CLOSED

GET A PIECE OF PRIME LIGHTWORKS

Green Hydrogen Rocket Launch

Show more

REASONS TO INVEST

TEAM

Kyle Bernard Flanagan • CEO, President, CFO/Treasurer, Secretary, Sole Director

Education: B.A. in Physics, Harvard University (2013)

Forbes 30 Under 30 Class of 2020 in Science

Kyle Flanagan worked as Electromagnetic Interference (EMI) & Survivability Engineer at SpaceX from 2013 to 2015. During that time, his responsibilities included power systems compatibility, grounding bonding shielding, and lightning/welding/ESD control programs for Falcon rocket and Dragon spacecraft. His prior research includes an internship with Harvard University for CERN ATRAP Antihydrogen Research and a fellowship with CalTech for NASA JPL Frequency & Timing Advanced Instrument Development Group. Full-time responsibilities include program management, science and engineering design, and business operations.

Read More

Mikhail Jackson • Operations Director, Software Developer

Education: B.S. in Earth Sciences Geology, University of New Hampshire (2017)

Mikhail Jackson has worked as Nuclear Radiation Safety Technician for the Department of Defense (DOD) at Portsmouth Naval Shipyard since 2018. His responsibilities during that time have grown to include spearheading innovation initiatives for technology integration to streamline workflow efficiency. “I love new exciting ideas, seeing them take shape and develop, and how they are fostered by Prime Lightworks. I also love raising a family, being a coach, shredding a snowboard, and playing music. My new infatuation is New England permaculture gardening methods.” Consulting responsibilities include operations management, test software development, and investor relations.

Read More

Simon James • Creative Director

Education: B.S. in Business Administration, Management & Marketing, University of Maine (2011)

Maine Top Scholar

In 2015, Simon James served as an Account Executive at Plixer International where he developed strategic marketing campaigns and managed a business development team for international enterprise sales. During that time, he was responsible for creating the most successful email campaign in the company's 10-year history (highest impression rate) and closed deals with several of North America's top universities and Fortune 500 companies. In 2018, he served as a design apprentice to legendary designer Glen Halliday of Kids Crooked House and :GHDESIGNCO where he was responsible for brand/logo design and web development for US clients. In 2020, he founded GoodBoy Design, a graphic design and marketing firm. In 2023, he joined the Prime Lightworks consulting team to provide creative direction for branding design and brand messaging.

Read More

the pitch

Founded by former SpaceX engineers with decades of experience in the field, we believe the Prime Lightworks system may generate a revolutionary advantage in spaceflight environmental and planetary sciences, enabling clean orbital launch by developing a fully reusable satellite rocket launch vehicle based on renewable natural resources that do not produce greenhouse gas emissions. By investing in Prime Lightworks, you could help advance the green movement of the aerospace industry, while holding equity in an innovative company that could soon establish itself in a flourishing multibillion-dollar market.

Updates Since Our Last Raise...

OVERVIEW

Investigating the Future of Renewable Aerospace Propulsion Based on Green H2 Fuel

*Image Courtesy of NASA

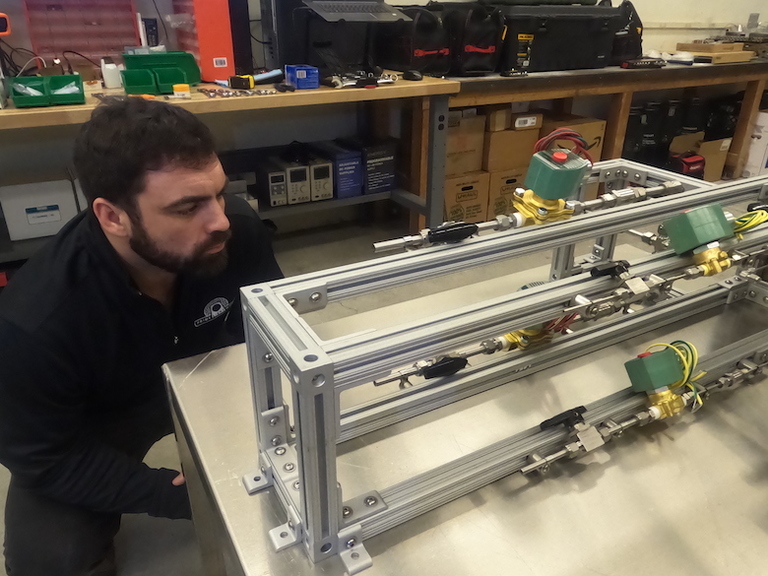

At Prime Lightworks, we are building a prototype hydrogen rocket engine combining green hydrogen fuel and launch vehicle reusability to reduce the environmental impact of satellite launches. We will test at our new facility at Brunswick Landing in Maine, with support from Maine Technology Institute and Midcoast Regional Redevelopment Authority.

Our Founder & CEO, Kyle Flanagan, has a wealth of experience from Harvard, CERN, Caltech/JPL, and SpaceX, having been entrenched in this world for years. Our strategy in the near-term is to identify a vendor of green hydrogen for initial testing, while our long-term strategy is to purchase green hydrogen generation infrastructure so we can produce our own propellant at the launch site.

THE PROBLEM & OUR SOLUTION

Eliminating Emissions and Waste from Satellite Launches

The current growth in satellite launches is causing a rapid increase in greenhouse gas emissions and waste. The average rocket launch using kerosene fuel emits 336 metric tons of CO2. Over 27,000 pieces of orbital debris, or “space junk”, are tracked by the Department of Defense (DOD) Space Surveillance Network (SSN), posing a catastrophic risk to satellites and spacecraft. (source, source)

Our plan is to create a sustainable and reusable rocket launch platform by integrating a variety of already existing technologies including green H2 generation, storage, and combustion. The use of green hydrogen as rocket fuel will eliminate CO2 emissions from propellant generation, while full vehicle reusability will mitigate orbital debris from launch vehicle waste.

Our beachhead market will be sales of orbital rocket launch services to SmallSat manufacturers and operators with environmental missions, such as Earth observation, weather monitoring, and climate science, who may be eager to launch on a green platform. In the long term, we believe supporting full launch vehicle reusability with green hydrogen generation infrastructure may further drive down the price of SmallSat launches as we phase out the growing waste from expendable launch vehicles and the rising price of fossil fuel extraction.

THE MARKET & OUR TRACTION

The Global Satellite Launch Services Market is a $5B+ per Year Industry

The global space launch services market was valued at $5.7 billion in 2021, and is predicted to grow to $14 billion by 2029 at a CAGR of 12% (Source, Source). Small satellites account for nearly half the global launch market and 94% of all satellites launched last year. Over 1,700 satellites were launched in 2021, with another 11,000 satellites predicted to launch by 2030 (Source, Source).

Recently, we have achieved the following milestones:

- We’ve raised $2.9+ million in seed funding from Y Combinator, Angel Investors, and StartEngine

- Graduated from Cleantech Open Northeast 2022 Accelerator with support from Maine Technology Institute

- Relocated to 2,000 square foot facility at Brunswick Landing in Maine + TechPlace prototyping space

- Begun assembly of our prototype hydrogen combustion chamber system for static fire testing

WHY INVEST

Help Us Launch into the Future of Space

The vision of Prime Lightworks is to help satellite manufacturers and operators achieve zero emissions spaceflight by developing a fully reusable launch vehicle for small satellites using green hydrogen propellant. With your support, we plan to complete hydrogen rocket engine testing and arrange for launch vehicle testing, sub-orbital flight testing, and re-entry testing, as we prepare for our first pilot customer satellite launch. Join us in building a sustainable future where air and space transportation are fully renewable based on natural resources with zero emissions footprint. Thank you for believing in our mission – we truly appreciate your support!

ABOUT

HEADQUARTERS

47 Katahdin Dr

Brunswick, ME 04011

WEBSITE

View Site

TERMS

Prime Lightworks

Overview

PRICE PER SHARE

$3.28

DEADLINE

Apr. 12, 2023 at 6:59 AM UTC

VALUATION

$19.64M

FUNDING GOAL

$10K - $3.93M

Breakdown

MIN INVESTMENT

$249.28

MAX INVESTMENT

$999,999.84

MIN NUMBER OF SHARES OFFERED

3,049

MAX NUMBER OF SHARES OFFERED

1,198,170

OFFERING TYPE

Equity

SHARES OFFERED

Common Stock

Maximum Number of Shares Offered subject to adjustment for bonus shares

*Maximum number of shares offered subject to adjustment for bonus shares. See Bonus info below.

Loyalty Bonus | 10% Bonus Shares

As you have previously invested in Prime Lightworks or are in our Friends & Family Network, you are eligible for additional bonus shares.

Time-Based Perks:

Ultra Early Bird Bonus

Invest within the first 7 days and receive 20% bonus shares.

Super Early Bird Bonus

Invest within the first 14 days and receive 10% bonus shares.

Early Bird Bonus

Invest within the first 30 days and receive 5% bonus shares.

Amount-Based Perks:

$500+ | Tier 1

Receive 1% bonus shares & Stickers w/ Company Logo.

$1,000+ | Tier 2

Receive 2% bonus shares & Flashlight w/ Company Logo.

$2,500+ | Tier 3

Receive 3% bonus shares & Baseball Cap w/ Company Logo.

$5,000+| Tier 4

Receive 5% bonus shares & Tumbler w/ Company Logo + Name Etched on Prototype.

$10,000+ | Tier 5

Receive 10% bonus shares & Backpack w/ Company Logo + Name Etched on Prototype.

$25,000+ | Tier 6

Receive 20% bonus shares & Visit to HQ in Brunswick, ME + Name Etched on Prototype.

*In order to receive perks from an investment, one must submit a single investment in the same offering that meets the minimum perk requirement. Bonus shares from perks will not be granted if an investor submits multiple investments that, when combined, meet the perk requirement. All perks occur when the offering is completed.

The 10% StartEngine Owners' Bonus

Prime Lightworks Inc. will offer 10% additional bonus shares for all investments that are committed by investors that are eligible for the StartEngine Crowdfunding Inc. OWNer's bonus.

This means eligible StartEngine shareholders will receive a 10% bonus for any shares they purchase in this offering. For example, if you buy 100 shares of Common Stock at $3.28 / share, you will receive 110 shares Common Stock, meaning you'll own 110 shares for $328. Fractional shares will not be distributed and share bonuses will be determined by rounding down to the nearest whole share.

This 10% Bonus is only valid during the investors eligibility period. Investors eligible for this bonus will also have priority if they are on a waitlist to invest and the company surpasses its maximum funding goal. They will have the first opportunity to invest should room in the offering become available if prior investments are canceled or fail.

Investors will receive the highest single bonus they are eligible for among the bonuses based on the amount invested and time of offering elapsed (if any). Eligible investors will also receive the Owner’s Bonus and the Loyalty Bonus in addition to the aforementioned bonus.

Irregular Use of Proceeds

PRESS

ALL UPDATES

02.17.23

Prime Lightworks is Live NOW on StartEngine!

Hello Everyone,

Whether you’re one of our existing investors (thank you for your support!) or you’re just now joining us on our journey, I want to welcome you and thank you for making all of this possible!

We are on the journey of a lifetime developing sustainable aerospace propulsion systems and aim to share our mission @primelightworks to develop the future of clean transportation with green H2 fuel.

Please share our campaign with your friends, family, and colleagues:

https://www.startengine.com/offering/primelightworks

Please help us reach our goal of $3.93M! We have big plans to improve our space economy and environment and together we could make an enormous positive impact!

Thank you again and I look forward to sharing our story with each of you!

Best regards,

Kyle and the Prime Lightworks Team

REWARDS

10%

Stack Venture Club & Rewards!

Members get an extra 10% shares in addition to rewards below!

Venture Club

Venture Club Members earn 10% bonus shares on top of this and all eligible investments for an entire year. Not a member? Sign up at checkout ($275/year).

$500

Tier 1

Receive 1% bonus shares & Stickers w/ Company Logo.

$1,000

Tier 2

Receive 2% bonus shares & Flashlight w/ Company Logo.

$2,500

Tier 3

Receive 3% bonus shares & Baseball Cap w/ Company Logo.

$5,000

Tier 4

Receive 5% bonus shares & Tumbler w/ Company Logo + Name Etched on Prototype.

$10,000

Tier 5

Receive 10% bonus shares & Backpack w/ Company Logo + Name Etched on Prototype.

$25,000

Tier 6

Receive 20% bonus shares & Visit to HQ in Brunswick, ME + Name Etched on Prototype.

JOIN THE DISCUSSION

0/2500

W Kim Colich

2 years ago

Hi, I see no mention of patents. What protections do you have for this technology you are developing? Thanks. Blessings

Show more

2

0

HOW INVESTING WORKS

Cancel anytime before 48 hours before a rolling close or the offering end date.

WHY STARTENGINE?

REWARDS

We want you to succeed and get the most out of your money by offering rewards and memberships!

SECURE

Your info is your info. We take pride in keeping it that way!

DIVERSE INVESTMENTS

Invest in over 200 start-ups and collectibles!

FAQS

With Regulation A+, a non-accredited investor can only invest a maximum of 10% of their annual income or 10% of their net worth per year, whichever is greater. There are no restrictions for accredited investors.

With Regulation Crowdfunding, non-accredited investors with an annual income or net worth less than $124,000 are limited to invest a maximum of 5% of the greater of those two amounts. For those with an annual income and net worth greater than $124,000, they are limited to investing 10% of the greater of the two amounts.

At the close of an offering, all investors whose funds have “cleared” by this time will be included in the disbursement. At this time, each investor will receive an email from StartEngine with their Countersigned Subscription Agreement, which will serve as their proof of purchase moving forward.

Please keep in mind that a company can conduct a series of “closes” or withdrawals of funds throughout the duration of the campaign. If you are included in that withdrawal period, you will be emailed your countersigned subscription agreement and proof of purchase immediately following that withdrawal.

StartEngine assists companies in raising capital, and once the offering is closed, we are no longer involved with whether the company chooses to list shares on a secondary market or what occurs thereafter. Therefore, StartEngine has no control or insight into your investment after the close of the live offering. In addition, we are not permitted to provide financial advice. You may want to contact a financial professional to discuss possible investment outcomes.

For Regulation Crowdfunding, investors are able to cancel their investment at any point throughout the campaign up until 48 hours before the closing of the offering. Note: If the company does a rolling close, they will post an update to their current investors, giving them the opportunity to cancel during this timeframe. If you do not cancel within this 5-day timeframe, your funds will be invested in the company, and you will no longer be able to cancel the investment. If your funds show as ‘Invested’ on your account dashboard, your investment can no longer be canceled.

For Regulation A+, StartEngine allows for a four-hour cancellation period. Once the four-hour window has passed, it is up to each company to set their own cancellation policy. You may find the company’s cancellation policy in the company’s offering circular.

Once your investment is canceled, there is a 10-day clearing period (from the date your investment was submitted). After your funds have cleared the bank, you will receive your refund within 10 business days.

Refunds that are made through ACH payments can take up to 10 business days to clear. Unfortunately, we are at the mercy of the bank, but we will do everything we can to get you your refund as soon as possible. However, every investment needs to go through the clearing process in order to be sent back to the account associated with the investment.

Both Title III (Regulation Crowdfunding) and Title IV (Reg A+) help entrepreneurs crowdfund capital investments from unaccredited and accredited investors. The differences between these regulations are related to the investor limitations, the differing amounts of money companies are permitted to raise, and differing disclosure and filing requirements. To learn more about Regulation Crowdfunding, click here, and for Regulation A+, click here.

Nicholas Marino

2 years ago

Glad to see you back on StartEngine but also kind of rude that investors in the last round (2021) have literally not heard a single peep from you since.. When we invest and don't hear anything for two years, we assume our money is gone. Please fix this moving forward Kyle

Show more

3

0