10 DAYS LEFT

GET A PIECE OF FUTURE CARDIA

Voice of the Heart

Show more

$1,842,364.92 Raised

REASONS TO INVEST

Deep Analytical Monitoring: Future Cardia’s implantable device delivers continuous, real-time cardiac monitoring, offering early detection and intervention.

Market Potential: The global cardiac monitoring market is valued at over $65B, with predicted growth driven by increasing demand for real-time, remote care solutions.

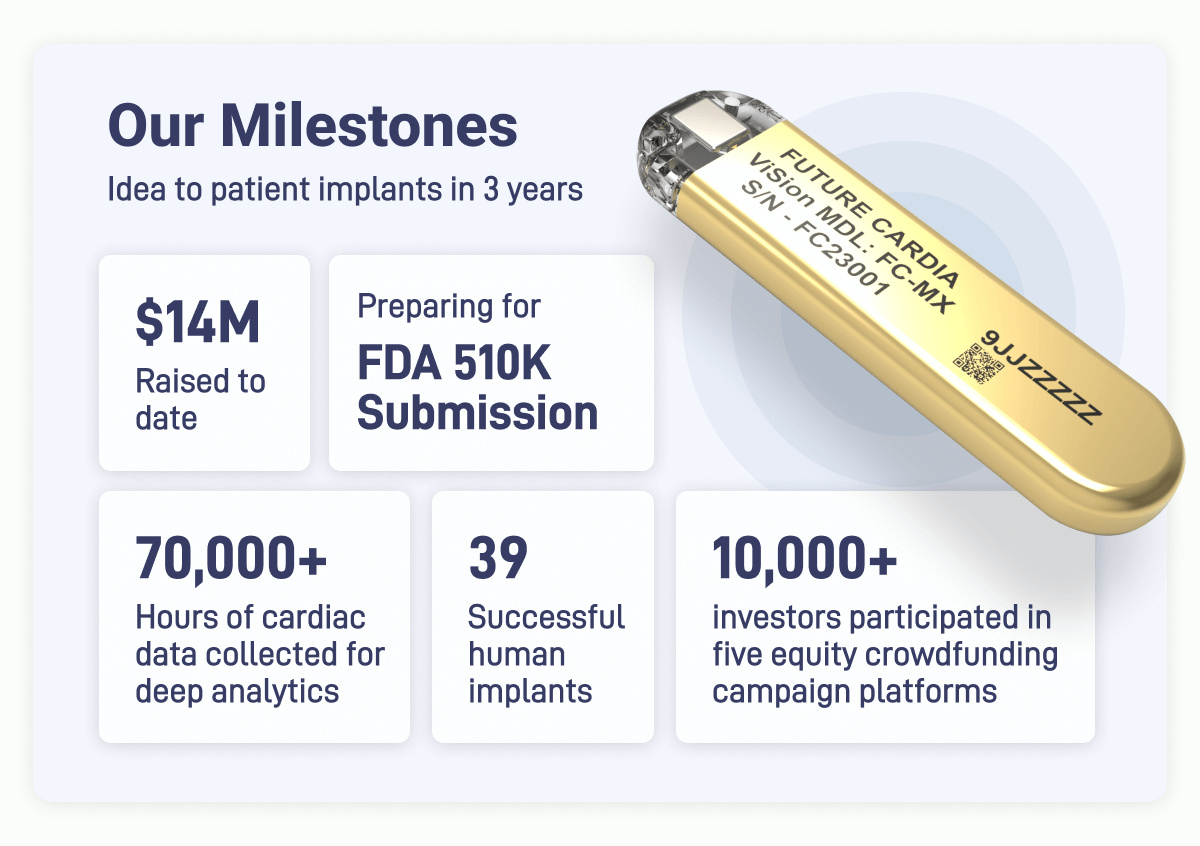

Strong Team: Traction: With $14M raised from 10,000+ investors, a top-tier team with 200 years of combined expertise (Medtronic and Stanford) and 60,000+ hours of data collected.

TEAM

Jaeson Bang • Founder, CEO, Director, Secretary, Treasurer

Read More

Anatoly Yakovlev, PhD • Data Scientist

Adam Gullickson • VP of Operations

Read More

the pitch

Future Cardia is transforming cardiac care with an deeply analytical, implantable monitoring device that offers real-time, continuous heart monitoring. Designed to provide continuous monitoring for patients with chronic cardiac conditions such as heart failure, Future Cardia aims to radically improve patient outcomes by collecting comprehensive cardiac data.

*This product is not yet available for purchase and will need to undergo the necessary review and clearance process prior to being marketed or sold.

Future Cardia offers a revolutionary cardiac monitoring device designed to revolutionize the way heart failure is managed. Our minimally-invasive device provides continuous, real-time data, enabling early detection of potential complications and proactive interventions. We believe this can help to reduce unnecessary hospitalizations, lowers healthcare costs, and significantly enhances patient outcomes.

The Future Cardia team has over 200 years of combined expertise with a team of experts from Medtronic, Boston Scientific, Stanford. As a Stanford StartX company JLABS, member of Johnson and Johnson's JLABS, and backed by Sand Hill Angels (SweetGarden, Ro, Masterclass, Parsley Health), we’ve raised $14 million, and have over 60,000 hours of data collected from 39 patients, Future Cardia is advancing towards its plan for commercialization.

the problem & our solution

Heart disease, heart failure, and cardiac arrhythmia affect billions globally, costing over $40 billion annuallyX,X. These complex and challenging conditions cause the heart muscle, responsible for pumping blood throughout the body, to gradually lose its strength and efficiency– leading to weakened heart muscle, fluid accumulation in lungs, and frequent hospitalizations. Current monitoring methods are limited, invasive, and costly, leaving a gap in proactive cardiac care. The absence of remote heart failure monitoring solutions hinders patients and healthcare providers from effectively managing emergencies.X,X

Sources: Cardiovascular Business, Springer

Future Cardia is redefining cardiac monitoring with a simple, two-minute implant procedure that transforms heart health management. This innovative, under-the-skin device combines simplicity, precision, and high patient compliance, offering a long-term solution that we believe exceeds the accuracy of wearables and other cardiac devices.

Our analytical platform provides real-time monitoring and management of heart conditions, setting a new standard for personalized care. Using multi-sensor technology, the device continuously gathers critical data, enabling remote monitoring and timely interventions– detecting early signs of potential issues, allowing physicians to deliver preventative care before symptoms arise.

*This product is not yet available for purchase and will need to undergo the necessary review and clearance process prior to being marketed or sold.

Our device connects to a patient’s smartphone, which securely transmits data to our cloud-based system. Clinicians can access this data through a secure web portal, supporting comprehensive, real-time patient care. Future Cardia monitors three key metrics: the heart’s electrical activity (ECG), heart and lung sounds, and patient movement. As the system collects more data, the AI’s accuracy improves, delivering even better cardiological insights.

the market & our traction

The heart failure monitoring market is experiencing significant growth due to the rising prevalence of heart disease, advancements in technology, and a shift towards preventive healthcare. With a total addressable market estimated to exceed $117 billion by 2032X, there's a substantial opportunity for Future Cardia to make a significant impact.

Sources: Grand View Research, Transparency Market Research, Precedence Research, Allied Market Research

Future Cardia is a pioneering medical device company dedicated to transforming heart failure management through innovative, minimally invasive technology. We've achieved significant milestones, including: successfully implanted devices in 39 patients in clinical trials and collaborating with leading healthcare organizations and industry experts to prepare us for FDA 510(k) submission, a crucial step towards market entry. Not to mention, we’re backed by over 10,000 investors and have raised $14 million to date. As a Stanford StartX company and a member of Johnson & Johnson's JLABS, we believe we're at the forefront of medical innovation.

*This product is not yet available for purchase and will need to undergo the necessary review and clearance process prior to being marketed or sold.

why invest

Invest in a future of proactive cardiac care and help us bring the mission of Future Cardia to life. We believe our innovative technology, backed by a strong team and significant market potential, has the potential to transform heart health for millions living with chronic heart diseases.

Join us in revolutionizing heart health and making a tangible difference in the world.

Invest Now and Be a Part of the Future of Cardiac Care.

Explore More Investment Opportunities in Biotech & Pharma on StartEngine!

Looking for more investment options in the Biotech & Pharma space? Click here to view all available offerings on StartEngine and get involved today.

ABOUT

HEADQUARTERS

910 Woodbridge Court

Safety Harbor, FL 34695

WEBSITE

View Site

TERMS

Future Cardia

Overview

PRICE PER SHARE

$3

DEADLINE

Jun. 20, 2025 at 6:59 AM UTC

VALUATION

$46.9M

FUNDING GOAL

$7.5K - $2.57M

Breakdown

MIN INVESTMENT

$348

MAX INVESTMENT

$2,565,375

MIN NUMBER OF SHARES OFFERED

2,500

MAX NUMBER OF SHARES OFFERED

855,125

OFFERING TYPE

Equity

SHARES OFFERED

Common Stock

Maximum Number of Shares Offered subject to adjustment for bonus shares

*Maximum number of shares offered subject to adjustment for bonus shares. See Bonus info below.

Voting Rights of Securities Sold in this Offering - The Proxy

Voting Proxy. Each Subscriber shall appoint the Chief Executive Officer of the Company (the “CEO”), or his or her successor, as the Subscriber’s true and lawful proxy and attorney, with the power to act alone and with full power of substitution, to, consistent with this instrument and on behalf of the Subscriber, (i) vote all Securities, (ii) give and receive notices and communications, (iii) execute any instrument or document that the CEO determines is necessary or appropriate in the exercise of its authority under this instrument, and (iv) take all actions necessary or appropriate in the judgment of the CEO for the accomplishment of the foregoing. The proxy and power granted by the Subscriber pursuant to this Section are coupled with an interest. Such proxy and power will be irrevocable. The proxy and power, so long as the Subscriber is an individual, will survive the death, incompetency and disability of the Subscriber and, so long as the Subscriber is an entity, will survive the merger or reorganization of the Subscriber or any other entity holding the Securities. However, the Proxy will terminate upon the closing of a firm-commitment underwritten public offering pursuant to an effective registration statement under the Securities Act of 1933 covering the offer and sale of Common Stock or the effectiveness of a registration statement under the Securities Exchange Act of 1934 covering the Common Stock.

Loyalty Bonus - All previous investors will receive 5% bonus shares.

Time Based:

Extreme Early Bird - Invest within the first 72 hours and receive 20% bonus shares.

Super Early Bird - Invest within the first week and receive 15% bonus shares.

Early Bird - Invest within the first two weeks and receive 10% bonus shares.

Amount-Based:

$1,000+ | Tier 1 - Invest $1,000 and receive 5% bonus shares.

$2,500+ | Tier 2 - Invest $2,500 and receive 7% bonus shares.

$5,000+ | Tier 3 - Invest $5,000 and receive 10% bonus shares.

$10,000+ | Tier 4 - Invest $10,000 and receive 15% bonus shares.

$20,000+ | Tier 5 - Invest $20,000 and receive 20% bonus shares.

*In order to receive perks from an investment, one must submit a single investment in the same offering that meets the minimum perk requirement. Bonus shares from perks will not be granted if an investor submits multiple investments that, when combined, meet the perk requirement. All perks occur when the offering is completed.

Crowdfunding investments made through a self-directed IRA cannot receive non-bonus share perks due to tax laws. The Internal Revenue Service (IRS) prohibits self-dealing transactions in which the investor receives an immediate, personal financial gain on investments owned by their retirement account. As a result, an investor must refuse those non-bonus share perks because they would be receiving a benefit from their IRA account.

The 10% StartEngine Venture Club Bonus

Future Cardia, Inc. will offer 10% additional bonus shares for all investments that are committed by investors that are eligible for the StartEngine Venture Club.

This means eligible StartEngine shareholders will receive a 10% bonus for any shares they purchase in this offering. For example, if you buy 100 shares of Common Stock at $3.00 / share, you will receive 110 shares of Common Stock, meaning you’ll own 110 shares for $300. Fractional shares will not be distributed and share bonuses will be determined by rounding down to the nearest whole share.

This 10% Bonus is only valid during the investor’s eligibility period. Investors eligible for this bonus will also have priority if they are on a waitlist to invest and the company surpasses its maximum funding goal. They will have the first opportunity to invest should room in the offering become available if prior investments are canceled or fail.

Investors will receive the highest single bonus they are eligible for among the bonuses based on the amount invested and the time of offering elapsed (if any). Eligible investors will also receive the Venture Club bonus and the Loyalty Bonus and the Reservations Bonus in addition to the aforementioned bonus.

Irregular Use of Proceeds

ALL UPDATES

06.06.25

Closing in 14 days.

Dear Investors and Supporter.

We’ll be closing our current offering in 14 days. We believe this campaign has been successful in striving to increase potential value and manage risks for our investors.

In 2025, we’ve remained scrappy and efficient, achieving major progress while navigating a few unexpected challenges.

Milestones Achieved:

Completed EU testing

Started U.S. testing – on track to finish by mid-June (delayed by two weeks)

We’ve made meaningful progress and remain on a strong trajectory.

If you’d like to participate in this final stretch or have questions, I’m happy to connect.

Best regards,

Jae B

This Reg CF offering is made available through StartEngine Primary, LLC. This investment is speculative, illiquid, and involves a high degree of risk, including the possible loss of your entire investment.

06.04.25

America’s Leading Cardiac Centers

Dear Investors and Supporters,

As we approach the close of this round, I wanted to share a quick update on our patient testing progress.

We’re currently testing patients at BayCare, one of Florida's most respected hospital systems, widely recognized for excellence in cardiac care. Partnering with BayCare, which is known for its cardiac care, we believe supports our clinical approach and may enhance our credibility as we grow.

Thank you for your continued support.

Best regards,

Jae B

This Reg CF offering is made available through StartEngine Primary, LLC. This investment is speculative, illiquid, and involves a high degree of risk, including the possible loss of your entire investment.

06.02.25

Patient Testing in US part 1

Dear Investors and Supporters,

We completed patient testing in Brooklyn. And we will start additional testing in Tampa, the first week of June.

It’s an exciting step toward strengthening our FDA submission with real-world comparative data.

Also, thank you sincerely for your time and interest in what we’re building.

Your investment means a lot to all of us!

Thank you

Jae Bang

This Reg CF offering is made available through StartEngine Primary, LLC. This investment is speculative, illiquid, and involves a high degree of risk, including the possible loss of your entire investment.

06.01.25

Closing Webinar - Future Cardia

Dear Investors and Supporters,

Thank you again for your continued support. This has been our most successful campaign to date, and we’re excited to share what’s next.

We’re hosting a special webinar to give you an exclusive look at how we’re scaling, reducing risk, and staying on track toward FDA clearance.

📅 WEBINAR: Voice of the Heart

Date: June 12th

Time: 4:00 PM EST / 1:00 PM PST

Thanks to your early belief, we’ve made it this far—and we’re just getting started.

⏳ Final Chance

We’ll be closing our current offering in 21 days.

If you’d like to join the final stretch or have questions, I’m happy to connect.

With gratitude,

Jae B

This Reg CF offering is made available through StartEngine Primary, LLC. This investment is speculative, illiquid, and involves a high degree of risk, including the possible loss of your entire investment.

05.30.25

more Human Testing

Dear Investors and Supporters.

Second day of testing in US.

It’s an exciting step toward strengthening our FDA submission with real-world comparative data.

Also, thank you sincerely for your time and interest in what we’re building. Your engagement means a lot at this stage.

Best regards,

Jae Bang

This Reg CF offering is made available through StartEngine Primary, LLC. This investment is speculative, illiquid, and involves a high degree of risk, including the possible loss of your entire investment.

05.28.25

Patient Testing Started

Dear Investors and Supporters.

Quick note—I’m currently in Brooklyn this week kicking off our patient patch testing as part of our ECG validation work. It’s an exciting step toward strengthening our FDA submission with real-world comparative data.

Also, thank you sincerely for your time and interest in what we’re building. Your engagement means a lot at this stage.

Best regards,

Jae Bang

This Reg CF offering is made available through StartEngine Primary, LLC. This investment is speculative, illiquid, and involves a high degree of risk, including the possible loss of your entire investment.

05.26.25

Closing in June

Huge thanks to our Investors and Supporter.

Huge thanks to our Investors and Supporter.

We’ll be closing our current offering in 21 days. We believe this campaign has been successful in striving to increase potential value and manage risks for our investors.

In 2025, we’ve remained scrappy and efficient, achieving major progress while navigating a few unexpected challenges.

Milestones Achieved:

Completed EU testing

Started U.S. testing – on track to finish by mid-June (delayed by two weeks)

Overcame a site withdrawal – a small but strong clinical site pulled out last minute, but we secured two replacements

Unexpected product development needs emerged during testing

Experienced a delay in Grade One Titanium delivery

Goal is to submit to FDA in Nov 2025

Despite setbacks, we’ve made meaningful progress and remain on a strong trajectory.

If you’d like to participate in this final stretch or have questions, I’m happy to connect.

Best regards,

Jae B

This Reg CF offering is made available through StartEngine Primary, LLC. This investment is speculative, illiquid, and involves a high degree of risk, including the possible loss of your entire investment.

05.23.25

LIVE CASE PUBLISHED

Dear Investors and Supporters,

Back in April 2025, we briefly mentioned a live heart procedure involving our technology.

We’re excited to share that the case has now been published and is available for all to read. We were honored to be featured during a live cardiac procedure showcased at the Heart Rhythm Society (HRS) meeting in San Diego.

HRS is the largest and most influential conference in our field, drawing thousands of physicians, nurses, strategic partners, and venture investors from around the world.

Here is the link:

https://argamedtech.com/news/f/hrs-pfa-summit-live-case

Thank you.

Jae B

This Reg CF offering is made available through StartEngine Primary, LLC. This investment is speculative, illiquid, and involves a high degree of risk, including the possible loss of your entire investment.

05.21.25

Goal of Heart Failure Monitors

Dear Investors and Supporter.

This is a short clip of me talking about the Heart Failure monitoring goal as an industry.

This isn’t just our goal—it’s the goal of the entire heart failure industry. Everyone is trying to solve the challenge of how to monitor heart failure patients effectively and intervene early.

Some solutions involve cumbersome vests that patients have to wear daily, while others require high-risk procedures to implant sensors directly inside the heart.

There are many approaches, but a critical gap remains between convenience and accuracy. That’s the space we are targeting—bringing the simplicity of wearables together with the precision of implants, through a minimally invasive, under-the-skin device.

We believe this is where the future of heart failure monitoring needs to go—and we’re leading the way.

Thank you

Jae B

This Reg CF offering is made available through StartEngine Primary, LLC. This investment is speculative, illiquid, and involves a high degree of risk, including the possible loss of your entire investment.

05.21.25

Mr. Wonderful and Jae Bang - Future Cardia

Dear Investors and Supporters,

This is a repeat, but thought to share it with you.

We’re thrilled to share that our interview with Mr. Wonderful, Kevin O’Leary, is now available on YouTube.

This was a major milestone for us, with over 650 registered for the event—an incredible show of support and interest in our vision.

A huge thank you to each of you for being part of this journey.

Your support means everything.

Here is the link:

Thank you.

Jae B

This product is not yet available for purchase and requires review and clearance before being marketed or sold. This Reg CF offering is made available through StartEngine Primary, LLC. This investment is speculative, illiquid, and involves a high degree of risk, including the possible loss of your entire investment. Kevin O’Leary is a paid spokesperson for StartEngine. Click here to see his 17(b) disclosure.Footnote:*Kevin O’Leary, aka Mr Wonderful, is paid spokesperson for StartEngine. See his 17(b) disclosure here: https://www.startengine.com/17b

REWARDS

10%

Stack Venture Club & Rewards!

Members get an extra 10% shares in addition to rewards below!

Venture Club

Venture Club Members earn 10% bonus shares on top of this and all eligible investments for an entire year. Not a member? Sign up at checkout ($275/year).

$1,000

$1,000+ | Tier 1

Invest $1,000 and receive 5% bonus shares.

$2,500

$2,500+ | Tier 2

Invest $2,500 and receive 7% bonus shares.

$5,000

$5,000+ | Tier 3

Invest $5,000 and receive 10% bonus shares.

$10,000

$10,000+ | Tier 4

Invest $10,000 and receive 15% bonus shares.

$20,000

$20,000+ | Tier 5

Invest $20,000 and receive 20% bonus shares.

JOIN THE DISCUSSION

0/2500

Robin Keaffaber

19 days ago

My husband just had a double bipass and I am interested in getting him into your study. He currently is experiencing Afib a couple times a week. We are also one of your investors.

Show more

2

0

David Gillies

21 days ago

My apologies——— spelled your name incorrectly.

2

0

David Gillies

21 days ago

Jason, I watched you launch your company and carefully follow its path. It took a couple of months to make the decision to invest, then alert my friends whom also invested. It’s clear you and staff have the intellectual capital to create a much needed product. But it was whether or not there was the fight within to execute a business plan when some doors opened, some closed. You are well positioned for vertical growth and IMO, we be faced within a year, determining which suitor is best positioned to carry out corporate mission. A few more green lights and it might happen sooner. A prize fight is 15 rounds and you don’t win every round. You will win the fight, have a disruptive product that changes the lives of many, and be rewarded financially. And I (we) know the fight you are in to survive. Nothing is easy, and if it were we would all become entrepreneurs. I assisted in taking a company public and I feel the pain. Continued success.

Show more

1

0

Yaacov Sakowitz

a month ago

Hi, is it possible to schedule a call with the team to discuss the investment? Thanks!

1

0

Yaacov Sakowitz

a month ago

When is this round ending? Who gave the 46.9m valuation?

2

0

Eileen Schneider

a month ago

When will shares be issued? My funds have been in escrow.

2

0

Ivan Gonzalez Lopez

2 months ago

Do you have utility patents on your technology? What prevents the two giant corporations, Medtronic (LinQ) and Boston Scientific (Lux), from developing a variation of their current established devices to perform the same monitoring as Future Cardia and take over most of the heart failure monitoring market?

Show more

1

0

Elizabeth Versace

2 months ago

To what extent does the success of the company rely on Medicare approval for the use of the device in senior citizens?

Show more

1

0

Edwin Gutierrez

3 months ago

How secure is the data? what is your plan on making sure it does not get manipulated by hackers?

Show more

1

0

HOW INVESTING WORKS

Cancel anytime before 48 hours before a rolling close or the offering end date.

WHY STARTENGINE?

REWARDS

We want you to succeed and get the most out of your money by offering rewards and memberships!

SECURE

Your info is your info. We take pride in keeping it that way!

DIVERSE INVESTMENTS

Invest in over 200 start-ups and collectibles!

FAQS

With Regulation A+, a non-accredited investor can only invest a maximum of 10% of their annual income or 10% of their net worth per year, whichever is greater. There are no restrictions for accredited investors.

With Regulation Crowdfunding, non-accredited investors with an annual income or net worth less than $124,000 are limited to invest a maximum of 5% of the greater of those two amounts. For those with an annual income and net worth greater than $124,000, they are limited to investing 10% of the greater of the two amounts.

At the close of an offering, all investors whose funds have “cleared” by this time will be included in the disbursement. At this time, each investor will receive an email from StartEngine with their Countersigned Subscription Agreement, which will serve as their proof of purchase moving forward.

Please keep in mind that a company can conduct a series of “closes” or withdrawals of funds throughout the duration of the campaign. If you are included in that withdrawal period, you will be emailed your countersigned subscription agreement and proof of purchase immediately following that withdrawal.

StartEngine assists companies in raising capital, and once the offering is closed, we are no longer involved with whether the company chooses to list shares on a secondary market or what occurs thereafter. Therefore, StartEngine has no control or insight into your investment after the close of the live offering. In addition, we are not permitted to provide financial advice. You may want to contact a financial professional to discuss possible investment outcomes.

For Regulation Crowdfunding, investors are able to cancel their investment at any point throughout the campaign up until 48 hours before the closing of the offering. Note: If the company does a rolling close, they will post an update to their current investors, giving them the opportunity to cancel during this timeframe. If you do not cancel within this 5-day timeframe, your funds will be invested in the company, and you will no longer be able to cancel the investment. If your funds show as ‘Invested’ on your account dashboard, your investment can no longer be canceled.

For Regulation A+, StartEngine allows for a four-hour cancellation period. Once the four-hour window has passed, it is up to each company to set their own cancellation policy. You may find the company’s cancellation policy in the company’s offering circular.

Once your investment is canceled, there is a 10-day clearing period (from the date your investment was submitted). After your funds have cleared the bank, you will receive your refund within 10 business days.

Refunds that are made through ACH payments can take up to 10 business days to clear. Unfortunately, we are at the mercy of the bank, but we will do everything we can to get you your refund as soon as possible. However, every investment needs to go through the clearing process in order to be sent back to the account associated with the investment.

Both Title III (Regulation Crowdfunding) and Title IV (Reg A+) help entrepreneurs crowdfund capital investments from unaccredited and accredited investors. The differences between these regulations are related to the investor limitations, the differing amounts of money companies are permitted to raise, and differing disclosure and filing requirements. To learn more about Regulation Crowdfunding, click here, and for Regulation A+, click here.

PREVIOUSLY CROWDFUNDED

RAISED

INVESTORS

MIN INVEST

VALUATION

Most Momentum

Top 15 in amount raised last 72 hours

What does this badge mean? See here

Kristopher Musselman

13 days ago

Thanks for sharing your company with us. A few questions from me: 1- what’s the nature of the $2M battery deal that you can speak about? Are battery use parameters covered in the FDA process or are there other regulatory constraints around that part of the product ? 2- it seems 100% of R&D have been expensed to date. Is that because of TCJA (tax reasons), because the expenses don’t have future use to be capitalized, or something else ? Best, Kris

Show more

1

0