CLOSED

GET A PIECE OF SAZMINING

Clean Bitcoin Mining

$210,705.51 Raised

REASONS TO INVEST

TEAM

William Szamosszegi • CEO

Read More

Martin Patrick Hidalgo • Chief Financial Officer

Read More

Andrew Zoltan Szamosszegi • Advisor and Board Member

Read More

the pitch

We believe that Bitcoin mining is too complicated and costly for billions of people around the world. It is also notoriously energy-intensive, and critics point to its carbon footprint. We believe that Sazmining solves all of these issues in one fell swoop. Sazmining manages the entire mining process for our customers, so that they don’t have to lift a finger in order to receive Bitcoin directly into their wallets. Even better, we lower the financial barriers to mining by aggregating customer purchasing power to buy mining rigs in bulk. With a 350 mining rig capacity facility already live, press enthusiasm, and the recent full launch of our platform, we are ready to build a clean, accessible future in Bitcoin mining.

The Marriage between Better Money and Clean Energy Begins

Will Szamosszegi had already been a seasoned tech entrepreneur when he first heard about Bitcoin, the next global reserve asset. After months of research, he knew he had to build a company that would make it easier for people to own Bitcoin.

Meanwhile, Kent Halliburton, a veteran in the renewable energy sector, heard Will in an interview. Kent was impressed, and he quickly connected with Will.

The pair immediately hit it off and brainstormed how they could merge Will’s passion for Bitcoin and Kent’s passion for renewable energy. Sazmining was born: a platform that managed the entire Bitcoin mining process for retail customers, so that people all over the world could have the opportunity to receive Bitcoin as passive income. Sazmining’s mining rigs would run on carbon-neutral energy sources, such as hydro and waste methane gas.

Will and Kent are in the middle of their mission to transform humanity’s relationship with both money and energy. We believe that Sazmining is accelerating Bitcoin adoption, and it is giving a boost to the renewable energy economy by relying on them to power its mining rigs.

Bitcoin Mining Should be as Easy as Ordering a Netflix Subscription

At Sazmining, we make turnkey Bitcoin mining accessible to retail customers by sourcing, hosting, and maintaining customer's rigs. Customers simply purchase machines through our platform and give us their wallet address, and we handle the rest. Because we only make money when our customers do, our incentives are aligned with those of our customers: we are incentivized to maximize customer mining rigs' uptime and Bitcoin production.

The Problem & Our Solution

Helping Customers Make Money by Solving the Climate Crisis

Our mining rigs run on either clean energy sources like hydropower, or on methane gas (a greenhouse gas up to 84x as potent as CO2) that would have otherwise been emitted into the atmosphere. We believe that we are contributing to subsidizing the clean energy sector and curbing humanity’s greenhouse gas emissions (source). We are endeavoring to solve both of these problems by aggregating customer purchasing power to access low-cost, carbon-neutral Bitcoin mining facilities.

Many Problems, One Solution

We believe that Bitcoin mining is too complicated and costly for billions of people around the world. It is also notoriously energy-intensive, and misinformed critics point to its carbon footprint. We believe that Sazmining solves both of these issues in one fell swoop. Sazmining manages the entire mining process for our customers, so that they don’t have to lift a finger in order to receive Bitcoin directly into their wallets. Sazmining is reshaping Bitcoin mining to be more sustainable and affordable. By harnessing hydropower and methane waste to fuel our rigs, we are building a carbon-negative future for Bitcoin mining. Even better, we lower the financial barriers to mining by aggregating customer purchasing power to buy mining rigs in bulk. Finally, our rigs run on only clean energy sources, so our customers can rest easy knowing that their Bitcoin has not damaged the environment. With a 350 mining rig capacity facility already live, press enthusiasm, and the recent full launch of our platform, we are ready to build a clean, accessible future in Bitcoin mining.

Green, Transparent, and Easy

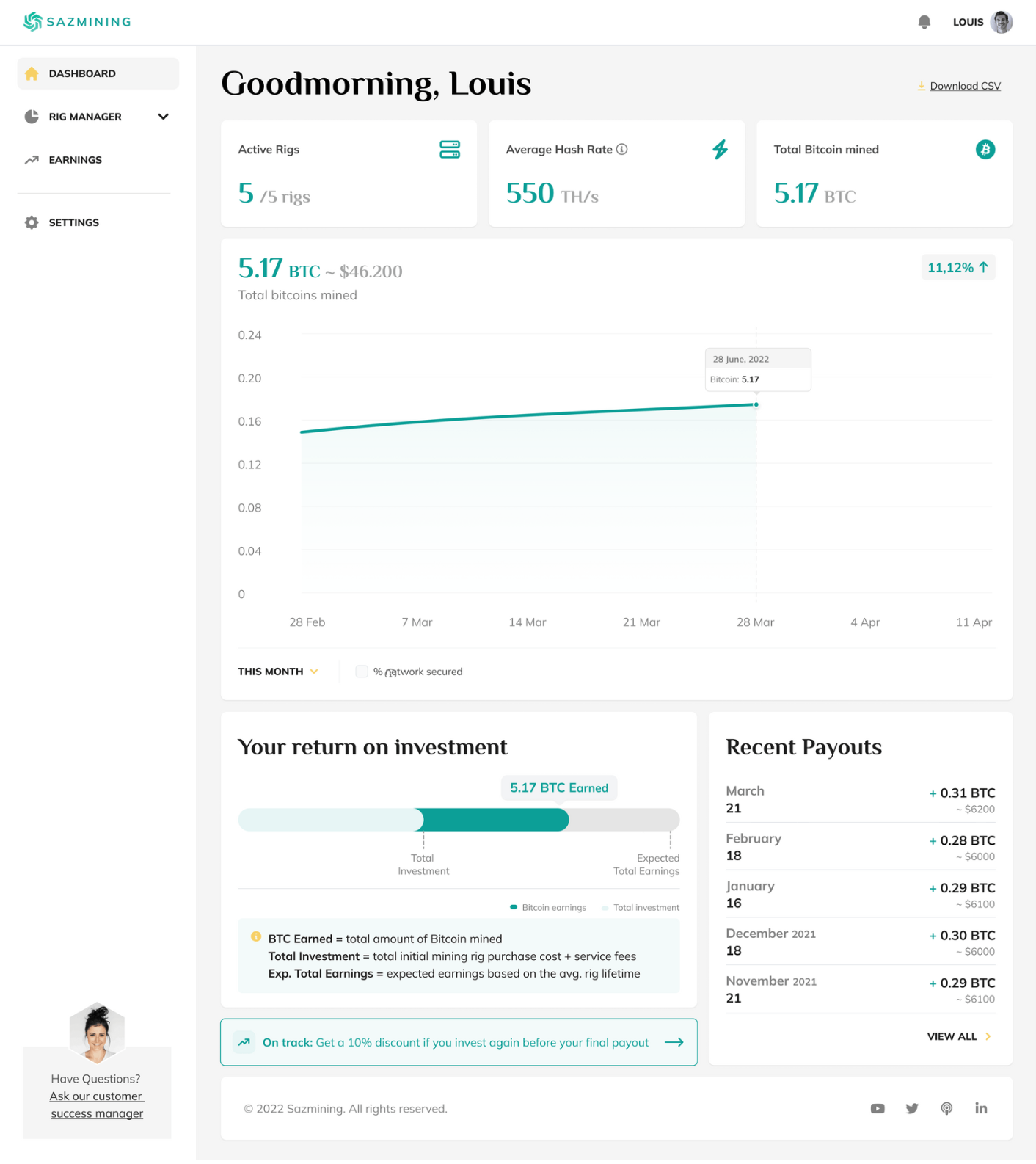

We are fully transparent with our customers. As they peruse our platform, they know exactly what to expect from their miners:

Our platform makes it easy for customers to track their miners’ progress:

The Market & Our Traction

Turning Toxic Emissions into Green Profits

Sazmining operates at the intersection of Bitcoin mining and climate change. The market opportunity that comes with consuming methane as our fuel source alone is estimated at $76.6 billion (source, source, source). Meanwhile, the market opportunity for Americans with at least $5,000 in savings represents a $149.35 billion opportunity (source).

Sazmining has been featured in Forbes, Bitcoin Magazine, Cointelegraph, and our CEO has been interviewed by E-Crypto News, Authority Magazine, The Halving Report, and the Crypto Coin Show.

*These testimonials may not represent the experience of other customers and are not a guarantee of future performance or success.

Why Invest

Bitcoin as a Weapon against Climate Change

Sazmining’s purpose is to improve the way humanity relates to energy & money. We believe that our carbon-neutral rigs can make the Bitcoin network more environmentally friendly as our market share grows. We plan to use this raise to reserve an additional 6 megawatts of clean energy, onboard an additional 2,000 customers through marketing, deliver a better customer experience, and build new customer-requested features. With early customer enthusiasm, press attention, and our recent full launch, we believe that we are perfectly positioned to reshape the way humanity mines Bitcoin for the better. We want to put newly mined Bitcoin in the pockets of one million customers.

Invest to Receive Bitcoin Goodies, Our Treat!

When we say that we want the entire world to adopt Bitcoin, we mean it. Investors will receive a Bitcoin hardware wallet, a mining rig, a ticket to Bitcoin Miami 2023, or other Sazmining perks. You won’t just buy a piece of Sazmining–you’ll become a proud Bitcoiner.

MicroStrategy co-founder Michael Saylor has previously stated that, "Bitcoin is digital gold, it's 100x better than gold" (source). Similarly, we believe that both Bitcoin and Bitcoin mining are here to stay.

The total number of Bitcoin addresses has grown past 1 billion in the asset’s extremely young lifespan, with no signs of deceleration (source). As shown in Figure 2, Bitcoin continues to prove its use as a medium of exchange. In 2021, its cumulative annual transfer volume officially surpassed that of Visa, reaching $13.1 trillion (source).

Figure 2. Annual transfer volume of Bitcoin and Visa

As shown in Figure 3, Bitcoin’s worth as a global store of value is demonstrated by the fact that those living under unstable monetary regimes adopt Bitcoin at a greater rate than those living under stable monetary regimes (source). In other words, Bitcoin is already proving valuable to those in the developing world, where fiat currencies lose value at a far greater rate than do currencies in the developed world (source).

Figure 3. Countries ranked by rate of crypto (Bitcoin) adoption.

ABOUT

HEADQUARTERS

9641 Eagle Ridge Drive

Bethesda, MD 20817

WEBSITE

View Site

TERMS

Sazmining

Overview

PRICE PER SHARE

$13.10

DEADLINE

Jun. 30, 2023 at 6:59 AM UTC

VALUATION

$20M

FUNDING GOAL

$15K - $1.23M

Breakdown

MIN INVESTMENT

$353.70

MAX INVESTMENT

$1,234,989.40

MIN NUMBER OF SHARES OFFERED

1,145

MAX NUMBER OF SHARES OFFERED

94,274

OFFERING TYPE

Equity

SHARES OFFERED

Common Stock

Maximum Number of Shares Offered subject to adjustment for bonus shares

Voting Rights of Securities Sold in this Offering

Voting Proxy. Each Subscriber shall appoint the Chief Executive Officer of the Company (the “CEO”), or his or her successor, as the Subscriber’s true and lawful proxy and attorney, with the power to act alone and with full power of substitution, to, consistent with this instrument and on behalf of the Subscriber, (i) vote all Securities, (ii) give and receive notices and communications, (iii) execute any instrument or document that the CEO determines is necessary or appropriate in the exercise of its authority under this instrument, and (iv) take all actions necessary or appropriate in the judgment of the CEO for the accomplishment of the foregoing. The proxy and power granted by the Subscriber pursuant to this Section are coupled with an interest. Such proxy and power will be irrevocable. The proxy and power, so long as the Subscriber is an individual, will survive the death, incompetency and disability of the Subscriber and, so long as the Subscriber is an entity, will survive the merger or reorganization of the Subscriber or any other entity holding the Securities. However, the Proxy will terminate upon the closing of a firm-commitment underwritten public offering pursuant to an effective registration statement under the Securities Act of 1933 covering the offer and sale of Common Stock or the effectiveness of a registration statement under the Securities Exchange Act of 1934 covering the Common Stock.

*Maximum number of shares offered subject to adjustment for bonus shares. See Bonus info below.

Time-Based Perks

Friends and Family - First 72 hours | 10% bonus shares

Super Early Bird - Next 72 hours | 7% bonus shares

Early Bird Bonus - Next 7 days | 5% bonus shares

Volume-Based Perks

Tier 1 Perk — Invest $750+ and receive access to our Exclusive Sazmining Investor Telegram group

Tier 2 Perk — Invest $1500+ and receive access to our Exclusive Sazmining Investor Telegram group + receive a free Coldcard Bitcoin hardware wallet

Tier 3 Perk — Invest $2500+ and receive access to our Exclusive Sazmining Investor Telegram group + receive a free Coldcard Bitcoin hardware wallet w/ metal seed plate + guaranteed reservation for an S19j Pro miner in our next facility, which is expected to launch in 3 - 6 months + a call with our CEO or COO

Tier 4 Perk — Invest $10,000+ and receive access to our Exclusive Sazmining Investor Telegram group + a free domestic flight to Miami to have dinner with team* + a free Coldcard Bitcoin hardware wallet w/ metal seed plate.

Tier 5 Perk — Invest $20,000+ and receive access to our Exclusive Sazmining Investor Telegram group + a free GA Bitcoin Miami 2023 ticket + domestic flight to Miami* + Dinner with team at Bitcoin Miami 2023 + a free Coldcard Bitcoin hardware wallet w/ metal seed plate

Tier 6 Perk — Invest $30,000+ and receive access to our Exclusive Sazmining Investor Telegram group + a free Industry Bitcoin Miami 2023 ticket + domestic flight to Miami* + Dinner with team at Bitcoin Miami 2023 + a free Coldcard Bitcoin hardware wallet w/ metal seed plate

Tier 7 Perk — Invest $50,000+ and receive access to our Exclusive Sazmining Investor Telegram group + a free Whale Bitcoin Miami 2023 ticket + domestic flight to Miami* + Dinner with team at Bitcoin Miami 2023 + a free Coldcard Bitcoin hardware wallet w/ metal seed plate

Tier 8 Perk — Invest $100,000+ and receive access to our Exclusive Sazmining Investor Telegram group + a free Whale Bitcoin Miami 2023 ticket + domestic/international business class flight to Miami* + Dinner with team at Bitcoin Miami 2023 + a spot on our podcast/Twitter spaces + a free Coldcard Bitcoin hardware wallet w/ metal seed plate

*In order to receive perks from an investment, one must submit a single investment in the same offering that meets the minimum perk requirement. Bonus shares from perks will not be granted if an investor submits multiple investments that, when combined, meet the perk requirement. All perks occur when the offering is completed.

10% StartEngine Owner's Bonus

Sazmining will offer 10% additional bonus shares for all investments that are committed by investors that are eligible for the StartEngine Crowdfunding Inc. OWNer's bonus.

This means eligible StartEngine shareholders will receive a 10% bonus for any shares they purchase in this offering. For example, if you buy 100 shares of Common Stock at $13.10 / share, you will receive 110 shares of Common Stock, meaning you'll own 110 shares for $1,310. Fractional shares will not be distributed and share bonuses will be determined by rounding down to the nearest whole share.

This 10% Bonus is only valid during the investors eligibility period. Investors eligible for this bonus will also have priority if they are on a waitlist to invest and the company surpasses its maximum funding goal. They will have the first opportunity to invest should room in the offering become available if prior investments are canceled or fail.

Investors will receive the highest single bonus they are eligible for among the bonuses based on the amount invested and time of offering elapsed (if any). Eligible investors will also receive the Owner’s Bonus and Time & Volume-based in addition to the aforementioned bonus.

Irregular Use of Proceeds

ALL UPDATES

06.29.23

Less than 12 hours to go..

Thank you for following our campaign and joining us in this Equity Raise. As there are less than 12 hours before our campaign ends, I wanted to share with you some pictures the Sazmining team received from Kent and Logan, who are currently in Paraguay visiting the location of our next facility.

The Itaipú Dam:

Kent Halliburton, President & COO, and Logan O'Neil, Head of Mining Operations

A substation erected for the facility

Kent vetting a meter at the bitcoin mining facility

Another angle of the second most powerful dam on the planet. This will be powering Sazmining's customers' rigs.

We're feeling optimistic and positive about where Sazmining is headed. Thank you for following our journey so far.

As I have previously mentioned in an update, this is our last public equity raise, and hence the last chance to own shares in Sazmining. Our business model is aligned with making sure we only profit when our customers do, and we're striving towards making greener, cleaner bitcoin mining accessible to retail investors.

Thank you for following our journey this far into the campaign. There are less than 12 hours to go to become a shareholder in Sazmining. 🌿⛏

Sincerely,

Will

06.28.23

We're gaining momentum 💪

I have some great news for you! Sazmining has partnered with 2 notable forces for good in the bitcoin space.

The first one is The Progressive Bitcoiners Podcast.

Started by Mark Stephany in December 2021, the intention of the podcast was to give a voice to the individuals and communities who have used Bitcoin to foster positive changes for personal, social, and environmental issues. After running the podcast for almost a year, Mark decided to take a step back. 6 months later, Trey Walsh, a Sazmining investor and miner, took the reigns to continue the success of Mark's mission with the podcast.

Trey held the position of senior director for youth programs at the MassHire Metro North Workforce Board in Somerville, Massachusetts, a 501(c)(3) nonprofit whose mission is to develop partnerships, generate resources and advocate for workforce solutions that result in a skilled workforce, prospering businesses and equitable access to meaningful career pathways and quality employment for residents.

In the next chapter of his life, he will be dedicating his time and efforts to Bitcoin initiatives. Trey has written articles for Bitcoin Magazine and has been interviewed on What Bitcoin Did - Why Progressives Need Bitcoin.

We're thrilled to partner with Trey and The Progressive Bitcoiner Podcast. 🤝

The second partnership that we've made is with the Orange Pill App.

The Orange Pill App, aka OPA, has an incredible mission - to connect the next 10M Bitcoiners. Their advisors include Natalie Brunell (Host of Coin Stories Podcast, Emmy Awarded Journalist), BTC Sessions (Host of the BTC Sessions on YouTube), Knut Svanholm (Bitcoin Author, Philosopher), Daniel Prince (Host of Once Bitten Podcast, Author), Joe Hall (Reporter Cointelegraph), Niko Laamanen (Educator, Founder Konsensus Network), and Sean Yeager (Business developer NYDIG).

The OPA is the best way to connect with bitcoiners in your area and find local bitcoin meetups and events. Since Sazmining has partnered with the OPA, their userbase of 5000+ bitcoiners now has direct access to us. 🔥

The excitement at Sazmining doesn't end here. Kent and Logan, key players in Sazmining's mining operations, are currently in Paraguay doing a site visit at the location of our next bitcoin mining facility. They have sent in incredible pictures of the Itaipu Dam, the world's 2nd largest dam and power generator in the world.

Stay tuned to tomorrow's update where I will share more pictures of Sazminin's second facility. This will be the location that houses our customers' rigs hydropowered by the Itaipu Dam.

Here's to mining bitcoin with 100% renewable energy and making the shift towards clean bitcoin mining.

Sincerely,

Will

06.27.23

2 days to go.

Sazmining is committed to ensuring maximum uptime for our customers. This metric is crucial for us to uphold, not simply for customer success, but also because it's the only way we make money. By aligning our incentives with those of our customers, we're creating a scenario where we win ONLY when our customer wins.

On that note, here is a recent review of a customer shared on Trustpilot:

*This testimonial may not be representative of the experience of other customers and is not a guarantee of future performance or success.

This not only confirms that our customers are satisfied mining with us, but also that they are noticing the values upon which we're building our business.

Sazmining is making it possible for retail investors to mine bitcoin without the hassle of setting it up themselves in their homes.

Why is this detail important?

Because Bitcoin is alive and thriving. When you're already DCAing into Bitcoin and want to go one step further, you naturally want to own a mining rig and receive BTC directly from the pool. As the number of people that own bitcoin increases, so will the number of people that want to mine bitcoin - and we're providing that service, fuelled by 100% renewable energy.

This is the last time we will ever hold an equity raise for the public. If our business model resonates with your values, there are only 2 days left before our campaign ends.

Here's to making turnkey bitcoin mining with renewables easy and accessible to the next million bitcoiners. 🍾

Sincerely,

Will

06.26.23

Only 3 Days Left.

In this update, I wanted to tell you a little bit more about our 2nd facility in Paraguay and the positive impact it will have on the economy. I'm going to tell you about the story behind the Itaipu Dam. With our bitcoin mining facility, we would be turning energy surplus into an economic miracle, and here's how.

The story begins about 20 years back when Brazil and Paraguay agreed to construct the Itaipu Dam. It's a powerhouse, generating a mammoth 14 gigawatts. Brazil footed the bill, and Paraguay ended up with more electricity than it could handle. With no infrastructure to absorb it, Paraguay began selling its excess power to Brazil at a loss.

The bitcoin mining industry saw this problem as an opportunity. What once was a loss has now turned into a source of profit. Politicians and the local power provider, ANDE, are all happily trading electricity for Bitcoin. It's not just profit - we're building a better future. We're erecting substations that will outlive Bitcoin mining and serve the people for generations.

At Sazmining, we've made connections and brokered deals that put us ahead in this electrifying game. Our Latin American ties give us an edge, helping us to understand and navigate this dynamic terrain. We're the frontier miners of the digital age, harnessing untapped resources, and sharing the gold rush with anyone wanting to jump on board.

If you've been waiting for the best chance to not only mine Bitcoin, but also help make a difference in the Paraguayan economy, the moment has arrived.

There are only 3 days left to invest in Sazmining through the StartEngine Campaign. As I mentioned in my last update, it is unlikely we will hold another public round for an equity fundraise. If our business incentives align with yours - this is your last chance to own shares in Sazmining.

Here's to creating better economies and making renewable bitcoin mining accessible to retail investors. 🌿

Sincerely,

Will

06.22.23

Sazmining's Top 3 Differentiating Factors

There are only 7 days left on our Equity Crowdfund. As I say this, I want to stress on the fact that the Sazmining team will likley never hold another Equity Crowdfund again. This means this is your last chance to own a piece of Sazmining in a public fundraising round by purchasing shares on StartEngine.

In this update, I hope to make you aware of how Sazmining sets itself apart from other hosted bitcoin mining providers. There are 3 key differentiating factors:

1. Sazmining is Behind the Meter

Similar to the heatwave that impacted millions of residents in Texas last year, the rise in temperatures this year is causing bitcoin miners to shut down and redirect the power they would usually use to mine bitcoin back to the grid. Now, this is a feature of bitcoin mining as it able to redirect power back to the grid when needed. How Sazmining differs from this approach is that we're NOT on the grid, we're right at the source of the power, i.e. we're behind the grid.

This doesn't mean it's bad for the grid, or that we're taking away from people who would otherwise have benefited from it. Transporting power from the power source to various locations in itself results in a loss of energy.

But what this means for our clients is maximum uptime since we're not subject to the rules that the grid places on facilities that are in front of the meter.

If you have been mining bitcoin, you understand the importance of having as close to 100% uptime as possible. With Sazmining, that is exactly what you get.

2. Sazmining's Incentives Align with Customers'

To put simply, we only make money when our customers make money.

We don't charge a markup on the rigs that we sell to our customers, we don't markup hosting costs, and overall, we don't charge anything extra on top of what we need to pay in order to set up customer rigs in our facility. The only way we make money is when our customers earn rewards from their miners.

At our Paraguay facility, we are offering a $0.047 / kWh hosting rate at a 15% bitcoin rewards share. That is the only amount we charge for providing our services. By aligning our incentives to make money in such a way that we only win when our customers win, we're ensuring we do the best we possibly can to keep our customers' rigs running.

3. Onsite Maintainance and Repairs included in Hosting Cost

This one is probably the most relatable for home miners. If your miner stops hashing, you'd need to pull your rig, diagnose/order parts, wait until it arrives, and then replace it. Depending on if you can repair it yourself or not, the cost of something like this can go anywhere from $15 to $400, depending on the availability of the part and the extent of the repair.

Our Wisconsin facility houses 100s of miners and our Paraguay facility will house 1000s. The hosting fee at both facilities covers full-service, white-glove hosting, which includes the cost of maintaining and repairing customers' rigs. This means customers don't have to foot any surprise bills for unexpected repairs.

Since Sazmining only makes money when the customer does, we're incentivized to optimize the mining environment for maximum efficiency and longevity of the miners as well as make sure any underperforming rigs that need maintenance are looked after promptly.

With Sazmining's business model, we're putting the customer first at all costs. If our values align with the business goals you have set for your investments, this is your last chance to get in on our equity fundraise.

Here's to providing a seamless and hassle-free hosted bitcoin mining experience to Sazmining customers. 🥂

Sincerely,

Will

06.19.23

Upcoming Paraguay site visit, and more..

With only 10 days left on our StartEngine Campaign, I wanted to make this update about all of the moving parts here at Sazmining. We will not be extending this campaign again, so before we get to the very end, here are some updates and ways to follow our progress after this campaign ends.

1. Paraguay Site Visit

Later this month, Kent Halliburton and Logan O'Neil, who have been championing due diligence for our second bitcoin mining facility in Paraguay, will be making an on-site visit. This is a crucial step in the process of dotting the i's and crossing the t's before our site goes live in a couple of months' time. We will be sharing pictures and videos of the site visit on all our social channels so be sure to follow us on LinkedIn and Twitter to stay updated.

2. Regular Webinars

The webinar held yesterday was well attended and we were asked some great questions from the audience. This reinforced the fact that our target audience wants more face-to-face interaction with the Sazmining team, and we're doing just that. Inspired by the book "Expert Secrets" authored by Russell Brunson, we're planning a series of webinars where our audience gets to interact with us directly. In addition to our podcast and weekly twitter spaces, we're confident this will boost our signal in the market.

3. Podcast and Twitter Spaces

Lastly, we host a weekly twitter space and are currently uploading podcasts per week on my youtube channel - Saz Stories with William Szamosszegi. This weekly engagement with our audience not only benefits them by spreading education on bitcoin and bitcoin mining, but also gives them an opportunity to ask us questions in real-time.

We're moving onwards and upwards. Thank you for being part of our journey.

Here's to being the only company making green bitcoin mining accessible to retail investors. ⛏🌿

Sincerely,

Will

06.14.23

Exchanges can be hacked, banned, and shut down

Cryptocurrency Exchanges have played a pivotal role as an on-ramp for many retail investors. Buying bitcoin and other cryptocurrencies on an exchange is still known to some as the only way to buy bitcoin. Yes, there are definitely multiple other ways like buying bitcoin at an ATM, earning bitcoin by working at a bitcoin-based company, receiving bitcoin as a gift at a local bitcoin meetup. However, most of these apply to a very small subset of the population.

I'd like to make myself clear by stating that I am, in no way, diminishing the importance of Exchanges. But keeping in touch with reality begs to make oneself aware that Exchanges can be:

- hacked

- shut down, or

- banned based on jurisdiction

and just like that, you could lose your primary on-ramp into buying bitcoin.

But we have a solution. An alternative to exchanges for acquiring bitcoin.

Join Kent Halliburton, Sazmining's President and COO, at tomorrow's webinar at 2:00pm ET to learn about all the ways Sazmining proves to be the best solution for bitcoin acquisition.

Bonus: 1 lucky attendee gets a guaranteed slot at our Paraguay facility.

Register for the webinar here - https://my.demio.com/ref/Dvks3rrG0Rnhd81a

Sincerely,

Will

06.10.23

📢 An Important Update on our Revenue and MRR

As we near the end of our Equity Fundraise, now is a great time to highlight Sazmining's accomplishment of major milestones:

1️⃣ Successful Launch of our First Bitcoin Mining Facility in Wisconsin:

We successfully filled our first facility in Wisconsin within 3 months of launching. This facility hosts 350 customer rigs and is mining on 100% hydropower. This milestone was significant for Sazmining since:

- It proved our business model works

- It proved that there was demand for hosted bitcoin mining with renewables, despite it being the bear market

- It proved the successful functioning of the Sazmining Dashboard - our proprietary customer-facing software to monitor rig performance

2️⃣ Renewable Energy Expansion in Paraguay:

We are actively working on securing hosting capacity of up to 5MW in Paraguay. This strategic move not only reinforces our commitment to sustainable bitcoin mining but also ensures more opportunities for retail investors to host their rigs with us.

At this facility, we're also offering 2 different types of rigs, following customer feedback. This is a step up from the rigs we were able to offer at our Wisconsin facility since it gives our customers the option to choose between 2 different hashrates. The fact that customers are purchasing both types of rigs provides further evidence that we made the correct decision.

Our announcement of the Paraguay facility was met with much celebration on Twitter:

3️⃣ Sazmining's Revenue since Launch:

Since our launch, we have achieved remarkable sales growth, with total sales reaching an impressive $718K. This success reflects the trust and confidence our clients have placed in us to deliver high-quality mining solutions.

(source)

*This testimonial may not be representative of the experience of other customers and is not a guarantee of future performance or success.

4️⃣ Monthly Recurring Revenue (MRR):

Currently, we generate a robust Monthly Recurring Revenue (MRR) of $66K. This consistent stream of revenue highlights the long-term value we provide to our customers and solidifies our position in the bitcoin mining industry.

With these milestones and achievements under our belt, we are more determined than ever to drive innovation, promote sustainability, and empower individuals to sustainably mine bitcoin from any corner of the world.

Here's to pushing boundaries, exploring new opportunities, and shaping the future of green bitcoin mining. 🌿⛏

Sincerely,

Will

06.07.23

Only 22 Days to Go

Bitcoin mining is too complicated and costly for billions of people around the world. It is also notoriously energy-intensive, for good reason, and critics point to its carbon footprint.

This has been the problem we set out to solve from the very beginning - by asking ourselves the question - how do we make it accessible for retail investors to mine Bitcoin with renewables?

Sazmining solves all of these issues in one fell swoop.

We manage the entire mining process for our customers so that they don’t have to lift a finger in order to receive Bitcoin directly into their wallets. What's even better is that, as we set out to solve this challenge, we found ourselves solving another - bitcoin acquisition without signing up on an Exchange.

With Binance and Coinbase coming under the scrutiny of the SEC, what's going to be the next alternative for steady, volatile free Bitcoin acquisition?

We know the answer.

Join Sazmining next Thursday, June 15th, at 2:00pm ET to get the full scope of how we're certain we're in the best position to serve the Bitcoin industry. Register for the webinar here - https://my.demio.com/ref/Dvks3rrG0Rnhd81a

Here's to being the only company providing a green alternative to Bitcoin acquisition. 🌿

Sincerely,

Will

06.02.23

THIS is the Superior Alternative to Exchanges

It's been a wildly successful week in the world of Bitcoin Mining. Here are 3 events that made it a win for the bitcoin mining industry:

1. The Texas Anti-Bitcoin mining bill (SB 1751) was defeated

2. Joe Biden's proposed 30% BTC mining tax was defeated

3. The pro-mining bill (SB1929) was successfully passed

Bitcoin Miners in Texas can now breathe easy knowing they've won the fight against getting shut down due to regulations. A huge shout-out goes to Lee Bratcher, President of the Texas Blockchain Council, and numerous other teams that won this fight against the anti-bitcoin mining bill.

ERCOT, the Electric Reliability Council of Texas, plays a crucial role in the energy landscape of the state, ensuring the stability and reliability of the grid. Bitcoin mining farms in Texas help stabilize the grid by providing a flexible load that can be adjusted in real-time.

Essentially, Bitcoin miners can effectively absorb the surplus power and prevent wastage, or alter their consumption when demand is high. This collaboration between ERCOT and Bitcoin mining not only leverages Texas' abundant energy resources but also contributes to grid stability and promotes the integration of renewable energy sources. This is why the anti-bitcoin mining bill being defeated is not only a win for Bitcoin Miners in Texas but also a win for ERCOT.

Speaking of Bitcoin Mining, I am inviting you to Sazmining's upcoming webinar hosted by Kent Halliburton, Sazmining's President and COO, taking place on June 15th at 2:00pm ET.

The webinar is titled "THIS is the Superior Alternative to Exchanges for Bitcoin Acquisition" and we mean every word of it. Something we learned from networking with over 100 people at the Bitcoin Conference is that a problem they are trying to solve is finding a way to acquire Bitcoin without needing to sign up on an exchange. Running a Bitcoin Mining company, we had the perfect solution for them!

Please register for the webinar using this link - https://my.demio.com/ref/Dvks3rrG0Rnhd81a - and invite your friends and colleagues to it as well!

I'm particularly excited for this webinar because it's such a different topic from the ones we have conducted before, and it brings a whole new layer of value to our customers and investors.

Thank you for being part of the Saz journey.

Sincerely,

Will

Here is the link to register for the webinar - https://my.demio.com/ref/Dvks3rrG0Rnhd81a

REWARDS

10%

Stack Venture Club & Rewards!

Members get an extra 10% shares in addition to rewards below!

Venture Club

Venture Club Members earn 10% bonus shares on top of this and all eligible investments for an entire year. Not a member? Sign up at checkout ($275/year).

$750

Tier 1 Perk

Invest $750+ and receive access to our Exclusive Sazmining Investor Telegram group

$1,500

Tier 2 Perk

Invest $1500+ and receive access to our Exclusive Sazmining Investor Telegram group + receive a free Coldcard Bitcoin hardware wallet

$2,500

Tier 3 Perk

Invest $2500 + the rewards from Tier 2 Perk + guaranteed reservation for an S19j Pro miner in our next facility, which is expected to launch in 3 - 6 months + a call with our CEO or COO

$10,000

Tier 4 Perk

Invest $10,000+ and receive access to our Exclusive Sazmining Investor Telegram group + a free domestic flight to Miami to have dinner with team* + a free Coldcard Bitcoin hardware wallet w/ metal seed plate.

$20,000

Tier 5 Perk

Invest $20,000+ & receive access to our Exclusive Sazmining Investor Telegram group + free GA Bitcoin Miami 2023 ticket + domestic flight to Miami* + Dinner with team at Bitcoin Miami 2023 + a free Coldcard Bitcoin hardware wallet w/ metal seed plate

$30,000

Tier 6 Perk

Invest $30,000+ & receive access to our Exclusive Sazmining Investor Telegram group + free Industry Bitcoin Miami 2023 ticket + domestic flight to Miami* + Dinner with team at Bitcoin Miami 2023 + Coldcard Bitcoin hardware wallet w/ metal seed plate

$50,000

Tier 7 Perk

Invest $50,000+ & receive access to our Exclusive Sazmining Investor Telegram group + Whale Bitcoin Miami 2023 ticket + domestic flight to Miami* + Dinner with team at Bitcoin Miami 2023 + a free Coldcard Bitcoin hardware wallet w/ metal seed plate

$100,000

Tier 8 Perk

Invest $100,000+ & receive access to Sazmining Investor Telegram group + Whale Bitcoin Miami 2023 ticket + domestic/intl' business class flight to Miami* + Dinner with team at Bitcoin Miami 2023 + a spot on our podcast/Twitter Spaces+ a free Cold...

JOIN THE DISCUSSION

0/2500

Richard Koch

2 years ago

I realize you're not in the crystal ball business, but when you put on the green eyeshades, where will do you see company in five years? Not necessarily price, but will it still be on a tertiary market or do you have plans for M&A or SPAC activities? Will profits be generated strictly from sales of rigs or is there a SAAS scheme for recurring revenue? I'm trying to assess whether you're looking for a niche market or are expecting wide acceptance of the rigs and how that benefits investors.

Show more

0

0

William Hackett

2 years ago

Interesting Business model. So How many sites does your mining company have. I take it at least two with one being the Wisconsin building on Hydro Power. Do you own the buildings or rent? You want to do several types of Energy. Do you plan to build a building with Solar panels or Wind Power? what happens if you build a Methane capture site and it runs out of Methane? How much capital does it cost to open a new site? How fast can you scale this business since you need to keep finding new sites and buying new machines? What is the sweet spot you are looking for where your company can be profitable and use profits to open new sites? What is the Price of new miner now it was 10000 or 5000 is it even lower now like 3000 or 2000? if I invest 2500 how long will I have to wait before I can buy a miner? Once I buy that miner how long will it typically last? Your company uses a Mining Pool right now in the future do you plan to have your own Mining Pool if you scale large enough? A good busiman has a plan for tough times. What types of plans do you have to deal with Bear Markets in the future? I made a Investment in HydroHash on Republic. They are making water cooled miners that are more efficent than regular miners. But they don't offer the ability to buy you own miner. I have seen with them that they got a deal in Washington st for Hydropower at 2.8 cents then they raised the deal to 5cents and up to 8 cents where the avg is 11cents. I wonder in Wisconsin do you have similar problem? is that energy on a lease or will you stay in that location for a long time? I know I am asking many questions because I like your model. I am worried about putting more money in unless I am sure you can scale fast. I Do like the idea of having my own Miner. By the way where will the next site be if I invest where will you house my miner? Okay lets see you answer my question.

Show more

0

0

Benjamin Landman

2 years ago

I just checked and even considering a price of $27,500 for Bitcoin, the profit calculator on the SazMining website shows "Mining rigs paid off after 58 months". How could a rational person invest in something that is very uncertain (like the price of Bitcoin) to get "paid off" after almost 5 years? And probably by then the rigs would be obsolete and would likely produce negative profits. What am I missing?

Show more

2

1

Bryce McDowell

2 years ago

Well, you seem to know how the money works. And you said people that know how the money works will still become billionaires. So... you have your billions, right?

Show more

1

0

Thomas Colvin

2 years ago

I guess you still live with your parents or collect welfare.

0

0

Thomas Colvin

2 years ago

Read the book The Bitcoin Standard.

0

0

Adrian Jackson

2 years ago

Oh brother. When is the USA going to ban Bitcoin already like other countries have done. You already have the US Dollar. There is nothing wrong with the currencies you use now. Bitcoin isn’t going to fix anything. The real issue is that most people are financially illiterate. That is what need to be fixed. If you used Bitcoin you would still run into the same issue with people still being financially illiterate and people will still not know how money work. This is the real issue in America which is why the debt is so huge. Those who know how money work will still be billionaires, those who don’t know how money work will be in debt with or without bitcoin. It doesn’t solve any real issues that “People” have. Its not even an Asset its just hype and a scam. During every recession in America bitcoin skyrockets because financially illiterate people get scared that the US financial system is going to crash. Then after the recession when everything is booming and good again. Bitcoin crashes because to be honest no one cares about it. It’s just hype during a downturn. No real value. If you want real Value invest in businesses, gold, real estate, land. Real Assets. Look at all the companies like Tesla that used Bitcoin during it’s hype when the pandemic started telling people you can now buy Tesla’s with bitcoin. Then after Elon made money off of the hype he pushed a press release saying that you can no longer buy Teslas with Bitcoin then came up with an excuse 😆. You can literally see that pattern. During the 2008 recession it was the same thing. Bitcoin skyrocket. Then after that recession Bitcoin crash. No one cares about. It is just hype. Warren Buffet warned his followers and all the billionaires that honor him to stay away from Bitcoin because it is the biggest scam in America history and everyone who follows him listens to his wise words. Look at all of these crypto companies filing for bankruptcy and being sued. Look at coinbase and all of these bitcoin platforms that seen their profits get wiped out in 2022. How are people still interested in this stuff. 😆 what is going on with these people and Bitcoin? Oh brother.🤦🏽♂️ Someone please pass me a cup of coffee please.

Show more

2

1

Thomas Colvin

2 years ago

Top-notch customer service. I like give a thumps up to Petar at Sazmining website for helping me out. He was willing to do what it took to problem solve my issue. Thanks again for all your help. I so excited and can not wait until my rigs are up and running. $$$$$

Show more

3

0

Stephen Hart

2 years ago

To accept the pitch, I have to believe that the methane you burn cannot be used to replace any fossil fuel source for any other use than an energy intensive, non-essential process. Please make that case.

Show more

2

0

HOW INVESTING WORKS

Cancel anytime before 48 hours before a rolling close or the offering end date.

WHY STARTENGINE?

REWARDS

We want you to succeed and get the most out of your money by offering rewards and memberships!

SECURE

Your info is your info. We take pride in keeping it that way!

DIVERSE INVESTMENTS

Invest in over 200 start-ups and collectibles!

FAQS

With Regulation A+, a non-accredited investor can only invest a maximum of 10% of their annual income or 10% of their net worth per year, whichever is greater. There are no restrictions for accredited investors.

With Regulation Crowdfunding, non-accredited investors with an annual income or net worth less than $124,000 are limited to invest a maximum of 5% of the greater of those two amounts. For those with an annual income and net worth greater than $124,000, they are limited to investing 10% of the greater of the two amounts.

At the close of an offering, all investors whose funds have “cleared” by this time will be included in the disbursement. At this time, each investor will receive an email from StartEngine with their Countersigned Subscription Agreement, which will serve as their proof of purchase moving forward.

Please keep in mind that a company can conduct a series of “closes” or withdrawals of funds throughout the duration of the campaign. If you are included in that withdrawal period, you will be emailed your countersigned subscription agreement and proof of purchase immediately following that withdrawal.

StartEngine assists companies in raising capital, and once the offering is closed, we are no longer involved with whether the company chooses to list shares on a secondary market or what occurs thereafter. Therefore, StartEngine has no control or insight into your investment after the close of the live offering. In addition, we are not permitted to provide financial advice. You may want to contact a financial professional to discuss possible investment outcomes.

For Regulation Crowdfunding, investors are able to cancel their investment at any point throughout the campaign up until 48 hours before the closing of the offering. Note: If the company does a rolling close, they will post an update to their current investors, giving them the opportunity to cancel during this timeframe. If you do not cancel within this 5-day timeframe, your funds will be invested in the company, and you will no longer be able to cancel the investment. If your funds show as ‘Invested’ on your account dashboard, your investment can no longer be canceled.

For Regulation A+, StartEngine allows for a four-hour cancellation period. Once the four-hour window has passed, it is up to each company to set their own cancellation policy. You may find the company’s cancellation policy in the company’s offering circular.

Once your investment is canceled, there is a 10-day clearing period (from the date your investment was submitted). After your funds have cleared the bank, you will receive your refund within 10 business days.

Refunds that are made through ACH payments can take up to 10 business days to clear. Unfortunately, we are at the mercy of the bank, but we will do everything we can to get you your refund as soon as possible. However, every investment needs to go through the clearing process in order to be sent back to the account associated with the investment.

Both Title III (Regulation Crowdfunding) and Title IV (Reg A+) help entrepreneurs crowdfund capital investments from unaccredited and accredited investors. The differences between these regulations are related to the investor limitations, the differing amounts of money companies are permitted to raise, and differing disclosure and filing requirements. To learn more about Regulation Crowdfunding, click here, and for Regulation A+, click here.

PINNED BY STARTUP

Thomas Colvin

2 years ago

Brilliant business plan, I'm a believer in bitcoin and saving energy in the mining process. What really sold me was being a miner owner. I started watching William's podcast and that has reinforced my investing in Sazmining and buy a rig. Win/win.

Show more

1

0