Offering Circular | Operating Agreement | Terms Sheet | Selected Risks Related to this Offering | StartEngine Collectibles' SEC EDGAR Page | Section 17(b) Disclosure

StartEngine Collectibles Fund I, LLC is not currently accepting investments from FL and TX.

Reasons to Invest

- StartEngine Assets, the fund manager of this offering, selects and acquires the wine, then arranges for storage and insurance, taking all of the hassle out of fine wine investing. Diversify your portfolio with fine wine for as little as $500.

- According to Entrepreneur, the fine wine market has outperformed most global equities and is less volatile than gold. Over the past 15 years, the fine wine market has seen a 13.6% average annualized return.

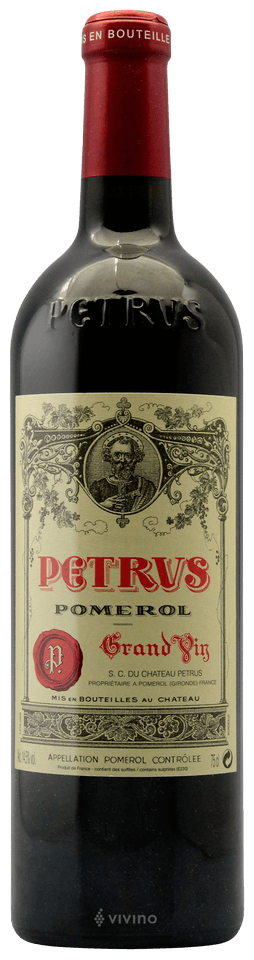

- The 2010 Petrus received two 100-points scores from Suckling and the Wine Advocate respectively. Hailed as “the greatest modern vintage of Petrus” and “Stunningly rich, full-bodied and more tannic and classic than the 2009.

- Owner's Bonus Exclusive: This offering is reserved for Owner’s Bonus members for the first 7 days. If you would like to invest during this period, and you are not currently an Owner's Bonus member, you can purchase it during the investment process.

*If you make an investment but you are not an Owner's Bonus member, your investment will be processed after 7 days, unless the offering is oversubscribed, in which event your investment will be cancelled. After the first 7 days, the offering will be available to all investors.

The wine

Chateau Petrus 2010

This 100% Merlot is an opulent vintage in Bordeaux and Petrus.

The Market

Fine wine has consistently outperformed the S&P 500 over the last 30 years

According to a 2018 article published by a Morgan Stanley analyst, Liv-ex Fine Wine 100 Index, which tracks the price movement of 100 of the most actively traded wines in the world, showed returns over a 10-year period exceeding that for FTSE and S&P 500, with lower volatility than gold.

*Please note that these are historical returns for the wine market as a whole, and do not reflect the value of or potential returns on the shares of this Series.

This graph represents some auction results for comparable works at auction but does not represent all sales for similar objects and does not represent sales of the work currently being offered by StartEngine Collectibles unless denoted by an asterix *.

Why Invest

Why invest in wine?

StartEngine Collectibles lets you diversify your portfolio with an asset that can increase in value as it increases in scarcity. Instead of company quarterly earnings changing the value of your investment, wine can increase in value as it is consumed, leaving fewer bottles on the market.

We anticipate holding our wine assets for a minimum of one year, and a maximum of six years. We intend to pay distributions to the extent we sell some or all of our assets. Otherwise, liquidity for investors would be obtained by transferring or selling their interests in a series.

What Is SE Collectibles?

StartEngine Collectibles is the future of alternative assets

Alternative Investments:

The 2018 U.S. Trust Insights on Wealth and Worth survey on wealthy household’s found that while baby boomers and older investors rely primarily on traditional stocks and bonds, younger investors, especially millennials, are more likely to incorporate alternative strategies into their investment portfolios.

Millennials allocate 17% to alternatives and assets other than stocks, bonds and cash. It also found that 61% of millennial investors think it’s not possible to achieve above-average returns by investing solely in stocks and bonds anymore, and are looking for alternative investments. For example, the report showed that millennials are the fastest growing segment of art collectors, up 8% year-over-year and comprising 36% of total respondents. We believe these shifts in millennial investing tastes suggest there will be more interest in investing in alternative assets.

Interested in purchasing this investment opportunity outright? Email assets@startengine.com.

Do you have artwork you would like to sell using Start Engine? Email assets@startengine.com.

No further investment commitments will be accepted for the current offering after 11:59pm PST on March 16, 2022. Commitments in the offering will be accepted up to that date and processed as promptly as possible. Processing may occur after commitments are no longer being accepted, but prior to closing. None of the terms of the offering have been changed. In addition, as described in the Offering Circular, the Company retains the right to continue the offering beyond this date in its sole discretion.

DISCLAIMER:

AN OFFERING STATEMENT REGARDING THIS OFFERING HAS BEEN FILED WITH THE SEC. THE SEC HAS QUALIFIED THAT OFFERING STATEMENT, WHICH ONLY MEANS THAT THE COMPANY MAY MAKE SALES OF THE SECURITIES DESCRIBED BY THE OFFERING STATEMENT. IT DOES NOT MEAN THAT THE SEC HAS APPROVED, PASSED UPON THE MERITS OR PASSED UPON THE ACCURACY OR COMPLETENESS OF THE INFORMATION IN THE OFFERING STATEMENT.

THE OFFERING CIRCULAR THAT IS PART OF THAT OFFERING STATEMENT CAN BE FOUND HERE .

THE OFFERING MATERIALS MAY CONTAIN FORWARD-LOOKING STATEMENTS AND INFORMATION RELATING TO, AMONG OTHER THINGS, THE COMPANY, ITS BUSINESS PLAN AND STRATEGY, AND ITS INDUSTRY. THESE FORWARD-LOOKING STATEMENTS ARE BASED ON THE BELIEFS OF, ASSUMPTIONS MADE BY, AND INFORMATION CURRENTLY AVAILABLE TO THE COMPANY’S MANAGEMENT. WHEN USED IN THE OFFERING MATERIALS, THE WORDS “ESTIMATE,” “PROJECT,” “BELIEVE,” “ANTICIPATE,” “INTEND,” “EXPECT” AND SIMILAR EXPRESSIONS ARE INTENDED TO IDENTIFY FORWARD-LOOKING STATEMENTS, WHICH CONSTITUTE FORWARD LOOKING STATEMENTS. THESE STATEMENTS REFLECT MANAGEMENT’S CURRENT VIEWS WITH RESPECT TO FUTURE EVENTS AND ARE SUBJECT TO RISKS AND UNCERTAINTIES THAT COULD CAUSE THE COMPANY’S ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE CONTAINED IN THE FORWARD-LOOKING STATEMENTS. INVESTORS ARE CAUTIONED NOT TO PLACE UNDUE RELIANCE ON THESE FORWARD-LOOKING STATEMENTS, WHICH SPEAK ONLY AS OF THE DATE ON WHICH THEY ARE MADE. THE COMPANY DOES NOT UNDERTAKE ANY OBLIGATION TO REVISE OR UPDATE THESE FORWARD-LOOKING STATEMENTS TO REFLECT EVENTS OR CIRCUMSTANCES AFTER SUCH DATE OR TO REFLECT THE OCCURRENCE OF UNANTICIPATED EVENTS.

THERE IS NO EXPECTATION THAT AN ACTIVE PUBLIC OR PRIVATE MARKET WILL BE ESTABLISHED FOR THE SECURITIES IN THIS OFFERING, EITHER IN THE UNITED STATES OR ANY FOREIGN JURISDICTION, WHETHER THROUGH STARTENGINE SECONDARY, THIRD-PARTY REGISTERED BROKER-DEALERS OR OTHERWISE. FURTHERMORE, EVEN IF A MARKET WAS ESTABLISHED, THERE IS NO GUARANTEE THAT FOREIGN INVESTORS WOULD BE ABLE TO PARTICIPATE IN TRANSACTIONS ON THOSE MARKETS. STARTENGINE SECONDARY CURRENTLY DOES NOT, AND MAY NEVER ALLOW FOREIGN INVESTORS TO ESTABLISH OR MAINTAIN SUBSCRIBER ACCOUNTS REQUIRED TO TRADE SECURITIES ON THE ALTERNATIVE-TRADING SYSTEM.

(or click)

(or click)

(or click)

ABOUT

HEADQUARTERS

3900 W ALAMEDA AVE, STE 1200

Burbank, CA 91505

WEBSITE

View Site

TERMS

Overview

PRICE PER SHARE

DEADLINE

Jun. 9, 2025 at 9:56 AM UTC

VALUATION

Breakdown

MIN INVESTMENT

MAX INVESTMENT

OFFERING TYPE

Maximum Number of Shares Offered subject to adjustment for bonus shares

ALL UPDATES

06.20.22

Minimum Investment Lowered to $150 for This Wine Offering

You asked and we listened! We’re lowering the minimum investment to make it even easier to own shares of Chateau Petrus 2010 (12 bottles).

Become a Fine Wine investor for just $150.00. Submit your investment today!

This investment is speculative, illiquid, and involves a high degree of risk, including the possible loss of your entire investment.

06.06.22

StartEngine Collectibles Now Accepts International Investments and Investments from Washington and New Jersey

StartEngine Collectibles is now accepting investments from Washington and New Jersey as well as from international investors. If you are an investor from WA or NJ and were not previously able to submit an investment, now you can!

Simply complete your investment flow as you normally would and our team will handle the rest!

We truly appreciate your patience and hope to have more updates soon.

This Reg A+ offering is made available through StartEngine Collectibles Fund I, LLC. No broker-dealer or other intermediary is involved in this offering. StartEngine Collectibles Fund I, LLC is not currently accepting investments from FL and TX.

03.31.22

Announcement About This Offering

As many of you are aware, StartEngine Collectibles has been notifying the public about the number of days left to invest in Chateau Petrus 2010 (12 bottles). Given the amount still available in the offering, StartEngine Collectibles has decided to adjust the final day to invest, which will now be April 27, 2022.

We appreciate your understanding and look forward to fulfilling the offering moving forward!

This Reg A+ offering is made available through StartEngine Collectibles Fund I LLC. No broker-dealer or other intermediary is involved in this offering. This investment is speculative, illiquid, and involves a high degree of risk, including the possible loss of your entire investment. For more information about this offering, please view the offering circular and the risks associated with this offering.

03.30.22

ONE DAY LEFT, 97% FILLED – INVEST IN CHATEAU PETRUS 2010 TODAY

There is just 1 day left to invest in Chateau Petrus 2010, and only about $1,000 left to fill. Invest in this highly-rated, 100-point wine today!

No further investment commitments will be accepted for the current offering after 11:59 pm PST on March 31, 2022. Commitments in the offering will be accepted up to that date and processed as promptly as possible. Processing may occur after commitments are no longer being accepted, but before closing. None of the terms of the offering have been changed. In addition, as described in the Offering Circular, the Company retains the right to continue the offering beyond this date at its sole discretion.

T his Reg A+ offering is made available through StartEngine Collectibles Fund I, LLC. No broker- dealer or other intermediary is involved in this offering. StartEngine Collectibles Fund I, LLC is not currently accepting investments from WA, NJ, FL and TX. This investment is speculative, highly illiquid, and involves a high degree of risk, including the possible loss of your entire investment. For more information about this offering, please view the offering circular and the risks associated with this offering.

03.16.22

Important Announcement

As many of you are aware, StartEngine Collectibles has been notifying the public about the number of days left to invest in Chateau Petrus 2010 (12 bottles). Given the amount still available in the offering, StartEngine Collectibles has decided to adjust the final day to invest, which will now be March 31, 2022.

We appreciate your understanding and look forward to fulfilling the offering moving forward!

This Reg A+ offering is made available through StartEngine Collectibles Fund I LLC. No broker-dealer or other intermediary is involved in this offering. This investment is speculative, illiquid, and involves a high degree of risk, including the possible loss of your entire investment. For more information about this offering, please view the offering circular and the risks associated with this offering.

03.11.22

QUESTIONS ABOUT INVESTING IN ART? JOIN STARTENGINE’S LIVE Q&A NEXT MONDAY 3/14

We know you have questions about investing in collectibles on StartEngine! So, we’re giving you a chance to get your burning questions answered LIVE.

Join Leon Benrimon, Vice President of Assets and Collectibles on Monday, 3/14 at 2:00 PM PST/5:00 PM EST for this virtual event.

INVESTING IN ART LIVE Q&A | STARTENGINE COLLECTIBLES

DATE: MARCH 14, 2022

TIME: 2:00 PM PST / 5:00 PM PST

We hope to see you there!

03.01.22

$6K LEFT TO INVEST | ONLY 7 DAYS LEFT TO INVEST

There are only seven days left to invest in Chateau Petrus 2010, and only about $6,000 left in investments. Invest in this 100-point rated wine today!

No further investment commitments will be accepted for the current offering after 11:59 pm PST on March 8, 2022. Commitments in the offering will be accepted up to that date and processed as promptly as possible. Processing may occur after commitments are no longer being accepted, but before closing. None of the terms of the offering have been changed. In addition, as described in the Offering Circular, the Company retains the right to continue the offering beyond this date at its sole discretion.

This Reg A+ offering is made available through StartEngine Collectibles Fund I LLC. No broker-dealer or other intermediary is involved in this offering. This investment is speculative, illiquid, and involves a high degree of risk, including the possible loss of your entire investment. For more information about this offering, please view the offering circular and the risks associated with this offering.

01.11.22

Updated Fee Structure

You spoke and we listened!

StartEngine is venturing out into this exciting new world of collectibles, and is therefore navigating a new field and business model, and doing the right thing for our investors.

We are happy to announce that after receiving your feedback, we have decided to change our fee structure for StartEngine Collectibles. For all collectibles currently open for investment on StartEngine our fee structure is below:

16.7% Sourcing Fee: Our sourcing fee is approximately 16.67% of the total amount we are seeking to raise and is built into the offering. The sourcing fee covers shipping, expertise, appraisal, and sourcing expenses.

0.5% Yearly Management Fee: This fee is retroactively charged when the object is sold and includes the costs for insurance, quarterly inventory assessment, and annual value appraisal, and storage

20% Profit Split: Lower than some of our competitors who charge as much as 50%.

We do not intend to charge you any other fees related to your collectibles investment!

What Has Changed:

Expenses and Fees: Previously expenses and fees were deducted from profits or had to be repaid by investors. We have now included those expenses in our fees and will deduct them from there rather than burden our investors.

Profit split: Previously the profit split was 50/50 to match our competitors, it is now 20% making us one of the leaders in the industry.

We look forward to implementing this new fee structure and more importantly to listen to you, our StartEngine community. If you have any questions, comments or concerns feel free to email us at assets@startengine.com.

FOR ANY SERIES OF STARTENGINE COLLECTIBLES FUND I LLC FOR WHICH THE OFFERING STATEMENT FOR THAT OFFERING HAS NOT YET BEEN QUALIFIED BY THE SEC:

NO MONEY OR OTHER CONSIDERATION IS BEING SOLICITED, AND IF SENT IN RESPONSE, WILL NOT BE ACCEPTED.

NO OFFER TO BUY THE SECURITIES CAN BE ACCEPTED AND NO PART OF THE PURCHASE PRICE CAN BE RECEIVED UNTIL THE OFFERING STATEMENT FILED BY THE COMPANY WITH THE SEC HAS BEEN QUALIFIED BY THE SEC. ANY SUCH OFFER MAY BE WITHDRAWN OR REVOKED, WITHOUT OBLIGATION OR COMMITMENT OF ANY KIND, AT ANY TIME BEFORE NOTICE OF ACCEPTANCE GIVEN AFTER THE DATE OF QUALIFICATION.

AN INDICATION OF INTEREST INVOLVES NO OBLIGATION OR COMMITMENT OF ANY KIND.

AN OFFERING STATEMENT REGARDING THIS OFFERING HAS BEEN FILED WITH THE SEC. YOU MAY OBTAIN A COPY OF THE PRELIMINARY OFFERING CIRCULAR THAT IS PART OF THAT OFFERING STATEMENT FROM HERE https://www.sec.gov/Archives/edgar/data/1841003/000110465921147333/tm2133841d2_1apos.htm.

01.10.22

Chateau Petrus 2010 (12 bottles) Update

It has been an exciting time for StartEngine Collectibles in offering investors an opportunity to diversify their portfolios with 12 bottles of 2010 Petrus. There have been some questions about our graphs, so we would like to present here our source data from Liv-Ex (Liv-Ex.com).

REWARDS

JOIN THE DISCUSSION

0/2500

Andrew McGrath

3 years ago

Why was the last update 3 months ago saying that “StartEngine Collectibles has decided to adjust the final day to invest, which will now be April 27, 2022.” but I’m writing this comment in the middle of June and it is still open for 13 day? Why has there been no update in 3 months and no option to move my money elsewhere? Run from this! Put your money in a drawer and it will be better dealt with then this campaign! Is this a scam….seems like it!

Show more

2

0

James Finseth

3 years ago

Also from the literature: "The successful operation of our series is in part dependent on the ability of the Asset Manager to effectively manage the underlying assets. Currently, StartEngine Assets LLC serves as the Asset Manager for all of our Series. StartEngine Assets LLC has only been in existence since May 18, 2020 and has no significant operating history within the fine wine sector, trading card sector, art sector, or any other collectibles sector that would evidence an ability to source and manage and the underlying assets of the applicable series. If the Asset Manager cannot effectively source and manage the underlying assets of its series, investors may not receive the expected returns on their investment. " Who is this so-called asset manager, Donald Duck?

Show more

1

0

James Finseth

3 years ago

The offering literature states: "The offering amount will exceed the value of the underlying assets and if the underlying assets are sold before they appreciate or generate income, then investors will not receive the amount of their initial investment back." This is a major red flag. According to this disclosure one can purchase these in the open market for less than through SE. Much of the info comes off as confusing, inconsistent, and simply unprofessional. Count me OUT.

Show more

1

0

M E

3 years ago

This investment is interesting, but like the question below why is this prices at $60k? Are you selling 5 bottles or 10 bottles? Also, the label of the bottles above has 1999. The 2010 bottles have no label.

Show more

1

0

Narayanan Veeraraghavan

3 years ago

Unless I’m missing something, why is this valued at 60K when there is a general availability at 6K? https://www.finewinespirits.com/sku50000797_CHATEAU-PETRUS-POMEROL-750ML-2010 And btw, the graph above has two 50K points, one of it out to be 55K. What is the source of that graph? I think I can create a much different graph with public data. Trying to understand how the valuation is $59.5K?

Show more

3

1

HOW INVESTING WORKS

Cancel anytime before 48 hours before a rolling close or the offering end date.

WHY STARTENGINE?

REWARDS

We want you to succeed and get the most out of your money by offering rewards and memberships!

SECURE

Your info is your info. We take pride in keeping it that way!

DIVERSE INVESTMENTS

Invest in over 200 start-ups and collectibles!

FAQS

With Regulation A+, a non-accredited investor can only invest a maximum of 10% of their annual income or 10% of their net worth per year, whichever is greater. There are no restrictions for accredited investors.

With Regulation Crowdfunding, non-accredited investors with an annual income or net worth less than $124,000 are limited to invest a maximum of 5% of the greater of those two amounts. For those with an annual income and net worth greater than $124,000, they are limited to investing 10% of the greater of the two amounts.

At the close of an offering, all investors whose funds have “cleared” by this time will be included in the disbursement. At this time, each investor will receive an email from StartEngine with their Countersigned Subscription Agreement, which will serve as their proof of purchase moving forward.

Please keep in mind that a company can conduct a series of “closes” or withdrawals of funds throughout the duration of the campaign. If you are included in that withdrawal period, you will be emailed your countersigned subscription agreement and proof of purchase immediately following that withdrawal.

StartEngine assists companies in raising capital, and once the offering is closed, we are no longer involved with whether the company chooses to list shares on a secondary market or what occurs thereafter. Therefore, StartEngine has no control or insight into your investment after the close of the live offering. In addition, we are not permitted to provide financial advice. You may want to contact a financial professional to discuss possible investment outcomes.

For Regulation Crowdfunding, investors are able to cancel their investment at any point throughout the campaign up until 48 hours before the closing of the offering. Note: If the company does a rolling close, they will post an update to their current investors, giving them the opportunity to cancel during this timeframe. If you do not cancel within this 5-day timeframe, your funds will be invested in the company, and you will no longer be able to cancel the investment. If your funds show as ‘Invested’ on your account dashboard, your investment can no longer be canceled.

For Regulation A+, StartEngine allows for a four-hour cancellation period. Once the four-hour window has passed, it is up to each company to set their own cancellation policy. You may find the company’s cancellation policy in the company’s offering circular.

Once your investment is canceled, there is a 10-day clearing period (from the date your investment was submitted). After your funds have cleared the bank, you will receive your refund within 10 business days.

Refunds that are made through ACH payments can take up to 10 business days to clear. Unfortunately, we are at the mercy of the bank, but we will do everything we can to get you your refund as soon as possible. However, every investment needs to go through the clearing process in order to be sent back to the account associated with the investment.

Both Title III (Regulation Crowdfunding) and Title IV (Reg A+) help entrepreneurs crowdfund capital investments from unaccredited and accredited investors. The differences between these regulations are related to the investor limitations, the differing amounts of money companies are permitted to raise, and differing disclosure and filing requirements. To learn more about Regulation Crowdfunding, click here, and for Regulation A+, click here.

Andrew McGrath

3 years ago

Only $50 left to invest but there is a $150 minimum. We are back to the same problem! Can you set the minimum to like $5 so that this can finally close!

Show more

0

0