CLOSED

GET A PIECE OF FOODSPASS

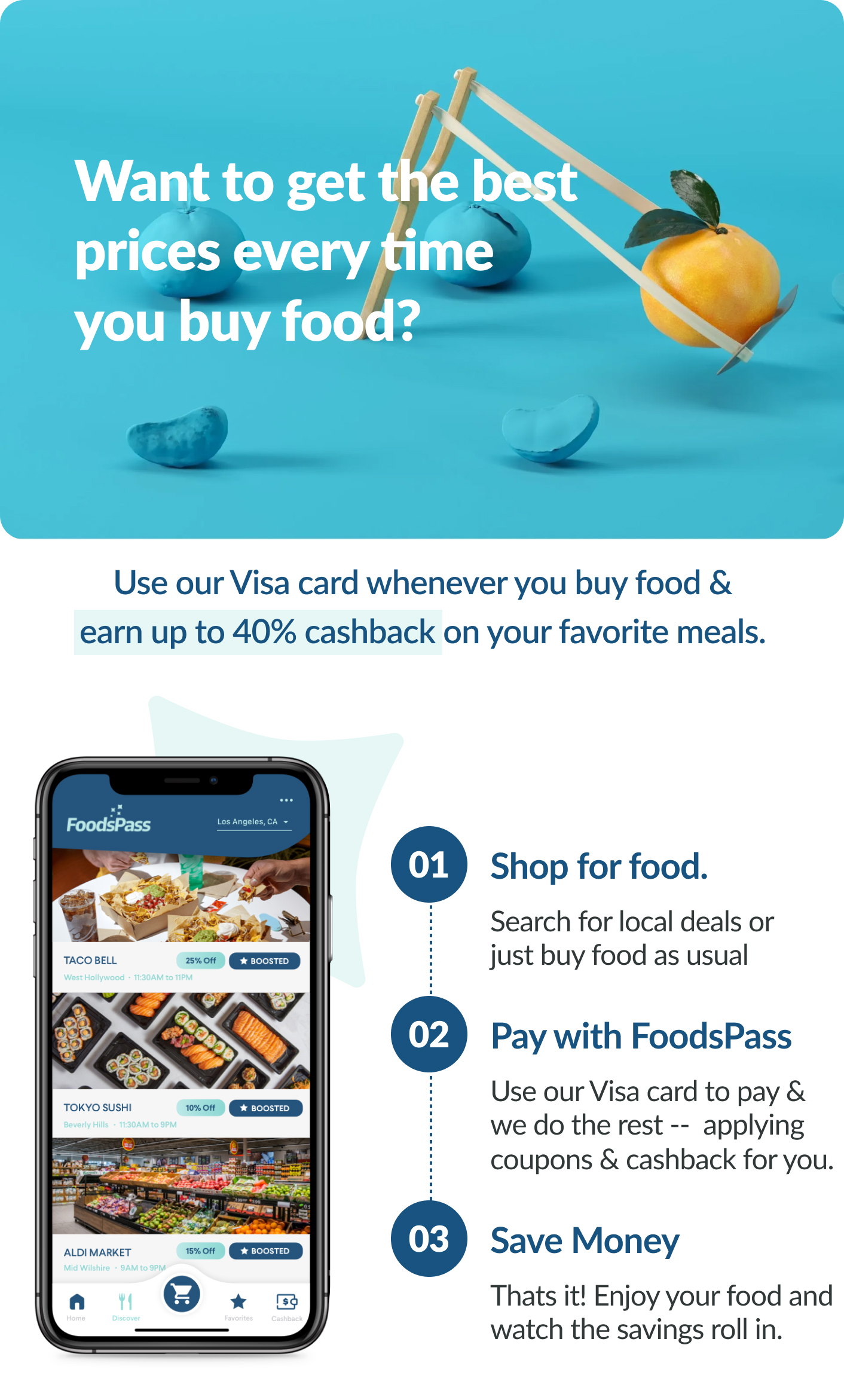

Eat smarter with 4-40% cashback!

REASONS TO INVEST

TEAM

Travis Siflinger • Founder & CEO

Read More

Thomas Dorwart, Esq. • Legal Counsel

Matthew Andrejkovics, MBA, CPA • Financial Advisor & CPA

The graphics shown on this campaign page contain images of FoodsPass' beta app which is currently not available for general use. FoodsPass' is currently pre-revenue.

The “future of food”

FoodsPass is made up of a team of global fintech specialists, entrepreneurs, and foodies. We connect communities to more affordable food, whether that’s at the grocery store, farmer’s market, dining out, delivery, or more! FoodsPass uses data to advocate for sustainable supply chains, for the people and the planet.

With our US launch this year, and thousands of active members required to reach profitability, we believe in the power of crowdfunding to get us to the next big milestone, while creating wealth for our early investors.

The Problem

The missing layer of our foods ecosystem

The average American spends more money on food than entertainment, health care, personal insurance, and education. We want to save money on it, but juggling different retail choices, apps, coupons, credit cards, and points eat into our time.

The emergence of large food-technology brands in the last 5 years has fragmented a delicate ecosystem, leading to inflated costs for consumers, and pushing small business owners to the verge of bankruptcy without offering a streamlined payment and savings solution to save more on everything we eat.

The Solution

Eat now, pay later, save more

FoodsPass isn’t just another rewards program. We’re brand, retailer, and product agnostic. This means members can always access the best deals, no matter where they go to eat. Our members earn an average of $950 per year, with 4-40% standard cashback on all food & beverage purchases. Finally, seamless savings, every time!

*The above graphic contains images of our beta app which is currently not available for general use

The Market

Our target market is worth +$100 billion

We aim to capture a $115B serviceable obtainable market, roughly 10% of the $1.62T serviceable addressable market (US food and beverage purchases 2020), with a global brand opportunity of over $16.55T total addressable market size (Global food & beverage purchases 2020).

FoodsPass is a truly unique, turnkey “fintech” opportunity, which we believe will yield major returns for our SEED investors!

Our Traction

Partnerships in place with major industry players, alongside a waitlist of thousands

Most recently, we’ve signed marketing agreements to work alongside popular brands like Recess Drinks, Starbucks, and Kroger. We’ve been able to organically leverage social media, email campaigns, and guerilla marketing into a waitlist of over 5,000 and were recently shortlisted for “Most Fundable Company 2021” by Pepperdine University, as well as the Techstars x Western Union Technology Accelerator. FoodsPass also intrigued Shark Tank’s Kevin O’Leary and was invited to solicit SEED funding with StartEngine, when we pitched our product on Clubhouse.

gif

Our CEO holds a key relationship with a UK fintech enabler backed by Visa®, and we’re currently securing BIN Sponsorship with a major US bank, positioning us to be the first fintech in America using these superior UK technologies. Our CTO is currently developing an elegantly simple app to accompany our deals database, and Visa cashback card as we strategically plan our product launch by the 3rd quarter of 2021.

What We Do

Disrupting the digital couponing ecosystem used by over 145M Americans

FoodsPass goes beyond what a typical savings app or broad-use credit card can do, automating an antiquated redemption and cashback process that is currently the status quo in the offline/online world of food. In creating the first payments card dedicated to food savings and largest searchable database of food deals, our proprietary technology analyzes relevant transactions against aggregated offers, and seamlessly issues the highest cashback in the industry, without any further steps required.

*The above graphic contains images of our beta app which is currently not available for general use

The Business Model

A uniquely blended business model that profits from multiple revenue streams

FoodsPass generates revenue when our credit cards are used, either through interchange fees paid for by merchants who accept our cards or as a percentage of return on any interest rates or membership fees. We also accrue advertising revenues, through coupon redemption, affiliate fee earnings and targeted advertising packages.

Connecting savings-hungry members with data-hungry brands, FoodsPass serves as a discovery platform for our food and beverage partners. As you get paid to eat, our intermediary marketplace will increase in value as we leverage member purchasing power around data to provide more accurate predictions of food-purchasing trends, yielding profits for all.

How We Are Different

Building community, simplifying food savings, and upsetting industries from fintech to food!

We are confident in our ability to cost-effectively stand out with unique marketing, profitable partnerships and strong branding. Discount clubs, digital coupon platforms, and other savings-related programs are available for those who want to save, but with FoodsPass you get the convenience of saving on everything, with one streamlined solution.

At a time when brands are trying to divide and box us in by race, gender, lifestyle, dietary and political preferences, FoodsPass is bringing people together through a shared affinity of food!

The Vision

Bringing people together, while building a better future, one bite at a time

Our aim is for FoodsPass to become the “top of mind” solution for food payment/savings across the US, within 18-24 months. We plan to achieve this by building a strong community of foodies who refer their friends to our app at FoodsPass.com

Within 48 months, we believe FoodsPass has the potential to help 100 million Americans eat smarter, while advocating for sustainable supply chains, donating meals, minimizing food waste, and maximizing community spending!

OUR LEADERSHIP

A diverse team that holds extensive experience across disciplines

At FoodsPass, our executive team is made up of diverse finance, legal, compliance, performance marketing, and business development executives, as well as web engineers and designers with extensive experience managing complex projects for lifestyle and corporate brands worldwide.

We’re in active communications with a major US bank, award-winning UK technology enablers, and top-tier VC firms like Sequoia Capital.

Why Invest

2021 is the perfect storm and we’re ready for hypergrowth!

Trending Google searches for “best credit card for groceries” prove that there is unmet demand for a product like ours. At FoodsPass, we’re building a unique platform for food savings, at a time when some of the best finance and tech investment opportunities are emerging! We believe FoodsPass offers the kind of dynamic business opportunity that sophisticated fintech investors crave.

*The above graphic contains images of our beta app which is currently not available for general use

With key partnerships in place and an aggressive launch strategy, we believe that FoodsPass represents the future of food savings and we look forward to growing a profitable business together!

THE OFFERING MATERIALS MAY CONTAIN FORWARD-LOOKING STATEMENTS AND INFORMATION RELATING TO, AMONG OTHER THINGS, THE COMPANY, ITS BUSINESS PLAN AND STRATEGY, AND ITS INDUSTRY. THESE FORWARD-LOOKING STATEMENTS ARE BASED ON THE BELIEFS OF, ASSUMPTIONS MADE BY, AND INFORMATION CURRENTLY AVAILABLE TO THE COMPANY’S MANAGEMENT. WHEN USED IN THE OFFERING MATERIALS, THE WORDS “ESTIMATE,” “PROJECT,” “BELIEVE,” “ANTICIPATE,” “INTEND,” “EXPECT” AND SIMILAR EXPRESSIONS ARE INTENDED TO IDENTIFY FORWARD-LOOKING STATEMENTS, WHICH CONSTITUTE FORWARD-LOOKING STATEMENTS. THESE STATEMENTS REFLECT MANAGEMENT’S CURRENT VIEWS WITH RESPECT TO FUTURE EVENTS AND ARE SUBJECT TO RISKS AND UNCERTAINTIES THAT COULD CAUSE THE COMPANY’S ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE CONTAINED IN THE FORWARD-LOOKING STATEMENTS. INVESTORS ARE CAUTIONED NOT TO PLACE UNDUE RELIANCE ON THESE FORWARD-LOOKING STATEMENTS, WHICH SPEAK ONLY AS OF THE DATE ON WHICH THEY ARE MADE. THE COMPANY DOES NOT UNDERTAKE ANY OBLIGATION TO REVISE OR UPDATE THESE FORWARD-LOOKING STATEMENTS TO REFLECT EVENTS OR CIRCUMSTANCES AFTER SUCH DATE OR TO REFLECT THE OCCURRENCE OF UNANTICIPATED EVENTS.

ABOUT

HEADQUARTERS

4533 MacArthur Blvd. Suite A-2193

Newport Beach, CA 92660

WEBSITE

View Site

TERMS

Overview

PRICE PER SHARE

DEADLINE

Jun. 22, 2025 at 9:24 PM UTC

VALUATION

Breakdown

MIN INVESTMENT

MAX INVESTMENT

OFFERING TYPE

Maximum Number of Shares Offered subject to adjustment for bonus shares

ALL UPDATES

12.14.21

Positive Market Feedback!

Our vision is to be the leading fintech company in the food industry & #1 in food savings! As the missing layer of the global foods ecosystem, our food savings club benefits our members, our business partners, and our mission of connecting communities to more affordable food.

Since officially launching our v2.5 iOS app last week, we’ve had over 300 total downloads in this first member cohort & are already seeing a 52.25% engagement rate! With an average conversion rate on the App Store of 2%, ours is 6.77% & as high as 28.57%.

We're excited by strong market appeal for our unique brand & proposition. With 30%+ weekly average growth, over 60% of website visits are direct, which means “FoodsPass” stays top of mind. Instagram is a popular growth channel for us, with over 1,000 organic fans @Foods3.0

Top Markets: CA, AZ, TX, FL

60% Women, 40% Men

Top Ages: 20-39

From grocery chains digitizing their deals, premium CPG brands upgrading their sampling efforts, independent restaurants looking to engage with real, local customers & more, we have 50 datasets in our B2B brand portal, giving us access to 500,000+ F&B brands, vendors & venues, from cool to corporate.

FoodsPass has earned press on Pursuitist, Digital Journal, Market Scale, Market Watch, TechCrunch, FOX, Benzinga & more! Our college ambassador program just distributed 1000’s of flyers to promote our app launch, with a billboard campaign rolling into 31 markets.

If you're considering an investment, now is the time, with only 8 days left!

12.08.21

3 Reasons Why You Should Invest 📈

Hello,

Thanks to all who invested in our first crowdfund. My team & I are grateful for your support! If you're considering an intelligent investment, below are 3 reasons why you should invest:

1) FoodsPass was recently shortlisted for “Most Fundable Company 2021” by Pepperdine University, the Techstars x Western Union Technology Accelerator and the Kroger Innovation fund.

2) FoodsPass aims to capture a $115B serviceable obtainable market, which is roughly 10% of the $1.62T serviceable addressable market (US food and beverage purchases 2020).

3) FoodsPass already has a waitlist of 10,000+ and has signed marketing agreements to work alongside popular food and beverage brands like Kroger, Starbucks, Recess Drinks & many more.

There's a limited window for you to become one of our first angel investors & this is the last full week of our campaign, so if you want to invest, now is your chance, as we're already in touch with multiple VC Firms & Family Offices from TechCrunch Disrupt for further capitalization efforts.

Respectfully,

Travis Matthew Siflinger

Founder & CEO

12.04.21

Foods 3.0

In 2020, 1 in 8 Americans weren’t able to afford the food they needed. These people had to choose between paying for rent, medicine, or bills. At the same time, 40% of all food in America is wasted each year - $161 billion worth!

These numbers are staggering, but as the missing layer in the global foods ecosystem, we have the chance to make a difference. Our business model and products clearly benefit consumers, our brand partners, and our mission of connecting communities to more affordable food. We don't profit from you, we profit with you, and together we can change the future of food.

We’re beyond excited to launch our v2.5 app and website this month! We can't wait to share more, and also tell you 3 reasons why investing in FoodsPass can yield an outsized ROI. Thank you for your support. This round is almost over, so if you've been considering an investment or want to double down, then let's come together to eat and make a real impact this holiday season!

Respectfully,

Travis Matthew Siflinger

Founder & CEO

12.03.21

Notice of Funds Disbursement

[The following is an automated notice from the StartEngine team].

Hello!

As you might know, FoodsPass has exceeded its minimum funding goal. When a company reaches its minimum on StartEngine, it's about to begin withdrawing funds. If you invested in FoodsPass be on the lookout for an email that describes more about the disbursement process.

This campaign will continue to accept investments until its indicated closing date.

Thanks for funding the future.

-StartEngine

11.29.21

Happy Thanksgiving!

FoodsPass is committed to donating meals to families-in-need as a part of our business model.

Last weekend we donated 1,000 turkeys, 10,000 canned goods, $5,000 in Kroger eGiftCards & Diamond Supply clothes for all the kids who attended our Turkey giveaway in Long Beach, CA. In collaboration with The Local Hearts Foundation, "Diamonds & Turkeys" was a huge success & we couldn't be more grateful.

Watch the video to see highlights from the day! We can't thank you enough for your continued support & look forward to sharing more successes with you.

We only have 4 weeks left for you to invest on StartEngine!

Are you with us? Join the club and let’s disrupt an antiquated ecosystem, as we increase food affordability in our communities.

11.17.21

The missing layer in the global food ecosystem.

As we approach the holidays we're reminded of our mission to connect communities to more affordable food!

This year we partnered with the Local Hearts Foundation & Diamond Supply Co. to give away 1,000 Turkeys to families in Long Beach, CA! This is truly an amazing event that will be taking place this Saturday, November 20th.

Thank you to everyone who has invested in FoodsPass, Inc. We have only have 5 short weeks left here on StartEngine, so if you’re still thinking about investing, now is the time!

Be one of the first to receive your own FoodsPass Visa® card when you join the waitlist at FoodsPass.com.

11.11.21

Together, we can create the future of food.

It’s hard to believe that we're approaching the holidays and getting close to finishing up the year. We're so grateful to look back at our growth throughout 2021, but this is just the beginning!

We are continuing to expand our partnerships with new F&B brands such as Palmetto Superfoods, Proper Wild & so many more.

The organic impressions of "FoodsPass" in the iOS app store is showing positive results and our conversion rate for installs is up to 4% higher than the app store average, reinforcing consumer demand in the market. We haven't even started any promotions yet!

In June of this year, we were named one of seven strong start-ups to buy right now by Investor Place, and since then our StartEngine investment has more than doubled, so if you're tired of getting gassed & are seeking an outsized ROI opportunity, please reach out to us anytime at hello@foodspass.com with your questions!

Thank you for your support & we look forward to welcoming you to #teamfoods

11.04.21

Let's eat.

It’s been a busy few weeks wrapping up our trips to New York and Las Vegas to meet with our bank, investors, F&B brands, & major grocery stores.

As we add hundreds of new deals every week & expand our reach across the U.S, we get closer to putting our card in the hands of our growing waitlist of members. We're thrilled to share the design of our Visa® cashback card!

As a next-generation food savings club, FoodsPass is more than a cashback credit card & we're building a community of foodies who want to easily save more on all food purchases.

As we make an impact by merging FinTech x FoodTech, your investment allows us to disrupt the status quo & bring technical innovation to a space that has been overlooked for decades.

Check back soon for more updates!

10.31.21

Notice of Funds Disbursement

[The following is an automated notice from the StartEngine team].

Hello!

As you might know, FoodsPass has exceeded its minimum funding goal. When a company reaches its minimum on StartEngine, it's about to begin withdrawing funds. If you invested in FoodsPass be on the lookout for an email that describes more about the disbursement process.

This campaign will continue to accept investments until its indicated closing date.

Thanks for funding the future.

-StartEngine

10.20.21

Thank You!

We just surpassed $50k in funding on StartEngine, and wanted to say thank you for your support! We’re thrilled to hit this milestone, but even more excited about where we are headed!

Our success would not be possible without the collaboration of our investors, brand partners, and team. Together we’re working to create the missing layer in the global foods ecosystem, bringing people together through food, while helping families in need!

Check back soon for more updates on what we are up to, as we aim to become #1 in food savings!

Have any questions about FoodsPass? You can always reach out to us at: hello@foodspass.com

REWARDS

Venture Club

Venture Club Members earn 10% bonus shares on top of this and all eligible investments for an entire year. Not a member? Sign up at checkout ($275/year).

$250

COFFEE & DONUTS

Free membership for 1 year + $10 Dunkin Donuts eGiftCard or our Virtual Visa®. PLUS we’ll donate 1 meal to a family in need.

$500

GET JUICED

5% bonus shares + $50 Jamba Juice eGiftCard or our Virtual Visa® + Free membership for 1 year. PLUS we’ll donate 10 meals to families in need.

$1,000

PIZZA PARTY

7% bonus shares + $100 Papa John’s eGiftCard or our Virtual Visa® + Free membership for 2 years. PLUS we’ll donate 20 meals to families in need.

$2,500

FILL THE FRIDGE

10% bonus shares + $250 Kroger eGift card or our Virtual Visa® + Free membership for 2 years. PLUS we’ll donate 50 meals to families in need.

$5,000

FEED THE HUNGRY

10% bonus shares + $250 FoodsPass Virtual Visa® card + Free lifetime membership. PLUS we’ll donate 500 meals to families in need.

$10,000

FOODSPASS, INC.

10% bonus shares + $250 FoodsPass Virtual Visa® card + Free lifetime membership + VIP corporate access. PLUS we’ll donate 500 meals to families in need.

JOIN THE DISCUSSION

0/2500

Robin Perkins

10 months ago

Congratulations on making big strides forward! Thanks for the update and good luck!

0

0

Robin Perkins

2 years ago

The Google Play Store shows that the FoodsPass app has about 50 downloads. It also shows that no updates have been made to the app since this offering closed. What is the status of this company?

Show more

1

0

Robin Perkins

3 years ago

I'd like to see an update on how our investment in FoodsPass is doing.

0

0

Marc Russell

4 years ago

I am intrigued. I like the idea of using the one credit card that has pre-loaded all the coupons. Is FoodsPass only focused on the food market? Will it take into account any of the BOGO offers? I know half the coupons I see on my Kroger app are for toiletries and other household items. Or what about other reward programs like McDonalds or the coupons in the mail for other fast food places which has special offers will those be automatically included? Will the app show which items received an automatic coupon (when purchasing groceries)? How many current beta users are using the app? I see the perks include memberships, how much is that? I would think that fee could be offset by the credit card fees and the interest you receive. I do like the idea of a premium membership for a higher cashback or additional coupon service.

Show more

1

1

Anton Maksimov

4 years ago

very cool product. I want to invest. The main question concerns the core business model. You write that you will be able to change the coupon market. You also write that the coupon agents themselves are in the earnings scheme. How is integration with coupon agents possible if their business model requires 1) to buy a coupon, 2) to present it BEFORE buying 3) there are restrictions on the number of buyers and other difficulties. in your model, there is no need to show a coupon, that is, you charge a discount in the form of a cashback. These 2 models are not compatible with each other. How do you plan to charge commission: coupon agents or will grocery stores and restaurants pay commission directly to you?

Show more

1

0

Samuel Azair Azair

4 years ago

How is a company with no revenue, no plan to start generating revenue until 2022, and a year 1 revenue projection of 250k valued at 12.5 million? It's all great to talk about how big the industry is and how much potential there is, but if you haven't even started generating revenue, it seems disingenuous to value your company at 12.5 million. That being said, I think this is a really cool idea and absolutely love the donating meal aspect of it, I just have a problem with the valuation. Looking forward to hearing your response.

Show more

1

1

Angela Zaitz

4 years ago

What is the cost to the consumer. Is there a membership fee, a fee for the app? Are you required to use your Visa card to purchase? What are the fees and interest rate of your Visa card?

Show more

1

0

Mohammad Haider

4 years ago

Thanks for the quick reply.. Here are follow up questions- 1. Let's say Doordash start this, how do you compete with them. 2. The apps is not even in beta state how come the valuation is 12.5M? Please explain more. 3. Why offering common share not preferred?

Show more

1

0

Mohammad Haider

4 years ago

I am interested. Have couple of questions- 1. Who is your competitor? If there are other competitor how do you success over them? 2. What are your revenue generating schemes? 3. Is just just food or promoting health foods here. 4. Any revenue projections for next couple of years. 5. Are there any premium paid service to get extra discount or just coupons?

Show more

2

0

HOW INVESTING WORKS

Cancel anytime before 48 hours before a rolling close or the offering end date.

WHY STARTENGINE?

REWARDS

We want you to succeed and get the most out of your money by offering rewards and memberships!

SECURE

Your info is your info. We take pride in keeping it that way!

DIVERSE INVESTMENTS

Invest in over 200 start-ups and collectibles!

FAQS

With Regulation A+, a non-accredited investor can only invest a maximum of 10% of their annual income or 10% of their net worth per year, whichever is greater. There are no restrictions for accredited investors.

With Regulation Crowdfunding, non-accredited investors with an annual income or net worth less than $124,000 are limited to invest a maximum of 5% of the greater of those two amounts. For those with an annual income and net worth greater than $124,000, they are limited to investing 10% of the greater of the two amounts.

StartEngine makes it easy to invest using your retirement funds. You can open a self-directed IRA account through Equity Trust, a trusted provider fully integrated with our platform. This integration allows for a fast, secure, and seamless investing experience, and includes a special offer on annual feesexclusively for StartEngine investors.

Already have a self-directed IRA with another provider? You can still invest on StartEngine, but please note that the process will be manual and may take longer to complete.

To get started, simply visit our IRA page for more information and step-by-step instructions.

At the close of an offering, all investors whose funds have “cleared” by this time will be included in the disbursement. At this time, each investor will receive an email from StartEngine with their Countersigned Subscription Agreement, which will serve as their proof of purchase moving forward.

Please keep in mind that a company can conduct a series of “closes” or withdrawals of funds throughout the duration of the campaign. If you are included in that withdrawal period, you will be emailed your countersigned subscription agreement and proof of purchase immediately following that withdrawal.

StartEngine assists companies in raising capital, and once the offering is closed, we are no longer involved with whether the company chooses to list shares on a secondary market or what occurs thereafter. Therefore, StartEngine has no control or insight into your investment after the close of the live offering. In addition, we are not permitted to provide financial advice. You may want to contact a financial professional to discuss possible investment outcomes.

For Regulation Crowdfunding, investors are able to cancel their investment at any point throughout the campaign up until 48 hours before the closing of the offering. Note: If the company does a rolling close, they will post an update to their current investors, giving them the opportunity to cancel during this timeframe. If you do not cancel within this 5-day timeframe, your funds will be invested in the company, and you will no longer be able to cancel the investment. If your funds show as ‘Invested’ on your account dashboard, your investment can no longer be canceled.

For Regulation A+, StartEngine allows for a four-hour cancellation period. Once the four-hour window has passed, it is up to each company to set their own cancellation policy. You may find the company’s cancellation policy in the company’s offering circular.

Once your investment is canceled, there is a 10-day clearing period (from the date your investment was submitted). After your funds have cleared the bank, you will receive your refund within 10 business days.

Refunds that are made through ACH payments can take up to 10 business days to clear. Unfortunately, we are at the mercy of the bank, but we will do everything we can to get you your refund as soon as possible. However, every investment needs to go through the clearing process in order to be sent back to the account associated with the investment.

Both Title III (Regulation Crowdfunding) and Title IV (Reg A+) help entrepreneurs crowdfund capital investments from unaccredited and accredited investors. The differences between these regulations are related to the investor limitations, the differing amounts of money companies are permitted to raise, and differing disclosure and filing requirements. To learn more about Regulation Crowdfunding, click here, and for Regulation A+, click here.

Thomas Mueller

7 months ago

Earlier today I received an email from Startengine regarding the "Q3 Update from FoodPass" status update. Unfortunately, the latest update I see here is from 2021. Am I missing something?

Show more

1

0