CLOSED

GET A PIECE OF GET MAINE LOBSTER BY BLACK POINT SEAFOOD

The Freshest Catch Delivered

$428,007.08 Raised

REASONS TO INVEST

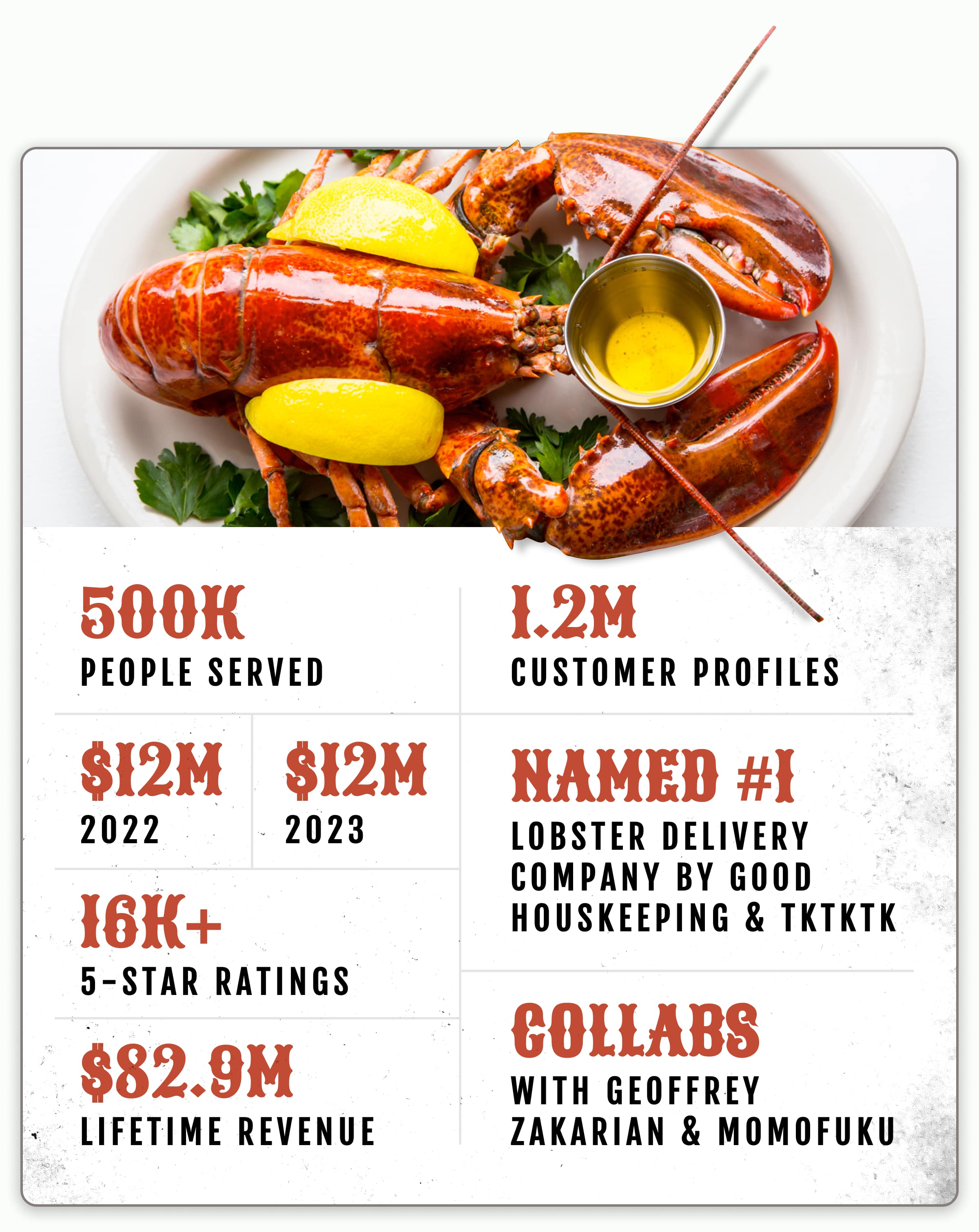

Get Maine Lobster boasts a loyal customer base with over $82.9M in lifetime revenue, $12.3M in 2023 revenue, over 16K 5-star reviews, & collaborations with Geoffrey Zakarian and Momofuku, & previously with MasterCard.

We are targeting the U.S. seafood market, valued at over $11B annually, with a specific focus on the lobster retail market, estimated to be worth approximately $367M.

Get Maine Lobster caters to eco-conscious consumers by delivering premium seafood with minimal environmental impact and partnering with like-minded Marine harvesters, promoting generations of conservation.

TEAM

Mark Murrell • Founder, CEO, Board Member

Read More

John Peich • Chief Operating Officer

Read More

Hoyt Harper II • Brand/Marketing Advisor, Board Member

Read More

the pitch

Get Maine Lobster brings the bounty of the Maine coast directly to your doorstep. As named the #1 direct-to-consumer lobster delivery company in the U.S. by Good Housekeeping, we’re dedicated to delivering exceptional quality and service. From our succulent deep-water lobsters to our sweet diver scallops and wild-caught swordfish, we ship premium seafood straight from the icy waters of Portland, Maine.

We’re committed to environmental preservation through our robust sustainability practices that prioritize conserving marine life and the ecosystem. That’s why we source our premium seafood from responsible Maine harvesters who share our commitment to environmental sustainability.

But Get Maine Lobster goes beyond just delivery, we aim to create unforgettable seafood experiences through innovating and elevating the customer experience. We offer unique seafood selections, creative recipe inspiration, and how-to videos to transform any gathering into a memorable culinary experience.

the market & our traction

The U.S. is one of the largest seafood markets in the world, annually producing approximately $11 billion worth of safe, sustainable, and wholesome seafood.1 Despite a general 11% decline in U.S. lobster sales in 2023, Get Maine Lobster experienced an 8% increase in its sales. We're focused on the lobster retail market, which has an estimated value of around $367 million. As one of the top lobster delivery companies recognized by Good Housekeeping, and bolstered by successful collaborations with culinary experts like Geoffrey Zakarian and the renowned restaurant group Momofuku, along with over 16,000 5-star customer reviews, Get Maine Lobster is eager to continue its expansion and deliver even more fresh seafood across the U.S.

Proven Traction & Exciting Growth

- Served over 500,000 happy customers

- Lifetime gross revenue of $82.9 million

- Secured $260,000 in seed funding through Reg CF via SeedInvest in 2018

- A loyal customer base with 16,000+ 5-star ratings

- Crowned the #1 direct-to-consumer lobster delivery company in the U.S. by Good Housekeeping

- Notable collaborations with culinary star Geoffrey Zakarian and established culinary brand Momofuku

- Previous and current partnerships with industry giants like WW, WHOLE30, Perry's Steakhouse & Grille, Mastercard, Arctic, and more.

Strong Brand & Loyal Community

- 3.3 million unique website visitors over the last 12 months

- 611,000 engaged email subscribers

- 35% customer return rate

- Over 8 billion media impressions since 2020

- $200 average order value, demonstrating our premium product appeal

The Opportunity

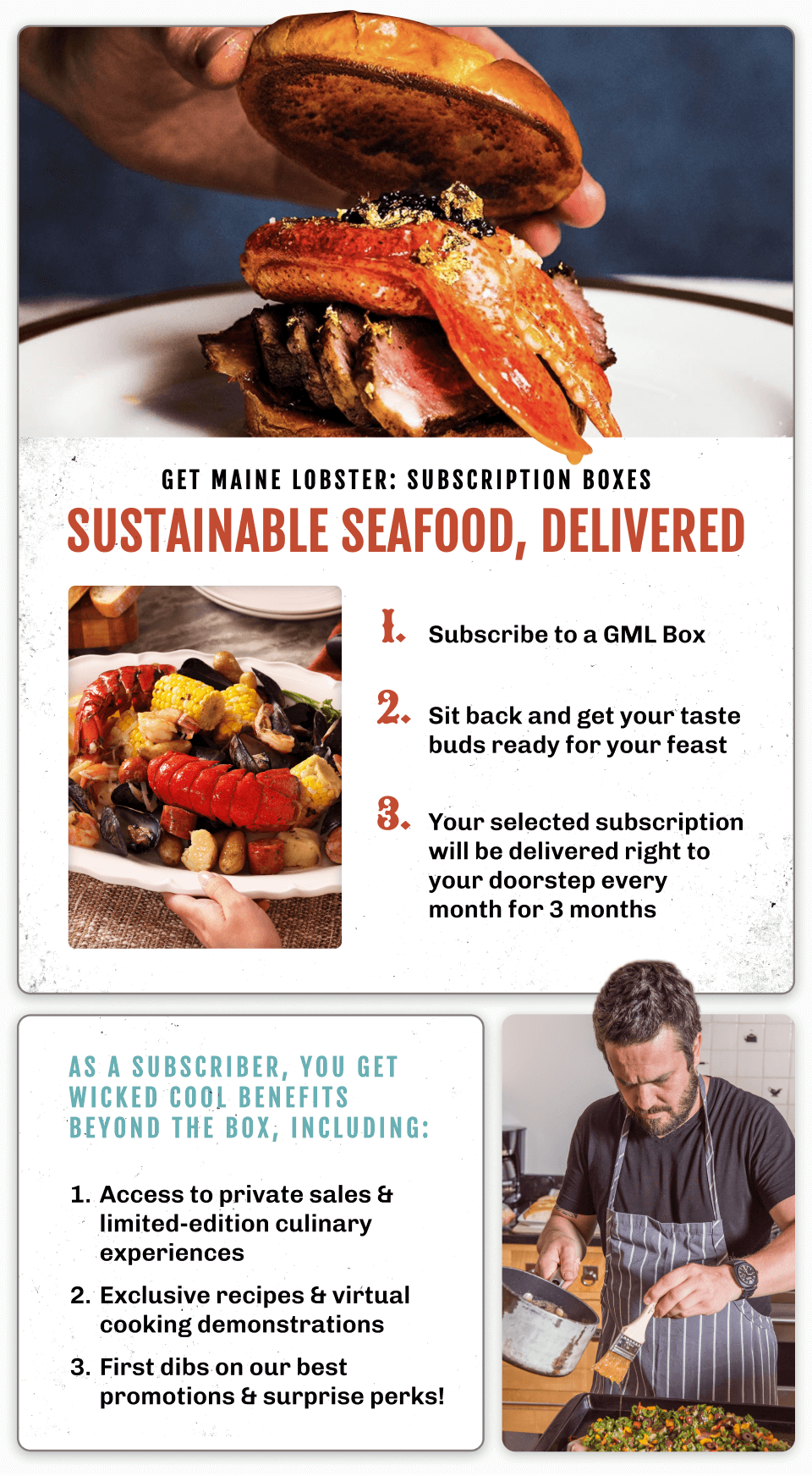

At Get Maine Lobster, we believe in celebrating the diverse bounty of Maine’s storied seafaring heritage. That’s why we create modern culinary adventures that bring the allure of the ocean right to your door. We know that the freshest seafood deserves to be much more than a meal, it should be an experience. We’re passionate about creating memorable gatherings with exceptional food. Think families, friend groups, and anyone who loves to host.

From meaty, deep-water Maine lobsters to sweet diver scallops and wild-caught swordfish, we ship them all with the tools of the trade and personal touches that turn eating into an event. Our sustainably sourced Maine lobster and premium seasonal selections provide an unrivaled culinary experience you’ll look forward to each month. Our subscription boxes include lobster in its various delicious forms that are expertly flash-frozen; arriving ready to thaw, prep, and enjoy.

Plus, according to the 2023 NeilsenIQ Consumer Report, 37% of consumers are spending less on "Out of Home" dining and eating, with 42% of consumers spending more on grocery and household items. That's where Get Maine Lobster comes in.

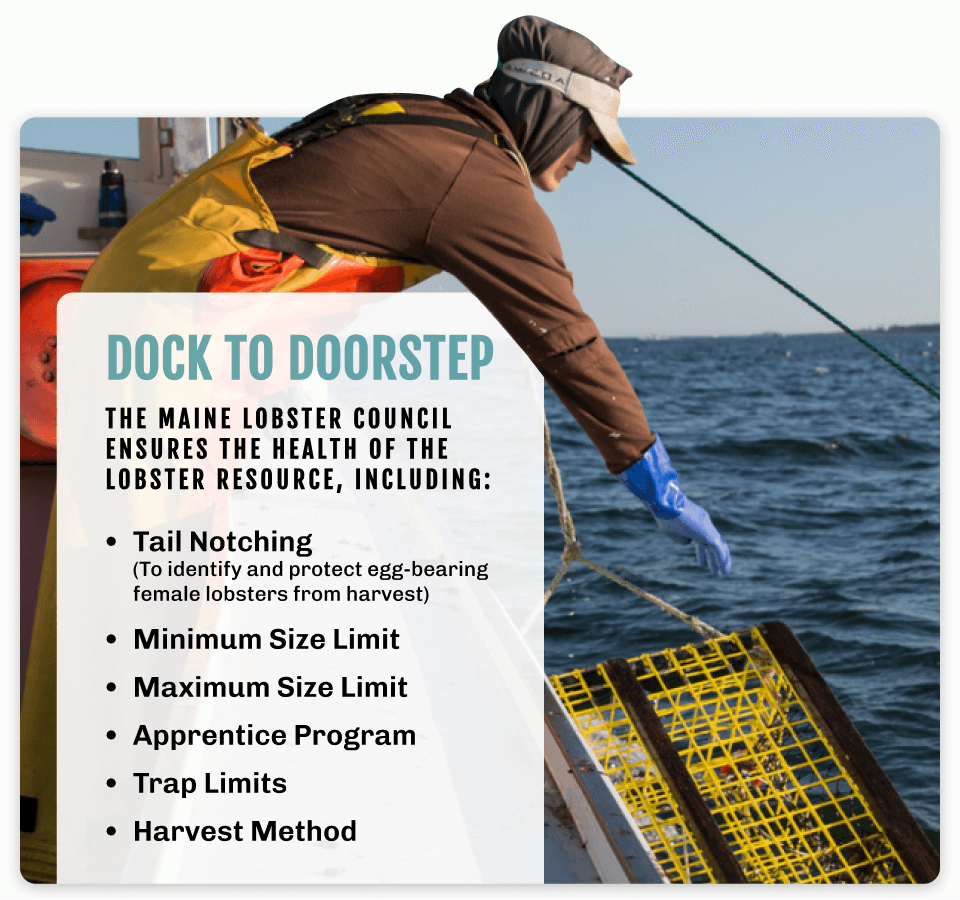

Sustainable From Sea to Table

We cater to the eco-conscious consumer, which is why we prioritize eco-friendly practices throughout our supply chain. We source our lobsters from a fishery renowned for its commitment to sustainability. Here's how Maine's lobster fishery sets the standard:

- Generations of Conservation – For over a century, Maine lobstermen have employed practices like returning egg-bearing females and using size limits to protect both young and breeding stock.

- Minimal Environmental Impact – Unlike some methods, Maine lobsters are harvested trap-by-trap, minimizing disruption to the seabed. Biodegradable trap components further reduce environmental footprint.

- Focus on the Future – Apprenticeship programs ensure new generations of lobstermen understand and adhere to sustainable practices.

By partnering with these responsible harvesters, Get Maine Lobster delivers what we believe to be the freshest, most delicious seafood while safeguarding the future of the Maine lobster industry and its surrounding ecosystem.

why invest

At Get Maine Lobster, we want to redefine the way people enjoy premium seafood, with a focus on sustainability, convenience, and creating unforgettable experiences. With strong partnerships, over $82 million in lifetime revenue, and a booming $11 billion seafood industry, we want to continue serving our 500,000 happy customers and expand to deliver more delicious and sustainable seafood across the country.

In Q4, we plan to deploy our ready-to-heat gourmet products, perfectly tailored for smaller households. This exciting launch aligns with the rapidly growing trend in the grocery market for convenient, delicious, and high-quality meals.

Join Get Maine Lobster and help us continue to thrive and redefine the way people enjoy premium seafood.

Invest in Freshness, invest in Get Maine Lobster.

ABOUT

HEADQUARTERS

48 Union Wharf

Portland, ME 04101

WEBSITE

View Site

TERMS

Overview

PRICE PER SHARE

DEADLINE

Aug. 5, 2025 at 11:24 PM UTC

VALUATION

Breakdown

MIN INVESTMENT

MAX INVESTMENT

OFFERING TYPE

Maximum Number of Shares Offered subject to adjustment for bonus shares

PRESS

ALL UPDATES

REWARDS

JOIN THE DISCUSSION

0/2500

Nicholas Gessner

10 months ago

I went on your website, $84.99 for two Lobster! What is this Alaskan King Crab Legs? My local shoprite sells the same lobster for a fraction of the price. I can't investing in a company that charges a fortune for a product. Families can't afford this.

Show more

0

0

Donald Werner

a year ago

Hello Mark, As an investor, how can I contact you regarding a recent order? Best regards, Don

Show more

1

0

William Hackett

a year ago

So what was revenue last year? What is this year projection for revenue? Are you profitable yet? 40 mil is a high valuation when do you see a exit coming? I am thinking Surf and Turf. When I had a Butcher Box Subscription They have a perk after I was there a while for Steak and Lobster tail. Do you sell surf and turf? Good Luck raising while the economy is stalling waiting for a rate cut.

Show more

1

0

Christopher Pang

a year ago

Can you provide context to the how the funds raised during this round will be utilized (i.e. working capital, marketing/sales, operations, debt repayment)? Additionally, can you elaborate on the ~$1.6M increase in combined short and long term debt.

Show more

3

0

HOW INVESTING WORKS

Cancel anytime before 48 hours before a rolling close or the offering end date.

WHY STARTENGINE?

REWARDS

We want you to succeed and get the most out of your money by offering rewards and memberships!

SECURE

Your info is your info. We take pride in keeping it that way!

DIVERSE INVESTMENTS

Invest in over 200 start-ups and collectibles!

FAQS

With Regulation A+, a non-accredited investor can only invest a maximum of 10% of their annual income or 10% of their net worth per year, whichever is greater. There are no restrictions for accredited investors.

With Regulation Crowdfunding, non-accredited investors with an annual income or net worth less than $124,000 are limited to invest a maximum of 5% of the greater of those two amounts. For those with an annual income and net worth greater than $124,000, they are limited to investing 10% of the greater of the two amounts.

StartEngine makes it easy to invest using your retirement funds. You can open a self-directed IRA account through Equity Trust, a trusted provider fully integrated with our platform. This integration allows for a fast, secure, and seamless investing experience, and includes a special offer on annual feesexclusively for StartEngine investors.

Already have a self-directed IRA with another provider? You can still invest on StartEngine, but please note that the process will be manual and may take longer to complete.

To get started, simply visit our IRA page for more information and step-by-step instructions.

At the close of an offering, all investors whose funds have “cleared” by this time will be included in the disbursement. At this time, each investor will receive an email from StartEngine with their Countersigned Subscription Agreement, which will serve as their proof of purchase moving forward.

Please keep in mind that a company can conduct a series of “closes” or withdrawals of funds throughout the duration of the campaign. If you are included in that withdrawal period, you will be emailed your countersigned subscription agreement and proof of purchase immediately following that withdrawal.

StartEngine assists companies in raising capital, and once the offering is closed, we are no longer involved with whether the company chooses to list shares on a secondary market or what occurs thereafter. Therefore, StartEngine has no control or insight into your investment after the close of the live offering. In addition, we are not permitted to provide financial advice. You may want to contact a financial professional to discuss possible investment outcomes.

For Regulation Crowdfunding, investors are able to cancel their investment at any point throughout the campaign up until 48 hours before the closing of the offering. Note: If the company does a rolling close, they will post an update to their current investors, giving them the opportunity to cancel during this timeframe. If you do not cancel within this 5-day timeframe, your funds will be invested in the company, and you will no longer be able to cancel the investment. If your funds show as ‘Invested’ on your account dashboard, your investment can no longer be canceled.

For Regulation A+, StartEngine allows for a four-hour cancellation period. Once the four-hour window has passed, it is up to each company to set their own cancellation policy. You may find the company’s cancellation policy in the company’s offering circular.

Once your investment is canceled, there is a 10-day clearing period (from the date your investment was submitted). After your funds have cleared the bank, you will receive your refund within 10 business days.

Refunds that are made through ACH payments can take up to 10 business days to clear. Unfortunately, we are at the mercy of the bank, but we will do everything we can to get you your refund as soon as possible. However, every investment needs to go through the clearing process in order to be sent back to the account associated with the investment.

Both Title III (Regulation Crowdfunding) and Title IV (Reg A+) help entrepreneurs crowdfund capital investments from unaccredited and accredited investors. The differences between these regulations are related to the investor limitations, the differing amounts of money companies are permitted to raise, and differing disclosure and filing requirements. To learn more about Regulation Crowdfunding, click here, and for Regulation A+, click here.

Lucy Burdick

5 months ago

I made a small investment of $400 but have never heard anything from the company.

1

0