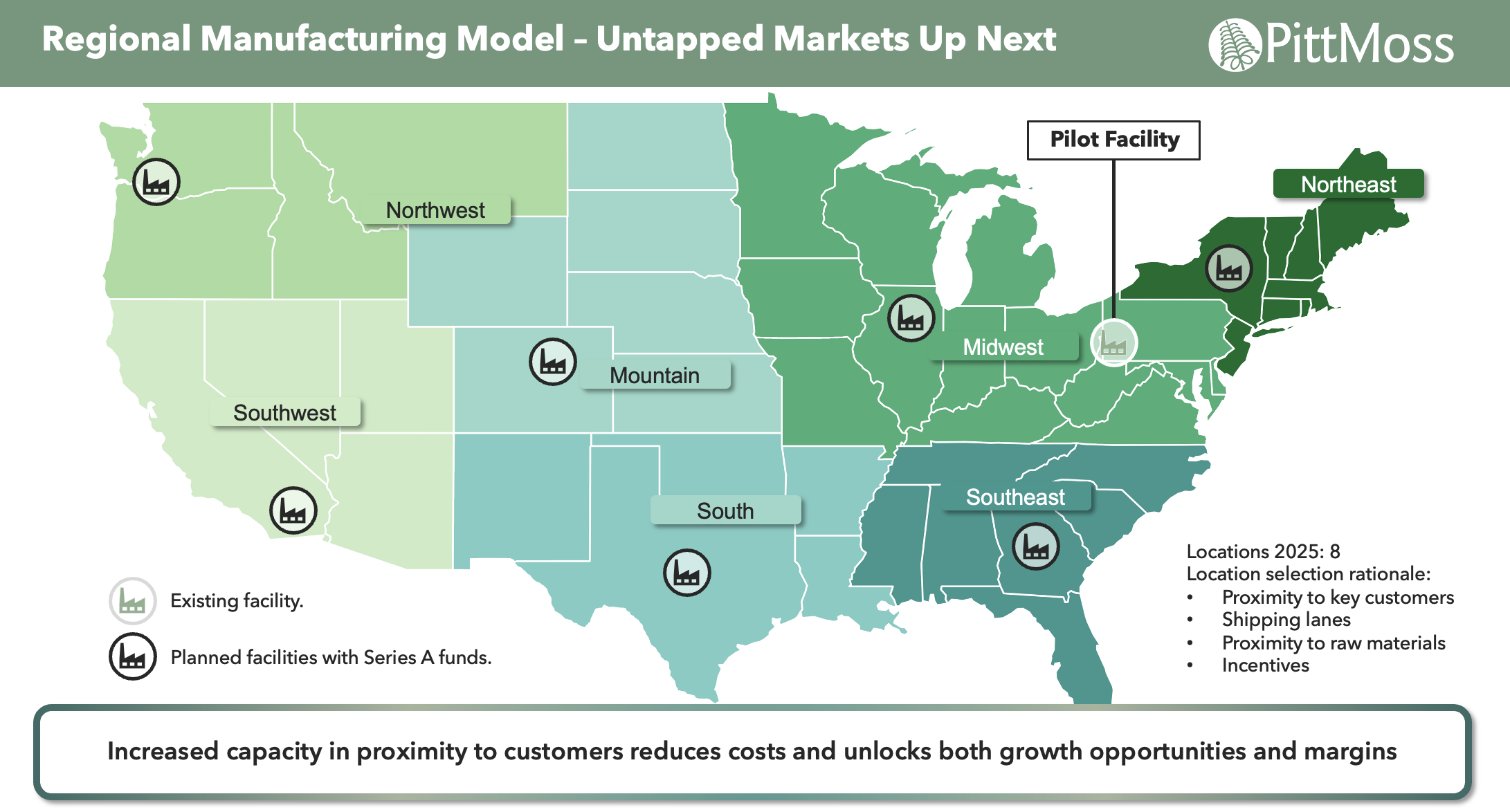

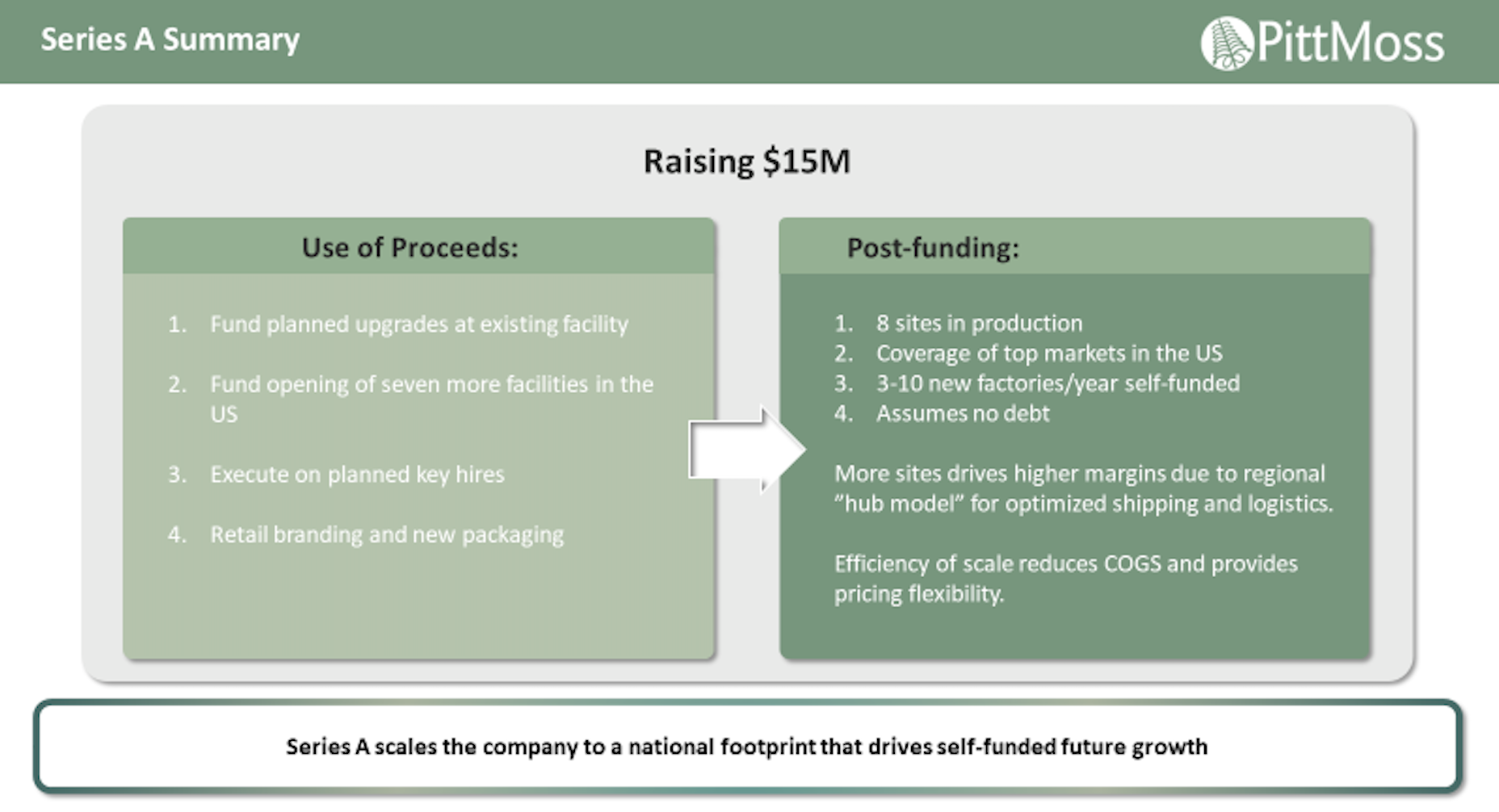

By reaching its fundraising goal, PittMoss plans to expand its sales, marketing, distribution, and production efforts across all product lines. Of particular importance is the development of new facilities in seven regions throughout the US – which will make PittMoss truly disruptive due to significantly lower logistical costs than competitive products.

Problem

The methods to grow plants should help the planet, not harm it.

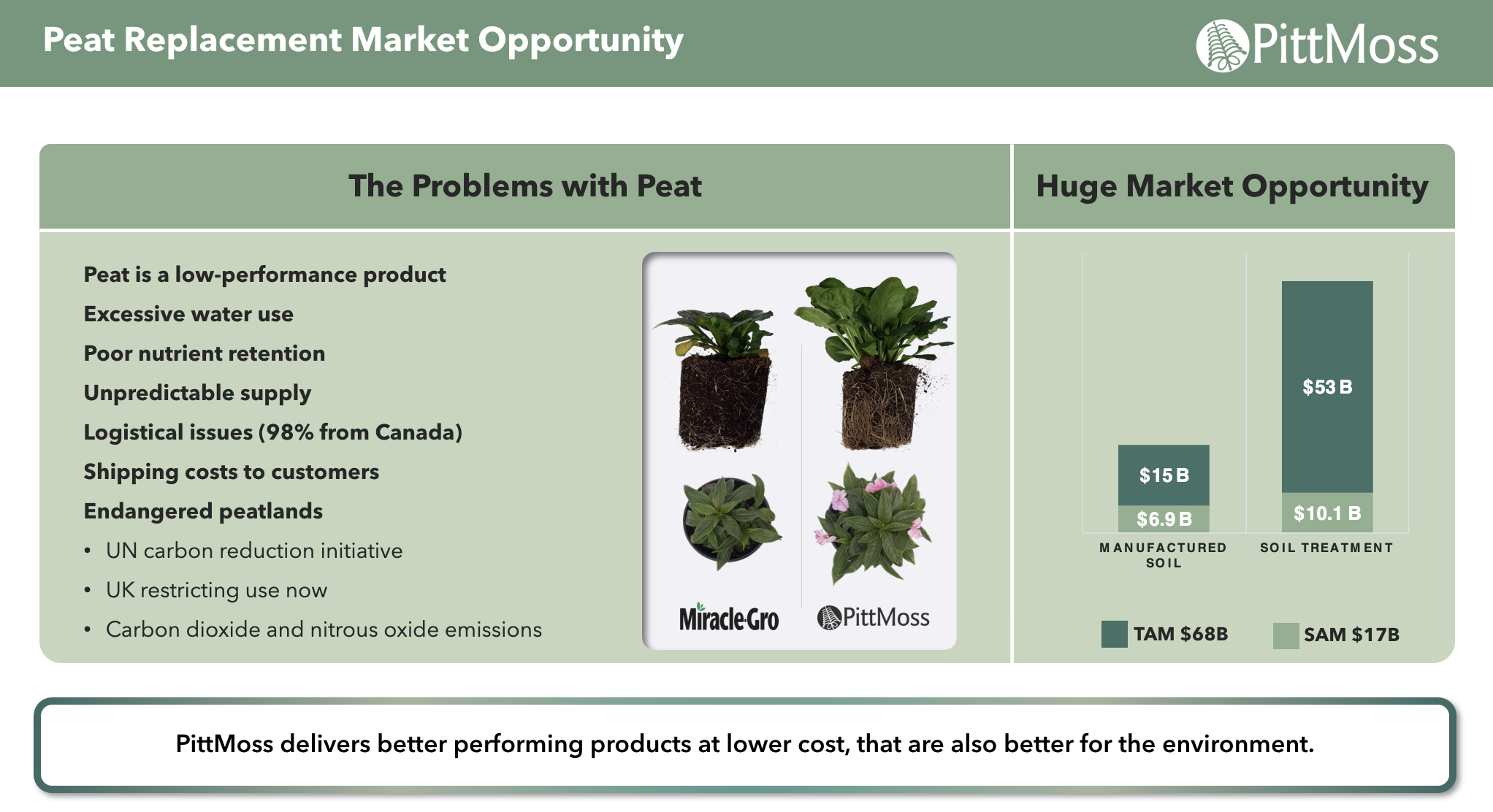

Today’s soils do not work well, are harmful to the planet, and cost more than they should.

The current materials we use for manufactured soils simply don’t make sense—that is why the market is ripe for disruption. Peat moss extraction and carbon emissions are bad for the planet, but all of the transportation and logistics involved are also bad for growers’ pocketbooks. Shouldn’t we invest our time and money into locally made, higher-quality, more sustainable products instead? Especially if we can do so for less than the “old line industry” to which people are accustomed?

For generations, gardeners and growers have been using soils that are harmful to our planet. Formulated with peat moss, the average bag of potting soil has always been less than ideal for horticultural use. PittMoss has many advantages over any peat-based soil on the market today.

The world is currently facing two major sustainability issues: land waste and CO₂ emissions. 34% of landfills are filled with recyclable cellulose fiber materials, such as newsprint, magazines, cardboard, and other paper products. In addition, many seemingly environmentally friendly products, like peat-based potting soils, are producing massive CO₂ emissions as soon as they are dug from the ground.

Peat bogs make up less than 3% of terrestrial land mass but act as massive carbon sinks. They hold more carbon than all of the world’s forests combined, and reducing peat mining is one of the top 10 carbon emissions initiatives from the UN.

Utilizing soil crafted from recycled materials available in local markets represents a groundbreaking concept. This innovation stands out significantly when compared to other alternatives, which often involve extensive mining or harvesting processes in distant, fragile, and contested environments, like the Arctic. The high expense associated with transportation and the environmental toll of traditional materials mean the market is on the hunt for locally produced, sustainable growing media–a niche only satisfied by PittMoss. Equally noteworthy, PittMoss can serve as an advantageous source material for various soil brands, replacing conventional components such as peat moss and coco coir.

We need sustainable alternatives to peat-based soils, and oversight and regulation on peatland preservation is rising, quickly.

– By 2030 the UK is enacting a full ban on peat use for consumer potting soil. https://www.lancswt.org.uk/news/uk-government-confirms-total-ban-all-peat-based-gardening-products-will-not-be-implemented

– Global peat output is expected to continue to decline due to increasing regulation and environmental concerns. https://www.globaltrademag.com/the-european-peat-market-to-languish-due-to-new-eco-regulation/

Solution

PittMoss: Soil Technology That is Better for Plants, and the Planet

PittMoss manufactures patented soils that not only preserve peatlands and upcycle waste, but also grow big, beautiful plants with less water and fertilizer. Made from the lignocellulosic fiber material currently sent to landfills, the revolutionary properties created by PittMoss’s upcycled materials optimize air, water, and nutrient delivery to plants. This encourages faster, stronger root development and top growth, resulting in bigger, healthier plants with more and larger blooms. The unique fiber structure of PittMoss creates physical, biological, and chemical properties that other soils simply cannot replicate. The PittMoss fiber structure is the secret (and protected) ingredient that can’t be replicated by others, and PittMoss products are much cleaner (pesticide free and organic) than other soils.

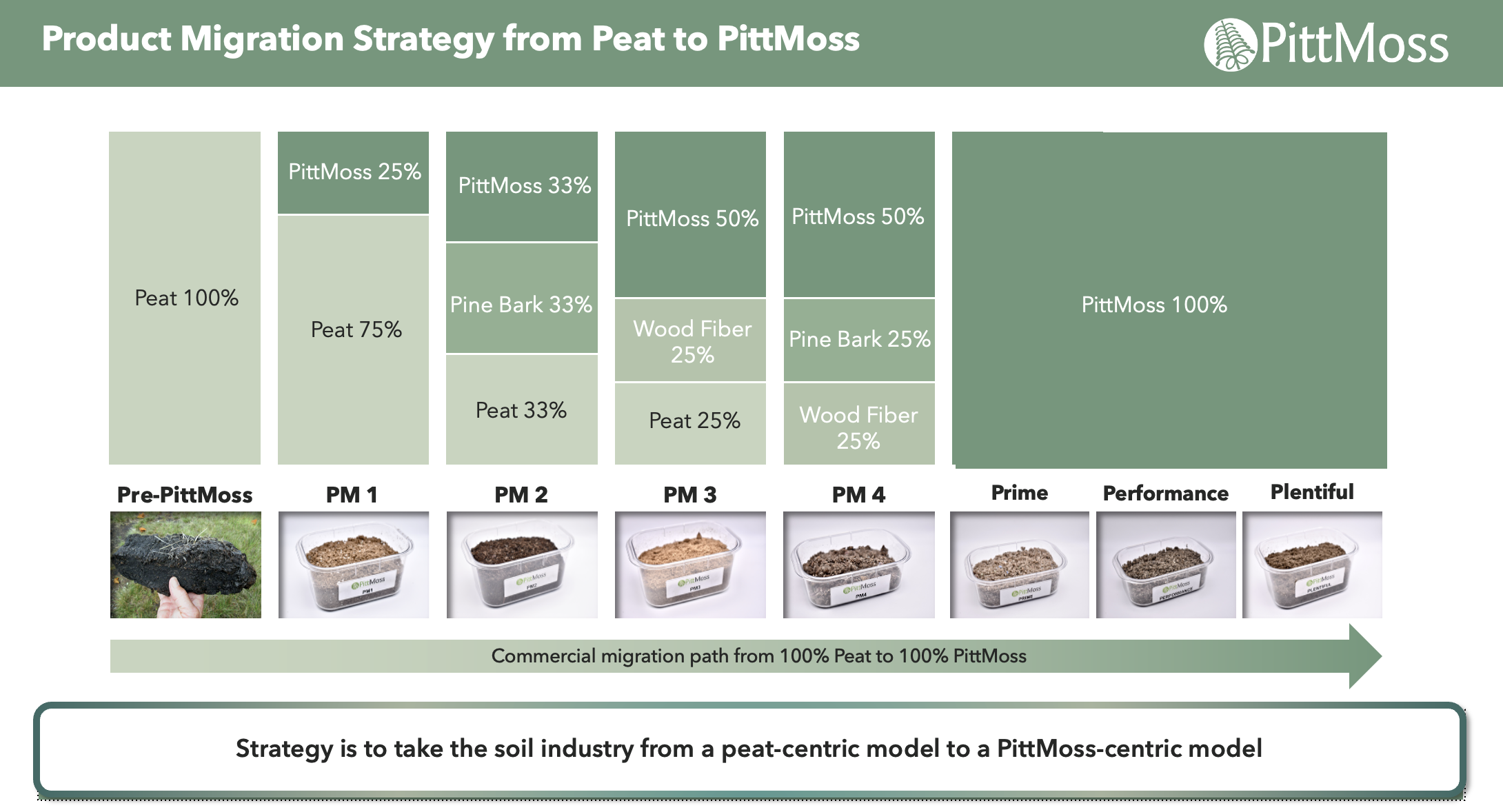

Many growers, like most experienced professionals, are resistant to changing their ways away from products that they have been using for generations (like peat-based soils). To overcome any barriers to adoption, PittMoss has developed a migration strategy for growers to move gradually from 100% peat-based products to reduced peat blends, then finally all the way to using PittMoss-only products. More progressive growers make the leap quickly, while others need to take their time and slowly migrate. PittMoss has a solution for either approach.

Business Model

A Universal Ingredient, Multiple Brands, and an Unmatched Strategic Advantage

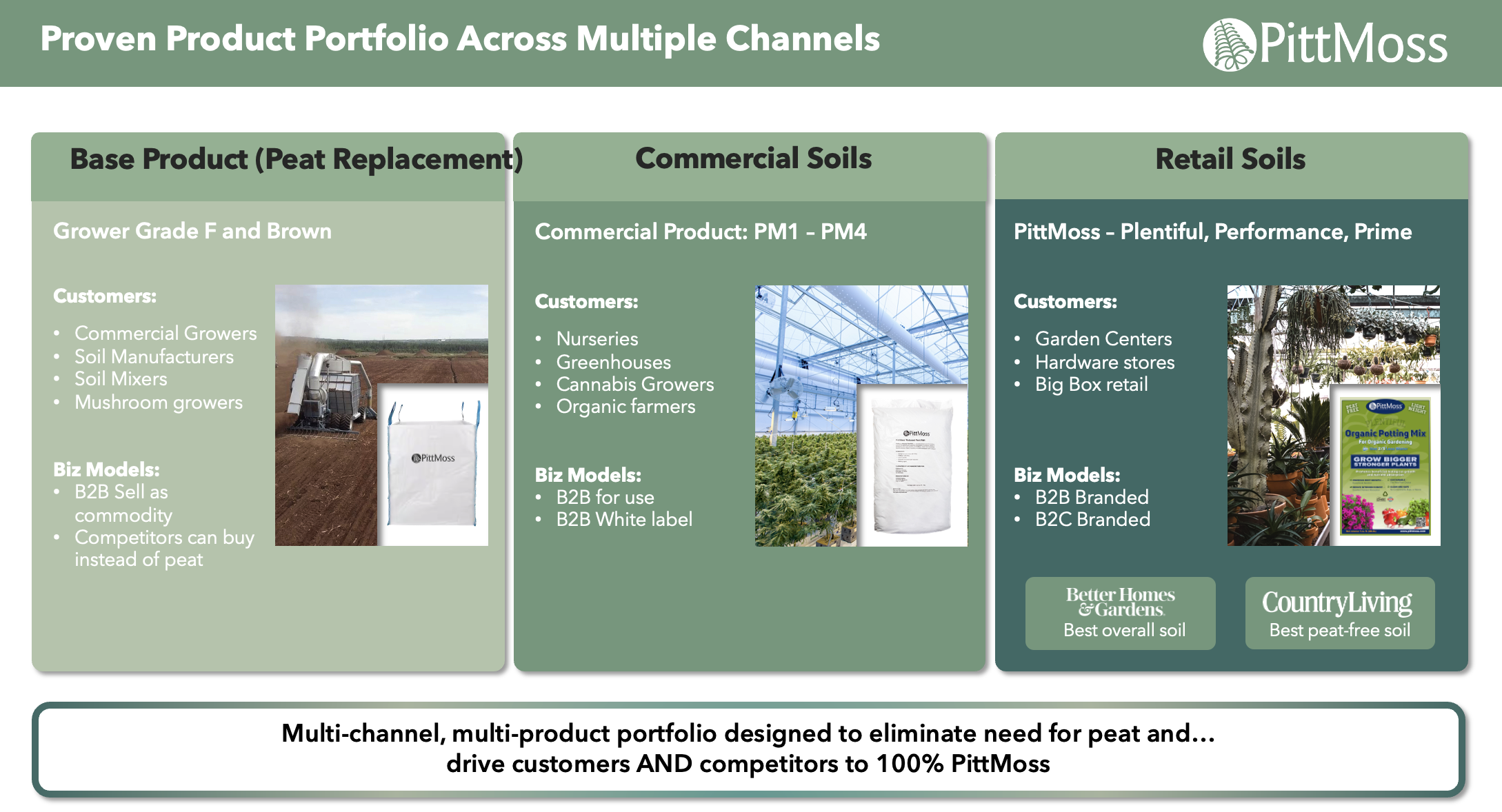

Not only does PittMoss offer the best branded soils on the market today, but their products can be the key ingredient for all other soil manufacturers to use instead of peat moss or coconut coir.

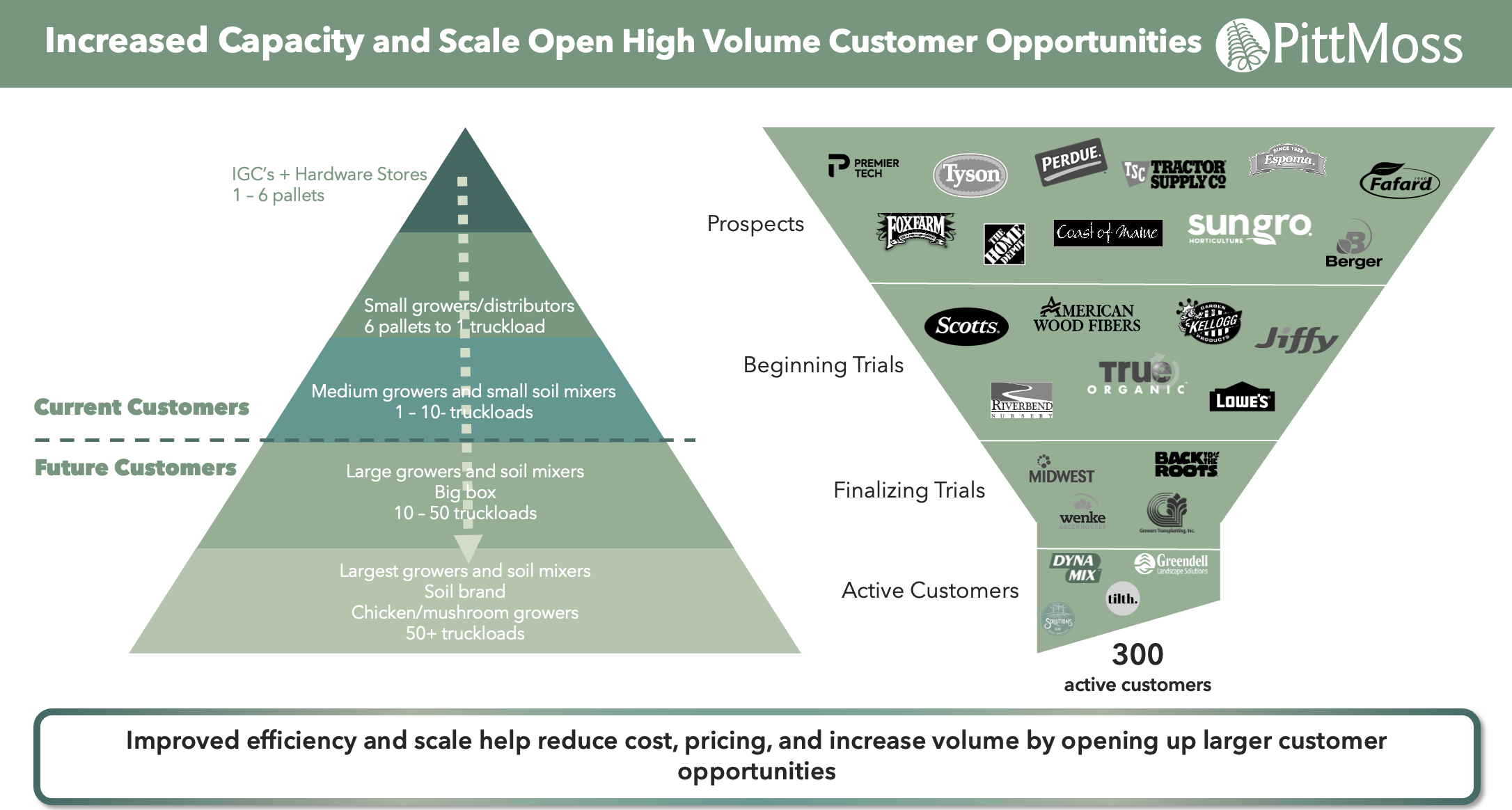

Currently, PittMoss sells to over 350 businesses across 4 countries, operating in three main channels. The PittMoss base product is used as a commoditized peat replacement. Commercial soils are sold to commercial growers that currently buy soil blends from other peat companies. Retail soils have a customer base that includes e-commerce direct-to-consumer and distribution through garden centers, hardware stores, and, in the future, big box stores.

The overall company customer portfolio ranges from large commercial growers to garden centers and large soil blenders. The company intends to grow its small sales team to further expand the company footprint. In 2022, the company marked its first year with over $1m in sales of our soil and animal bedding products.

PittMoss has a variety of wholesale and commercial customers in key markets. PittMoss is in over 150 stores nationwide, and it is available online at PittMoss.com, Amazon, and other online outlets. Furthermore, PittMoss has over 100 commercial accounts, including international cultivators. The company has also been selling via distributors and large substrate mixers, so the exact customer count is larger than that tracked by the company itself. PittMoss has customers that have been purchasing PittMoss soils for over 5 years. PittMoss has also been featured or cited in nationwide news outlets, appeared on Shark Tank with a successful raise, and is in current trials with major institutions and recognizable substrate manufacturers.

The company has been recording revenues since 2016 and has been increasing revenues on average by +40% year over year. All of the revenue so far has been generated out of the first prototype plant, located in Ambridge, PA. With regard to the market opportunity, PittMoss has just scratched the surface and currently faces demand that exceeds the company’s production capacity.

However, after securing the necessary capital to expand the company’s footprint and upgrade equipment to the proper scale, PittMoss’s strategic advantages grow exponentially. As the one and only producer of soil from completely recycled materials, PittMoss is able to localize manufacturing, slashing the cost of logistics and providing substrate solutions to industries across the globe. Moreover, PittMoss produces materials that are not damaging to the planet’s peatlands or forests. The hyper-local manufacturing and capabilities at scale of PittMoss dramatically reduce costs for growers and farmers, all while providing meaningful and quantifiable positive impacts on the environment.

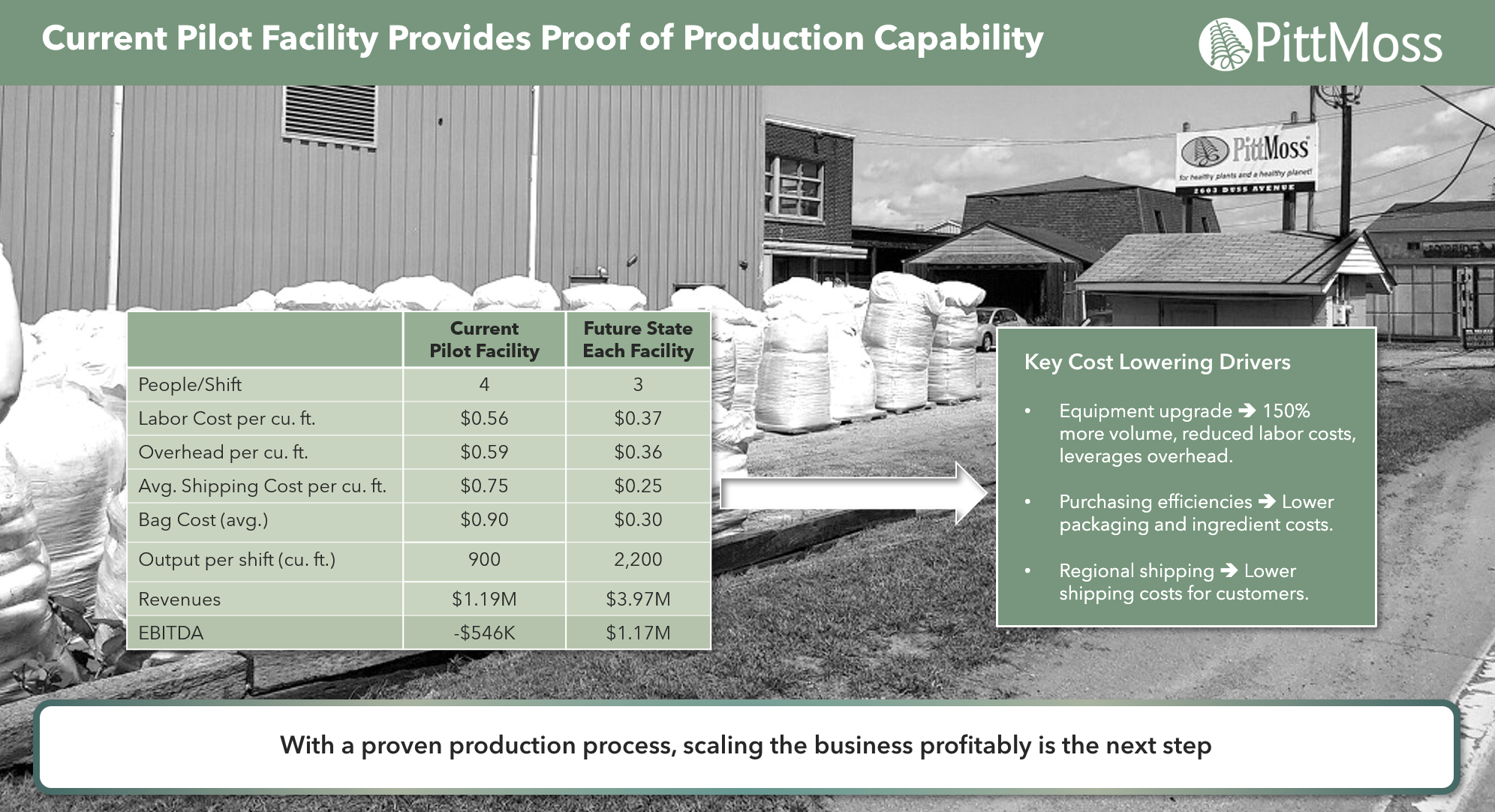

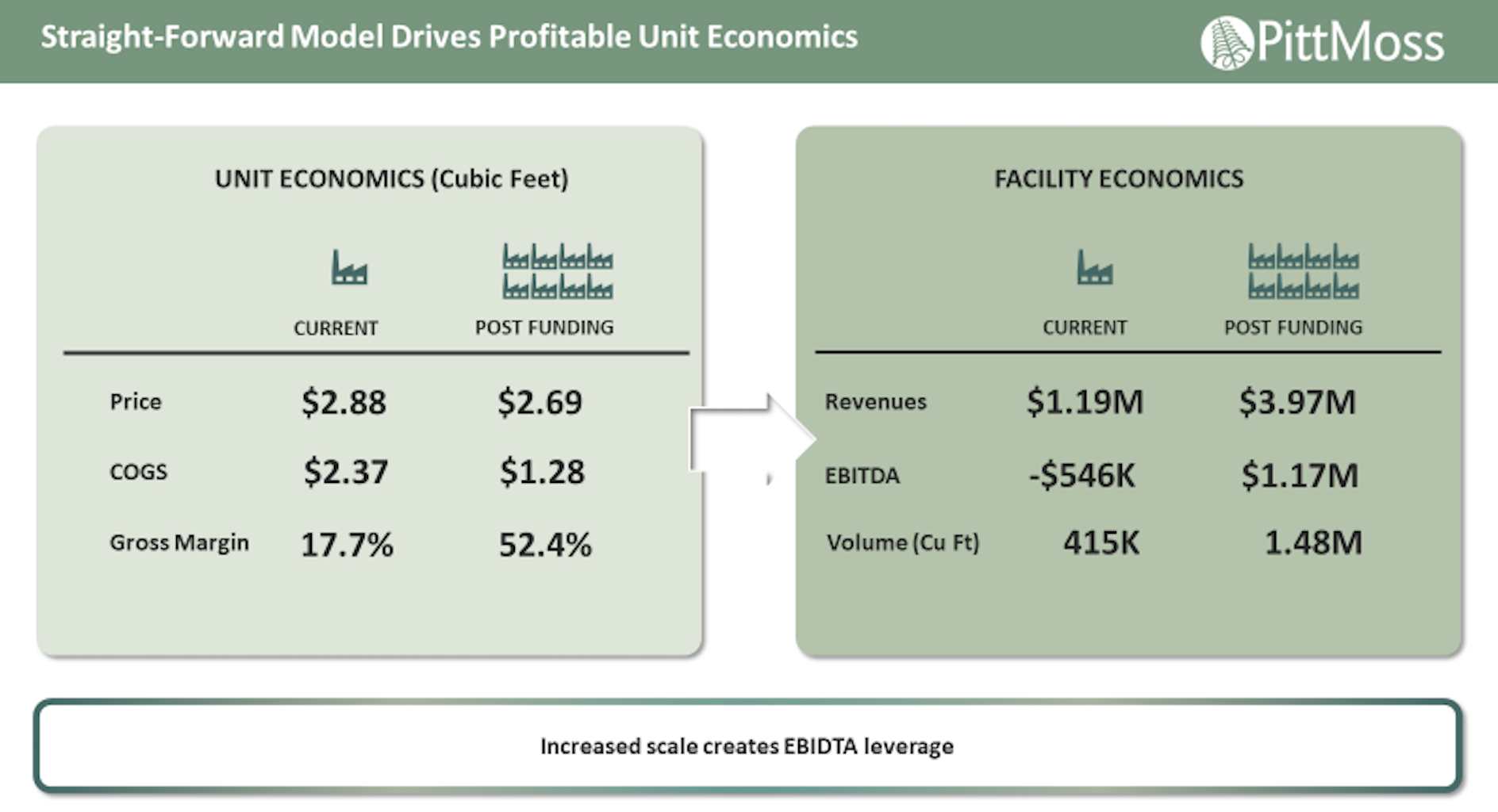

Although the current pilot facility has proven PittMoss’s ability to make product at scale, newer, upgraded facilities provide significantly more efficiency.

Once new facilities are on-line along with the existing pilot facility, it will give PittMoss the ability to lower sales prices, dramatically reduce costs of goods sold (COGS), and dramatically improve gross margins while also dramatically increasing volumes and profit margins per facility.

Market Projection

A Massive Market – Ripe for Disruption

$68 Billion Total Addressable Market

The estimated manufactured retail soil market alone is $16 billion; however, the platform technology developed by PittMoss has products that service not only retail markets, but large commercial applications in soil treatment, bio-fertilizer delivery systems, animal husbandry, and more. The market valuation for soil treatment alone is estimated to be upwards of $60 billion. Furthermore, demand for soil is growing while the world’s arable land supply is dwindling. Solutions like PittMoss are needed, and quickly.

Competition

Planting the seed for a new kind of soil

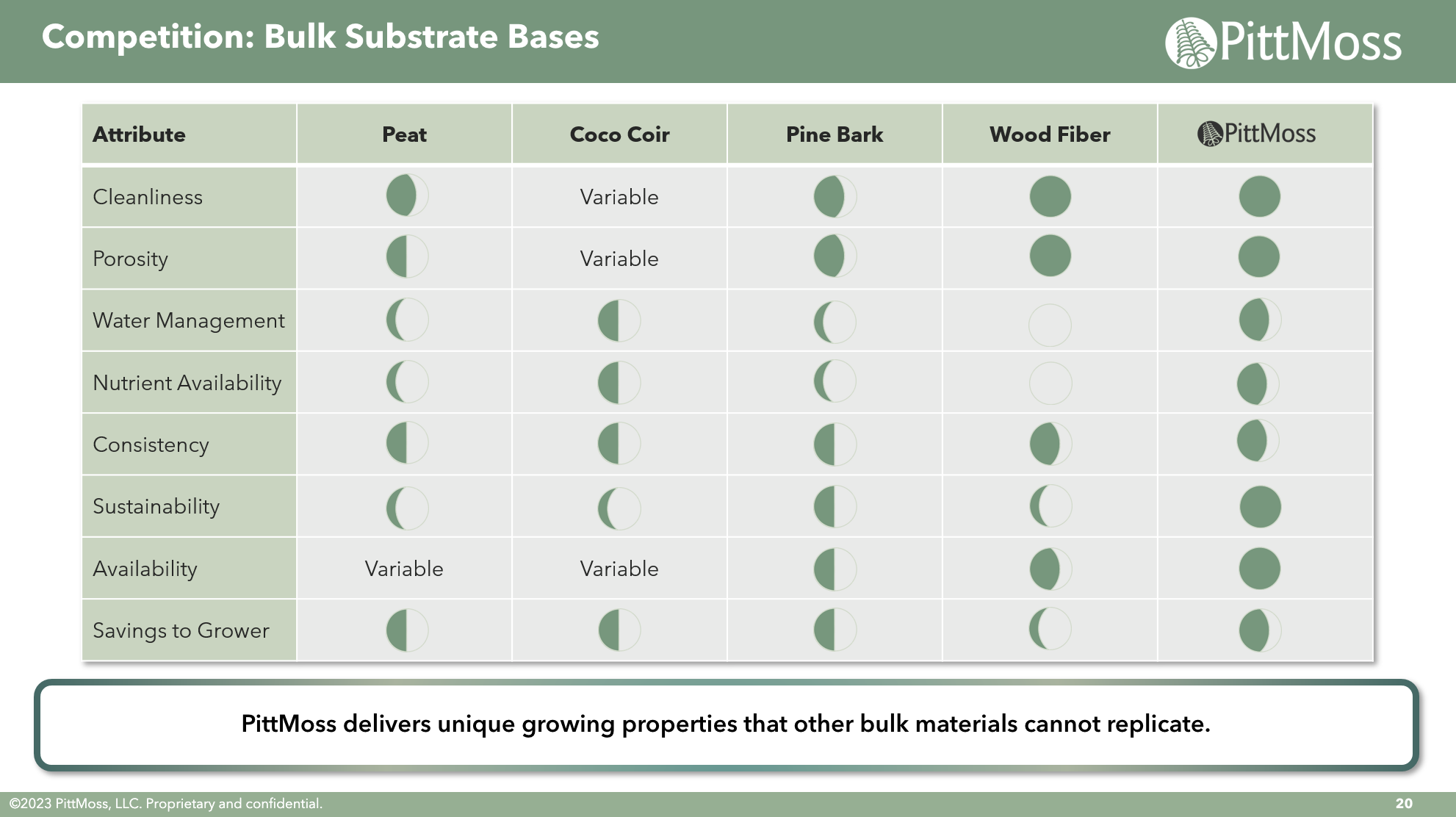

PittMoss is disrupting the traditional peat-based soil market by offering a greener, more effective and truly sustainable solution to all growers. Not only is PittMoss better for the planet, it helps create stronger, healthier plants with significantly less water and fertilizer. In fact, independent growth trials demonstrated using time-lapse photography that PittMoss plants actually grow bigger every week compared to plants in competing soil blends.

Traction & Customers

Secure Intellectual Property

First patent issued with second and third approved by the patent office to be issued in the coming months.

PittMoss has a multi-tiered strategy to protect its intellectual property, strategically segmented by patents, trademarks, and trade secrets. PittMoss’s portfolio includes patents for our soil products and utility patents covering process to product. PittMoss has been allowed filing for a recent (2022) process patent for their animal bedding technology. In addition to foundational IP and live patent families, a key facet of the company’s intellectual property is the guard protection of trade secrets. PittMoss trade secrets include product formulation and well over a decade of research into the many variables that make PittMoss products successful. This includes ingredients, feed stock ratios, equipment modifications, and more. PittMoss has established a trade secret policy analogous to that of companies like Abbott, Nike, etc., safeguarding trade secrets through secure internal catalogs, as well as non-centralized aggregation of process and methodology.

There has been precedent of PittMoss process obscurity and complexity effectively inhibiting imitation products by competitors. PittMoss has been approached by a large fertilizer conglomerate that attempted to produce a product like PittMoss in the past, but was unsuccessful. Their inability to replicate PittMoss’s success has garnered many active discussions that leverage the company’s position and strength of IP.

To date, PittMoss has focused on distribution into Independent Garden Centers (IGCs), hardware stores, small growers and distributors, and some medium growers and soil mixers. The company has focused on the customers above the dotted line in the pyramid illustrated in the figure below. This approach was preferred because the company didn’t have the capacity to fulfill the needs of larger customers, even though several have successfully trialed the company’s products. Additional capacity and regional facilities will allow the company to more actively approach some of the largest customers in the industry (i.e., those represented at the base of the pyramid and the top of the sales funnel in the aforementioned figure). Even so, the company is in the process of (or has completed) trials with many more customers than it is currently selling to due to capacity constraints.

Investors

Current Fundraise:

The company has actively engaged with an investment bank to secure a $15M Series A funding round. To date, the investment bank has identified two potential lead candidates and several potential syndication partners to fill the round.

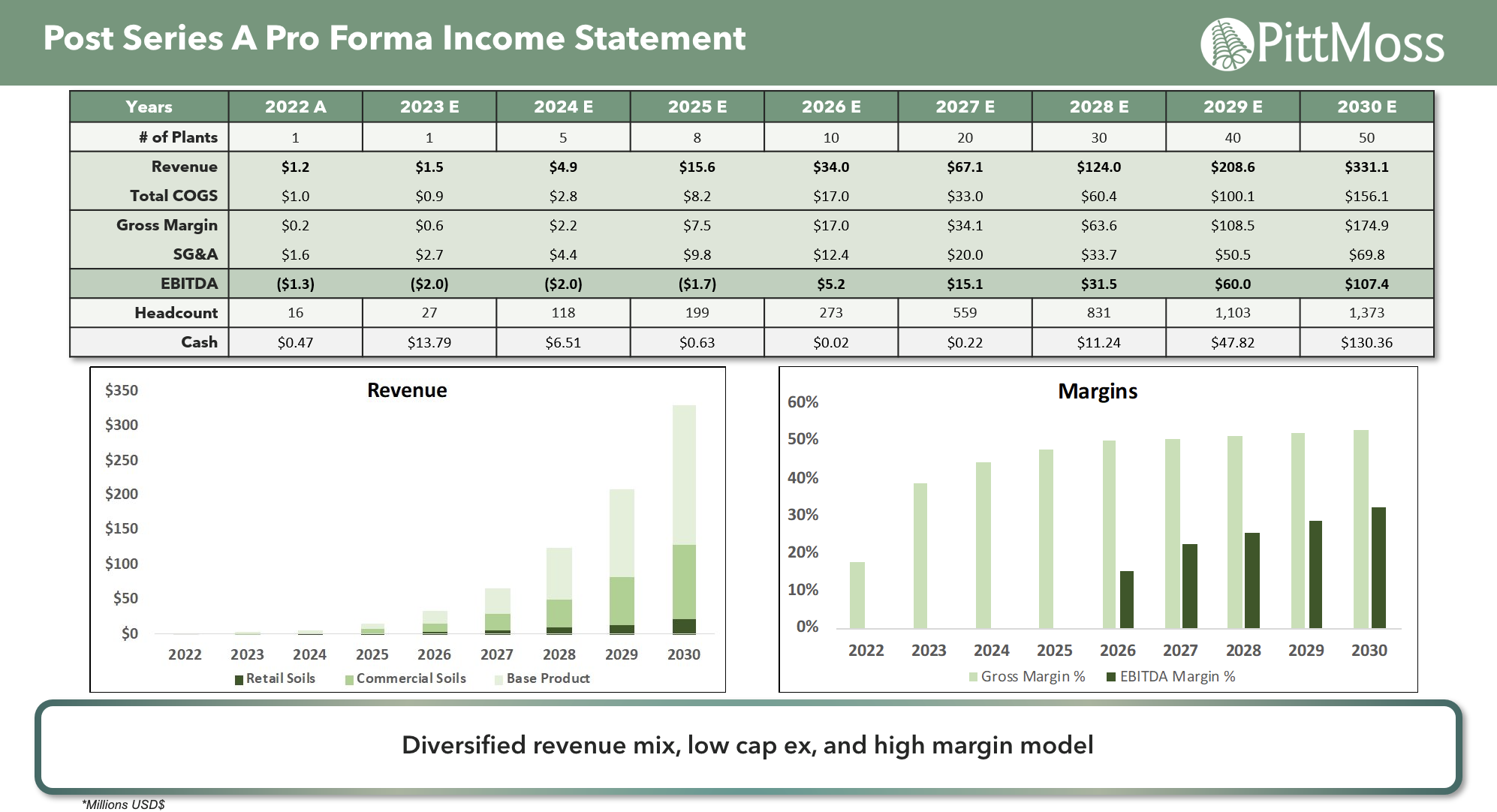

Assuming the company can close the Series A round, the following pro-forma financials demonstrate the projections related to opening SEVEN new facilities with the proceeds of the round. This should allow the company to open 3-10 new facilities each year which are to be self-funded thereafter.

As shown in the pro-forma financial statements, the company should be profitable as quickly as the earnings drag from new facilities are mitigated through growth.

PicMii investors will be investing in a SAFE agreement at a 15% discount to the Series A round. The company anticipates that this will be the last opportunity for non-institutional investors to invest in the company.

PittMoss LLC has conducted the following offerings in the past:

Year: 2015-2016

Exemption: Regulation D Offering

Final Amount Sold: $2.52M

Year: 2017-2018

Exemption: Regulation D Offering

Final Amount Sold: $3.25M

Year: 2020

Exemption: Regulation CF Offering

Final Amount Sold: $241,849.85

Year: 2021

Exemption: Regulation CF Offering

Final Amount Sold: $491,066.77

Year: 2022 – Present

Exemption: Regulation D Offering

Final Amount Sold: $1.095M

Year: March 2023 – April 2023

Exemption: Regulation CF Offering

Final Amount Sold: $275,000

Terms

Up to $325,000 in Crowd Simple Agreements for Future Equity (Crowd SAFE) with a minimum target amount of $10,000. The SAFE is part of a “bridge round” prior to closing their Series A.

Offering Minimum: $10,000 | 10,000 Securities

Offering Maximum: $325,000 | 325,000 Securities

Type of Security: Crowd Simple Agreement for Future Equity (Crowd SAFE).

Offering Deadline: April 28, 2024

Minimum Investment Amount (Per Investor): $500

Bonus:

Loyalty Discount: Investors who have previously invested in PittMoss through an earlier offering will receive an additional 2.5% discount added to the 15% discount of the Crowd SAFE.

Early Bird Discount: Investors who invest prior to January 1st, 2024 will receive an additional 2.5% discount added to the 15% discount of the Crowd SAFE.

*Should both conditions apply, both discounts will apply for a Crowd SAFE with a 20% discount.

Equity Financing: Company shall promptly notify the Investor of the closing of the First Equity Financing and of the Company’s discretionary decision to either (1) continue the term of this Crowd SAFE without converting the Purchase Amount to Equity Interests; or (2) issue to the Investor a number of units of the CF Shadow Series, of Equity Interests (whether Preferred Securities or another classes issued by the Company), as applicable, sold in the First Equity Financing. The number of units of the CF Shadow Series of such Equity Interests shall equal the quotient obtained by dividing (x) the Purchase Amount by (y) the applicable Conversion Price (such applicable Conversion Price, the First Equity Financing Price).

Liquidity Event: If there is a Liquidity Event before the termination of this instrument and before any Equity Financing, the Investor must select, at its option, within thirty (30) days of notice (whether actual or constructive), either (1) to receive a cash payment equal to the Purchase Amount or (2) to receive from the Company a number of units of Common Securities equal to the Purchase Amount divided by the Liquidity Price.

The Minimum Individual Purchase Amount accepted under this Regulation CF Offering is $500. The Company must reach its Target Offering Amount of $10,000 by April 28, 2024 (the “Offering Deadline”). Unless the Company raises at least the Target Offering Amount of $10,000 under the Regulation CF offering by the Offering Deadline, no securities will be sold in this Offering, investment commitments will be cancelled, and committed funds will be returned.

Risks

Please be sure to read and review the Offering Statement. A crowdfunding investment involves risk. You should not invest any funds in this offering unless you can afford to lose your entire investment.

In making an investment decision, investors must rely on their examination of the issuer and the terms of the offering, including the merits and risks involved. These securities have not been recommended or approved by any federal or state securities commission or regulatory authority. The U.S. Securities and Exchange Commission does not pass upon the merits of any securities offered or the terms of the offering, nor does it pass upon the accuracy or completeness of any offering document or literature.

These securities are offered under an exemption from registration; however, the U.S. Securities and Exchange Commission has not made an independent determination that these securities are exempt from registration.

Neither PicMii Crowdfunding nor any of its directors, officers, employees, representatives, affiliates, or agents shall have any liability whatsoever arising from any error or incompleteness of fact or opinion in, or lack of care in the preparation or publication of, the materials and communication herein or the terms or valuation of any securities offering.

The information contained herein includes forward-looking statements. These statements relate to future events or future financial performance and involve known and unknown risks, uncertainties, and other factors that may cause actual results to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by these forward-looking statements. You should not place undue reliance on forward-looking statements since they involve known and unknown risks, uncertainties, and other factors, which are, in some cases, beyond the company’s control and which could, and likely will materially affect actual results, levels of activity, performance, or achievements. Any forward-looking statement reflects the current views with respect to future events and is subject to these and other risks, uncertainties, and assumptions relating to operations, results of operations, growth strategy, and liquidity. No obligation exists to publicly update or revise these forward-looking statements for any reason or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

Security Type:

SAFE

Discount Rate

15%

Post Money Valuation:

N/A

Investment Bonuses!

Loyalty Discount: Investors who have previously invested in PittMoss through an earlier offering will receive an additional 2.5% discount added to the 15% discount of the Crowd SAFE.

Early Bird Discount: Investors who invest prior to January 1st, 2024 will receive an additional 2.5% discount added to the 15% discount of the Crowd SAFE.

*Should both conditions apply, both discounts will apply for a Crowd SAFE with a 20% discount.

Regulatory Exemption:

Regulation Crowdfunding – Section 4(a)(6)

Deadline:

April 28, 2024

Minimum Investment Amount:

$500

Target Offering Range:

$10,000-$325,000

*If the sum of the investment commitments does not equal or exceed the minimum offering amount at the offering deadline, no securities will be sold and investment commitments will be cancelled returned to investors.