CLOSED

GET A PIECE OF SONGSPLITS BY SONG SOLUTIONS, INC.

Revolutionizing broken data rights in the music industry

Show more

REASONS TO INVEST

TEAM

Todd Wright • Director & Co-CEO

Read More

Al "Butter" McLean • Director, Co-CEO & Chief Business Development Officer

Read More

Jeremy DuVall • Head of Technology Development

Jeremy is a software craftsman with more than a decade of experience building and advising others on how to build rugged, performant, and beautiful software in nearly every industry. He has a commitment to build a smart, flexible, human-centric team of experienced software architects, engineers, and developers who obsess about quality and expert advice and execution.

Read More

OVERVIEW

The DNA of the music business

A song split confirms which songwriters receive credit on a song and each person’s corresponding percentage of the royalties. Song splits are the DNA of the music business—without this information, songwriters can’t get paid their due. However, the current system for tracking and storing these critical details is splintered and out of date, leaving billions of dollars in limbo. As music industry veterans with deep experience, we recognized this problem and created SongSplits to become the standard and essential tool for the industry.

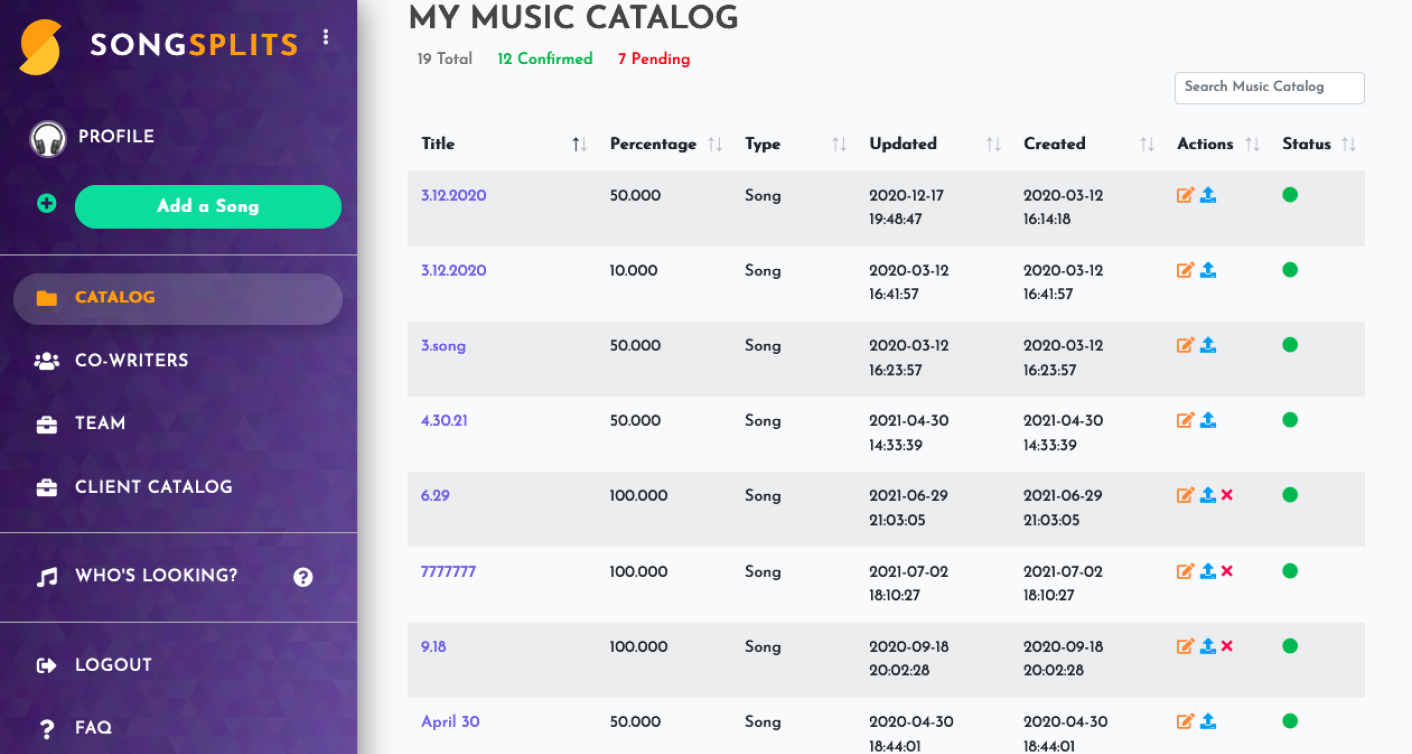

SongSplits is an online platform that enables songwriters to cross-verify songwriting credits with all relevant collaborators before storing the information in a centralized digital database. SongSplits’ universal system works to eliminate the types of hurdles created by verbal agreements and paper split sheets. No conflicts and no delays means that when the largest shoe company in the world seeks out your song as the soundtrack for its latest commercial, the process will be seamless and conflict-free.

The problem

Hundreds of millions and by some estimates even billions sitting in a “black box”

For years, songwriters have defaulted to jotting down song credit and collaborator information on paper split sheets. Missing names and numbers or questions about accuracy can lead to delays, obstacles, and outright losses in royalty payouts. By some industry estimates, as much as 25% of all mechanical royalties go unpaid due to identification issues because the collection agencies do not know who to pay.

(Source)

The result? Billions of music industry dollars are held in dispute or aren’t properly licensed for use. This money will sit in this purgatorial state until the proper papers and percentages are (hopefully) chased down. Big industry corporations that collect royalties have little to no incentive to address the issue—after all, the lack of proper data allows them to benefit from interest earned on these billions of “black box” dollars every year. $424 million of unallocated royalties was dispersed by the Digital Service Providers to the Mechanical Licensing Collective alone.

These are earned dollars in the United States that don’t have correct songwriter data and can’t be paid to the actual writers as a result.

(Source)

Split data affects more than royalty percentages

Beyond the question of income, lacking accurate split data prevents songwriters from getting new publishing deals or getting out of existing ones, licensing music to a third party (e.g. TV, film, video games), properly copyrighting their work, and repaying the advance of a publishing deal. While the song split is such an integral part of the music business, the lack of a user-friendly, standardized process for verification and documentation has resulted for years and years in songwriters failing to be properly compensated.

Industry Overview:

(Source 1 and Source 2)

THE SOLUTION

A digital platform for songwriters and teams

With SongSplits, we cut out the middlemen and control the split process from start to finish. The SongSplits platform provides songwriters with the tools to easily create, organize, and cross-verify their royalty percentages and agreements, serving as a standard ledger that can subsequently be accessed by the songwriter's managers and attorneys as well. By digitizing and centralizing what was formerly stored on sheets of paper, we’re making it easy for music publishers, distribution companies, and performing rights societies to locate the information they need.

SongSplits operates on multiple revenue streams. Serving as the industry standard for third-party licensors, we’ll charge an administrative transaction fee for ensuring that earned royalties successfully reach the right songwriters. Additionally, songwriters have the option to have SongSplits handle their royalty collections for a fee that’s 50% lower than the current industry standard. We’ll offer subscription services to our “Who’s Looking List,” which allows songwriters to see which of the major label artists are looking for new songs, with direct submission for record placement. Lastly, we’ll white label our technology to large, independent music publishers, distribution companies, performance and mechanical rights collectives to improve their own data management.

THE MARKET

The music industry is booming

The music industry was worth $62B in 2017 and is estimated to reach $131B in revenue by 2030 (source). The music publishing business alone was estimated to be worth $11.7B in 2020 (source). Whether a song is performed at a live concert, placed on an album, or streamed on a personal device, a royalty is earned by the songwriter every time the song is played.

(Source)

Yet despite these massive numbers, it’s been estimated that 70% of recorded music is independently uploaded and released without proper licensing protocols (source). All of this presents an enormous, pressing opportunity to provide much-needed infrastructure within a sprawling, decentralized industry. While a handful of other companies have attempted to jump in to address these gaps, none have focused on the song split. We’re here to solve the issue from its core, and we’re well on our way to becoming the industry standard.

OUR TRACTION

A quarter-million users and counting

SongSplits already has more than 200,000 users on our platform. Built with best-of-class technology, we’ve scaled quickly and with very little marketing budget. Our platform is poised to grow exponentially as we reach more users and expand our partnerships with distributors, streaming companies, and other collection agencies.

We’ve already secured a partnership with the Mechanical Licensing Collective to address their quandary of $424M in unmatched music royalties (source). We’re happy to have received very positive press coverage from the music industry, praising our work to protect the rights of songwriters.

WHY INVEST

A cornerstone of tomorrow’s music industry

SongSplits is fast-becoming (aiming to become, if needed) the industry standard for data rights management. The senior team has deep industry experience both in working for the major music corporations as well as personally representing some of the biggest names in the business.

We are disrupting the industry and changing lives for songwriters and music creators around the world while participating in the revenue of the entire ecosystem.

We’ll also be investing attention in education; you can expect to see us in several of the major university music programs as well as the Master Sessions at the Songwriters Hall of Fame. In creating SongSplits, our team of industry veterans invested a great deal of time talking to the music community about what they wanted. Now, every single day, we get shout-outs from songwriters telling us how our service has changed their lives. We’re ready to continue changing lives for songwriters and creators everywhere and building a better music industry for everyone—and we’d love for you to join us.

*This testimonial may not be representative of the experience of other customers and is not a guarantee of future performance or success.

ABOUT

HEADQUARTERS

2061 Middle Street Suite 215

Sullivans Island, SC 29482

WEBSITE

View Site

TERMS

SongSplits by Song Solutions, Inc.

Overview

PRICE PER SHARE

$15

DEADLINE

Mar. 30, 2022 at 6:59 AM UTC

VALUATION

$15M

FUNDING GOAL

$10K - $1.07M

Breakdown

MIN INVESTMENT

$240

MAX INVESTMENT

$106,995

MIN NUMBER OF SHARES OFFERED

666

MAX NUMBER OF SHARES OFFERED

71,333

OFFERING TYPE

Equity

SHARES OFFERED

Common Stock

Maximum Number of Shares Offered subject to adjustment for bonus shares

*Maximum number of shares offered subject to adjustment for bonus shares. See bonus info below.

Voting Rights of Securities Sold in this Offering

Voting Proxy. Each Subscriber shall appoint the Chief Executive Officer of the Company (the “CEO”), or his or her successor, as the Subscriber’s true and lawful proxy and attorney, with the power to act alone and with full power of substitution, to, consistent with this instrument and on behalf of the Subscriber, (i) vote all Securities, (ii) give and receive notices and communications, (iii) execute any instrument or document that the CEO determines is necessary or appropriate in the exercise of its authority under this instrument, and (iv) take all actions necessary or appropriate in the judgment of the CEO for the accomplishment of the foregoing. The proxy and power granted by the Subscriber pursuant to this Section are coupled with an interest. Such proxy and power will be irrevocable. The proxy and power, so long as the Subscriber is an individual, will survive the death, incompetency and disability of the Subscriber and, so long as the Subscriber is an entity, will survive the merger or reorganization of the Subscriber or any other entity holding the Securities. However, the Proxy will terminate upon the closing of a firm-commitment underwritten public offering pursuant to an effective registration statement under the Securities Act of 1933 covering the offer and sale of Common Stock or the effectiveness of a registration statement under the Securities Exchange Act of 1934 covering the Common Stock.

Investment Incentives*

Time-Based

Friends and Family Early Birds

Invest within the first 72 hours and receive an additional 15% bonus shares.

Super Early Bird Bonus

Invest within the first week and receive an additional 10% bonus shares.

Early Bird Bonus

Invest within the first two weeks and receive an additional 5% bonus shares.

Amount-Based

Tier 1 | $2,500+

SongSplits shirt

Tier 2| $5,000+

SongSplits shirt and trucker hat

Tier 3| $10,000+

5% bonus shares

Tier 4| $25,000+

10% bonus shares

Tier 5 | $50,000+

10% bonus shares + invitation to quarterly CEO Roundtable

*All perks occur when the offering is completed.

The 10% StartEngine Owners' Bonus

Song Solutions, Inc. will offer 10% additional bonus shares for all investments that are committed by investors that are eligible for the StartEngine Crowdfunding Inc. OWNer's bonus.

This means eligible StartEngine shareholders will receive a 10% bonus for any shares they purchase in this offering. For example, if you buy 100 shares of Common Stock at $15 / share, you will receive 110 shares of Common Stock, meaning you'll own 110 shares for $1,500. Fractional shares will not be distributed and share bonuses will be determined by rounding down to the nearest whole share.

This 10% Bonus is only valid during the investors' eligibility period. Investors eligible for this bonus will also have priority if they are on a waitlist to invest and the company surpasses its maximum funding goal. They will have the first opportunity to invest should room in the offering become available if prior investments are cancelled or fail.

Investors will only receive a single bonus, which will be the highest bonus rate they are eligible for.

Irregular Use of Proceeds

ALL UPDATES

03.29.22

Last day to invest!

Thank you to everyone that invested in our campaign thus far. There is still just a little time to do so under these terms.

You may see us again here yet if you are 'on the fence', we encourage you to invest before this clock runs out.

Big things ahead as our user growth continues to flourish.

02.04.22

New Update from SongSplits!

First of all, we'd like to say a big THANK YOU to all that have invested so far in our campaign. We appreciate your trust and confidence!

To those of you that are following but have not yet committed, please get on board and help us continue to change the industry.

Some quick updates: Our team has been working on some new features that we expect to be releasing in the next handful of weeks to include a portal for music publishers to manage their songwriter data (on a subscription basis) as well greater energy around the Who's Looking List to help songwriters get their music connected with major artists (also on a subscription basis)...and we finally have our mobile app being developed now as well!

Ultimately we want our platform to be the place where songwriters go first to make sure their royalty splits are cross-verified, connect with artists to have the songs recorded and then to be able to manage and collect those royalties directly from our platform (all in one place).

Very excited about where we are headed and again, THANK YOU, to those of you that have invested and those of you that will be investing soon!

Sincerely,

Todd Wright & Al McLean

REWARDS

Venture Club

Venture Club Members earn 10% bonus shares on top of this and all eligible investments for an entire year. Not a member? Sign up at checkout ($275/year).

$2,500

Tier 1

SongSplits Shirt.

$5,000

Tier 2

SongSplits Shirt and trucker hat.

$10,000

Tier 3

5% bonus shares.

$25,000

Tier 4

10% bonus shares

$50,000

Tier 5

10% bonus shares + Invitation to quarterly CEO Roundtable.

JOIN THE DISCUSSION

0/2500

Benny Rodriguez

4 years ago

interesting idea. the company has to make money. can you lay out and example what you will charge in a split in case of a split is it a one time fee or royalty, percentage?

Show more

1

0

Marc Russell

4 years ago

First I would like to see some responses to previous comments. I like the concept and see the solution it's bringing to the market. However, what is the revenue model? I see there were efforts to earn revenue in the 2020 year, but none are posted, have you received any this year? With a following of over 200,000 users I would expect to see some revenue. Is it based on managing the songsplit? Or are you a broker for royalties of songwriters who want to sell? I'm try to understand the % that song splits gets for providing this service to songwriters.

Show more

3

0

Andrew Coppola

4 years ago

Interesting idea, but the valuation is too high. A round like this should be priced to reward investors who support the company when there is $0 in revenue.

Show more

3

1

MICHAEL DELAPENA

4 years ago

Agree with the previous comment. My initial reaction was this is another checkbox style Docusign but for music, so caution on existing platform's ability to duplicate systematizing music contracts. You may want to look at https://audius.co/ which is already addressing empowering artists. See if you can integrate blockchain. Wish you success! (LaneAxis and Metaiye Knights investor)

Show more

1

2

Justin Koo

4 years ago

Hi, perhaps I missed on the explanation, but I’m thinking that your digital process is a perfect candidate for a blockchain. Use of a utility coin. Have you ever considered that? It will eventually add another revenue stream for your company. Check LaneAxis as the reference. -Justin

Show more

1

2

HOW INVESTING WORKS

Cancel anytime before 48 hours before a rolling close or the offering end date.

WHY STARTENGINE?

REWARDS

We want you to succeed and get the most out of your money by offering rewards and memberships!

SECURE

Your info is your info. We take pride in keeping it that way!

DIVERSE INVESTMENTS

Invest in over 200 start-ups and collectibles!

FAQS

With Regulation A+, a non-accredited investor can only invest a maximum of 10% of their annual income or 10% of their net worth per year, whichever is greater. There are no restrictions for accredited investors.

With Regulation Crowdfunding, non-accredited investors with an annual income or net worth less than $124,000 are limited to invest a maximum of 5% of the greater of those two amounts. For those with an annual income and net worth greater than $124,000, they are limited to investing 10% of the greater of the two amounts.

At the close of an offering, all investors whose funds have “cleared” by this time will be included in the disbursement. At this time, each investor will receive an email from StartEngine with their Countersigned Subscription Agreement, which will serve as their proof of purchase moving forward.

Please keep in mind that a company can conduct a series of “closes” or withdrawals of funds throughout the duration of the campaign. If you are included in that withdrawal period, you will be emailed your countersigned subscription agreement and proof of purchase immediately following that withdrawal.

StartEngine assists companies in raising capital, and once the offering is closed, we are no longer involved with whether the company chooses to list shares on a secondary market or what occurs thereafter. Therefore, StartEngine has no control or insight into your investment after the close of the live offering. In addition, we are not permitted to provide financial advice. You may want to contact a financial professional to discuss possible investment outcomes.

For Regulation Crowdfunding, investors are able to cancel their investment at any point throughout the campaign up until 48 hours before the closing of the offering. Note: If the company does a rolling close, they will post an update to their current investors, giving them the opportunity to cancel during this timeframe. If you do not cancel within this 5-day timeframe, your funds will be invested in the company, and you will no longer be able to cancel the investment. If your funds show as ‘Invested’ on your account dashboard, your investment can no longer be canceled.

For Regulation A+, StartEngine allows for a four-hour cancellation period. Once the four-hour window has passed, it is up to each company to set their own cancellation policy. You may find the company’s cancellation policy in the company’s offering circular.

Once your investment is canceled, there is a 10-day clearing period (from the date your investment was submitted). After your funds have cleared the bank, you will receive your refund within 10 business days.

Refunds that are made through ACH payments can take up to 10 business days to clear. Unfortunately, we are at the mercy of the bank, but we will do everything we can to get you your refund as soon as possible. However, every investment needs to go through the clearing process in order to be sent back to the account associated with the investment.

Both Title III (Regulation Crowdfunding) and Title IV (Reg A+) help entrepreneurs crowdfund capital investments from unaccredited and accredited investors. The differences between these regulations are related to the investor limitations, the differing amounts of money companies are permitted to raise, and differing disclosure and filing requirements. To learn more about Regulation Crowdfunding, click here, and for Regulation A+, click here.

Marc Russell

3 years ago

Any updates from 2021 would be greatly appreciated. Users, growth, revenue, etc.

1

0