CLOSED

GET A PIECE OF COLLEGE COACHING NETWORK

Digital Human Scholarship Coaching

Show more

REASONS TO INVEST

Since our last raise

Potential Growth and Exciting Partnerships

Since our last offering, College Coaching Network has been extremely busy reaching multiple milestones.

Our new corporate sponsors program has supported over 4,000 new students. We have also created a national Scholarship Foundation Podcast allowing our students to learn more about local and national scholarships and grants.

Meanwhile, we have added a Digital Human tech team to our platform, enhancing our student experience and increasing student engagement through our new “Edutainment” platform. Recognized faces like Comedian Eddie Griffin have agreed to become a digital scholarship coach helping students stay engaged through our "Edutainment" Platform.

We have also partnered with Infinite Scholars to provide a national College Fair to HyVee Arena.

We have partnered with author Tom Corley “Rich Habits” to create one of the first Digital Human AI Career/Financial Assessment Test while also joining our Digital Human tech team.

And we have secured a new office facility!

The Problem

Counselor Shortage Leads to Missed Opportunities for Students

In the US, students only receive an average of 38 minutes with their school counselor over their entire four years of high school. ( Source) For every guidance counselor in the country, there are 480 students. Parents are desperate for better solutions to help their children with college decisions.

* Source

This lack of support results in $2.3 billion in unclaimed scholarships and contributes to the $1.6 trillion student debt crisis. (Source)

The Solution

Using Digital Human Technology to Equip Students for Success

College Coaching Network was founded with the vision of providing students with access to their school counselors 24/7 using digital human technology. We use our technology-based solution to help students navigate through the college and career readiness process.

Through our platform, students gain access to an AI powered experience that recreates traditional human interaction. Our Digital Human Coach has been uploaded with 10’s of thousands of hours of college and career best practices to help students in Finding Scholarships, improving ACT/SAT test performance, writing essays for admissions and scholarships, Virtual College Tours, applying for Financial Aid, Money Management and even more.

The Market

A Massive Market Serving Students Everywhere

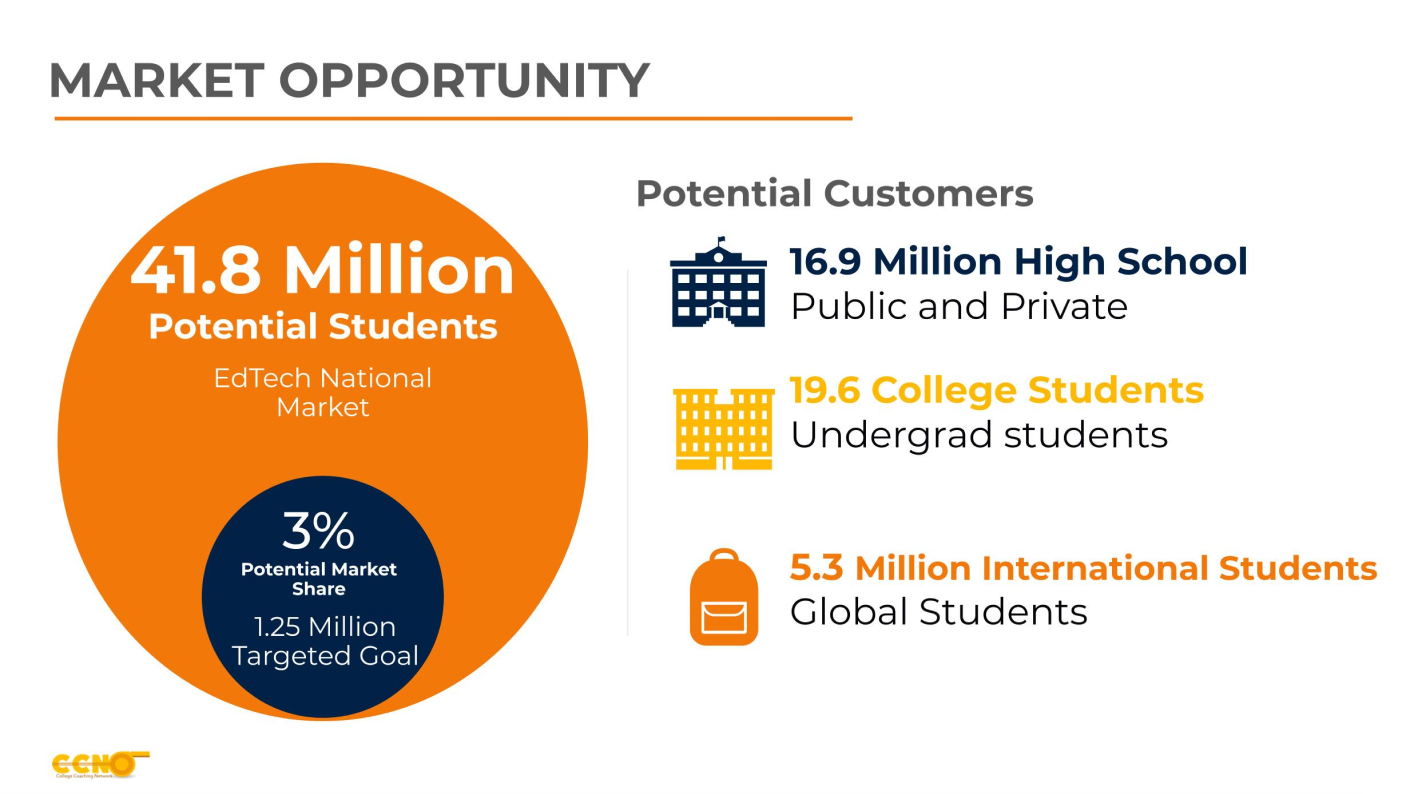

The EdTech industry is valued at $76.4 billion. Currently, there are 16.9 million students between public and private high schools, 19.6 million students in pursuit of their undergraduate degree, and an additional 5.3 million international students seeking funding for college.

With a total addressable market of 41 million students, our goal is to acquire a 3% market share within the next 3-5 years. Our business model previously consisted of charging school districts 5k to utilize our platform. With the emergence of Covid-19, the market demand for virtual scholarship training spiked and we had to pivot from a B2B company to a B2C and B2B company. Our new SaaS model provides students access to a 12-month membership subscription for only us $300/year. With the goal of reaching 1.25 million students, our revenue could reach $375 million.

Our Traction

A Fast-Growing Community of Users and Strong Partnerships

Since our launch, we have experienced tremendous growth, now with 43,000 students currently accessing our program.

We currently partner with Sallie Mae to provide private scholarships, as well as the following foundations and individuals:

- the Coca Cola Foundation

- AFL CIO Labor Union

- Big Brothers Big Sisters

- Tom Corley, Author of Rich Habits

- Comedian Eddie Griffin

- Former Tampa Bay Buccaneers receiver Frank Murphy

- And more!

What we do

A Simple Three Step System to Get Students Ahead

Our three-step approach connects students to opportunities already available to them that they often otherwise miss because of a lack of support. We guide students towards three primary areas: private scholarships, institutional scholarships, and early college credits.

Step 1: Private Scholarships

Our platform assists students in finding private scholarships. Through our partnership with Sallie Mae, our students gain access to $24 billion in combined private scholarships.

We connect students to all additional scholarship aggregator databases out there so no opportunity goes to waste. In addition, our scholarship foundation podcast gives our students access to various local and national charity driven scholarships that are often overlooked.

Step 2: Institutional Scholarships

The average student that fulfills the admissions criteria to attend prestigious, top-tier universities frequently opt-out of applying because they are petrified by the sticker price, even though these schools have massive endowments and robust aid programs.

College Coaching Network teaches students how to leverage the award letters that they have received from their second or third choice college as a means of negotiation with their top schools.

This technique has proven to help students obtain greater financial aid in the form of scholarships and lessens the burden of student loan debt.

Step 3: Early College Credits

We educate students on the various ways that they can obtain their high school diploma and simultaneously acquire an Associate Degree. Students in our program are taught about Advance Placement (AP) classes and Dual Credit courses.

AP classes increase a student's probability of acceptance into Ivy League universities and schools of high distinction because of the rigorous work they require. Meanwhile, dual credit courses allow a student the opportunity to work with a community college to obtain their associates degree along with their high school credit.

We educate our students on the distinctions between these two programs to ensure that they can take full advantage in a way that can greatly impact their futures. By engaging in these opportunities, parents can significantly reduce the burden of college cost by up to 50% at a fraction of the cost.

Our Go-To-Market Strategies

We geo-target our audience by primarily using social media marketing campaigns. Our target market entails parents with students between the ages of 13-18 domestically and internationally. Our FB marketing ads manager focus’ keeping our CAC (Customer Acquisition Cost) between $15-25 per customer and a ROI of 3:1-5:1 per campaign. Utilizing Facebook and automated email marketing campaigns we believe we could capture 5-7% market share and acquire of 1 million students in the next 3 years or less paying $300/year for access to our program.

We also plan to launch an affiliate network where influencers can promote our offering. We will also join Grin, the #1 influencer marketing program, to contract influencers to promote our brand and generate organic traffic to our sales funnels.

In addition, we have contracts with comedian Eddie Griffin and New York Times best selling author Tom Corley.

Helping Students Find their Perfect Path

Our Wealth Pathway Assessment project will give students the opportunity to discover their own wealth blueprint. Our assessment will allow students to envision the future they are best equipped for educationally, emotionally, financially and commutatively.

We are launching this assessment in partnership with New York Times Best-Selling author Tom Corley, whose extensive research has identified the principles that can help create wealth in the life of anyone willing to commit to applying his proven principles.

We want our students to discover how they are wired for financial success before they choose their career path. For example, some students will not thrive at a 9-5 job but are wired to start their own businesses. Our program will help students identify their true path to wealth and will provide them a roadmap on how to turn their dreams into reality.

Why Invest

Help Revolutionize The College & Career Readiness Process!

Your investment in the College Coaching Network will help millions of students receive 24/7 College and Career Readiness Support. Our potential is endless with only 7% market share in the edtech space and 80% profit margins the ROI is endless.

Students need a community that can help them make decisions about their future that won't lead to crushing debt.

With 43,000 students already using our platform and a number of exciting upcoming partnerships, we are ready to disrupt the multi-billion EdTech industry and change the lives of millions of students for the better.

An investment in College Coaching Network gives students a fighting chance at bringing their college and career goals to life.

ABOUT

HEADQUARTERS

12936 Craig ave

Grandview, MO 64030

WEBSITE

View Site

TERMS

College Coaching Network

Overview

PRICE PER SHARE

$10.91

DEADLINE

Feb. 23, 2022 at 7:59 AM UTC

VALUATION

$6M

FUNDING GOAL

$10K - $250K

Breakdown

MIN INVESTMENT

$109.10

MAX INVESTMENT

$106,994.37

MIN NUMBER OF SHARES OFFERED

916

MAX NUMBER OF SHARES OFFERED

22,914

OFFERING TYPE

Equity

SHARES OFFERED

Common Stock

Maximum Number of Shares Offered subject to adjustment for bonus shares

*Maximum Number of Shares Offered subject to adjustment for bonus shares. See Bonus info below.

Company Perks*

Tier 1 perk - ($500 + t-shirts)

Tier 2 perk - ($1000 + t-shirts)

Tier 3 perk - ($5,000+ Polo Shirt)

Tier 4 perk - ($10,000+ Polo Shirt + 5% bonus shares)

Tier 5 perk - ($25,000+ Polo Shirt + 10% bonus shares)

Tier 6 perk - ($50,000+ Polo Shirt+ 15% bonus shares)

*All perks occur when the offering is completed.

The 10% StartEngine Owners' Bonus

College Coaching Network will offer 10% additional bonus shares for all investments that are committed by investors that are eligible for the StartEngine Crowdfunding Inc. OWNer's bonus.

This means eligible StartEngine shareholders will receive a 10% bonus for any shares they purchase in this offering. For example, if you buy 100 shares of Common Stock at $10.91 / share, you will receive 110 shares of Common Stock, meaning you'll own 110 shares for $1,091. Fractional shares will not be distributed and share bonuses will be determined by rounding down to the nearest whole share.

This 10% Bonus is only valid during the investors' eligibility period. Investors eligible for this bonus will also have priority if they are on a waitlist to invest and the company surpasses its maximum funding goal. They will have the first opportunity to invest should room in the offering become available if prior investments are canceled or fail.

Investors will only receive a single bonus, which will be the highest bonus rate they are eligible for.

ALL UPDATES

01.03.22

Notice of Funds Disbursement

[The following is an automated notice from the StartEngine team].

Hello!

As you might know, College Coaching Network has exceeded its minimum funding goal. When a company reaches its minimum on StartEngine, it's about to begin withdrawing funds. If you invested in College Coaching Network be on the lookout for an email that describes more about the disbursement process.

This campaign will continue to accept investments until its indicated closing date.

Thanks for funding the future.

-StartEngine

12.03.21

Notice of Funds Disbursement

[The following is an automated notice from the StartEngine team].

Hello!

As you might know, College Coaching Network has exceeded its minimum funding goal. When a company reaches its minimum on StartEngine, it's about to begin withdrawing funds. If you invested in College Coaching Network be on the lookout for an email that describes more about the disbursement process.

This campaign will continue to accept investments until its indicated closing date.

Thanks for funding the future.

-StartEngine

10.28.21

Notice of Funds Disbursement

[The following is an automated notice from the StartEngine team].

Hello!

As you might know, College Coaching Network has exceeded its minimum funding goal. When a company reaches its minimum on StartEngine, it's about to begin withdrawing funds. If you invested in College Coaching Network be on the lookout for an email that describes more about the disbursement process.

This campaign will continue to accept investments until its indicated closing date.

Thanks for funding the future.

-StartEngine

REWARDS

Venture Club

Venture Club Members earn 10% bonus shares on top of this and all eligible investments for an entire year. Not a member? Sign up at checkout ($275/year).

$500

Tier 1 perk

($500 + t-shirts)

$1,000

Tier 2 perk

($1000 + t-shirts)

$5,000

Tier 3 perk

($5,000+ Polo Shirt)

$10,000

Tier 4 perk

($10,000+ Polo Shirt + 5% bonus shares

$25,000

Tier 5 perk

($25,000+ Polo Shirt + 10% bonus shares)

$50,000

Tier 6 perk

($50,000+ Polo Shirt+ 15% bonus shares)

JOIN THE DISCUSSION

0/2500

Ice breaker! What brought you to this investment?

HOW INVESTING WORKS

Cancel anytime before 48 hours before a rolling close or the offering end date.

WHY STARTENGINE?

REWARDS

We want you to succeed and get the most out of your money by offering rewards and memberships!

SECURE

Your info is your info. We take pride in keeping it that way!

DIVERSE INVESTMENTS

Invest in over 200 start-ups and collectibles!

FAQS

With Regulation A+, a non-accredited investor can only invest a maximum of 10% of their annual income or 10% of their net worth per year, whichever is greater. There are no restrictions for accredited investors.

With Regulation Crowdfunding, non-accredited investors with an annual income or net worth less than $124,000 are limited to invest a maximum of 5% of the greater of those two amounts. For those with an annual income and net worth greater than $124,000, they are limited to investing 10% of the greater of the two amounts.

At the close of an offering, all investors whose funds have “cleared” by this time will be included in the disbursement. At this time, each investor will receive an email from StartEngine with their Countersigned Subscription Agreement, which will serve as their proof of purchase moving forward.

Please keep in mind that a company can conduct a series of “closes” or withdrawals of funds throughout the duration of the campaign. If you are included in that withdrawal period, you will be emailed your countersigned subscription agreement and proof of purchase immediately following that withdrawal.

StartEngine assists companies in raising capital, and once the offering is closed, we are no longer involved with whether the company chooses to list shares on a secondary market or what occurs thereafter. Therefore, StartEngine has no control or insight into your investment after the close of the live offering. In addition, we are not permitted to provide financial advice. You may want to contact a financial professional to discuss possible investment outcomes.

For Regulation Crowdfunding, investors are able to cancel their investment at any point throughout the campaign up until 48 hours before the closing of the offering. Note: If the company does a rolling close, they will post an update to their current investors, giving them the opportunity to cancel during this timeframe. If you do not cancel within this 5-day timeframe, your funds will be invested in the company, and you will no longer be able to cancel the investment. If your funds show as ‘Invested’ on your account dashboard, your investment can no longer be canceled.

For Regulation A+, StartEngine allows for a four-hour cancellation period. Once the four-hour window has passed, it is up to each company to set their own cancellation policy. You may find the company’s cancellation policy in the company’s offering circular.

Once your investment is canceled, there is a 10-day clearing period (from the date your investment was submitted). After your funds have cleared the bank, you will receive your refund within 10 business days.

Refunds that are made through ACH payments can take up to 10 business days to clear. Unfortunately, we are at the mercy of the bank, but we will do everything we can to get you your refund as soon as possible. However, every investment needs to go through the clearing process in order to be sent back to the account associated with the investment.

Both Title III (Regulation Crowdfunding) and Title IV (Reg A+) help entrepreneurs crowdfund capital investments from unaccredited and accredited investors. The differences between these regulations are related to the investor limitations, the differing amounts of money companies are permitted to raise, and differing disclosure and filing requirements. To learn more about Regulation Crowdfunding, click here, and for Regulation A+, click here.