WAITLIST

CLOSED

ACCREDITED INVESTORS ONLY

GET A PIECE OF SERIES FANATICS

Sports Retailer Raises $8.9B from Blackstone, Joseph Tsai, and Other Known VCs

$842,160 Raised

STARTENGINE PRIVATE: YOUR PORTAL TO INVEST IN VENTURE-BACKED BUSINESSES WITHOUT SPENDING MILLIONS

REASONS TO INVEST

Billions in Yearly Revenue

Founded by Michael Rubin, Fanatics has licenses to sell apparel for some of the most well-known U.S. sports teams; 3 they’ve serviced over 100 million fans worldwide 4 and generated an estimated $8B in revenue last year alone (2023) 2

From the Dallas Cowboys to Fortnite 6

Fanatics licensing deals span across the world — including multi-billion dollar sports franchises, popular video games, top athletes, and major sports leagues (NFL, MLB, NHL, NBA, NCAA) 4 5

$8.9B Raised from Big League VCs

Blackrock, Blackstone, SoftBank, Joseph Tsai… Fanatics investments come from some of the most prominent VCs around

$500M Topps Acquisition 9

Fanatics recently purchased Topps Trading Cards and Collectibles (2022), giving them trading card rights to some of the biggest and most popular sports leagues and teams

Direct Exposure to the U.S. Sports Betting Market

The $225M acquisition of the PointsBet sportsbook 10 provides Fanatics direct exposure to U.S. sports betting, an industry that generated $119.84 billion on wagers in 2023 6

This valuation is in connection with offerings of unspecified securities and based on the prices of the unspecified securities at that time. Series Fanatics owns Class A Common Stock. Unless otherwise indicated, the information herein is based on information obtained from Pitchbook. This information is from publicly available sources, and we do not guarantee its accuracy or completeness. Past performance and valuations are not indicative of future results, and investors should not assume that investments in Series Fanatics will increase in value. Valuation is not static and can fluctuate based on various factors. See full details in footnote 2.

The value of the offered interests may not be directly equivalent to those of the existing shares of Fanatics, and may have differing material rights, including a carried interest fee of 20%. Series Fanatics has the right to purchase additional shares in its sole discretion and purchase additional shares of the underlying company. Assuming no reorganization or other corporate events in the underlying company, there will be 1-1 correspondence between the number of shares owned by Series Fanatics and the number of shares in the Series outstanding.

This offering is not eligible for any bonus shares. Any reference to bonus shares or similar terms should not be interpreted as an offer or entitled to bonus shares.

Disclaimers:

1. Fanatics Holdings, Inc. (“Fanatics”) is not participating or involved in this offering. The availability of company information does not indicate that the company has endorsed, supports or otherwise participates with StartEngine Private LLC or any of its affiliates. StartEngine Private LLC purchases shares from current and former employees, early investors, and advisors of the company. When you make an investment in a company on StartEngine Private, you are purchasing an interest in a series of StartEngine Private LLC, a Delaware limited liability company (the “Series LLC”), which was created to hold shares of a privately held company. An investor will not directly own or hold shares of the private company but instead will own member interests in a series of the Series LLC, which either directly or indirectly, will hold shares in the company. There may not be a one-to-one economic parity on the value of the Series LLC interests and Fanatics shares.

StartEngine Advisers LLC manages the Series LLC and reports as an exempt reporting advisor (“ERA”) to the Securities and Exchange Commission, which is an investment advisor that is not required to register as a registered investment advisor (“RIA”).

2. Unless otherwise indicated, the information on this webpage and our marketing materials for Series Fanatics is sourced from Pitch Book, a website that maintains a record of the company’s funding rounds, along with their corresponding pre- and post-money valuations. As information on the company, including the valuations, are sourced from publicly available information, we do not guarantee their accuracy or completeness. The data and information may be subject to errors, omissions, or changes over time, and we are not responsible for any inaccuracies in the data and information provided. All the information contained on this page is derived from publicly available data and information, and has not been independently verified by us or any of our affiliates. This information should not be considered as financial or investment advice. Before making any investment decision you should consult your own financial, investment and tax advisors.

3.Source: https://www.fanaticsinc.com/commerce-partners

5. Source: https://www.fanaticsinc.com/all-partners

7.Source:https://www.forex.com/en/news-and-analysis/fanatics-ipo-everything-you-need-to-know-about-fanatics/

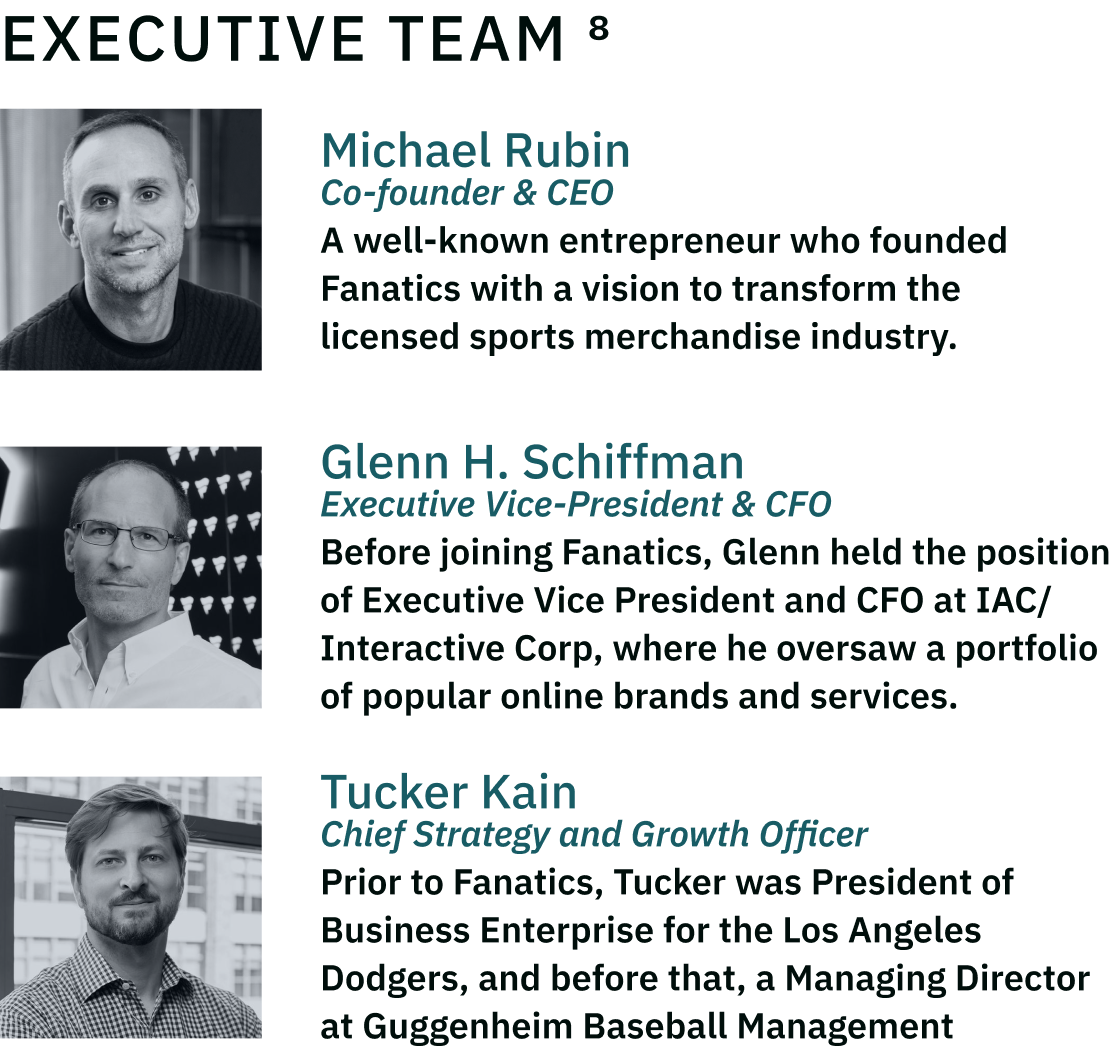

8.Source: https://www.fanaticsinc.com/leaders

9.Source:https://www.cbssports.com/general/news/fanatics-acquires-topps-trading-cards-in-500m-deal/

This Reg D offering is made available through StartEngine Primary, LLC, and sold only to accredited investors through general solicitation. An accredited investor is an individual or entity that meets specific income or net worth requirements as defined by the Securities and Exchange Commission.

The securities being offered have not been registered under the Securities Act of 1933 or any state securities laws and are being offered and sold in reliance on exemptions provided by Regulation D.

This offering is speculative and illiquid, and investors should be prepared to hold the securities for an indefinite period. Investing in securities involves risk, and there is the possibility of losing your entire investment. Neither StartEngine nor its affiliates provide investment advice or recommendations, nor do they offer legal or tax advice regarding any securities.

Investors should carefully review all offering documents, including the private placement memorandum, subscription agreement, and any other relevant materials before making an investment decision.

ABOUT

HEADQUARTERS

8100 Nations Way

Jacksonville, FL 32256

WEBSITE

View Site

ALL UPDATES

HOW INVESTING WORKS

Cancel anytime before 48 hours before a rolling close or the offering end date.

WHY STARTENGINE?

REWARDS

We want you to succeed and get the most out of your money by offering rewards and memberships!

SECURE

Your info is your info. We take pride in keeping it that way!

DIVERSE INVESTMENTS

Invest in over 200 start-ups and collectibles!

FAQS

There are no restrictions for accredited investors.

When you invest, you are purchasing an interest in a Series LLC, which owns shares of the underlying company either directly or indirectly. You will not be purchasing shares in the underlying company itself.

StartEngine makes it easy to invest using your retirement funds. You can open a self-directed IRA account through StartEngine. To get started, simply visit our IRA page for more information and step-by-step instructions.

Already have a self-directed IRA with another provider? You can still invest on StartEngine, but please note that the process will be manual and may take longer to complete.

A Series LLC, like StartEngine Private, is a parent LLC that includes multiple series, each of which holds interests in different underlying companies. The series either directly or indirectly invests in and holds shares of the underlying company. Each series will merely be a separate series and not a separate legal entity. Under Delaware law, if certain conditions are met, the liability of investors holding one series of interests is segregated from the liability of investors holding another series of interests, and the assets of one series of interests are not available to satisfy the liabilities of other series of interests. In the case of StartEngine Private, each series will be created for the purpose of holding an equity interest in stated underlying companies.

After the close of an offering, all investors whose funds have “cleared” by this time will be included in the disbursement. At this time, each investor will receive an email from StartEngine with their Countersigned Subscription Agreement, which will serve as their proof of purchase moving forward. Please keep in mind that a company can conduct a series of “closes” or withdrawals of funds throughout the duration of the campaign. If you are included in that withdrawal period, you will be emailed your countersigned subscription agreement and proof of purchase immediately following that withdrawal.

The Series of StartEngine Private purchases the underlying securities from an affiliate. The affiliate previously sourced and negotiated the terms to purchase these underlying securities from third parties. The amount paid by the Series is higher than the price the affiliate paid for the securities previously in the secondary market. We also note that while StartEngine does not impose any continuing management fee expenses, there is a carried interest of 20 percent associated with the investment in our series, and therefore, to the extent the securities appreciate in value, there will not be a one-to-one economic parity between the share value of the StartEngine Private shares and the company’s shares. Please read the “Risk Factors,” which is included as Exhibit B to the subscription agreement for further details.

In the event that an underlying company experiences a liquidity event, after the relevant holding period is over, either the proceeds from the sale of the shares will be distributed to investors, or if requested, the shares will be transferred to the investor’s brokerage account of choice, minus any applicable fund operating expenses or carried interest. Holding period length varies from company to company. Please note that we are not permitted to provide financial advice. You may want to contact a financial professional to discuss possible investment outcomes.

Investors are able to cancel their investment for 48 hours after submitting their investment. Once your investment is canceled, there is a 10-day clearing period (from the date your investment was submitted). After your funds have cleared the bank, you will receive your refund within 10 business days. Refunds that are made through ACH payments can take up to 10 business days to clear. Unfortunately, we are at the mercy of the bank, but we will do everything we can to get you your refund as soon as possible. However, every investment needs to go through the clearing process in order to be sent back to the account associated with the investment.

Regulation D 506(c) allows companies to raise an unlimited amount of capital from accredited investors through general solicitation and advertising, provided that all purchasers are verified as accredited investors. Both Title III (Regulation Crowdfunding) and Title IV (Reg A+) help entrepreneurs crowdfund capital investments from unaccredited and accredited investors. The differences between these regulations are related to the investor limitations, the differing amounts of money companies are permitted to raise, and differing disclosure and filing requirements. To learn more about Regulation Crowdfunding, click here, and for Regulation A+, click here.

In the US, an accredited investor includes anyone who:

- earned income that exceeded $200,000 (or $300,000 together with a spouse or spousal equivalent) in each of the prior two years and reasonably expects the same for the current year, or;

- has a net worth over $1 million, either alone or together with a spouse or spousal equivalent (excluding the value of the person’s primary residence), or;

- holds in good standing a Series 7, 65, or 82 license.

In the U.S., a "qualified purchaser" must meet a higher financial qualification than "accredited investor."

Individuals and certain entities may qualify as qualified purchasers. In order to be considered a qualified purchaser, you are required to have:

- $5+ million in investments for an individual, family business, or estate planning entity (e.g., certain trusts) excluding primary residences and business property.

- $25+ million in investments for an investment manager

Investments can include:

- Stocks

- Bonds

- Mutual funds

- Cash or cash equivalents

- Real estate (excluding primary residence or business property)

For more information, you can visit here and contact your financial advisor.

Please note: you can also have a Licensed Attorney, Licensed Accountant, Registered Broker-Dealer, or Registered Investment Advisor provide a letter affirming your accreditation.

Alternatively, the following information will be required:

- To verify your income: provide the last 2 years’ worth of tax documents that prove you have had sufficient income for the last two years to meet requirements.

- To verify your net worth: provide account statements, proof of property ownership, or other documentation showing ownership that proves you have a net worth that meets requirements.

- To verify your Series 7, 65, or 82 license: provide your FINRA CRD number for validation.