5 DAYS LEFT

GET A PIECE OF VIRTUIX

Step Into the Game

Show more

$2,456,803.58 Raised

REASONS TO INVEST

Backed by $40M+ in funding from major investors such as Mark Cuban, Maveron, & Scout Ventures, the Omni transforms immersive gaming and simulation by enabling 360-degree movement in VR.

We’ve sold over $18 million worth of products to major companies such as Dave & Buster’s, and have built a player community of over 400,000 registered players.

Our newest product, Omni One, is our most advanced treadmill yet, providing full freedom of movement for applications including at-home gaming, fitness, and defense training & simulation.

TEAM

Jan Goetgeluk • Chief Executive Officer and Board Member

Read More

David Allan • Managing Director - Asia, Board Member

Read More

Parth Jani • Board Member

ABOUT

HEADQUARTERS

11500 Metric Blvd., Suite 430

Austin, TX 78758

WEBSITE

View Site

TERMS

Virtuix

Overview

PRICE PER SHARE

$6.22

DEADLINE

Jun. 13, 2025 at 6:59 AM UTC

VALUATION

$201.13M

FUNDING GOAL

$15K - $5M

Breakdown

MIN INVESTMENT

$497.60

MAX INVESTMENT

$4,999,996.76

MIN NUMBER OF SHARES OFFERED

2,411

MAX NUMBER OF SHARES OFFERED

803,858

OFFERING TYPE

Equity

SHARES OFFERED

Series B Preferred Stock

Maximum Number of Shares Offered subject to adjustment for bonus shares

*Maximum number of shares offered subject to adjustment for bonus shares. See Bonus info below.

Voting Rights of Securities Sold in This Offering

Proxy: Investors in this offering will appoint the Company’s Chief Executive Officer (the “CEO”), or his or her successor, as the Investor’s true and lawful proxy and attorney, with the power to act alone and with full power of substitution, to, consistent with this instrument and on behalf of the Subscriber, (i) vote all Securities, (ii) give and receive notices and communications, (iii) execute any instrument or document that the CEO determines is necessary or appropriate in the exercise of its authority under this instrument, and (iv) take all actions necessary or appropriate in the judgment of the CEO for the accomplishment of the foregoing. The proxy and power granted by theInvestor will be coupled with an interest. Such proxy and power will be irrevocable. The proxy and power, so long as the Investor is an individual, will survive the death, incompetency and disability of the Investor and, so long as the Investor is an entity, will survive the merger or reorganization of the Investor or any other entity holding the Securities. However, the proxy will terminate upon the closing of a firm commitment underwritten public offering pursuant to an effective registration statement under the Securities Act of 1933 covering the offer and sale of Common Stock or the effectiveness of a registration statement under the Securities Exchange Act of 1934 covering the Common Stock.

Loyalty Bonus

Previous investors will receive 10% bonus shares (accumulative to all other perks).

Time-Based Investment Incentives

Early Bird

Invest by November 21 and receive 10% bonus shares.

Flash Perk

Invest between February 20th and March 22nd 9:49 AM EST and receive 10% bonus shares.

Amount-Based Investment Incentives

$1,000+ | Explorer

Invest $1,000+ and receive $100 store credit applicable to all products sold on our website.

$2,000+ | Pathfinder

Invest $2,000+ and receive $200 store credit applicable to all products sold on our website.

$5,000+ | Voyager

Invest $5,000+ and receive 5% bonus shares and $500 store credit applicable to all products sold on our website.

$10,000+ | Trailblazer

Invest $10,000+ and receive 10% bonus shares and $1,000 store credit applicable to all products sold on our website.

$20,000+ | Pioneer

Invest $20,000+ and receive 20% bonus shares and $2,000 store credit applicable to all products sold on our website.

$50,000+ | Legend

Invest $50,000+ and receive 20% bonus shares and the “Pioneer” non-bonus share perks + a VIP trip to Austin that includes air travel for 2 people (within continental U.S.), 5-star hotel for 3 nights (1 room), BBQ meal with Virtuix’s CEO Jan Goetgeluk + tour of Virtuix to meet the team.

*In order to receive perks from an investment, one must submit a single investment in the same offering that meets the minimum perk requirement. Bonus shares from perks will not be granted if an investor submits multiple investments that, when combined, meet the perk requirement. All perks occur when the offering is completed.

Crowdfunding investments made through a self-directed IRA cannot receive non-bonus share perks due to tax laws. The Internal Revenue Service (IRS) prohibits self-dealing transactions in which the investor receives an immediate, personal financial gain on investments owned by their retirement account. As a result, an investor must refuse those non-bonus share perks because they would be receiving a benefit from their IRA account.

The 10% StartEngine Venture Club Bonus

Virtuix Holdings Inc. will offer 10% additional bonus shares for all investments that are committed by investors that are eligible for the StartEngine Venture Club.

This means eligible StartEngine shareholders will receive a 10% bonus for any shares they purchase in this offering. For example, if you buy 100 shares of Series B Preferred Stock at $6.22 / share, you will receive 110 shares of Series B Preferred Stock, meaning you’ll own 110 shares for $622. Fractional shares will not be distributed and share bonuses will be determined by rounding down to the nearest whole share.

This 10% Bonus is only valid during the investor’s eligibility period. Investors eligible for this bonus will also have priority if they are on a waitlist to invest and the company surpasses its maximum funding goal. They will have the first opportunity to invest should room in the offering become available if prior investments are canceled or fail.

Investors will receive the highest single bonus they are eligible for among the bonuses based on the amount invested and the time of offering elapsed (if any). Eligible investors will also receive the Loyalty Bonus and the Venture Club bonus in addition to the aforementioned bonus.

Irregular Use of Proceeds

NEW UPDATES

06.07.25

[Closing Soon] What Are Customers Saying?

What Customers Are Saying

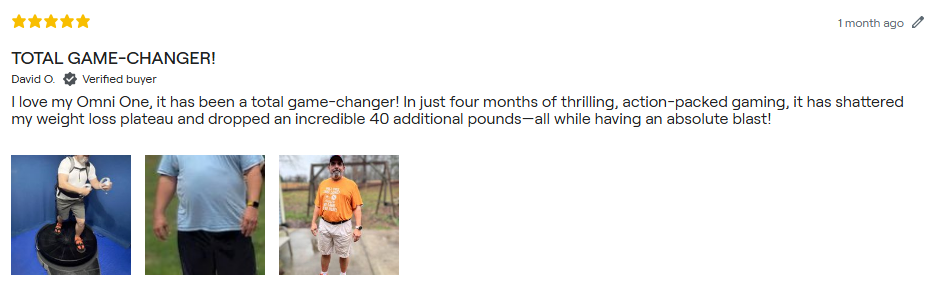

Over the past few months, we delivered the first 1,600 Omni One systems to customers.

Omni One isn’t just a gaming experience — it’s also an exciting way to stay active. Check out what players say about how Omni One gets them moving, sweating, and having fun while playing their favorite VR games.

Why sit on the couch when you can step into the action?

These testimonials may not be representative of the experience of other customers and is not a guarantee of future performance or success.

Our StartEngine campaign continues its strong momentum. We’ve now topped $2.3MM raised from over 900 investors.*

We hope you join our growing investor community! Complete your investment today.

Best regards,

Jan and the Virtuix team

Why Invest in Virtuix?

✅ | Impressive Momentum: $18M+ in product sales, 400K+ registered players, and 4X revenue growth this past fiscal year. |

✅ | Beyond Gaming: Our new Omni Mission Trainer (OMT) system is already in testing with the U.S. Air Force, with broader applications for training across the military. |

✅ | Industry-Leading IP: 32 patents (24 issued, 8 pending) covering motion tracking, game integration, and mechanical design. |

✅ | Backed by $40M+: Invest alongside Mark Cuban, Maveron, Scout Ventures, and more than 900 StartEngine investors. |

* The amount raised may include insider investments, which may go toward meeting the minimum offering amount.

This Reg CF offering is made available through StartEngine Primary LLC, member FINRA/SIPC. This investment is speculative, illiquid, and involves a high degree of risk, including the possible loss of your entire investment. In addition, as described in the Offering Circular, the Company retains the right to continue the offering beyond the Termination Date, in its sole discretion.

06.06.25

[Reminder] Livestream TODAY an Upcoming Webinar

StartEngine Livestream TODAY

Our StartEngine campaign is closing soon. We’ve now raised over $2.2MM from more than 900 investors.* Thank you all for your incredible enthusiasm and support.

As a reminder, we’re hosting two opportunities to hear directly from our CEO and executive leadership team.

Join Virtuix CEO Jan Goetgeluk today at 1pm Eastern Time for a livestream via the StartEngine mobile application. Jan will give a live demo of Omni One and answer any questions you may have. To join, download the StartEngine app and go to the “Discover” tab at 1pm ET.

On Wednesday, June 11 at 12pm Eastern Time, we’ll host this campaign’s final investor webinar. Ask us any questions and learn the details of our strategy and business plan. Joining us to present the plan will be:

- Jan Goetgeluk, founder and CEO

- Ugo de Charette, board member and our largest investor

- David Allan, board member who manages our Asian manufacturing subsidiaries

- Lauren Premo, Virtuix’s head of marketing

You can sign up and join here:

https://app.livestorm.co/p/fd35aa35-e30f-4ded-ba56-eef800cac623

If you believe in the Omni technology, now’s the chance to invest and take an ownership stake in Virtuix. Our round is closing soon.

Best regards,

Jan and the Virtuix Team

*The amount raised may include insider investments, which may go toward meeting the minimum offering amount.

This Reg CF offering is made available through StartEngine Primary LLC, member FINRA/SIPC. This investment is speculative, illiquid, and involves a high degree of risk, including the possible loss of your entire investment. In addition, as described in the Offering Circular, the Company retains the right to continue the offering beyond the Termination Date, in its sole discretion.

ALL UPDATES

REWARDS

10%

Stack Venture Club & Rewards!

Members get an extra 10% shares in addition to rewards below!

Venture Club

Venture Club Members earn 10% bonus shares on top of this and all eligible investments for an entire year. Not a member? Sign up at checkout ($275/year).

$1,000

Explorer

Invest $1,000+ and receive $100 store credit applicable to all products sold on our website.

$2,000

Pathfinder

Invest $2,000+ and receive $200 store credit applicable to all products sold on our website.

$5,000

Voyager

Invest $5,000+ and receive 5% bonus shares and $500 store credit applicable to all products sold on our website.

$10,000

Trailblazer

Invest $10,000+ and receive 10% bonus shares and $1,000 store credit applicable to all products sold on our website.

$20,000

Pioneer

Invest $20,000+ and receive 20% bonus shares and $2,000 store credit applicable to all products sold on our website.

$50,000

Legend

Invest $50,000+ and receive the “Pioneer” perks + a VIP trip to Austin that includes air travel for 2 people (within continental U.S.), 5-star hotel for 3 nights (1 room), BBQ meal with Virtuix’s CEO Jan Goetgeluk + tour of Virtuix to meet the team.

JOIN THE DISCUSSION

0/2500

Karen Haldeman-Clark

5 days ago

Hi Jan, I’m new to this process and have recently heard of an “IPO lock up period”. What is the planned IPO lock up period for shares purchased in this round when the company goes public? I want to make sure I will be able to sell the shares immediately if day traders jack up the price quickly.

Show more

1

0

Martin Belardo

a month ago

Hi Jan, I visited the launch in Orlando and noticed the Omni one setup was removed. I asked personnel in launch why it was removed. They told me that the system kept going down and it did operate properly. They got fed up with it. Is this being experienced in other commercial locations or home systems? How do you remedy this so as to not have it removed from other commercial locations? Thank you, Martin

Show more

1

0

amit sharda

3 months ago

I really love the product and am impressed by the growing community and the launches the company has been making. With that in mind, I’d like to hear about the projections for the coming year. Also, could you share the reason behind the significant decline in revenue (from $4.2M to $2.4M) this past year? Additionally, what steps are you taking to address the growing net losses, which have increased from -$5.5M to -$8.1M?

Show more

3

0

Dan Cobb

3 months ago

Hey Jan, thanks for your very prompt response to my previous question. I should have asked it better. How did you arrive at that number? Did another company help you arrive at that number? What metrics were used to get there?

Show more

1

0

Dan Cobb

3 months ago

Hey guys, been an investor since 2021 round. Very cool product and happy to see great progress. I'm wondering where you get the current valuation of $201.13mm from?

Show more

1

0

amit sharda

3 months ago

Hi I have invest in two rounds before, the product is great, what is the time frame to bring the Omni n other versions to major retailers ? Also what is the time frame for ipo or exit strategy

Show more

1

0

Tara Geria

4 months ago

I invested $5,000 in 2016. Glad to see the progress Virtuix has made, but at this point after 9 years, I am hoping to see some ROI. This investment was my retirement savings, which I could have invested in something that I could have cashed out.Are you planning to IPO in near future?

Show more

1

0

James Wood

4 months ago

I invested in 2016 through SeedInvest and then again in May 2023. My account shows the initial investment but not the 2nd round. Is this related to the Start Engine display issue that was previously mentioned.

Show more

1

0

Doevon Lucas

7 months ago

Hi, I Invested back in 2021 through SeedInvest, and since then had to get my investment transferred here to StartEngine. My investments now shows up as "Virtuix Holdings Inc. (VTUPJ)" and I can't click on my investment to come to your page, I have to find it manually. Also my custodian shows "New Direction Trust Company". Is that who the custodian is supposed to be? Just wanted to see if everything is good on my end or is something funky going on with my shares. Thanks in advance!

Show more

1

0

HOW INVESTING WORKS

Cancel anytime before 48 hours before a rolling close or the offering end date.

WHY STARTENGINE?

REWARDS

We want you to succeed and get the most out of your money by offering rewards and memberships!

SECURE

Your info is your info. We take pride in keeping it that way!

DIVERSE INVESTMENTS

Invest in over 200 start-ups and collectibles!

FAQS

With Regulation A+, a non-accredited investor can only invest a maximum of 10% of their annual income or 10% of their net worth per year, whichever is greater. There are no restrictions for accredited investors.

With Regulation Crowdfunding, non-accredited investors with an annual income or net worth less than $124,000 are limited to invest a maximum of 5% of the greater of those two amounts. For those with an annual income and net worth greater than $124,000, they are limited to investing 10% of the greater of the two amounts.

At the close of an offering, all investors whose funds have “cleared” by this time will be included in the disbursement. At this time, each investor will receive an email from StartEngine with their Countersigned Subscription Agreement, which will serve as their proof of purchase moving forward.

Please keep in mind that a company can conduct a series of “closes” or withdrawals of funds throughout the duration of the campaign. If you are included in that withdrawal period, you will be emailed your countersigned subscription agreement and proof of purchase immediately following that withdrawal.

StartEngine assists companies in raising capital, and once the offering is closed, we are no longer involved with whether the company chooses to list shares on a secondary market or what occurs thereafter. Therefore, StartEngine has no control or insight into your investment after the close of the live offering. In addition, we are not permitted to provide financial advice. You may want to contact a financial professional to discuss possible investment outcomes.

For Regulation Crowdfunding, investors are able to cancel their investment at any point throughout the campaign up until 48 hours before the closing of the offering. Note: If the company does a rolling close, they will post an update to their current investors, giving them the opportunity to cancel during this timeframe. If you do not cancel within this 5-day timeframe, your funds will be invested in the company, and you will no longer be able to cancel the investment. If your funds show as ‘Invested’ on your account dashboard, your investment can no longer be canceled.

For Regulation A+, StartEngine allows for a four-hour cancellation period. Once the four-hour window has passed, it is up to each company to set their own cancellation policy. You may find the company’s cancellation policy in the company’s offering circular.

Once your investment is canceled, there is a 10-day clearing period (from the date your investment was submitted). After your funds have cleared the bank, you will receive your refund within 10 business days.

Refunds that are made through ACH payments can take up to 10 business days to clear. Unfortunately, we are at the mercy of the bank, but we will do everything we can to get you your refund as soon as possible. However, every investment needs to go through the clearing process in order to be sent back to the account associated with the investment.

Both Title III (Regulation Crowdfunding) and Title IV (Reg A+) help entrepreneurs crowdfund capital investments from unaccredited and accredited investors. The differences between these regulations are related to the investor limitations, the differing amounts of money companies are permitted to raise, and differing disclosure and filing requirements. To learn more about Regulation Crowdfunding, click here, and for Regulation A+, click here.

PREVIOUSLY CROWDFUNDED

RAISED

INVESTORS

MIN INVEST

VALUATION

Most Momentum

Top 15 in amount raised last 72 hours

What does this badge mean? See here

Sergio Campos

4 days ago

I invested a few years ago. I see my initial purchase/investment on start engine. Can you explain to me the process once you become public? Do my shares automatically convert to shares under the "omni" ticker ar the current price per share listed? if so, how will we be able to manage our investment once it's in the stock market (thru start engine or other such as robinhood etc.)?

Show more

1

0