WAITLIST

CLOSED

ACCREDITED INVESTORS ONLY

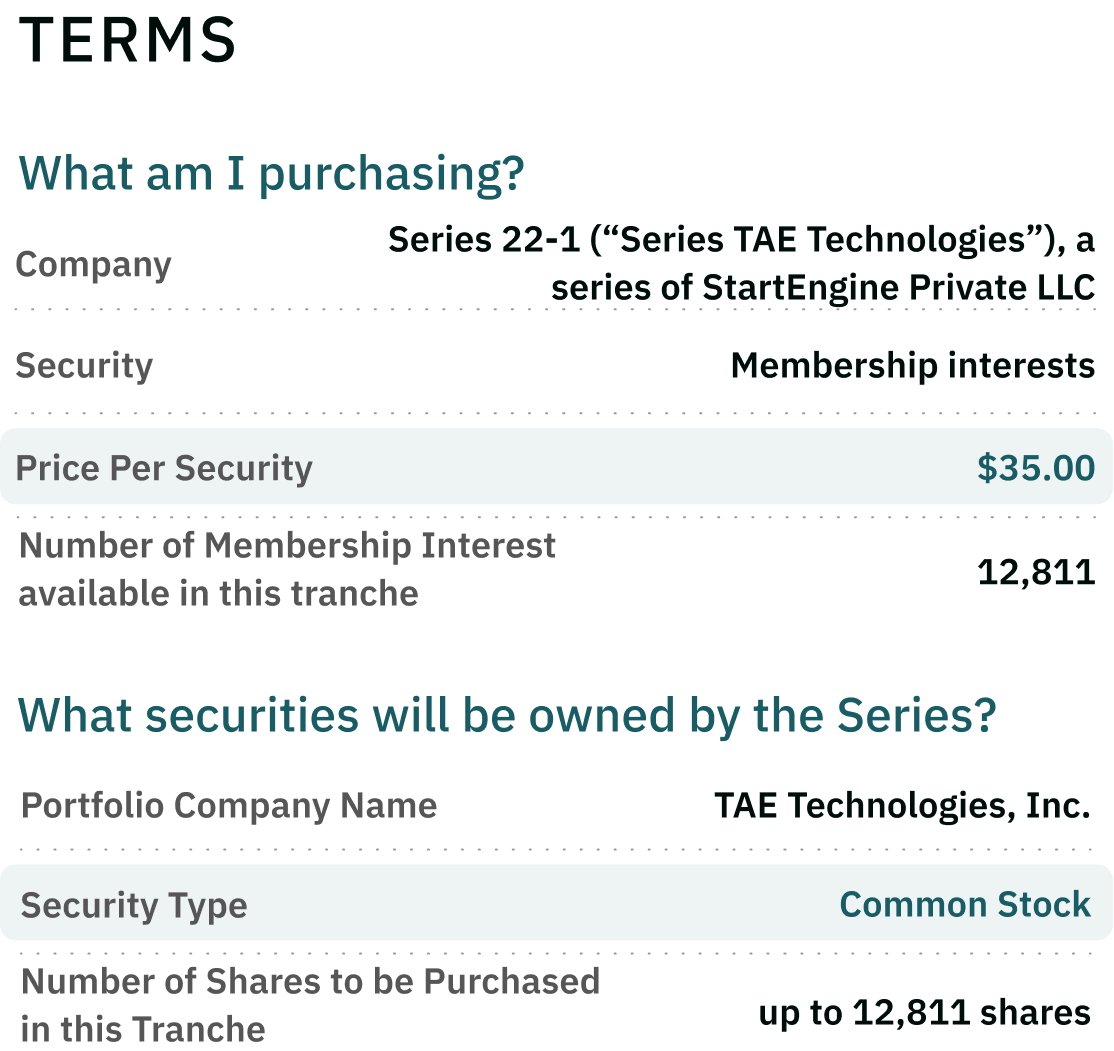

GET A PIECE OF SERIES TAE TECHNOLOGIES

TAE Technologies: Invest in Fusion for A.I.’s Soaring Energy Demands

$440,895 Raised

STARTENGINE PRIVATE: YOUR PORTAL TO INVEST IN VENTURE-BACKED BUSINESSES WITHOUT SPENDING MILLIONS

The A.I. industry is booming but with that expansion comes soaring energy consumption, — so much so that by 2027, the A.I. industry's energy demands could match those of a small country. 3 Sam Altman (OpenAI CEO) states the only solution is “breakthroughs in fusion,” and "there's no way to get there without a breakthrough. It motivates us to go invest more in fusion." 4

Altman recently invested $375M into the sector. Other Silicon Valley icons Jeff Bezos, Bill Gates, and even the U.S government have made similar investments, contributing to the 790% spike in venture funding since 2021. 5, 6, 7

TAE Technologies: A Potential Solution for A.I.’s Energy Needs

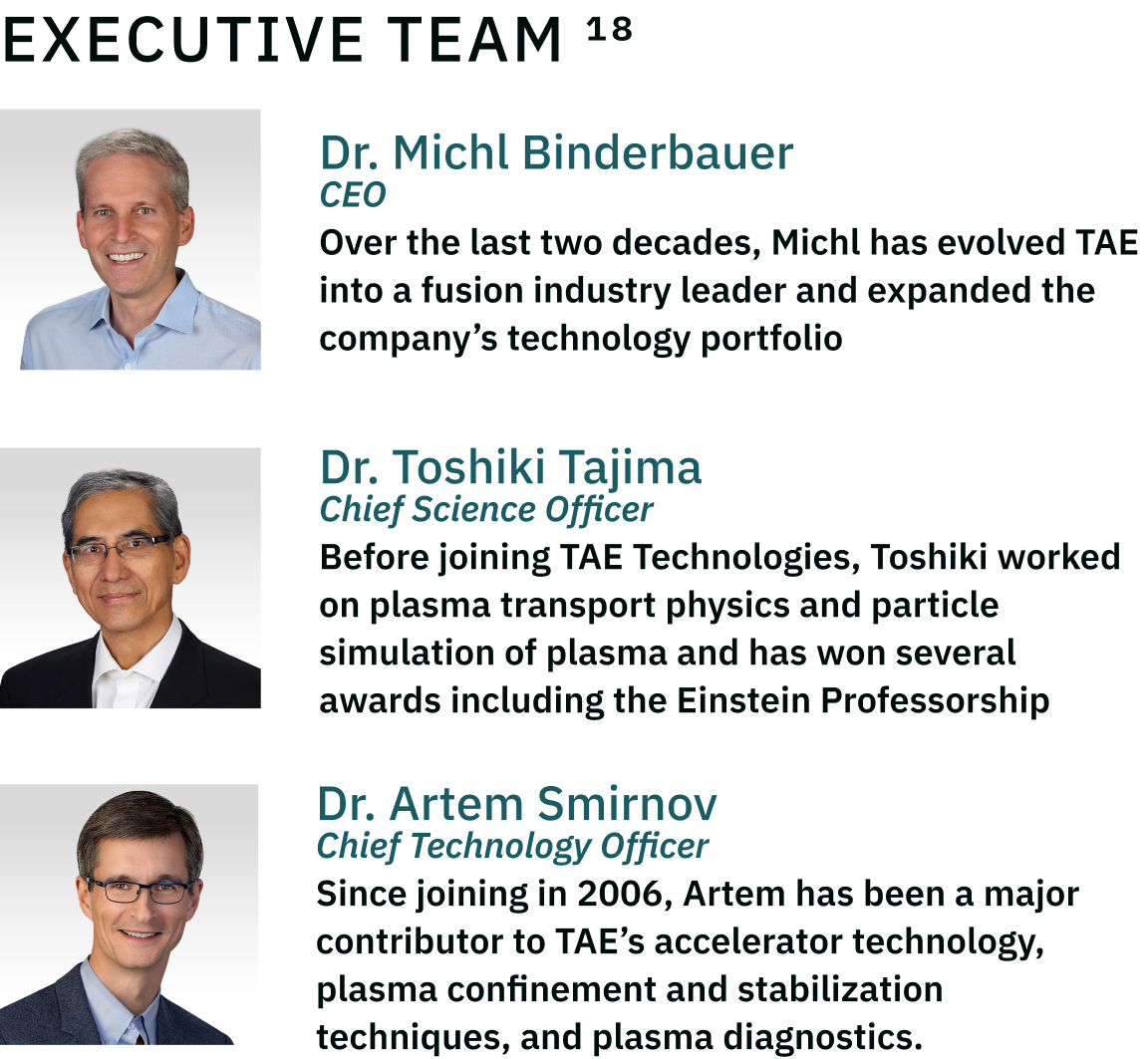

With 20+ years experience developing aneutronic fusion, an approach that further reduces radioactive waste compared to other nuclear fusion methods 8, TAE Technologies is leading the charge in giving us clean, renewable energy — a mission they believe could revolutionize the power grid as we know it. 9REASONS TO INVEST

“We Need Fusion” – Sam Altman, OpenAI CEO 10

Fusion investments from Silicon Valley have boomed recently thanks to large capital raises from Bill Gates, Jeff Bezos, and Sam Altman 11 ($375M personal investment) 10; national governments like China and the U.S. have also made significant investments in fusion 10

TAE Technologies and the $1.8 Trillion Opportunity 12

Over the last 20+ years, TAE Technologies has developed an innovative approach employing hydrogen and boron to create, sustainable fusion energy — a potential solution for A.I’s expected $1.8T market by 2030 12

From Cancer to Electric Cars: Tapping into Multiple Market Opportunities

TAE Technologies and its subsidiaries are poised to enter several significant markets with its advanced technological capabilities, targeting areas like clean energy, cancer treatment, and the automotive sector 13, 14

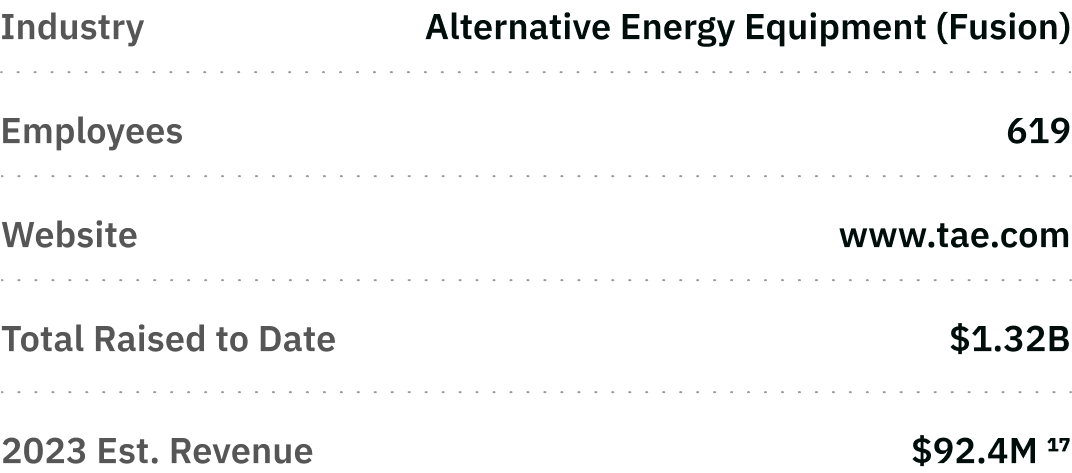

$1.32B Cumulatively Raised — Google, Goldman Sachs Back TAE Technologies 2

Adding to the list, TAE Technology investors includes Chevron, Sumitomo, and KittyHawk Ventures (to name a few) 2; the private sector has contributed over $6B to fusion start-ups, with roughly 20% of this funding directed towards TAE Technologies 2, 15

FURTHER RESEARCH

1. Recharge News: ‘We'll Need Something Else to Fight Over': Nuclear Fusion Could End Energy Wars, Says Pioneer.

2. TAE Technologies Research Library: Over 20 years of Developments.

3. Fast Company: The Frontrunners in the Trillion-Dollar Race for Limitless Fusion Power.

4. Yahoo: Google-backed TAE Technologies raises $280 million from new, existing investors.

5. TAE Technologies Applauds California’s Landmark Fusion Energy Bill.

6. TAE Life Sciences: Bringing New Hope to Patients with the Most Difficult to Treat Cancers.

*The articles and video provided are for informational purposes only about TAE Technologies, Inc. The information provided is not guaranteed for accuracy or completeness, has not been independently verified, and should not be considered financial or investment advice; consult your financial and tax advisors before making investment decisions.

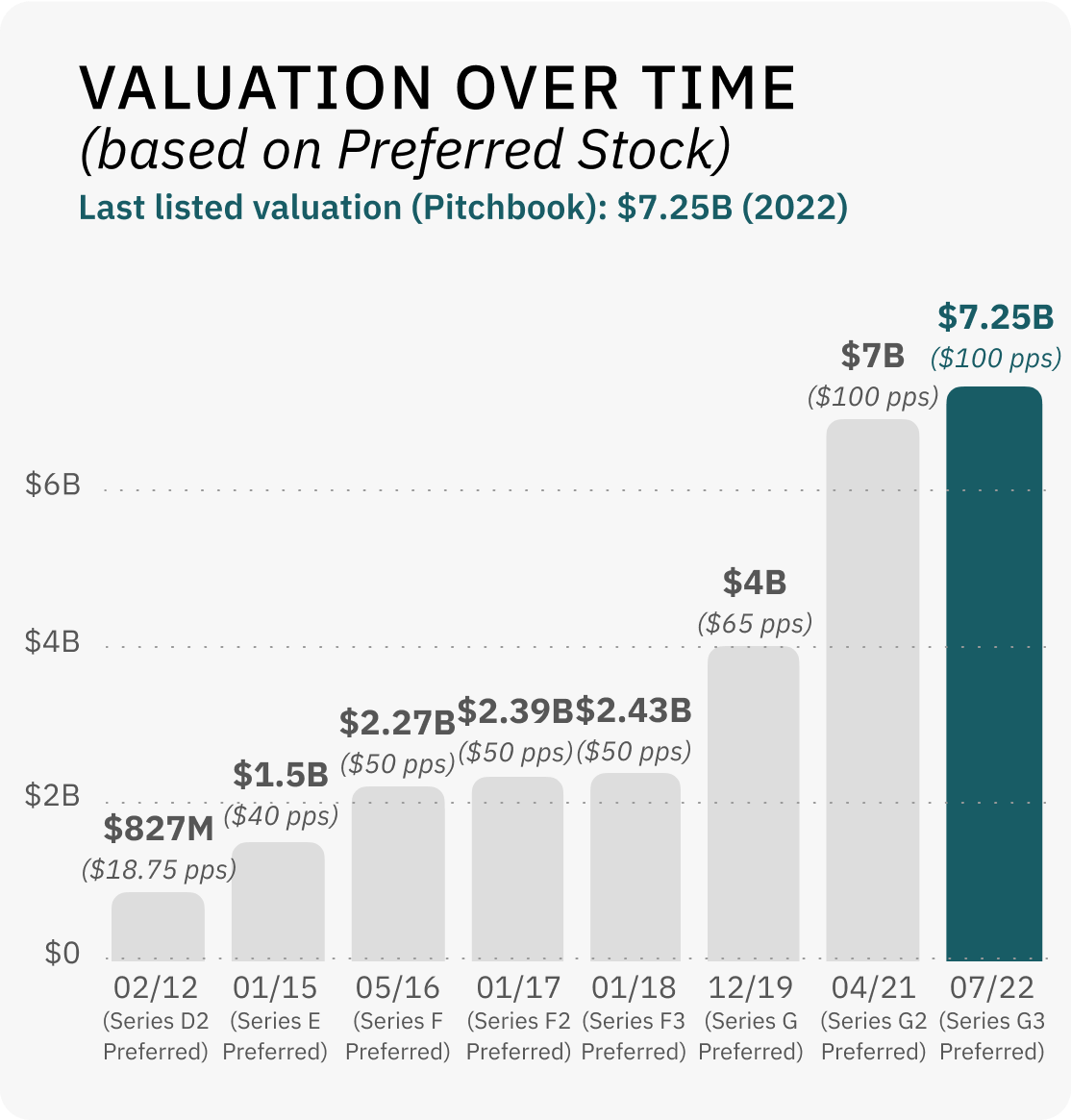

This valuation is in connection with offerings of preferred stock and based on the prices of the preferred stock at that time. Series TAE Technologies owns Common Stock. Unless otherwise indicated, the information herein is based on information obtained from Pitchbook. This information is from publicly available sources, and we do not guarantee its accuracy or completeness. Past performance and valuations are not indicative of future results, and investors should not assume that investments in Series TAE Technologies will increase in value. Valuation is not static and can fluctuate based on various factors. See full details in footnote 2.

The value of the offered interests may not be directly equivalent to those of the existing shares of TAE Technologies, Inc. and may have differing material rights, including a carried interest fee of 20%. Series TAE Technologies has the right to purchase additional shares in its sole discretion and purchase additional shares of the underlying company. Assuming no reorganization or other corporate events in the underlying company, there will be 1-1 correspondence between the number of shares owned by Series TAE Technologies and the number of shares in the Series outstanding.

This offering is not eligible for any bonus shares. Any reference to bonus shares or similar terms should not be interpreted as an offer or entitled to bonus shares.

Disclaimers:

1. TAE Technologies, Inc. (“TAE Technologies”) is not participating or involved in this offering. The availability of company information does not indicate that the company has endorsed, supports or otherwise participates with StartEngine Private LLC or any of its affiliates. StartEngine Private LLC purchases shares from current and former employees, early investors, and advisors of the company. When you make an investment in a company on StartEngine Private, you are purchasing an interest in a series of StartEngine Private LLC, a Delaware limited liability company (the “Series LLC”), which was created to hold shares of a privately held company. An investor will not directly own or hold shares of the private company but instead will own member interests in a series of the Series LLC, which either directly or indirectly, will hold shares in the company. There may not be a one-to-one economic parity on the value of the Series LLC interests and TAE Technologies shares.

StartEngine Advisers LLC manages the Series LLC and reports as an exempt reporting advisor (“ERA”) to the Securities and Exchange Commission, which is an investment advisor that is not required to register as a registered investment advisor (“RIA”).

The underlying securities of Series TAE Technologies offered herein are subject to restrictions on transferability and resale including a Right of First Refusal ("ROFR"). As such, the TAE Technologies, Inc. has the first right to purchase the securities should Series TAE Technologies wish to sell or transfer them. This may affect the ability of Series TAE Technologies to dispose of the securities. Before investing, potential investors should carefully read the offering documents and consult with their advisor to understand the implications of these restrictions.

2. Unless otherwise indicated, the information on this webpage and our marketing materials for Series TAE Technologies is sourced from Pitch Book, a website that maintains a record of the company’s funding rounds, along with their corresponding pre- and post-money valuations. As information on the company, including the valuations, are sourced from publicly available information, we do not guarantee their accuracy or completeness. The data and information may be subject to errors, omissions, or changes over time, and we are not responsible for any inaccuracies in the data and information provided. All the information contained on this page is derived from publicly available data and information, and has not been independently verified by us or any of our affiliates. This information should not be considered as financial or investment advice. Before making any investment decision you should consult your own financial, investment and tax advisors.

3.Source: https://nyti.ms/3V4riYX

4.Source: https://reut.rs/3ykc35g

5.Source: https://bit.ly/3wGk9EF

6.Source: https://bit.ly/3QSOy9F

7.Source: https://politi.co/3ULMYaN

8.Source: https://bit.ly/3QNSOqU

9.Source: https://tae.com/faq-fusion/

10.Source: https://politi.co/3ULMYaN

11.Source: https://bit.ly/3wGk9EF

12.Source: https://bit.ly/3K6uInE

13.Source: https://taelifesciences.com/

14.Source: https://power-solutions.tae.com/

15.Source: https://bit.ly/4aurYLn

16.Source:https://tae.com/fusion-power/

17.Source:https://growjo.com/company/TAE_Technologies

This Reg D offering is made available through StartEngine Primary, LLC, and sold only to accredited investors through general solicitation. An accredited investor is an individual or entity that meets specific home or net worth requirements as defined by the Securities and Exchange Commission.

The securities being offered have not been registered under the Securities Act of 1933 or any state securities laws and are being offered and sold in reliance on exemptions provided by Regulation D.

This offering is speculative and illiquid, and investors should be prepared to hold the securities for an indefinite period. Investing in securities involves risk, and there is the possibility of losing your entire investment. Neither StartEngine nor its affiliates provide investment advice or recommendations, nor do they offer legal or tax advice regarding any securities.

Investors should carefully review all offering documents, including the private placement memorandum, subscription agreement, and any other relevant materials before making an investment decision.

ABOUT

HEADQUARTERS

19631 Pauling

Lake Forest, CA 92610

WEBSITE

View Site

PRESS

ALL UPDATES

06.06.25

TAE Raises $150M to Power the Future of Fusion

TAE Technologies just hit another major milestone: a fresh $150 million funding round joined by heavy hitters like Chevron, Google, and NEA.¹

That brings TAE’s total equity funding to more than $1.3 billion, and adds even more fuel to their mission to deliver the world’s first commercial fusion power plant.

This isn’t just about capital. It’s a strong vote of confidence in TAE’s approach to safe, scalable, zero-carbon energy. Google’s been working with TAE for more than a decade, and they’re doubling down to help crack the code for the plasma breakthroughs needed to reach net energy.

TAE’s next big step? Copernicus, their sixth-gen fusion device, now in construction and aiming to hit net energy before 2030. After that: Da Vinci, their first commercial reactor.

Want to further diversify your portfolio? View our open Private offerings.

***

DISCLAIMERS

1. Source: TAE Technologies, “TAE Technologies Raises $150 Million in Latest Funding Round,” Press Release, June 2, 2025

2. This Reg D offering was made available through StartEngine Primary, LLC, and sold only to accredited investors through general solicitation. An accredited investor is an individual or entity that meets specific home or net worth requirements as defined by the Securities and Exchange Commission.

The securities being offered have not been registered under the Securities Act of 1933 or any state securities laws and are being offered and sold in reliance on exemptions provided by Regulation D.

This offering is speculative and illiquid, and investors should be prepared to hold the securities for an indefinite period. Investing in securities involves risk, and there is the possibility of losing your entire investment. Neither StartEngine nor its affiliates provide investment advice or recommendations, nor do they offer legal or tax advice regarding any securities.

Investors should carefully review all offering documents, including the private placement memorandum, subscription agreement, and any other relevant materials before making an investment decision.

REWARDS

HOW INVESTING WORKS

Cancel anytime before 48 hours before a rolling close or the offering end date.

WHY STARTENGINE?

REWARDS

We want you to succeed and get the most out of your money by offering rewards and memberships!

SECURE

Your info is your info. We take pride in keeping it that way!

DIVERSE INVESTMENTS

Invest in over 200 start-ups and collectibles!

FAQS

With Regulation A+, a non-accredited investor can only invest a maximum of 10% of their annual income or 10% of their net worth per year, whichever is greater. There are no restrictions for accredited investors.

With Regulation Crowdfunding, non-accredited investors with an annual income or net worth less than $124,000 are limited to invest a maximum of 5% of the greater of those two amounts. For those with an annual income and net worth greater than $124,000, they are limited to investing 10% of the greater of the two amounts.

StartEngine makes it easy to invest using your retirement funds. You can open a self-directed IRA account through Equity Trust, a trusted provider fully integrated with our platform. This integration allows for a fast, secure, and seamless investing experience, and includes a special offer on annual feesexclusively for StartEngine investors.

Already have a self-directed IRA with another provider? You can still invest on StartEngine, but please note that the process will be manual and may take longer to complete.

To get started, simply visit our IRA page for more information and step-by-step instructions.

At the close of an offering, all investors whose funds have “cleared” by this time will be included in the disbursement. At this time, each investor will receive an email from StartEngine with their Countersigned Subscription Agreement, which will serve as their proof of purchase moving forward.

Please keep in mind that a company can conduct a series of “closes” or withdrawals of funds throughout the duration of the campaign. If you are included in that withdrawal period, you will be emailed your countersigned subscription agreement and proof of purchase immediately following that withdrawal.

StartEngine assists companies in raising capital, and once the offering is closed, we are no longer involved with whether the company chooses to list shares on a secondary market or what occurs thereafter. Therefore, StartEngine has no control or insight into your investment after the close of the live offering. In addition, we are not permitted to provide financial advice. You may want to contact a financial professional to discuss possible investment outcomes.

For Regulation Crowdfunding, investors are able to cancel their investment at any point throughout the campaign up until 48 hours before the closing of the offering. Note: If the company does a rolling close, they will post an update to their current investors, giving them the opportunity to cancel during this timeframe. If you do not cancel within this 5-day timeframe, your funds will be invested in the company, and you will no longer be able to cancel the investment. If your funds show as ‘Invested’ on your account dashboard, your investment can no longer be canceled.

For Regulation A+, StartEngine allows for a four-hour cancellation period. Once the four-hour window has passed, it is up to each company to set their own cancellation policy. You may find the company’s cancellation policy in the company’s offering circular.

Once your investment is canceled, there is a 10-day clearing period (from the date your investment was submitted). After your funds have cleared the bank, you will receive your refund within 10 business days.

Refunds that are made through ACH payments can take up to 10 business days to clear. Unfortunately, we are at the mercy of the bank, but we will do everything we can to get you your refund as soon as possible. However, every investment needs to go through the clearing process in order to be sent back to the account associated with the investment.

Both Title III (Regulation Crowdfunding) and Title IV (Reg A+) help entrepreneurs crowdfund capital investments from unaccredited and accredited investors. The differences between these regulations are related to the investor limitations, the differing amounts of money companies are permitted to raise, and differing disclosure and filing requirements. To learn more about Regulation Crowdfunding, click here, and for Regulation A+, click here.