CLOSED

GET A PIECE OF AVIMESA

Climate-friendly sensor network

Show more

REASONS TO INVEST

TEAM

Joe Austin • CEO/Co-Founder

Read More

Jake Fields • Member — Board of Directors/Co-Founder

Collin Hinson • VP Technology

Read More

Overview

Avimesa makes putting sensors on Things easy — even over acres of coverage!

We focus on industrial customers who have working yards. A working yard is anything from a shipping port, to railroad yards, to farms, to school yards, to parks, rare lumber yards, waste, and water treatment facilities. All Things (like in Internet of Things) have something to say, even if they are not digital. For example, a gate moves, water flows, air has different pressure (and so does water), chemicals react, and moving Things like motors change speed, power, and vibration. Most Things have some aspect that can be measured, and Avimesa is designed to keep track of all of those variables. Inexpensive sensors on Things can be placed over acres or just a few square feet. Better yet, Avimesa is fully self-sufficient and can optionally get power from the sun and Internet from LTE. Even if there isn’t a readily available power source in your field, Avimesa can connect to a network.

Avimesa works with thousands of different types of sensors that can be used for security, business intelligence, usage graphing, cost savings, notifications, early warning alerts, and routing personnel to Things in need of attention, just to name a few. Customers also have the benefit of receiving 2,000 free monthly readings as well as free technical support.

THE PROBLEM

Businesses can’t innovate and solve 21st century problems with 20th century technology and techniques

While working yards come in an array of shapes and sizes, their one commonality is that they have an abundance of moving parts. With all of these moving parts, it can be easy to lose track of Things and even personnel, which can negatively impact performance and even threaten the safety of workers. Most current working yards haven’t had the necessary technological overhauls needed to modernize their solutions. If industrial yards are to thrive in the modern era, they are going to need modern solutions.

Is the cooling system in the equipment room blowing the right temperature? Have the medications in the deep freezer been kept at the proper temperature? Are you aware of any flooding in underground facilities? These are just a few of the near infinite questions yard managers need to keep up with if they are going to work efficiently.

THE SOLUTION

A platform that monitors all your Things

We built an Industrial IoT platform that makes it easy to use existing high-end industrial sensors and inexpensive Bluetooth sensors. Our platform immediately allows businesses to increase awareness of their business with a small, low-cost deployment and quickly scale to their entire facility. And, while the value of business intelligence is immediate, it actually appreciates in value as more historical data is stored over time.

With Avimesa, customers can easily set up alarms for user-configurable thresholds to notify you of any potential mishaps. Freezer temperature too high? Send a message to a group of admins through our platform. Entry gate stuck open? Trigger an alert and get it fixed. In addition, Avimesa’s API allows developers to build custom IoT applications without having to build their own IoT backend.

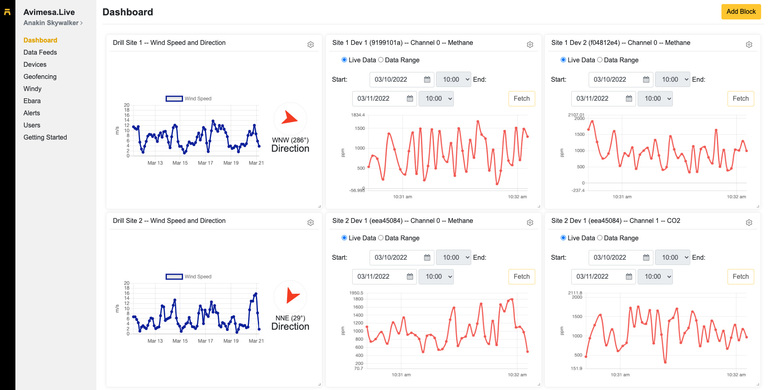

Avimesa simplifies remote monitoring for industrial customers by providing a plug-and-play setup of sensors, hardware, and application. A customer orders a starter kit specific to their industry. Setup is as easy as an Amazon Echo, and in just a few minutes, customers are able to monitor their assets with a customizable dashboard in the Avimesa.live web app.

We offer a monthly, subscription-based recurring revenue with base monthly charges for the number of Avimesa Gadgets (gateways) running at a customer site. Additional fees are charged for higher sampling rates (up to multiple times per minute) and professional services are available for enterprise level customers.

OUR TRACTION

Small victories pave a road to massive success

We have achieved a stout $1.6 million in seed funding which has allowed us to develop a complete IoT solution, including complete cloud and provisioning infrastructure and a browser-based application called Avimesa.Live.

We completed primary product development in January 2020 with a variety of test customers throughout 2021 including working farms, semiconductor manufacturing, and a four acre multi-use yacht club with a marina and private beach. The provisioning and perimeter aware and advanced BLE enhancements that make the Avimesa.Live Starter Kit possible just recently reached beta development status.

THE MARKET

One solution for a multitude of industries

The Industrial IoT market is heading to $263.4 billion by 2027, and Avimesa is well on its way to claiming a stake of this massive industry (Source).

There are many factors that prevent the modernization of industrial facilities such as availability of power, harsh environments, accessibility, network, and personnel issues. These obstacles can make installing existing IoT solutions even more expensive and complex than they already are. Avimesa, however, was created specifically with flexibility in mind so we could scale our platform to virtually any type of industry. We offer a remote monitoring solution that can be set up in minutes, with hardware that can be powered by a small solar panel if power isn’t readily available.

Solar is important to many industrial customers.

This flexibility allows us to measure virtually any variable in virtually any facility and working yards. We work with sensors that can monitor vibration, power, liquid flow, volumetric moisture, light, temperature, motion, force, radar, pollution, and much more. Even better, we have developed technology to tag people and equipment if they have entered or exited a geofenced area. We are committed to bringing industrial businesses into the modern age, and our innovative and cost-effective platform will accomplish that goal.

Industrial businesses come in all shapes and sizes but share the characteristic that they can be large, diversified, and have obstacles. Even if a site does not have power or internet, Avimesa can drop-in an inexpensive plug-and-play solar field unit to power its platform. Avimesa can combine low-cost BLE sensors/tags with high-end industrial loop sensors in a mixed-use solar powered environment. Plus, Avimesa’s Industrial Starter Kits provide a quick and painless way for customers to test out the actual Avimesa system that can be scaled to their needs.

WHY INVEST

We are the future of Industrial IoTs

Avimesa aims to be the gold standard in Industrial IoT, particularly for working yards. We have the scalability, the technology, and the leadership to be the number one player in our field. In the digital age, information is the currency of the realm, and our platform can provide customers with real-time information for every Thing in their facility. By investing in Avimesa, you are investing in the backbone of tomorrow’s industry.

ABOUT

HEADQUARTERS

3725 Mission Blvd.

San Diego, CA 92109

WEBSITE

View Site

TERMS

Avimesa

Overview

PRICE PER SHARE

$18.76

DEADLINE

Apr. 20, 2022 at 6:59 AM UTC

VALUATION

$12.19M

FUNDING GOAL

$10K - $1.07M

Breakdown

MIN INVESTMENT

$131.32

MAX INVESTMENT

$93,800

MIN NUMBER OF SHARES OFFERED

533

MAX NUMBER OF SHARES OFFERED

57,036

OFFERING TYPE

Equity

SHARES OFFERED

Preferred Stock

Maximum Number of Shares Offered subject to adjustment for bonus shares

*Maximum Number of Shares Offered subject to adjustment for bonus shares. See Bonus info below.

Investment Incentives and Bonuses*

Time-Based

Friends and Family Early Birds

Invest within the first 24 hours and receive an additional 15% bonus shares.

Super Early Bird Bonus

Invest within the next 72 hours and receive an additional 10% bonus shares.

Early Bird Bonus

Invest within the next 7 days and receive an additional 5% bonus shares.

Amount-Based

$500+

Avimesa 10W Solar Travel Charger— perfect for all smartphones.

$1,000+

Avimesa 40W Folding Solar Charger — perfect for laptops in the field.

$1,500+

Avimesa 40W Folding Solar Charger and join the Avimesa Launch Party at Mission Bay Yacht Club!

$3,500+

Avimesa comes to you and installs an Avimesa Solar Field Hub and six sensors (travel expense not included).

*All perks occur when the offering is completed.

The 10% StartEngine Owners' Bonus

Avimesa will offer 10% additional bonus shares for all investments that are committed by investors that are eligible for the StartEngine Crowdfunding Inc. OWNer's bonus.

This means eligible StartEngine shareholders will receive a 10% bonus for any shares they purchase in this offering. For example, if you buy 100 shares of Preferred Stock at $18.76 / share, you will receive 110 shares of Preferred Stock, meaning you'll own 110 shares for $1,876. Fractional shares will not be distributed and share bonuses will be determined by rounding down to the nearest whole share.

This 10% Bonus is only valid during the investors' eligibility period. Investors eligible for this bonus will also have priority if they are on a waitlist to invest and the company surpasses its maximum funding goal. They will have the first opportunity to invest should room in the offering become available if prior investments are cancelled or fail.

Investors will only receive a single bonus, which will be the highest bonus rate they are eligible for.

Irregular Use of Proceeds

ALL UPDATES

04.18.22

Last day to invest in Avimesa

Greetings.

Today is the last day to invest in Avimesa. If you haven't invested yet, today is the day. Even if you have invested, you can increase your amount today.

Sincerely,

The Avimesa Team.

04.14.22

Only five days left to invest in Avimesa!

Greetings from Avimesa.

We're making excellent progress on the methane monitoring front, with our first Solar Field Unit with a built-in NevadaNano methane sensor shipping out next week! More about the SFU here: https://esg.avimesa.com/solar-field-unit

And lastly, testing of our handheld internet-connected methane detection devices is underway. These use the same NevadaNano methane sensor as the Solar Field Unit and connect to Avimesa.Live for data viz and alerting. Don't miss out; click that invest button today!

Best regards,

The Avimesa Team

03.23.22

Shipping Our First Avimesa Methane Gun

We’re really excited to be shipping the first Avimesa Methane Gun — an ultra-portable solution to pin-point areas with concentrations of methane gas. The device plugs into a handheld computer (part of the SFU Travel Kit) for instant data readings, or reading them remotely, via our cloud-based SaaS.

The main idea behind the methane gun and the SFU Travel Kit, is to find the best place to install the pole-mounted Solar Field Unit for longer-term monitoring of greenhouse gas emissions. Here’s a picture of the Methane Gun in action:

Campaign ends in less than 30 days!

We had an amazing (nearly 10%) increase in investment since we reported on hitting the $100k mark. Hurry, only 27 days left to invest! Click that invest button today!

03.18.22

Notice of Funds Disbursement

[The following is an automated notice from the StartEngine team].

Hello!

As you might know, Avimesa has exceeded its minimum funding goal. When a company reaches its minimum on StartEngine, it's about to begin withdrawing funds. If you invested in Avimesa be on the lookout for an email that describes more about the disbursement process.

This campaign will continue to accept investments until its indicated closing date.

Thanks for funding the future.

-StartEngine

03.17.22

Avimesa Updates IoT Application for Methane Sensor Readings and Weather Feeds

Weather feeds can be tied to shared sensor readings to improve data reporting and business logic.

Hello! We have updated our IoT application, Avimesa.Live, with methane sensor data capabilities in preparation for the release of their forthcoming Solar Field Unit and Solar Field Unit Travel Kits for methane detection and monitoring.

Also included in the release are weather forecast feeds via Windy.com. Weather events such as wind or varied temperatures can affect methane sensor readings and the ability to tie weather forecasts and sensor readings allow for improved data analysis and logic-based event triggers in the application.

Initial weather forecasts will include: wind, wind gusts, temperature, dew point, precipitation (rain, snow, convective), precipitation type, CAPE index, high clouds, medium clouds, low clouds, humidity, geopotential height, pressure, waves, wind waves, swell, swell 2, CO concentration, dust mass, and SO2.

Logic such as “If wind gusts are greater than 30 then don’t send an alert” is one example of how the weather might be used to fine-tune user notifications More complex logic can be constructed using other Avimesa features, such as perimeter awareness, to create highly aware alerts, notifications, and graphs.

Avimesa is compatible with the NevadaNano MPS methane gas sensor, which is included in the Avimesa Solar Field Unit and the Solar Field Unit Travel Kit, as well as Cubic SJH-100 methane sensor, with plans to add more in the future.

Pricing for the new climate feeds is free to Avimesa.Live beta users and the feature is available today. Users will be able to get a free regional climate reading that updates often throughout the day.

03.08.22

First Avimesa Travel Kit for methane (CH4) shipping next week!

First Avimesa Travel Kit for methane (CH4) shipping next week!

- The SFU Travel Kit contains everything needed, including a handheld Ubuntu computer, for Climate Scientists, Climate Engineers, and Oil and Gas sites, to pinpoint sources of methane in working yards and the associated yard equipment.

AVIMESA SFU TRAVEL KIT

While we were working on the details for climate and oil & gas partners for the pole-mounted Solar Field Unit (SFU), we discovered a pain point that Avimesa can uniquely solve in a cost-effective way -- introducing the SFU Travel Kit. It runs the same Avimesa software and uses the same methane sensor as the pole-mounted SFU, but the Travel Kit is handheld. As you can imagine, installing the pole-mounted SFU can be quite a bit of work and may even require digging a hole in the ground, etc. We solve a pain point with a portable handheld unit for testing purposes.

Using the SFU Travel Kit is simple. The user connects it to their smartphone for Internet access and explores the working yard for optimal locations to place the pole-mounted SFU. An optional LTE hotspot is available for users that prefer to not use their phone. This is enormously powerful because it is running the same exact software and uses the same exact methane, temperature, and humidity sensors as the pole unit. And because it is transmitting data to the Avimesa cloud in real-time, it is instantly accessible to engineers and scientists at other locations and the home office. Climate conditions are an integral part of methane measurements, so Avimesa's integrated regional climate readings are perfect for the task.

Included with the SFU Travel Kit is:

- Avimesa Methane Gun. A handheld unit that includes methane, temperature, and humidity with self-calibrating logic. It connects via the RS232 port on the back of the included handheld computer.

- A GPD (6" screen) handheld computer running Ubuntu Linux and Avimesa Gadget. The user sees the readings in real-time while it is transmitting data to the cloud for sharing with other engineers and scientists.

-

A lithium-ion auxiliary battery capable of powering the GPD for up to 10 hours without draining the built-in battery in the GPD. This is essential for long testing hours, especially at night when solar does not work.

- An Avimesa 30 watt solar charger to keep things charged for extended time in the field. This is similar to the solar charger that investors get when they invest more than $1,000 in Avimesa thru StartEngine.

- An Avimesa burgee flag. Not just for fun, this can be useful to get an idea of wind direction.

The first Avimesa Methane Gun units are 3D printed by a high-end 3D printing house. The industrial design will be mass-produced using injection molding. It includes a highly accurate methane sensor (250 PPM) with integrated temperature and humidity sensing.

We are very proud of the SFU Travel Kit. It fills an important need in the ESG, Climate Change, and Oil & Gas markets because, unlike any other handheld unit, it runs exactly the same software and uses the same sensors as permanent pole-mounted units. The MSRP is $1,999, so it is very affordable for volume purchases. Right now, we are supplying major key partners to do extensive joint testing.

Help Avimesa help the earth and make money too. Please invest in Avimesa today!

Sincerely,

The Avimesa Team

03.07.22

Notice of Funds Disbursement

[The following is an automated notice from the StartEngine team].

Hello!

As you might know, Avimesa has exceeded its minimum funding goal. When a company reaches its minimum on StartEngine, it's about to begin withdrawing funds. If you invested in Avimesa be on the lookout for an email that describes more about the disbursement process.

This campaign will continue to accept investments until its indicated closing date.

Thanks for funding the future.

-StartEngine

03.02.22

Avimesa website gets facelift

Avimesa website update... We have updated our website to reflect our current emphasis on the addition of greenhouse sensing to our Flagship Avimesa Solar Field Unit (SFU). It includes an updated overview of the SFU. We are nearing completion of the SFU version with an integrated methane sensor and are finalizing the internal design for the sensor air flow and water resistance.

We are getting excellent responses to our business development in the greenhouse gas / ESG mitigation space. Whether you believe in climate change or not, there is a vast amount of money in detection for compliance, safety, and planning. We have a lot of competitive advantage in this space because of our ability to integrate shared sensors and regional climate feeds along with the sensors in our rules engine.

If you have not yet invested in Avimesa -- come and join us!

The Avimesa Team

02.28.22

Notice of Funds Disbursement

[The following is an automated notice from the StartEngine team].

Hello!

As you might know, Avimesa has exceeded its minimum funding goal. When a company reaches its minimum on StartEngine, it's about to begin withdrawing funds. If you invested in Avimesa be on the lookout for an email that describes more about the disbursement process.

This campaign will continue to accept investments until its indicated closing date.

Thanks for funding the future.

-StartEngine

02.28.22

New climate sensor for Avimesa

Update on investments: On Friday, February 25th, we hit our $100k invested goal. This means that the StartEngine system will automatically generate announcements to its base of investors. Nice!

New Climate Sensor... We just received delivery of MPS Methane Gas Sensors from NevadaNano, a leader in the gas detection market. MPS stands for their Molecular Property Spectrometer technology. These sensors are in use in the most challenging environments -- from Arctic wellheads to shale fields in South Texas. The sensors will be incorporated into our solar powered Avimesa ESG Climate Kits for the Oil and Gas industry. Other uses include paints & solvents, chemical processing, algae growth, water runoff / drainage, alloy manufacturing, and agriculture.

Our early study finds this NevadaNano sensor to be quite remarkable. It has built-in environmental compensation, very low power requirements, and is inherently poison immune. It can detect methane with a resolution of only 250 parts of methane per million parts of ambient air. It can also operate in very harsh environments ranging from -40° to 75° celsius.

As previously announced, Avimesa is putting a lot of emphasis on developing and marketing kits for the massively growing gas mitigation business of fugitive methane emissions. World government agencies, including the United States EPA, have made methane mitigation one of their highest climate priorities for 2022 and beyond.

We will keep you posted as we near the shipments of the first Climate Kit prototype.

- The Avimesa Team

REWARDS

Venture Club

Venture Club Members earn 10% bonus shares on top of this and all eligible investments for an entire year. Not a member? Sign up at checkout ($275/year).

$500

$500+

Avimesa 10W Solar Travel Charger— perfect for all smartphones.

$1,000

$1,000+

Avimesa 40W Folding Solar Charger — perfect for laptops in the field.

$1,500

$1,500+

Avimesa 40W Folding Solar Charger and join the Avimesa Launch Party at Mission Bay Yacht Club!

$3,500

$3,500+

Avimesa comes to you and installs an Avimesa Solar Field Hub and six sensors (travel expense not included).

JOIN THE DISCUSSION

0/2500

Varun Gupta

3 years ago

what is YTD revenue and projected for 2022?

2

0

Jess Wiley

4 years ago

Does this product have compatibility with condition monitoring products from major Bearing and Power Transmission manufacturers? e.g. SKF, Rexnord, Schaeffler Group, ABB, etc

Show more

2

0

Vy Nguyen

4 years ago

How, if at all, does this technology compare with or complement the Helium technology for IoT device connection & communication?

Show more

3

0

Patrick Annan

4 years ago

I want to invest but the share price is too high to me. A start up with such high share price🙄🙄

3

1

HOW INVESTING WORKS

Cancel anytime before 48 hours before a rolling close or the offering end date.

WHY STARTENGINE?

REWARDS

We want you to succeed and get the most out of your money by offering rewards and memberships!

SECURE

Your info is your info. We take pride in keeping it that way!

DIVERSE INVESTMENTS

Invest in over 200 start-ups and collectibles!

FAQS

With Regulation A+, a non-accredited investor can only invest a maximum of 10% of their annual income or 10% of their net worth per year, whichever is greater. There are no restrictions for accredited investors.

With Regulation Crowdfunding, non-accredited investors with an annual income or net worth less than $124,000 are limited to invest a maximum of 5% of the greater of those two amounts. For those with an annual income and net worth greater than $124,000, they are limited to investing 10% of the greater of the two amounts.

At the close of an offering, all investors whose funds have “cleared” by this time will be included in the disbursement. At this time, each investor will receive an email from StartEngine with their Countersigned Subscription Agreement, which will serve as their proof of purchase moving forward.

Please keep in mind that a company can conduct a series of “closes” or withdrawals of funds throughout the duration of the campaign. If you are included in that withdrawal period, you will be emailed your countersigned subscription agreement and proof of purchase immediately following that withdrawal.

StartEngine assists companies in raising capital, and once the offering is closed, we are no longer involved with whether the company chooses to list shares on a secondary market or what occurs thereafter. Therefore, StartEngine has no control or insight into your investment after the close of the live offering. In addition, we are not permitted to provide financial advice. You may want to contact a financial professional to discuss possible investment outcomes.

For Regulation Crowdfunding, investors are able to cancel their investment at any point throughout the campaign up until 48 hours before the closing of the offering. Note: If the company does a rolling close, they will post an update to their current investors, giving them the opportunity to cancel during this timeframe. If you do not cancel within this 5-day timeframe, your funds will be invested in the company, and you will no longer be able to cancel the investment. If your funds show as ‘Invested’ on your account dashboard, your investment can no longer be canceled.

For Regulation A+, StartEngine allows for a four-hour cancellation period. Once the four-hour window has passed, it is up to each company to set their own cancellation policy. You may find the company’s cancellation policy in the company’s offering circular.

Once your investment is canceled, there is a 10-day clearing period (from the date your investment was submitted). After your funds have cleared the bank, you will receive your refund within 10 business days.

Refunds that are made through ACH payments can take up to 10 business days to clear. Unfortunately, we are at the mercy of the bank, but we will do everything we can to get you your refund as soon as possible. However, every investment needs to go through the clearing process in order to be sent back to the account associated with the investment.

Both Title III (Regulation Crowdfunding) and Title IV (Reg A+) help entrepreneurs crowdfund capital investments from unaccredited and accredited investors. The differences between these regulations are related to the investor limitations, the differing amounts of money companies are permitted to raise, and differing disclosure and filing requirements. To learn more about Regulation Crowdfunding, click here, and for Regulation A+, click here.

Alan DeRossett

3 years ago

Congratulations your product launch looks great. I will need some in 2022 for a project I'm working on in my day job. I'm planning on investing and understanding the share price can be addressed later in a stock split to make the secondary market more liquid. However, tell StartEngine your TERMS link on this page is Broken

Show more

2

0