CLOSED

GET A PIECE OF JANOVER VENTURES

Simplifying real estate & business loans

Show more

$304,991.48 Raised

TEAM

Blake Janover • Founder/CEO

Read More

Nikita Drozd • Senior Full Stack Engineer

Read More

Steve Schwartz • Director of Growth

Read More

Reasons to Invest

- The FinTech, Janover Ventures, grew 184% during the pandemic, powering more than $180 million in loan closings for commercial property and business owners.

- Janover's proprietary technology, the intelligent portal is processing, on average, $2.6B in loan inquiries per month.

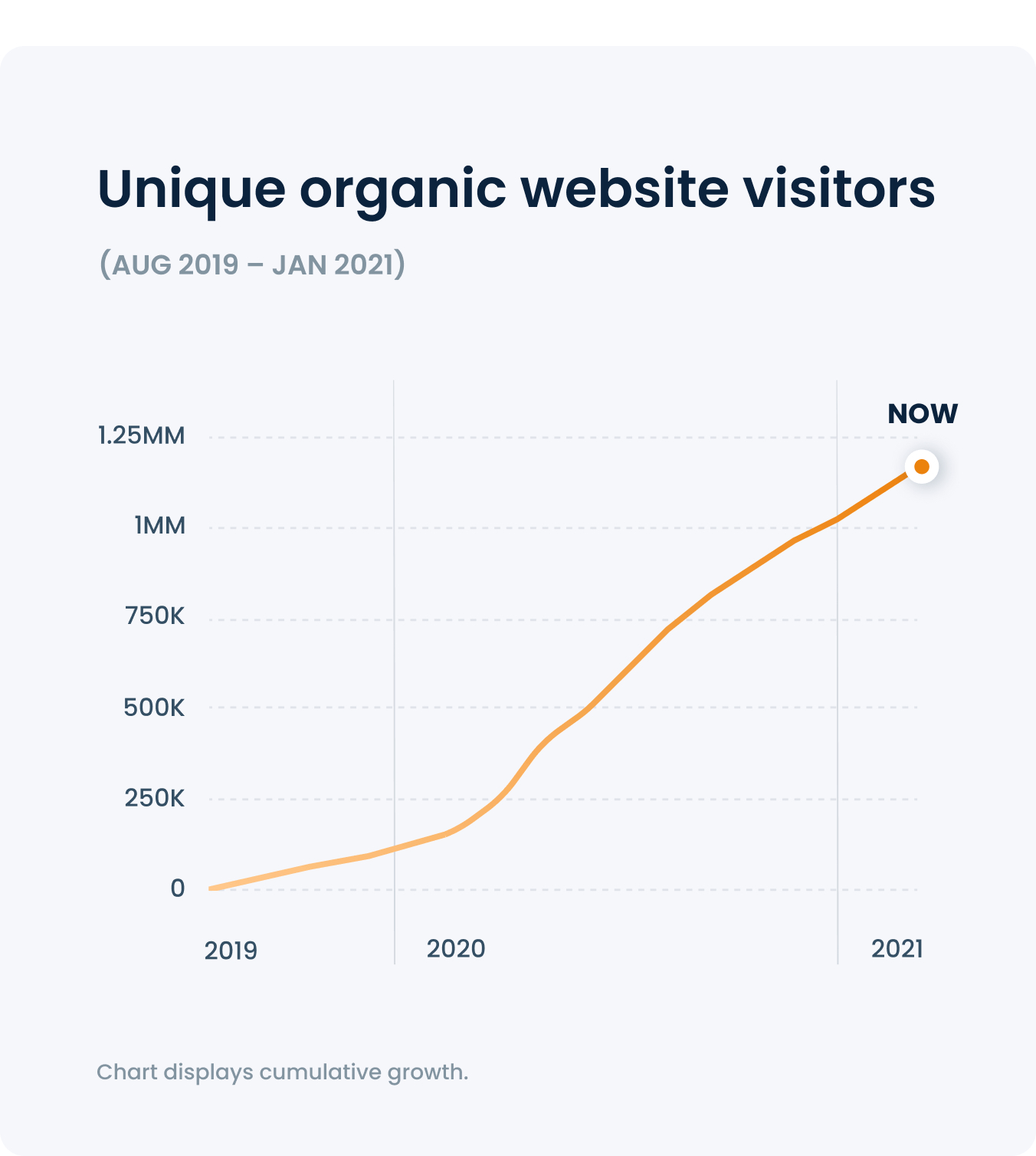

- The Janover Ventures suite of websites grew to more than 1 million unique website users last year, primarily from organic, SEO-driven traffic.

Even the largest and most sophisticated commercial real estate and small business investors don't know — and are rarely ever presented with — their best financing options.

Lenders have not actively embraced digital client engagement or technology to improve efficiency. Their old-school approach ultimately leads to a lack of incentivization to seek and originate “small” loans under $15 million, because it costs as much to originate a $50MM loan as a $50k loan... until now.

Neither borrowers nor lenders have a way to access each other at scale. With hundreds of thousands of borrowers, and lenders, all with their unique “deal” components; how can everyone possibly connect with their best counterpart?

Through a growing network of educationally-focused digital media assets owned by Janover Ventures, we are empowering commercial real estate, multifamily and small business owners with loan options they may not have known existed.

By leveraging a combination of industry-leading, proprietary technology, and carefully curated lender and investor relationships, Janover Ventures is helping borrowers get access to superior loan options, and at the same time, helping lenders get more clients that fit their ideal credit profile.

Thanks to our data-driven expertise in digital growth engineering, capital markets and agile web development; we are able to help unlock access to multifamily, small business, and commercial real estate debt capital.

We own some of the most valuable, highly-trafficked commercial real estate, multifamily and small business finance websites on the Internet. You can think of it like this... Imagine each website is a piece of real estate, and where it appears organically on Google Search as its location. Because we appear on the first page of Google for thousands of commercial real estate and business finance terms, we own the world's best "digital real estate".

Our technology collects and processes the data, connects borrowers with the right lenders and loan products, and removes frictions for everyone so that they can do what they came to do. Business.

Our intuitive portal guides borrowers at their own pace on a computer, tablet, or smartphone, securely through a process that used to take days and dozens of touchpoints, in mere minutes. This beautiful digital package is then processed through our proprietary data analysis framework which is overseen by our expert capital advisors, and matched directly to the best possible lender for that unique transaction.

Maintaining established relationships with external lender-partners allows us to focus on what we're the best at: technology enhancing commercial real estate, multifamily and small business financing for borrowers and lenders. We have developed strategic lending partnerships with some of the nation’s leading public and private financial institutions.

We have created a network of successful brands (such as multifamily.loans and hud.loans) which have aided us in arranging more than $223 million in closed loans through 2020, with our smallest loans being as modest as $20,000 or less and the high-end being as large as $26,000,000 or more.

Our algorithms draw on our proprietary dataset to score and distribute opportunities to our internal advisory team and external lender partners.

We don't close loans in our name, and therefore do not carry large liabilities on our books. We earn income when a loan closes, and everyone succeeds.

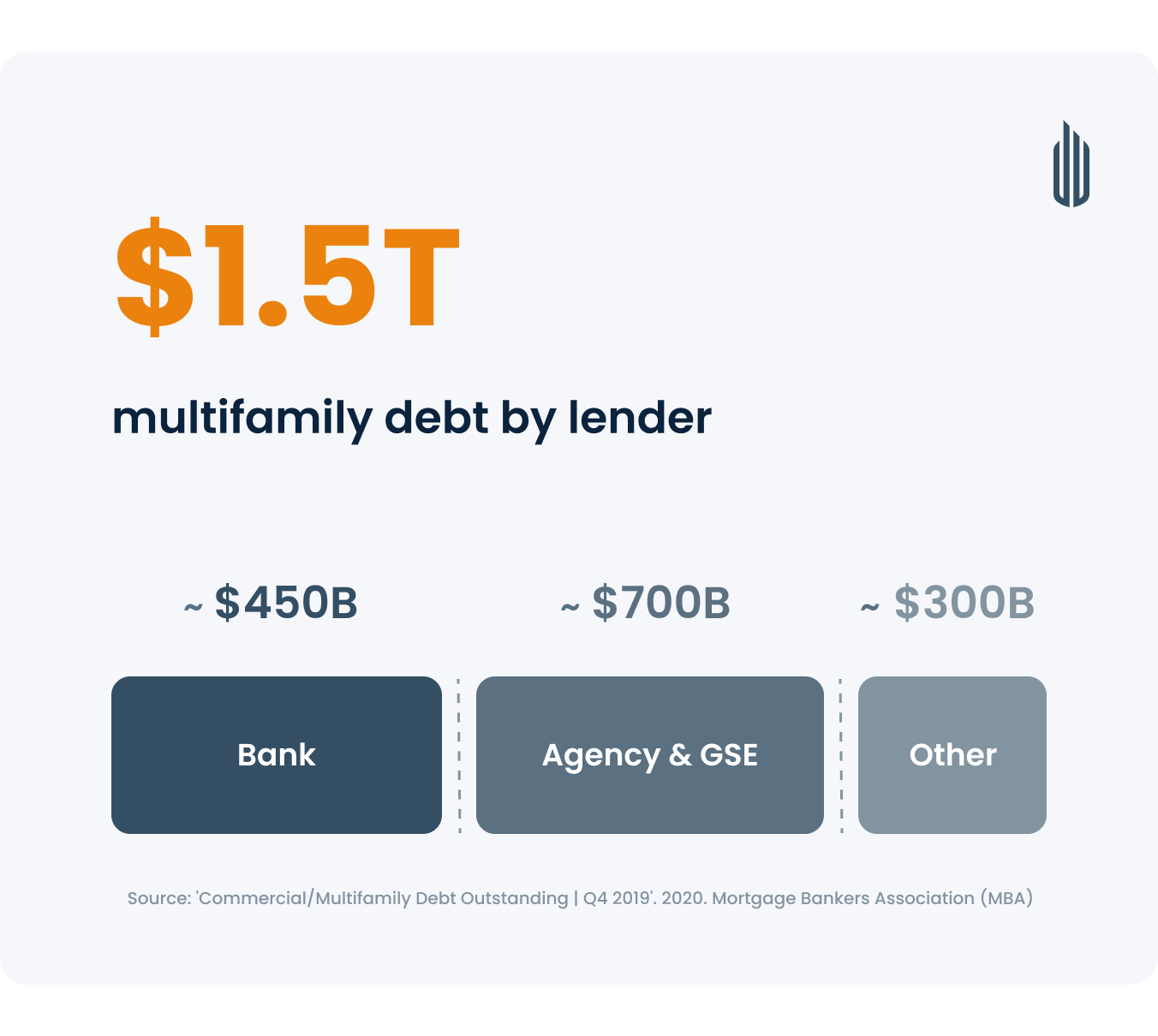

The market for multifamily and commercial real estate financing is huge, and is growing. Multifamily continues to be a highly-attractive asset class with long-term stable demand through economic cycles. The opportunity to reposition bank borrowers to agency and government-sponsored products is by far the largest opportunity; although there remains tremendous opportunity in opening the door to more options for all commercial borrowers across the country. Put simply, a small credit union down the street that you’ve never heard of may be able to provide higher leverage, lower cost, better cash flowing financing than a bank just a couple doors down. There’s no way for everyone to know all their options. The same goes for small business financing.

There’s an opportunity to educate small balance bank borrowers on the benefits of Fannie Mae, Freddie Mac, and FHA multifamily financing and help them pivot to more competitive financing options.

The market for small business loans is tremendous and comes in many forms, shapes and sizes. For example, government-backed SBA (Small Business Administration) loans were responsible for over $28B in small business funding in 2020, and that doesn’t include the significant increase from the enactment of the CARES act during the pandemic. In 2020, during the Coronavirus pandemic, Janover Ventures was able to help hundreds of businesses secure access to PPP (Paycheck Protection Program) loans, totaling close to $20MM. Other conventional loan products such as lines of credit, term loans, merchant cash advances, business credit cards and equipment financing offer even more opportunities for us to empower business owners with options. According to the Federal Reserve’s Small Business Credit Survey, 43% of small businesses in the United States applied for a loan last year. The average small business bank loan is $633,000, while the average SBA loan is around $107,000. With over 30.2M small businesses in the United States and roughly 70% with outstanding debt, you can safely assume the market size is massive.

We like to think of our competitors as business partnership opportunities. Most of the potential competition, such as large lenders, struggle with digital client acquisition. Others have tried to build digital marketplaces, but never see the type of traction that we've attained. Our borrower acquisition costs are a fraction of those of incumbents because of the data-driven nature of our digital growth strategies and our ability to monetize a larger swath of our opportunities (due to our broader credit parameters). Our software and proprietary processes allow us to sift, parse and distribute loan opportunities more efficiently, with a lower touch and with higher-converting engagement than any of our peers. We think we can close more loans, at a lower cost per loan, with lower risk, at a faster clip than anyone, period.

First and foremost, we are tasked with getting much needed financial education into the hands of business, multifamily and commercial real estate owners. Our 2021 vision is as clear as our 20/20 vision: to be the first digital touchpoint for as many business, multifamily and commercial real estate borrowers as possible on the Internet and to provide them with education and loan options that they never had before. By 2026 we aim to become the highest volume multifamily, commercial real estate and digital finance platform in America. We will create a closed ecosystem for the best and most diverse group of lenders in the business to provide high quality financing to the business owners of America; starting with apartment buildings, commercial real estate, and ultimately all business financing. The 'Lending Tree' of business financing, without selling leads to the highest bidder. BAM! :)

Prior to our first investment round in mid-2020, Janover Ventures was 100% bootstrapped with a lot of organic growth. During our first round, we saw tremendous support and were ultimately backed by over 2,000 investors who aligned with our vision.

Blake Janover has over 15 years of real estate capital markets and entrepreneurial experience. Some of Mr. Janover’s track record includes: owning a commercial real estate-licensed direct lender agency; overseeing the analysis and processing of billions of dollars in commercial real estate mortgages; building more than 100 class-A apartment units in Miami; building a global logistical infrastructure as the CEO of a large direct to consumer company; and many more.

Mr. Janover has built companies transcending various industries and countries, and successfully executed a corporate exit.

He has been published by Forbes, Housing Wire and other industry journals and is a member of the 2021 Forbes Real Estate Council. Mr. Janover received a certificate for completing Leveraging Fintech Innovation To Grow And Compete at Harvard Business School from September 3-6, 2019.