CLOSED

GET A PIECE OF THE SMART TIRE COMPANY, INC

The Next Great American Tire Company

Show more

REASONS TO INVEST

TEAM

Earl Cole • CEO

Read More

Brian Yennie • CTO

Read More

Jim Benzing • Principal Engineer

Overview

Meet SMART Tire: Bringing NASA Technology Back Down to Earth

Introducing Shape Memory Alloy Radial Technology (SMART), a revolutionary technology for the $250 billion tire industry. This space-age tire changes the way vehicles perform on and off road, enabling new transportation possibilities around the globe.

*Images are in the prototype phase. Product is still currently under development and not available on the market

Originally developed by NASA and now commercialized for terrestrial use by The SMART Tire Company, these superelastic tires are airless, durable, and will never go flat. The secret ingredient is an advanced material called NiTinol (nickel titanium), a shape memory alloy with 30x the reversible strain of steel. This amazing alloy will always snap back to its original shape no matter how you stretch or bend it. It comes in a variety of exotic colors, and will be first available on our METL™ tires for bicycles and scooters.

The SMART tire was born out of the extreme challenges NASA faces on Mars, where there are no roads, temperatures can reach -100C, and tire performance is mission-critical. Today, The SMART Tire Company is Reimagining the Wheel™, by bringing superelastic tire technology to a variety of transportation applications here on Earth.

the problem

Air-Filled Tires Are Overflowing with Issues

Pneumatic (air-filled) rubber tires are an invention that has barely changed in 100+ years. Problems include:

- Constant maintenance and monitoring

- Over 200 million flat tires per year in the US

- Billions of gallons of fuel are wasted due to underinflation

- Contribute to 27% of all roadside emergencies

- Responsible for 50 billion pounds of waste, annually

Sources: Historic UK, Undiscovered Scotland

Practically all modes of transportation from trucks to bikes, airplanes and space applications can benefit from high-performance airless tires that never go flat, save on gas, and can handle the most extreme environments on and off of Earth.

the solution

We believe that SMART Tires are the first of their kind: made from shape memory alloys, they are both airless AND high performing. Their special superelastic properties are unlike anything else on earth. This allows them to bend and flex like a rubber tire - but with the strength and performance of a titanium alloy, and always retaining their original shape. Not only that, but they never go flat and require almost no maintenance, are lightweight, and use significantly less rubber than a traditional tire.

What makes these tires so special? It's the combination of structural design with the unique properties of SMA. This amazing material actually rearranges its molecular structure in response to stress. The "superelastic" effect is fundamentally superior to conventional materials, delivering one of the highest energy returns of any structure on Earth.

SMART Tire’s lead engineer originally led the invention of spring tires at Goodyear, receiving an R&D 100 Award (“the Oscars of innovation”). SMART Tires are the 3rd generation offspring of this invention, incorporating over a decade of space program research with new, patented terrestrial designs and commercial integrations.

*Images are in the prototype phase. Product is still currently under development and not available on the market

We believe SMART Tires are perfect for the next generation of electric vehicles, where load-carrying ability, fuel efficiency, consistent performance and long life are paramount. According to our research, the trucking industry can benefit by eliminating costly tire maintenance, better fuel efficiency, and eliminating the need for redundant tires. The future 18-wheeler may benefit greatly from running instead on 10 advanced SMART Tires.

The SMART Tire Company makes money through several key terrestrial sources:

- Consumer products (METL bicycle tire): we have a waiting list of 3,500+ customers for our high-performance METL™ bicycle tire, with its innovative “Nike Air” style see-through design.

- Fleet sales: We are working with “Spin” scooters (backed by Ford Mobility) to bring these tires to their rideshare fleet. The shared electric scooter market represents hundreds of thousands to millions of units worldwide.

- B2B/OEM: We currently have strong interest from both the cycling and automotive industries in OEM opportunities for their vehicles.

- Licensing: Our patent-pending inventions include critical advancements required to produce high-performing SMA tires on earth. In certain markets, we may choose to license portions of the technology rather than produce it ourselves.

How much does it cost?

Our estimated price for the METL™ bicycle tire is $100-$150 at launch, or competitively priced as an integrated high-end wheelset. Similarly, we project automotive and trucking applications to be priced in the “sport” or premium “performance” categories.

One key goal of The SMART Tire Company is to reduce the material costs of our structural SMA applications by 50% or more over the next 3 years through collaboration with our supply chain partners, and optimizations to our designs. Within 5 years we believe there will be an industry shift to more economical shape memory alloys with similar properties. Similar to the “Tesla model”, we will sell high-end, high-performance products with decreasing price points over time.

the market

Entering Growing Market of $250 Billion

The overall global tire market is a $250 billion market with a CAGR of 3.2%, and two wheel market (target for the METL™ tire) is $20 billion with a CAGR of 8%. Micro-mobility is the fastest-growing segment of the tire market, with more than 50% of all bicycle dollars spent on higher-end specialty bike stores, and urban mobility on the rise.

The EV market is expected to grow by over 4.5 times in the next 7 years with a CAGR of 24%. These vehicles are heavier and expected to go longer distances between maintenance, and are our target for a future automotive product.

In fact, the tire and EV markets are similar in size today, at about $250 billion. In the same way Tesla has changed transportation for the better by improving upon the combustion engine, we use first principles thinking and advanced technology to address another key component of every vehicle: the tire.

Our first customers are early adopters and technophiles, who prefer sustainable solutions made in the USA. They are cycling enthusiasts, commuters, and own electric scooters. Our corporate partners include private space companies, micro-mobility providers, and automotive manufacturers.

Private Space Exploration

Based on technology originally invented by NASA for future missions to Mars, we believe Smart Tire Company (STC) is uniquely positioned to provide commercial shape memory alloy solutions to private space companies, a lucrative emerging market.

We are currently collaborating with multiple large aerospace companies preparing bids for Project Artemis, NASA’s return to the south pole of the moon. The overall NASA budget for Artemis is $6.88 billion, and the original LRV (Lunar Rover Vehicle) cost $38,000,000 to develop in 1963 ($345,164,183 in 2021 adjusted for inflation). SMART Tire hopes to participate in this future LTV contract through a winning bid, as well as other Mars and moon missions.

why invest

Driving into a Smarter Future, Made in the USA

From Akron, Ohio to Los Angeles, California, SMART Tires are made in the USA. Based on foundational technology originally developed at NASA Glenn Research Center (Cleveland, Ohio), our tires are produced in a 5,000 square foot facility in Akron, Ohio, where the American tire industry was born.

All of our competitors (Michelin/ France, Bridgestone/ Japan, Continental/ Germany, Goodyear/ USA), are long-established rubber companies competing with largely similar, pneumatic rubber tire products. We believe STC establishes a new category of structural, airless tires not available from the industry today.

Our All-American partners include NASA (as part of a Space Act Agreement for further collaborative research), top aerospace companies, Spin Labs, Felt Bicycles, The University of Akron, and The University of Minnesota. Our shape memory alloy materials are also produced exclusively in the USA.

We plan to release the METL tire in 2022/2023, to put the power of SMA tires directly in the hands of consumers.

By 2025, we hope to see SMART tires make their first trip to the moon, as part of NASA’s project Artemis. Currently we are engaged with major aerospace partners, to help them compete for NASA’s upcoming RFP.

Over the next two years, we plan to demonstrate our tires on a concept vehicle from a top-three major automaker, as well as develop our first trucking prototypes for heavy loads.

*Images are in the prototype phase. Product is still currently under development and not available on the market

In 2026, a rover co-developed by NASA and the ESA (European Space Agency) will launch for Mars on a sample return mission, equipped with SMA tires. This mission plans to utilize the same foundational technology being commercially developed at The SMART Tire Company.

By 2030, we envision SMA tires as the tire of choice for electric & autonomous vehicles, and entering the aviation industry, where the elimination of extremely heavy landing gear systems may be the biggest win of all.

Our bright future is backed by some other big wins…

- 2-year Space Act Agreement with NASA, to further develop the METL™ bike tire

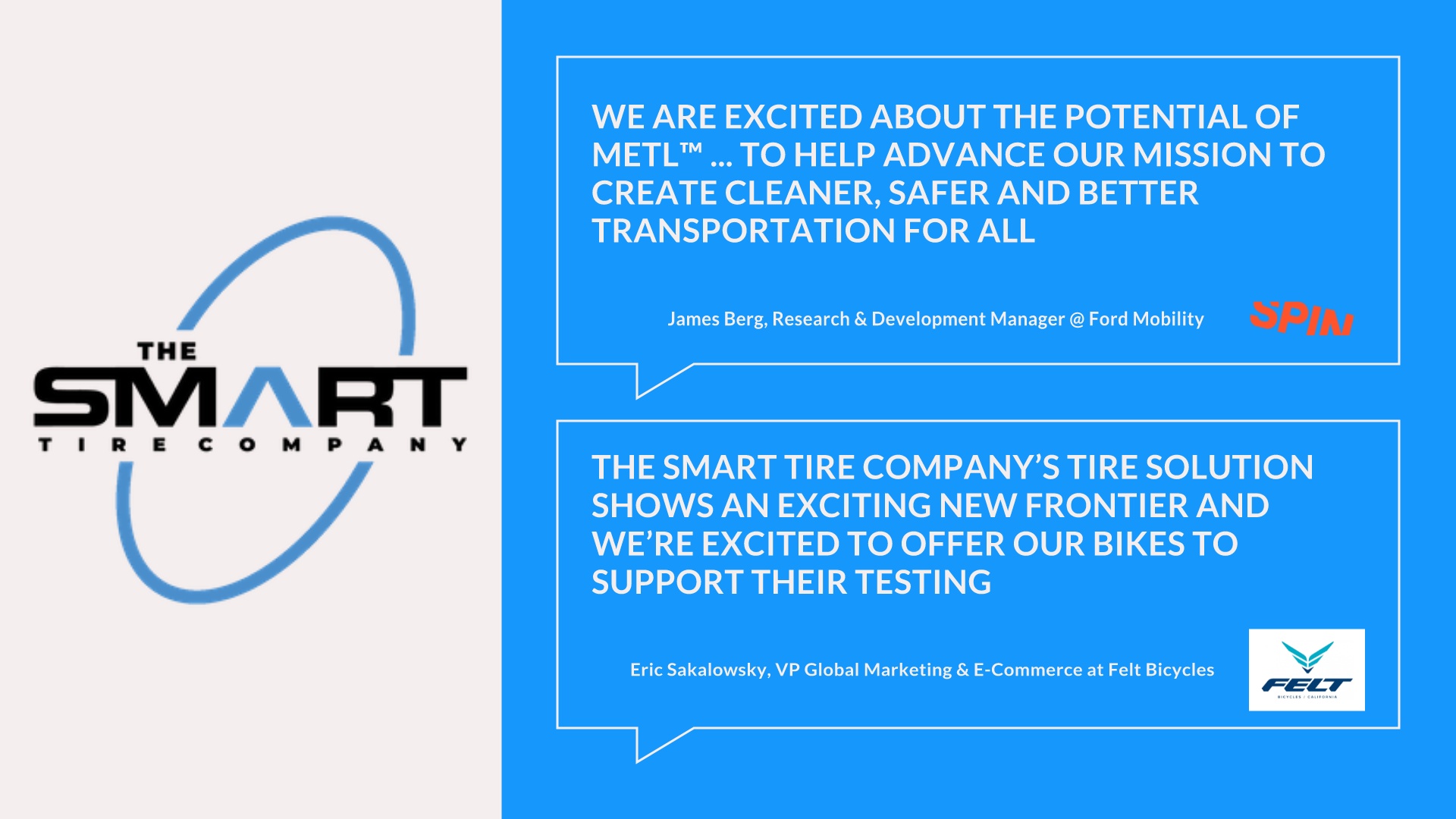

- R&D partnerships with Spin (Ford Mobility) and Felt Bicycles

- $1.29 million in previous crowdfunding from 1,750+ investors

- Lunar tire supplier for aerospace companies (pre-RFP phase)

- Major automaker research vehicle collaboration

- 3,500+ waiting list for METL tires

We believe we are building the next great American tire company: a safer, greener, more advanced tire based on NASA technology. Together we can create a smarter, safer future for transportation, and bring back the US as the world leader in tires!

“With a technology entrusted by NASA for future Mars exploration, we are very excited for the opportunity to use it right here on Earth, right now. One of humankind’s greatest inventions, reimagined.”

— Earl Cole, CEO, The SMART Tire Company

*Images are in the prototype phase. Product is still currently under development and not available on the market

SMARTTIRECOMPANY.COM

ABOUT

HEADQUARTERS

1450 Firestone Pkwy, Unit E

Akron, OH 44301

WEBSITE

View Site

TERMS

The SMART Tire Company, Inc

Overview

PRICE PER SHARE

$4.60

DEADLINE

Apr. 30, 2022 at 6:59 AM UTC

VALUATION

$50.04M

FUNDING GOAL

$10K - $3.7M

Breakdown

MIN INVESTMENT

$243.80

MAX INVESTMENT

$999,998.60

MIN NUMBER OF SHARES OFFERED

2,173

MAX NUMBER OF SHARES OFFERED

805,096

OFFERING TYPE

Equity

SHARES OFFERED

Series Seed-1 Preferred Stock

Maximum Number of Shares Offered subject to adjustment for bonus shares

Voting Proxy. Each Investor shall appoint the Chief Executive Officer of the Company (the “CEO”), or his or her successor, as the Investor’s true and lawful proxy and attorney, with the power to act alone and with full power of substitution, to, consistent with this instrument and on behalf of the Investor, (i) vote all Securities, (ii) give and receive notices and communications, (iii) execute any instrument or document that the CEO determines is necessary or appropriate in the exercise of its authority under this instrument, and (iv) take all actions necessary or appropriate in the judgment of the CEO for the accomplishment of the foregoing. The proxy and power granted by the Investor pursuant to this Section are coupled with an interest. Such proxy and power will be irrevocable. The proxy and power, so long as the Investor is an individual, will survive the death, incompetency and disability of the Investor and, so long as the Investor is an entity, will survive the merger or reorganization of the Investor or any other entity holding the Securities. However, the Proxy will terminate upon the closing of a firm commitment underwritten public offering pursuant to an effective registration statement under the Securities Act of 1933 covering the offer and sale of Common Stock or the effectiveness of a registration statement under the Securities Exchange Act of 1934 covering the Common Stock.

Irregular Use of Proceeds

PRESS

ALL UPDATES

04.18.22

SMART Tire to Appear at TechCrunch Event

TC Sessions: Mobility is back and raring to go big — returning live and in-person — for its fourth consecutive year. It’s a two-day deep dive featuring the best, brightest and most intriguing founders, engineers, investors, regulators and technologists dedicated to transforming the way we move people and packages around the globe.

The SMART Tire Company will showcase their latest tire technology at the TC Sessions event, which will take place in San Mateo, CA, May 18-19. If you live in the SF Bay area or will be in attendance, we invite you to stop by our space to see what cool things we’ve been working on with NASA and other forward-thinking organizations.

TechCrunch editors will break through the hype and go beyond the headlines to discover how merging technology and transportation will affect a broad swath of industries, cities and the people who work and live in them. SMART Tire Company Co-Founder & CEO, Earl Cole, will also be returning to TC’s Found podcast as a follow-up to his original interview on the show.

Check out the exhibition and demo area to meet the SMART Tire team and other founders and engineers behind buzzy early-stage startups to get an up close or even a hands-on encounter our their tech. Founders, investors, engineers and tech enthusiasts alike can witness and experience the future of mobility in TechCrunch’s outdoor playground — with plenty of demos, test drives and exhibits. Expect to see the latest tech in scooters, ebikes, autonomous vehicle technology, electrification, and of course, the future of smart tires.

04.06.22

Notice of Material Change in Offering

[The following is an automated notice from the StartEngine team].

Hello! Recently, a change was made to the The SMART Tire Company, Inc offering. Here's an excerpt describing the specifics of the change:

Issuer is extending campaign

When live offerings undergo changes like these on StartEngine, the SEC requires that certain investments be reconfirmed. If your investment requires reconfirmation, you will be contacted by StartEngine via email with further instructions.

03.30.22

SMART Tire Company featured on NASA.gov

Read more about the commercialization of NASA technologies in this March 2022 feature:

https://www.nasa.gov/feature/

It's been quite the ride, and we're just getting started! Stay tuned for more updates on our progress bringing the METL™ tire to market, and our early forays into private space exploration.

01.07.22

SMART is on Shark Tank!

Thank you again for your interest in The SMART Tire Company! We've been live on StartEngine for just a few hours now, and we already have a great update to share with you.

We will be appearing on Shark Tank this Friday, January 7th at 8pm on ABC! That’s right, our little startup with huge potential is going to face the Sharks in front of MILLIONS of viewers! What does this mean for STC? Mark your calendars and tune in this Friday to find out.

JOIN THE DISCUSSION

0/2500

PINNED BY STARTUP

Zachary Erwin

3 years ago

(1) How do these tires perform on icy roads as compared to standard snow tires? (2) How does the integrated rubber not wear and tear like a standard tire, resulting in reduced traction and shortening the tire’s life when at maximum performance? (3) How is breaking performance compared to standard rubber tires?

Show more

1

1

BRIAN HARRISON

3 years ago

I had 3 withdrawals from SmartTire from my account today but I only REMEMBER one. I'd like someone to reach out before I mark the two as fraud. Either from StartEngine or SmartTire - whoever could help.

Show more

2

0

Bryan McDaniel

3 years ago

Hi there, I came across this from the First Stage Investor team. I know there is still some time left but my main question is what do you plan to do to raise more money in the near future given this looks like it will fall short of your target raise? How much longer before you need another raise? Any plans in the works?

Show more

1

0

William Olsen

3 years ago

I believe you have the potential to completely and permanently disrupt the tire industry, to blindside the big tire manufacturers, and reduce fossil-fuel based tire materials, all while being made in USA. Yay! But, please address the increased need for raw materials - Nickel Titanium (NiTi) with Hafnium (Hf) and Zirconium (Zr) many of which are mined outside USA. Please share your assessment on the need to globally source, mine, refine and process large quantities of these metals Let's say that within 10-15 yrs 50% of all new tires on the road will be SMA vice pneumatic. Less fossil fuels, less tire maintenance, less replacements, better gas mileage, etc... but quantomly more metals needed. What is the supply impact? Are you partnering with mining companies? Have you studied other materials, like carbon fiber, that could reduce the amount of rare metals needed?

Show more

1

0

Felix Vayssieres

3 years ago

Hello, from what I've read airless tires have yet to replace pneumatic tires due to them having less suspension, being susceptible to overheating, uncomfortable vibrations and noise at high speeds, uncomfortable for workers when used for long hours, and poorer fuel efficiency due to the tires being heavier and having greater rolling resistance (from having a larger patch area touching the ground) than pneumatic tires. How do you avoid, overcome, or mitigate these issues? Thanks

Show more

1

0

Logan Carstens

3 years ago

In your promotional video, all of your tires looked to be made out of a mesh design. Reading though the comments there was a discussion about winter traction. Snow will push though the mesh design and cause snow/ice buildup within the tire. What are the efforts going forward to counter that possibility? Correct me if I’m wrong about my thoughts.

Show more

1

0

Keith Davis

3 years ago

When will you send an update to your investors? It's been mighty quiet as of last.

2

0

Justin Brodie-Kommit

3 years ago

Why has your valuation not changed since your WeFunder round?

2

1

Michael Nadler

3 years ago

What's the cost of the bike tire and the cost of the car tire? What's changed with the company since the $20 mil ask in the shark tank?

Show more

1

0

HOW INVESTING WORKS

Cancel anytime before 48 hours before a rolling close or the offering end date.

WHY STARTENGINE?

REWARDS

We want you to succeed and get the most out of your money by offering rewards and memberships!

SECURE

Your info is your info. We take pride in keeping it that way!

DIVERSE INVESTMENTS

Invest in over 200 start-ups and collectibles!

FAQS

With Regulation A+, a non-accredited investor can only invest a maximum of 10% of their annual income or 10% of their net worth per year, whichever is greater. There are no restrictions for accredited investors.

With Regulation Crowdfunding, non-accredited investors with an annual income or net worth less than $124,000 are limited to invest a maximum of 5% of the greater of those two amounts. For those with an annual income and net worth greater than $124,000, they are limited to investing 10% of the greater of the two amounts.

At the close of an offering, all investors whose funds have “cleared” by this time will be included in the disbursement. At this time, each investor will receive an email from StartEngine with their Countersigned Subscription Agreement, which will serve as their proof of purchase moving forward.

Please keep in mind that a company can conduct a series of “closes” or withdrawals of funds throughout the duration of the campaign. If you are included in that withdrawal period, you will be emailed your countersigned subscription agreement and proof of purchase immediately following that withdrawal.

StartEngine assists companies in raising capital, and once the offering is closed, we are no longer involved with whether the company chooses to list shares on a secondary market or what occurs thereafter. Therefore, StartEngine has no control or insight into your investment after the close of the live offering. In addition, we are not permitted to provide financial advice. You may want to contact a financial professional to discuss possible investment outcomes.

For Regulation Crowdfunding, investors are able to cancel their investment at any point throughout the campaign up until 48 hours before the closing of the offering. Note: If the company does a rolling close, they will post an update to their current investors, giving them the opportunity to cancel during this timeframe. If you do not cancel within this 5-day timeframe, your funds will be invested in the company, and you will no longer be able to cancel the investment. If your funds show as ‘Invested’ on your account dashboard, your investment can no longer be canceled.

For Regulation A+, StartEngine allows for a four-hour cancellation period. Once the four-hour window has passed, it is up to each company to set their own cancellation policy. You may find the company’s cancellation policy in the company’s offering circular.

Once your investment is canceled, there is a 10-day clearing period (from the date your investment was submitted). After your funds have cleared the bank, you will receive your refund within 10 business days.

Refunds that are made through ACH payments can take up to 10 business days to clear. Unfortunately, we are at the mercy of the bank, but we will do everything we can to get you your refund as soon as possible. However, every investment needs to go through the clearing process in order to be sent back to the account associated with the investment.

Both Title III (Regulation Crowdfunding) and Title IV (Reg A+) help entrepreneurs crowdfund capital investments from unaccredited and accredited investors. The differences between these regulations are related to the investor limitations, the differing amounts of money companies are permitted to raise, and differing disclosure and filing requirements. To learn more about Regulation Crowdfunding, click here, and for Regulation A+, click here.

PINNED BY STARTUP

marc aten

3 years ago

I do not see any mention on the medical market like scooters and wheelchairs? I know my wheelchair tires are very similar to high performance bike tires, with a medical markup of course, and it would be useful not to have to worry about maintaining them. I am more then willing to give them a test run if/when they are available.

Show more

1

0