CLOSED

GET A PIECE OF CITIZENS COFFEE BY CITIZENS HOLDINGS LLC

Forbes Featured National Breakfast & CPG Brand Scaling U.S

Show more

$1,086,064.19 Raised

REASONS TO INVEST

Citizens is a Forbes ft national breakfast & coffee brand with $27M+ lifetime sales* with a 2024 sales run rate of $7.2M and backed by notable angels like Randi Zuckerberg from our oversubscribed $1.2M crowd raise.

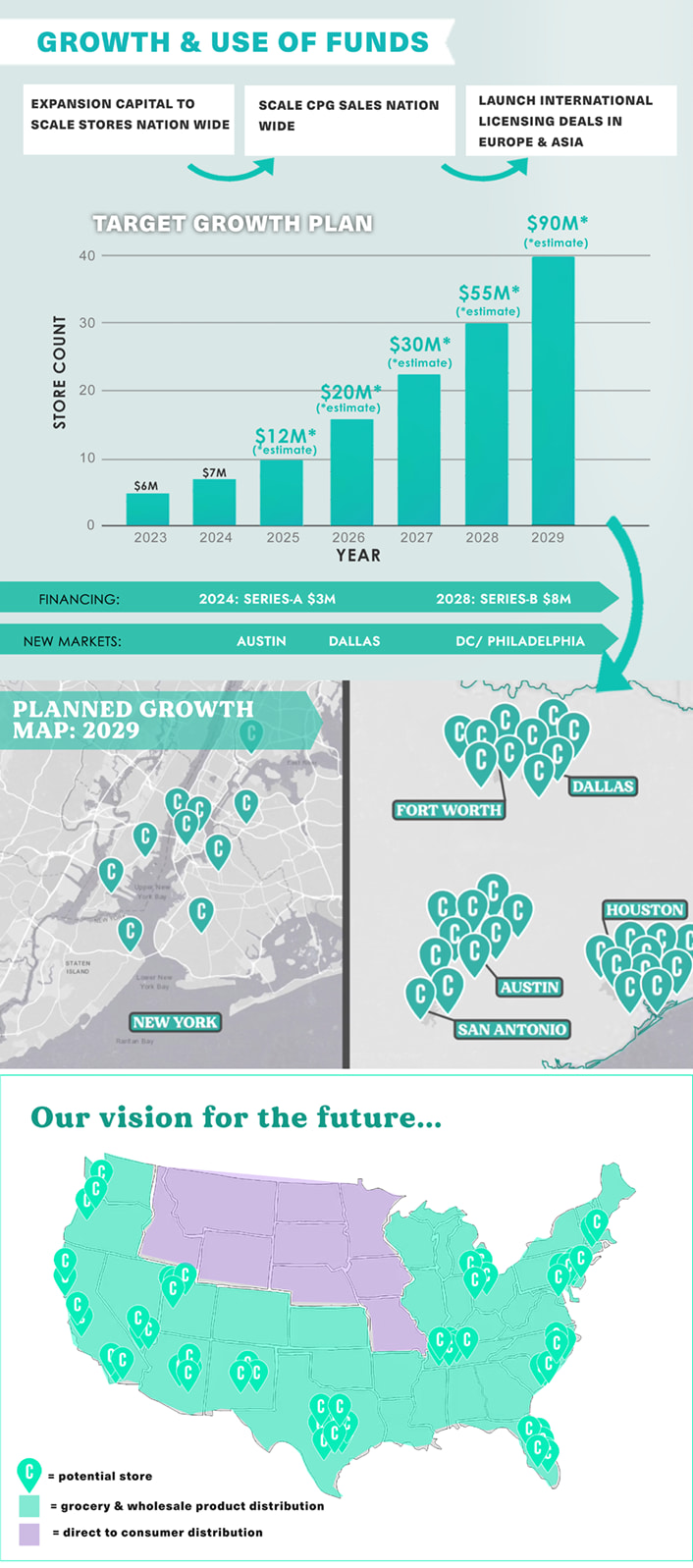

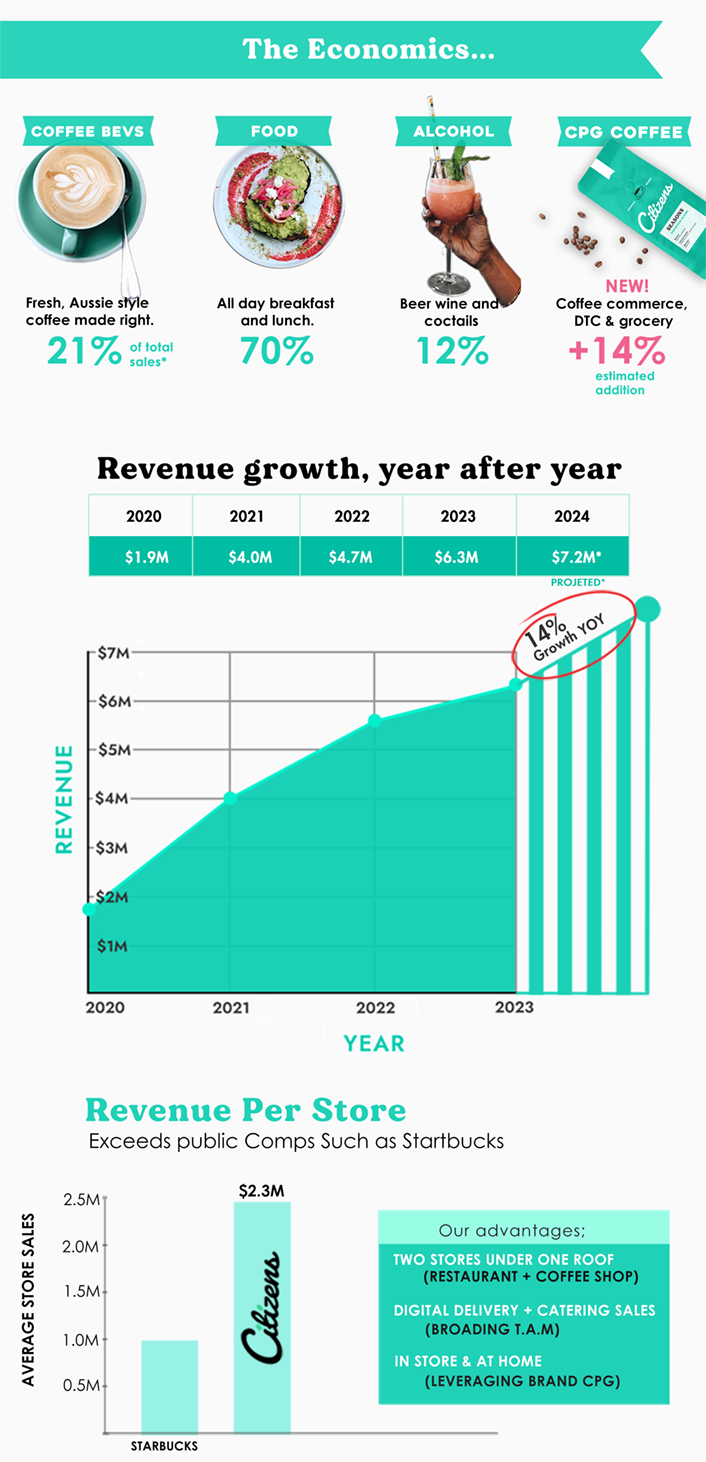

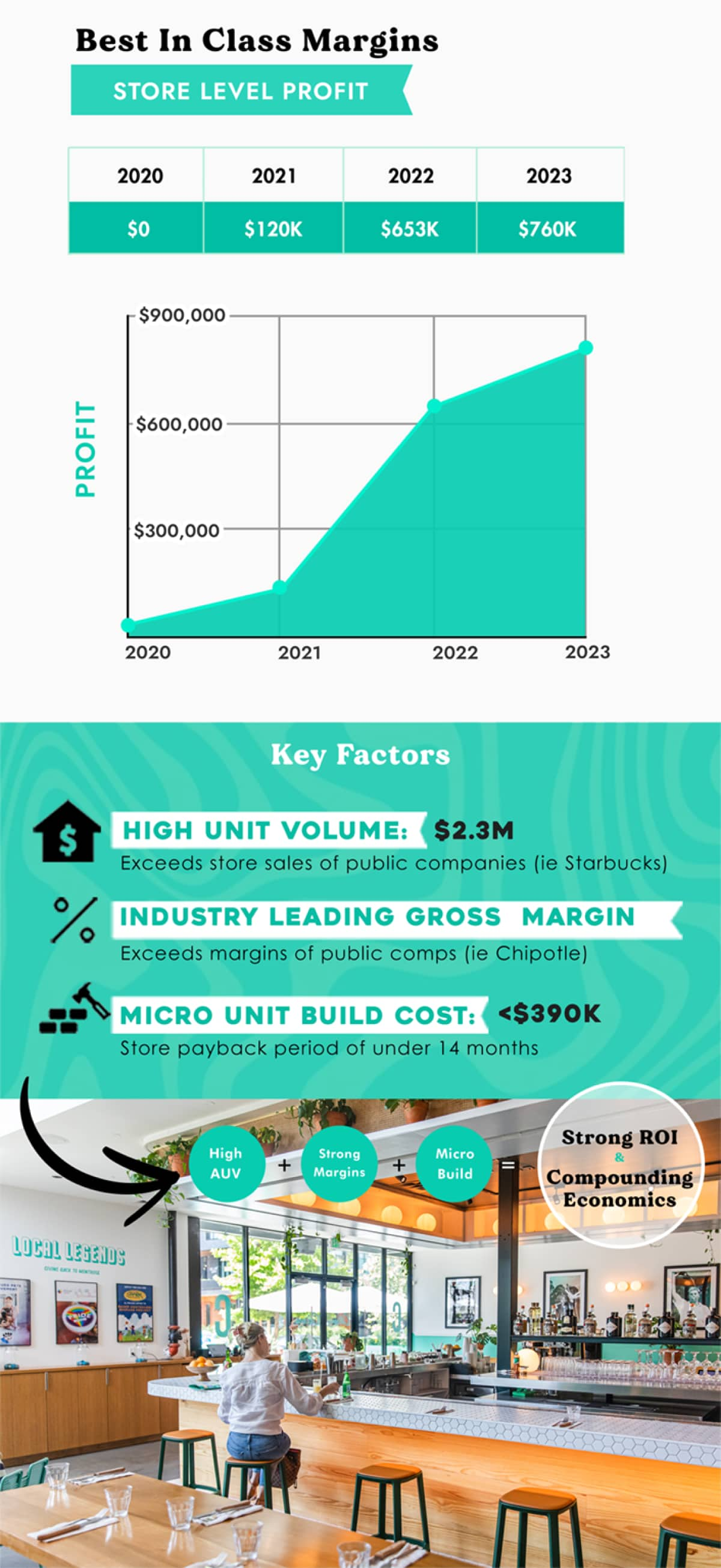

Citizens has a proven track record across NY & Texas, with a national growth pipeline of stores & industry-leading site sales outpacing companies like Starbucks, we’re projecting to hit $100M in annual sales by 2029**.

Just launched a new arm of the business distributing a premium product range of coffee beans, pods, and K-cups. With pod sales set to overtake instant coffee, this new expansion will quickly scale sales nationwide.

*Lifetime sales refer to sales from all locations and business lines since 2017.

**THE OFFERING MATERIALS MAY CONTAIN FORWARD-LOOKING STATEMENTS AND INFORMATION RELATING TO, AMONG OTHER THINGS, THE COMPANY, ITS BUSINESS PLAN AND STRATEGY, AND ITS INDUSTRY. THESE FORWARD-LOOKING STATEMENTS ARE BASED ON THE BELIEFS OF, ASSUMPTIONS MADE BY, AND INFORMATION CURRENTLY AVAILABLE TO THE COMPANY’S MANAGEMENT. WHEN USED IN THE OFFERING MATERIALS, THE WORDS “ESTIMATE,” “PROJECT,” “BELIEVE,” “ANTICIPATE,” “INTEND,” “EXPECT” AND SIMILAR EXPRESSIONS ARE INTENDED TO IDENTIFY FORWARD-LOOKING STATEMENTS, WHICH CONSTITUTE FORWARD LOOKING STATEMENTS. THESE STATEMENTS REFLECT MANAGEMENT’S CURRENT VIEWS WITH RESPECT TO FUTURE EVENTS AND ARE SUBJECT TO RISKS AND UNCERTAINTIES THAT COULD CAUSE THE COMPANY’S ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE CONTAINED IN THE FORWARD-LOOKING STATEMENTS. INVESTORS ARE CAUTIONED NOT TO PLACE UNDUE RELIANCE ON THESE FORWARD-LOOKING STATEMENTS, WHICH SPEAK ONLY AS OF THE DATE ON WHICH THEY ARE MADE. THE COMPANY DOES NOT UNDERTAKE ANY OBLIGATION TO REVISE OR UPDATE THESE FORWARD-LOOKING STATEMENTS TO REFLECT EVENTS OR CIRCUMSTANCES AFTER SUCH DATE OR TO REFLECT THE OCCURRENCE OF UNANTICIPATED EVENTS.

TEAM

Justin Giuffrida • Chief Executive Officer (CEO)

Andrew Paul Geisel • Co-Founder & VP Of Development & Growth

Benjamin Darmanin • District Manager & Head of People

the pitch

Meet Citizens; the national breakfast brand disrupting the old legacy players in the industry who we believe are phasing out.

Source: Mordor Intelligence

THE opportunity

Citizens is an Australian breakfast restaurant on a mission to become the top breakfast brand in the country; offering chef-driven breakfast menus, specialty roasted coffee, and craft cocktails. Breakfast is now the fastest-growing segment in the U.S. restaurant industry and with current locations in NY and Texas, and a CPG channel distributing coffee pods, beans, and K-Cups into grocery stores, homes and offices.

Sources: Stir Tea Coffee, Food Insight

Our Brand Pillars

Our Vision - Pathway to Citizens At Scale

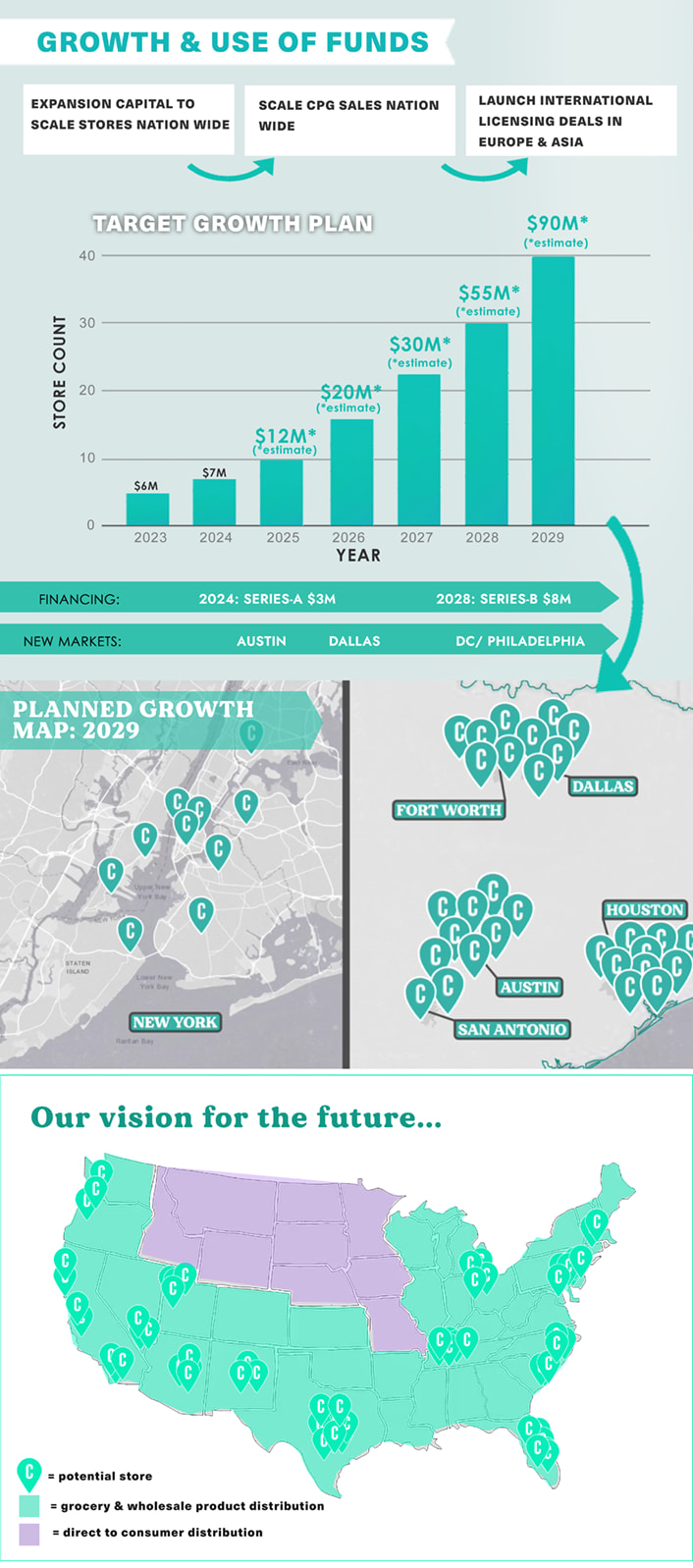

After years of developing and refining our model, tweaking our menu and optimizing our operations, we're beginning our journey of scale with a focus on expanding in the NY and TX markets.

In 2024 we opened our Houston location; our first store launch outside of NYC. The response to this has been amazing, hitting an annual run rate of over $2 million. Off the back of this success, we now look to both expand our Houston market, as well as deepen our foothold into Texas with launches into the Austin & Dallas market.

Following in the footsteps of IPO brands:

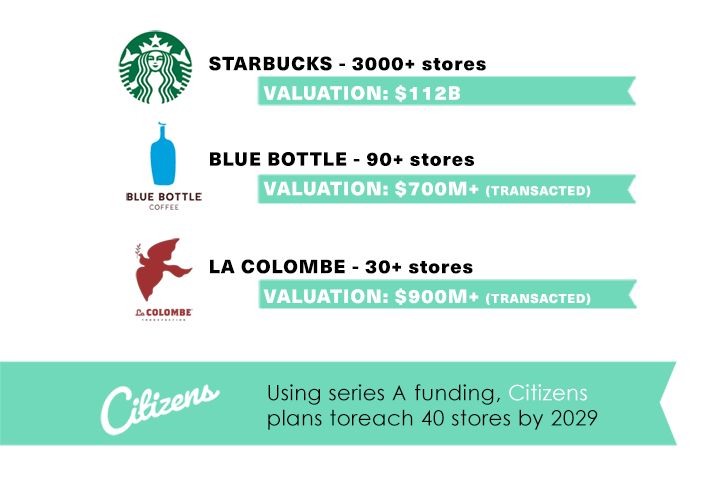

Citizens has a goal to grow its business profitably, use free cash flow as well as strategic capital injections to fuel our growth over the next 5 years. At this point, the company is projecting to have 40 stores across the country, producing approximately $90-100 million in revenue by 2029** across our restaurants, retail and wholesale channels. Upon completing our projected growth pipeline, we hope to follow public brands who have successfully executed an IPO.

These projections are forward-looking statements subject to risks and uncertainties, and actual results may differ materially from those anticipated or guaranteed. Please refer to our forward looking information legend at the top of this page and our Risk Factors in our Offering Memorandum. While the company intends to explore the possibility of an IPO in the future, any statements regarding a potential IPO are highly speculative and subject to numerous risks, uncertainties, and market conditions. Please refer to our IPO Disclosure at the end of our page.

While Citizens Coffee currently operates 4 locations, we are inspired by the growth trajectories of established brands such as Starbucks (3,000+ locations), La Colombe (90+ stores), and Blue Bottle Coffee (30+ stores). These comparisons are aspirational and reflect our long-term growth goals, rather than direct comparisons in terms of current scale, market presence, or financial performance. Any references to these companies should not be interpreted as projections or guarantees of similar outcomes for our business.

While Citizens Coffee currently operates 4 locations, we are inspired by the growth trajectories of established brands such as Starbucks (3,000+ locations), La Colombe (90+ stores), and Blue Bottle Coffee (30+ stores). These comparisons are aspirational and reflect our long-term growth goals, rather than direct comparisons in terms of current scale, market presence, or financial performance. Any references to these companies should not be interpreted as projections or guarantees of similar outcomes for our business.

our business model

The concept was born in Australia, the global leaders in specialty cafes, inspired by wellness-forward lifestyle, craft coffee, and embracing technology and innovation. Citizen’s management team has proven experience from Australia's leading brands in scaling the concept.

Industry Leading ‘Store Level’ Profitability of 18%

The breakfast restaurant industry is an extremely profitable sector due to its high customer demand, cost-effective ingredients, and quick service model. Breakfast items like eggs, pancakes, and coffee have low food costs but can be sold at attractive price points, leading to strong profit margins.*

Additionally, breakfast service typically involves faster table turnover, allowing for more customers to be served in a shorter time frame. This combination of low overhead costs and high volume sales makes breakfast restaurants a lucrative opportunity in the food and beverage industry.1,2

our traction

Citizens successfully completed an oversubscribed $1.2M crowd raise on Republic in 2021, which saw notable angels such as Randi Zuckerberg (Facebook, Zuckerberg Media, Hugg) and Sean Davis (MLS Captain) join Citizens as advisors.

These testimonials may not be representative of the experience of other customers and are not a guarantee of future performance or success.

These testimonials may not be representative of the experience of other customers and are not a guarantee of future performance or success.

Why Invest

Over the past 8 years, we have spent our lives building this company and enjoying the ride along the way. We’re developed as restaurant operators, but more importantly, have grown as people on our journey to see Citizens become one of the top breakfast brands in the country. We are excited to see where we can take this company, and to have you on the journey with us.

IPO Statements Disclosure

While the company intends to explore the possibility of an initial public offering (IPO) in the future, any statements regarding a potential IPO are highly speculative and subject to numerous risks, uncertainties, and market conditions. There is no guarantee that an IPO will occur, and any forward-looking statements should not be relied upon as a prediction or assurance of future events.

**Forward Looking Information Disclosure

THE OFFERING MATERIALS MAY CONTAIN FORWARD-LOOKING STATEMENTS AND INFORMATION RELATING TO, AMONG OTHER THINGS, THE COMPANY, ITS BUSINESS PLAN AND STRATEGY, AND ITS INDUSTRY. THESE FORWARD-LOOKING STATEMENTS ARE BASED ON THE BELIEFS OF, ASSUMPTIONS MADE BY, AND INFORMATION CURRENTLY AVAILABLE TO THE COMPANY’S MANAGEMENT. WHEN USED IN THE OFFERING MATERIALS, THE WORDS “ESTIMATE,” “PROJECT,” “BELIEVE,” “ANTICIPATE,” “INTEND,” “EXPECT” AND SIMILAR EXPRESSIONS ARE INTENDED TO IDENTIFY FORWARD-LOOKING STATEMENTS, WHICH CONSTITUTE FORWARD LOOKING STATEMENTS. THESE STATEMENTS REFLECT MANAGEMENT’S CURRENT VIEWS WITH RESPECT TO FUTURE EVENTS AND ARE SUBJECT TO RISKS AND UNCERTAINTIES THAT COULD CAUSE THE COMPANY’S ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE CONTAINED IN THE FORWARD-LOOKING STATEMENTS. INVESTORS ARE CAUTIONED NOT TO PLACE UNDUE RELIANCE ON THESE FORWARD-LOOKING STATEMENTS, WHICH SPEAK ONLY AS OF THE DATE ON WHICH THEY ARE MADE. THE COMPANY DOES NOT UNDERTAKE ANY OBLIGATION TO REVISE OR UPDATE THESE FORWARD-LOOKING STATEMENTS TO REFLECT EVENTS OR CIRCUMSTANCES AFTER SUCH DATE OR TO REFLECT THE OCCURRENCE OF UNANTICIPATED EVENTS.

ABOUT

HEADQUARTERS

521 E. 12th St

New York, NY 10009

WEBSITE

View Site

TERMS

Citizens Coffee by Citizens Holdings LLC

Overview

PRICE PER SHARE

$3.53

DEADLINE

May. 1, 2025 at 6:59 AM UTC

VALUATION

$25.89M

FUNDING GOAL

$15K - $1.23M

Breakdown

MIN INVESTMENT

$250.63

MAX INVESTMENT

$1,233,999.75

MIN NUMBER OF SHARES OFFERED

4,249

MAX NUMBER OF SHARES OFFERED

349,575

OFFERING TYPE

Equity

SHARES OFFERED

Class B Common Units

Maximum Number of Shares Offered subject to adjustment for bonus shares

*Maximum number of units offered subject to adjustment for bonus units. See Bonus info below.

Investment Incentives & Bonuses*

Time-Based Perk

Early Bird 1: Invest $250+ within the first 2 weeks | 2% bonus units

Early Bird 2: Invest $5,000+ within the first 2 weeks | 7% bonus units

Early Bird 3: Invest $10,000+ within the first 2 weeks | 10% bonus units

Early Bird 4: Invest $25,000+ within the first 2 weeks | 15% bonus units

Early Bird 5: Invest $50,000+ within the first 2 weeks | 20% bonus units

Early Bird 6: Invest $100,000+ within the first 2 weeks | 25% bonus units

Mid-Campaign

Invest $5,000+ between day 35 - 40 and receive 10% bonus units

Invest $5,000+ between day 60 - 65 and receive 10% bonus units

Amount-Based Perk

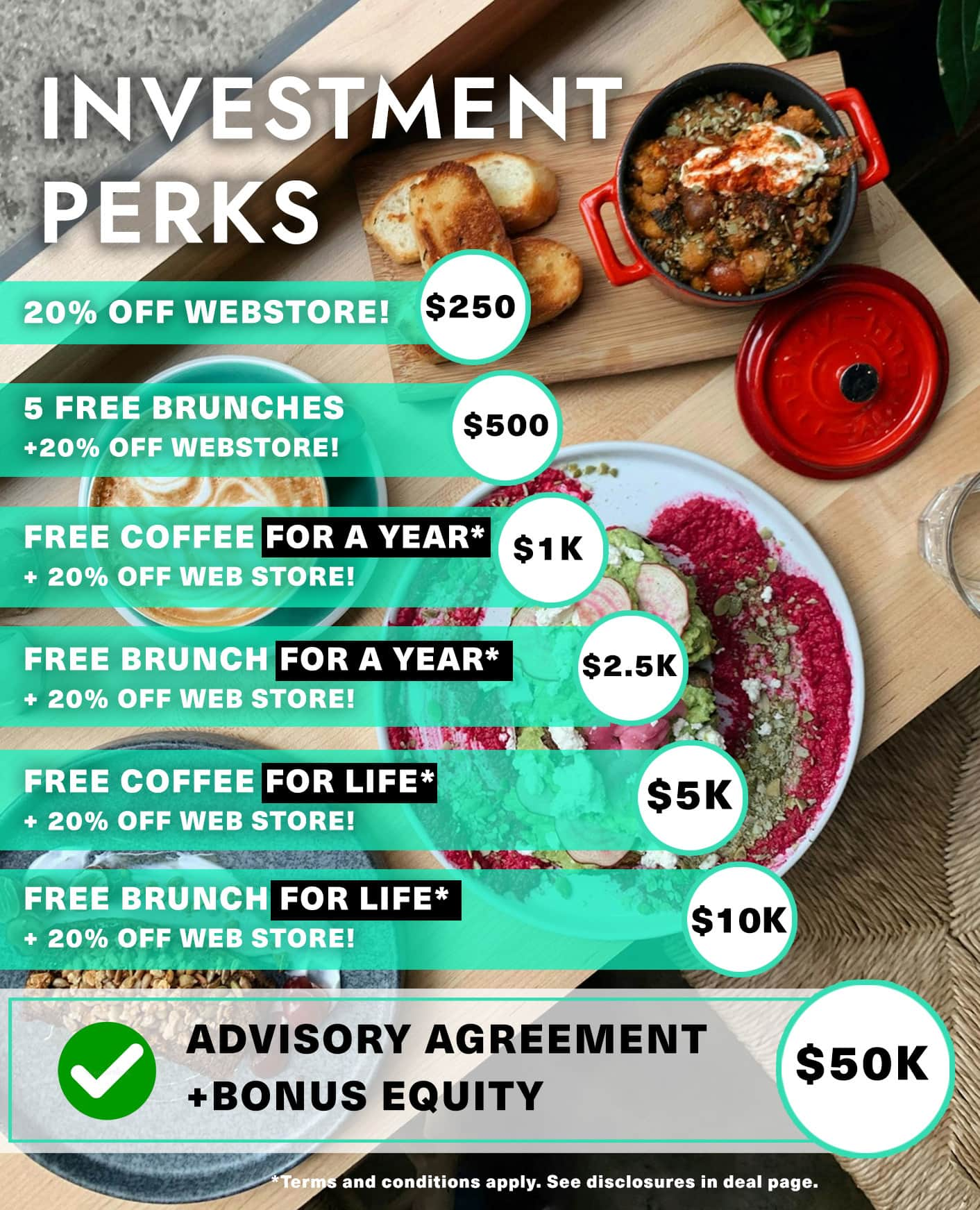

Tier 1 Perk — Invest $250+ and receive: 20% off web store

Tier 2 Perk — Invest $500+ and receive: 5 free brunches**, 20% off web store

Tier 3 Perk — Invest $1000+ and receive: Free coffee for a year**, 20% off web store, and 2% bonus units

Tier 4 Perk — Invest $2500+ and receive: Free brunch for a year**, 20% off web store and 4% bonus units

Tier 5 Perk — Invest $5000+ and receive: Free coffee for life***(conditions apply), 20% off web store and 5% bonus units

Tier 6 Perk — Invest $10,000+ and receive: Free brunch for life***(conditions apply), 20% off web store, and 7% bonus units

Tier 7 Perk — Invest $50,000 and receive: Advisory equity*, 20% off web store, free brunch for life*** (conditions apply), and 15% bonus units

Tier 8 Perk — Invest $100,000 and receive: Advisory equity*, 20% off web store, free brunch for life*** (conditions apply), and 20% bonus units

*Advisor Equity Package; Vesting equity grant with an advisory agreement. Please inquire: justin.g@citizens.coffee

*In order to receive perks from an investment, one must submit a single investment in the same offering that meets the minimum perk requirement. Bonus units from perks will not be granted if an investor submits multiple investments that, when combined, meet the perk requirement. All perks occur when the offering is completed.

**A ‘free coffee’ is valued at $6 store purchase. A ‘free brunch’ is valued at a $25 store purchase. The appropriate value to your tier will be added to a house account. This credit can only be redeemed for in-store, regular menu purchases. This excludes retail coffee beans, merchandise & more. This credit may not be used for payment of gratuities.

***‘Coffee’ and ‘Brunch’ for life represents that a house account will be created providing fifty-two coffees or brunches (depending on the investment tier) per year valid for 15 years. If the business is acquired, receives a majority acquisition or a change of control, coffee & brunch for life perks will be withdrawn, but may not be withdrawn before a minimum period of 3 years from original investment date on Start Engine.

Crowdfunding investments made through a self-directed IRA cannot receive non-bonus unit perks due to tax laws. The Internal Revenue Service (IRS) prohibits self-dealing transactions in which the investor receives an immediate, personal financial gain on investments owned by their retirement account. As a result, an investor must refuse those non-bonus unit perks because they would be receiving a benefit from their IRA account.

The 10% StartEngine Venture Club Bonus

Citizens will offer 10% additional bonus units for all investments that are committed by investors who are eligible for the StartEngine Venture Club.

This means eligible StartEngine unitholders will receive a 10% bonus for any units they purchase in this offering. For example, if you buy 100 Class B Common Units at $3.45 / unit, you will receive 110 Class B Common Units, meaning you’ll own 110 units for $345. Fractional units will not be distributed and unit bonuses will be determined by rounding down to the nearest whole unit.

This 10% Bonus is only valid during the investor’s eligibility period. Investors eligible for this bonus will also have priority if they are on a waitlist to invest and the company surpasses its maximum funding goal. They will have the first opportunity to invest should room in the offering become available if prior investments are canceled or fail.

Investors will receive the highest single bonus they are eligible for among the bonuses based on the amount invested and the time of offering elapsed (if any). Eligible investors will also receive the Venture Club bonus in addition to the aforementioned bonus.

Irregular Use of Proceeds

ALL UPDATES

04.30.25

Closing Soon! 🥂

Only hours left as we near hitting our investment cap!

We're incredibly flattered by the tremendous interest and support for Citizens as we plan our national growth and aspire to follow in the footsteps of top IPO Brands! Join us on our journey.

Onwards & Upwards,

CEO & Founder - Justin Giuffrida

This Reg CF offering is made available through StartEngine Primary, LLC. This investment is speculative, illiquid, and involves a high degree of risk, including the possible loss of your entire investment. In addition, as described in the Offering Circular, the Company retains the right to continue the offering beyond the Termination Date, in its sole discretion.

04.30.25

Over $1 MILLION RAISED! 🥳 Thank you, investors!

Thank You for Fueling Our Growth!

We are absolutely STOKED about reaching this milestone, and we couldn't have done it without our amazing community of investors believing in our vision.

Last Call for Investors

As we celebrate this $1M milestone* and prepare to launch in Austin, we're seeing investment spaces fill up fast. For those still watching from the sidelines—this is your reminder that this opportunity won't last forever.

We're building something special with Citizens Coffee:

Exceptional unit economics ($2.4M average annual store sales)

Multi-channel revenue strategy with nationwide CPG distribution

Strategic expansion toward 40 locations by 2029

Vertical integration with our in-house roasting facility

Final call for investors. We would love to have you join us.

With immense gratitude and excitement for what's ahead,

Justin Giuffrida

Co-Founder & CEO

*The amount raised may include insider investments, which may go toward meeting the minimum offering amount.

This Reg CF offering is made available through StartEngine Primary, LLC. This investment is speculative, illiquid, and involves a high degree of risk, including the possible loss of your entire investment.

04.30.25

2 Hours Left - Final Call!

Final Hours to join the ride - nearing our investment cap!

From Australia to New York, Texas and across the US market - join Andrew and I as we plan our national growth and aspire to build Citizens into one of the leading national breakfast brands!

Onwards & Upwards,

CEO & Founder - Justin Giuffrida

Onwards & Upwards,

CEO & Founder - Justin Giuffrida

This Reg CF offering is made available through StartEngine Primary, LLC. This investment is speculative, illiquid, and involves a high degree of risk, including the possible loss of your entire investment. In addition, as described in the Offering Circular, the Company retains the right to continue the offering beyond the Termination Date, in its sole discretion.

04.30.25

Hours Left to invest - Final Day!

Final few Hours to join the ride - approaching our investment maximum!

This week we launched Austin our newest market with more new markets on the way! We're working toward our goals of being the leading breakfast & coffee brand in the US market!

We seek to emulate the strategic approaches of IPO-stage brands

Onwards & Upwards,

CEO & Founder - Justin Giuffrida

This Reg CF offering is made available through StartEngine Primary, LLC. This investment is speculative, illiquid, and involves a high degree of risk, including the possible loss of your entire investment. In addition, as described in the Offering Circular, the Company retains the right to continue the offering beyond the Termination Date, in its sole discretion.

04.30.25

🚨 Last Call to Invest in Citizens Coffee

This is it.

Our Citizens Coffee funding round closes TODAY, and this is your invitation to join our investor family.

From Melbourne to Manhattan to multiple Texas locations, we've proven that our Australian-inspired café concept resonates across America. With $2.4M average store sales outperforming major chains and our nationwide expansion underway, we're positioned for exceptional growth.

We’re so excited for what the future holds, and we would love to have you along for the journey.

Warmly,

Justin Giuffrida

Co-Founder & CEO

This Reg CF offering is made available through StartEngine Primary, LLC. This investment is speculative, illiquid, and involves a high degree of risk, including the possible loss of your entire investment.

04.30.25

Over $1,000,000 Raised 🥳 Thank you, investors!

Thank You for Fueling Our Growth!

We couldn't have done it without our amazing community of investors believing in our vision.

Last Call for Investors

As we celebrate this $1M milestone* and prepare to launch in Austin, we're seeing investment spaces fill up fast. For those still watching from the sidelines—this is your reminder that this opportunity is coming to an end.

We're building something special with Citizens Coffee:

Exceptional unit economics ($2.4M average annual store sales)

Multi-channel revenue strategy with nationwide CPG distribution

Aiming to expand into 40 locations by 2029

Vertical integration with our in-house roasting facility

If you haven't invested yet, we hope you will join us. If you have already invested, consider increasing your commitment. Take a look at our offering documents to see if our opportunity aligns with your financial goals.

With immense gratitude and excitement for what's ahead,

Justin Giuffrida

Co-Founder & CEO

*The amount raised may include insider investments, which may go toward meeting the minimum offering amount.

This Reg CF offering is made available through StartEngine Primary, LLC. This investment is speculative, illiquid, and involves a high degree of risk, including the possible loss of your entire investment. In addition, as described in the Offering Circular, the Company retains the right to continue the offering beyond the Termination Date, in its sole discretion.

04.29.25

🍳 Invest in Citizens Before The Toast Gets Cold

You know that feeling when you arrive at brunch five minutes after they've stopped serving?

That's what it'll feel like tomorrow when our investment round closes and you’ve missed your chance.

With just 24 hours remaining, we're serving up our final call for investors who want a piece of our rapidly expanding breakfast empire. Our wellness bowl isn't the only thing that's fresh – our 38% year-over-year growth is pretty appealing too.

Like the perfect poached egg, this opportunity will not last forever. The kitchen closes on this funding round tomorrow.

Warmly,

Justin Giuffrida

Co-Founder & CEO

This Reg CF offering is made available through StartEngine Primary, LLC. This investment is speculative, illiquid, and involves a high degree of risk, including the possible loss of your entire investment.

04.29.25

Last Chance to Invest in Citizens!

Six hours remaining, seize the opportunity to invest!

At Citizens, we aim to expand across the country and aspire to become a leading breakfast and coffee brand in the US market. Join us on this exciting journey to redefine how America starts its day.

6 Hours Left! Act now and be a part of our growth story!

Onwards & Upwards,

CEO & Founder - Justin Giuffrida

This Reg CF offering is made available through StartEngine Primary, LLC. This investment is speculative, illiquid, and involves a high degree of risk, including the possible loss of your entire investment. In addition, as described in the Offering Circular, the Company retains the right to continue the offering beyond the Termination Date, in its sole discretion.

04.29.25

12 Hours Left to Invest!

We now have 12 Hours left in our campaign!

We are approaching our investment target, subject to final confirmation

Big thank you to all our new investors for joining the ride on this next chapter of growth! We're flattered by the incredible support and interest in our growth.

Here is a personal video live from Austin Texas at our newest location!

Onwards & Upwards,

CEO & Founder

Justin Giuffrida

This Reg CF offering is made available through StartEngine Primary, LLC. This investment is speculative, illiquid, and involves a high degree of risk, including the possible loss of your entire investment. In addition, as described in the Offering Circular, the Company retains the right to continue the offering beyond the Termination Date, in its sole discretion.

04.29.25

Why Invest in Citizens

Just 48 hours remain. Are you still asking “Why invest”?

Explosive Growth: We’re rapidly expanding, with plans to scale to 40 locations across the U.S. and hit $100M in revenue in the next five years.*

Market Opportunity: The coffee industry is growing, and we believe Citizens Coffee is positioned to be a major player.

Community First: We’re focused on sharing our success with the people who love our brand – not just big investors.

Act now to secure your investment.

Justin Giuffrida

Co-Founder & CEO

*This is a forward-looking statement. Actual results may vary.

This Reg CF offering is made available through StartEngine Primary, LLC. This investment is speculative, illiquid, and involves a high degree of risk, including the possible loss of your entire investment. In addition, as described in the Offering Circular, the Company retains the right to continue the offering beyond the Termination Date, in its sole discretion.

REWARDS

10%

Stack Venture Club & Rewards!

Members get an extra 10% shares in addition to rewards below!

Venture Club

Venture Club Members earn 10% bonus shares on top of this and all eligible investments for an entire year. Not a member? Sign up at checkout ($275/year).

$250

Tier 1 Perk

Invest $250+ and receive: 20% off web store

$500

Tier 2 Perk

Invest $500+ and receive: 5 free brunches**, 20% off web store

$1,000

Tier 3 Perk

Invest $1000+ and receive: Free coffee for a year**, 20% off web store, and 2% bonus units

$2,500

Tier 4 Perk

Invest $2500+ and receive: Free brunch for a year**, 20% off web store and 4% bonus units

$5,000

Tier 5 Perk

Invest $5000+ and receive: Free coffee for life***(conditions apply), 20% off web store and 5% bonus units

$10,000

Tier 6 Perk

Invest $10,000+ and receive: Free brunch for life***(conditions apply), 20% off web store, and 7% bonus units

$50,000

Tier 7 Perk

Invest $50,000 and receive: Advisory equity*, 20% off web store, free brunch for life*** (conditions apply), and 15% bonus units

$100,000

Tier 8 Perk

Invest $100,000 and receive: Advisory equity*, 20% off web store, free brunch for life*** (conditions apply), and 20% bonus units

JOIN THE DISCUSSION

0/2500

Yaacov Sakowitz

3 months ago

What is the exit goal in 5 years? Get acquired or IPO?

0

0

Yaacov Sakowitz

3 months ago

I see you raised almost 1.23m on Republic a few years ago. I was just curious why you decided to us Start Engine and not Republic again...

Show more

0

0

Yaacov Sakowitz

3 months ago

Are there any bonuses for investments?

0

0

Senitiki Rokocakau

4 months ago

With all these issues regarding tariffs, how vulnerable or exposed is your supply chain and business?

Show more

0

0

Lucas Selvidge

5 months ago

Any ETA on when rolling close investors from 2024 will receive K-1 reporting info for finalized investment in Citizens?

Show more

0

0

Ashish Nirkhe

5 months ago

Invested in Dec and closed the disbursement in Jan. When can the investor expect perk distribution?

0

0

Michael Pasieczny

5 months ago

Justin, Looking over the offering and was wondering your thoughts on maintaining a price point that customers are willing to pay as cost seem to be rising. Any steps being taken to secure product (coffee beans, food ingredients) to avoid passing extra costs onto customers or preventing potential customers from experiencing Citizen Coffee based on price increases. Even a great product/experience can be scared away by price. Thanks, Mike

Show more

0

0

Ashish Nirkhe

6 months ago

How should investor get free lifetime coffee that’s included in the offer?

1

0

Senitiki Rokocakau

7 months ago

Have you closed down one of your NY restaurants? If yes, why?

2

0

HOW INVESTING WORKS

Cancel anytime before 48 hours before a rolling close or the offering end date.

WHY STARTENGINE?

REWARDS

We want you to succeed and get the most out of your money by offering rewards and memberships!

SECURE

Your info is your info. We take pride in keeping it that way!

DIVERSE INVESTMENTS

Invest in over 200 start-ups and collectibles!

FAQS

With Regulation A+, a non-accredited investor can only invest a maximum of 10% of their annual income or 10% of their net worth per year, whichever is greater. There are no restrictions for accredited investors.

With Regulation Crowdfunding, non-accredited investors with an annual income or net worth less than $124,000 are limited to invest a maximum of 5% of the greater of those two amounts. For those with an annual income and net worth greater than $124,000, they are limited to investing 10% of the greater of the two amounts.

StartEngine makes it easy to invest using your retirement funds. You can open a self-directed IRA account through Equity Trust, a trusted provider fully integrated with our platform. This integration allows for a fast, secure, and seamless investing experience, and includes a special offer on annual feesexclusively for StartEngine investors.

Already have a self-directed IRA with another provider? You can still invest on StartEngine, but please note that the process will be manual and may take longer to complete.

To get started, simply visit our IRA page for more information and step-by-step instructions.

At the close of an offering, all investors whose funds have “cleared” by this time will be included in the disbursement. At this time, each investor will receive an email from StartEngine with their Countersigned Subscription Agreement, which will serve as their proof of purchase moving forward.

Please keep in mind that a company can conduct a series of “closes” or withdrawals of funds throughout the duration of the campaign. If you are included in that withdrawal period, you will be emailed your countersigned subscription agreement and proof of purchase immediately following that withdrawal.

StartEngine assists companies in raising capital, and once the offering is closed, we are no longer involved with whether the company chooses to list shares on a secondary market or what occurs thereafter. Therefore, StartEngine has no control or insight into your investment after the close of the live offering. In addition, we are not permitted to provide financial advice. You may want to contact a financial professional to discuss possible investment outcomes.

For Regulation Crowdfunding, investors are able to cancel their investment at any point throughout the campaign up until 48 hours before the closing of the offering. Note: If the company does a rolling close, they will post an update to their current investors, giving them the opportunity to cancel during this timeframe. If you do not cancel within this 5-day timeframe, your funds will be invested in the company, and you will no longer be able to cancel the investment. If your funds show as ‘Invested’ on your account dashboard, your investment can no longer be canceled.

For Regulation A+, StartEngine allows for a four-hour cancellation period. Once the four-hour window has passed, it is up to each company to set their own cancellation policy. You may find the company’s cancellation policy in the company’s offering circular.

Once your investment is canceled, there is a 10-day clearing period (from the date your investment was submitted). After your funds have cleared the bank, you will receive your refund within 10 business days.

Refunds that are made through ACH payments can take up to 10 business days to clear. Unfortunately, we are at the mercy of the bank, but we will do everything we can to get you your refund as soon as possible. However, every investment needs to go through the clearing process in order to be sent back to the account associated with the investment.

Both Title III (Regulation Crowdfunding) and Title IV (Reg A+) help entrepreneurs crowdfund capital investments from unaccredited and accredited investors. The differences between these regulations are related to the investor limitations, the differing amounts of money companies are permitted to raise, and differing disclosure and filing requirements. To learn more about Regulation Crowdfunding, click here, and for Regulation A+, click here.

Yaacov Sakowitz

3 months ago

Goal is to hit 100m in revenue by end of 2029? What would profit be (i.e whats profit margin)?

0

0