CLOSED

GET A PIECE OF CERTIFIED TRUE, INC.

Only believe what is CertifiedTrue - Accurate. Authentic. Original.

Show more

TEAM

Stephen Graves • Founder & CEO

Read More

Clive Boulton • Co-Founder & Chief Technical Architect

Read More

VJ Tabone • Co-Founder & Head of Business Development

Read More

Reasons to Invest

- EARLY MOVER WITH CUTTING EDGE TECHNOLOGY

CertifiedTrue is an early entrant into fraud prevention through certification and verification of digital photos and other files, with a product (PhotoProof) built on proprietary 4th gen blockchain technology and early mover advantages across multiple industries with a path to viral growth.

- HUGE MARKET ACROSS MULTIPLE INDUSTRIES

Market opportunities across TIC, insurtech and legaltech that are expected to grow exponentially. The global Testing, Inspection and Certification market was valued at $213.60 billion in 2020 and is estimated to reach $349.27 by 2030, growing at a CAGR of 5.3%.* The global insurtech industry was valued at $9.41 billion in 2020 is estimated to generate $158.99 billion by 2030**, growing at a CAGR of 32.7% from 2021 to 2030; in 2020, the global legal tech market was valued at $17.6 billion.***

- EXPERIENCED TECH AND BUSINESS TEAM

CertifiedTrue has a team with many years of experience in the technology and the business side of the targeted industries we focus on, with deep relationships and a history of execution. Our Directors and Advisors are established industry leaders which will give us a leg up on becoming the gold standard for third party certification and verification of digital images.

**Source

***Source

Overview

We provide protection from image fraud

CertifiedTrue enables law firms, businesses and government organizations to capture and store photos in a manner that makes them reliable and makes image fraud a thing of the past. Our app makes it easy to take attested, geo-tagged, time-stamped, and immutably registered photos with a smartphone. Users can annotate photos, manage cases, make notes, and tag photos all through our secure cloud network. This process provides a secure service that enables companies to capture, manage, and authenticate digital photos that will stand up in court and help win more cases because people can trust the evidence they provide.

The Problem

Law firms and courts struggle with image fraud

g

Now more than ever, digital photos are easy to manipulate and can't be trusted to be a reliable source of truth. This has become a significant problem for law firms and courts, who have been unable to keep up with the pace of technology. Law firms can't easily demonstrate the chain of custody of photos they have in their case management systems or files and the same is true for prosecutors and police. This exposes legal cases, clients, lawyers and their firms to risk. When it's so easy to create fake news, photoshop images, and submit AI-assisted deep fakes that can sway a judge and jury, firms need a reputable tool to counter this problem and can’t just rely on what their clients email them.

g

All it takes is one bad case, one dishonest client and law firms risk losing their good name, an important case and clients. A malpractice suit could even put the entire firm in jeopardy. In the digital age, clients expect the firms that represent them to leverage technology to defend them, secure a competitive edge and win their cases. The firms who survive and thrive with these new demands will be those who have the tools to stay ahead of the tech curve instead of being crushed by it. At the same time, police and prosecutors face pressure to release evidence quickly that all parties can rely on as the source of truth.

The answer is digital photographs and videos taken with Certified True’s PhotoProof solution. Photoproof establishes an unbreakable chain of custody from collection to cloud storage to the courthouse steps.

THE SOLUTION

We create photos you can trust

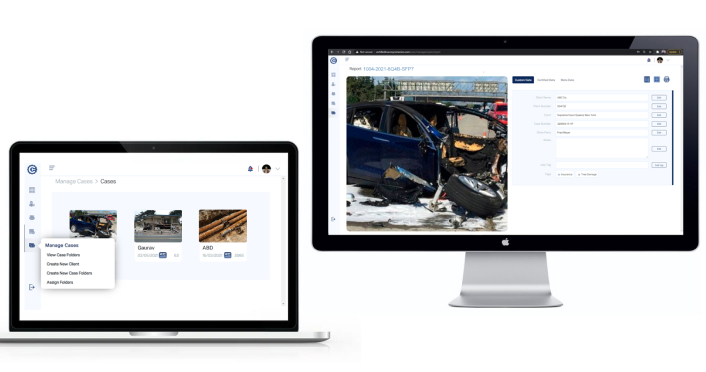

CertifiedTrue provides a secure service that enables anyone with a phone to capture, manage, and authenticate digital photos that will stand up in court. Using our PhotoProof platform, users can capture photos and videos and then manage, search, and use account management and permission features of the photos for optimum case management and client folder access. On the back-end, our core technology is a unique system we have custom-built from our deep experience with blockchain networks and protocols that ensures chain of custody and immutability. On the front end a user-friendly interface optimizes case and file management and client billing to seamlessly integrate CertifiedTrue right into a law firm’s existing workflows and case management protocols.

CertifiedTrue is as user-friendly as it gets. Simply take a photo on your phone through our app, which captures the unique digital fingerprint of the image and its metadata. That unique ID is recorded on our blockchain registry and the image is uploaded in the cloud to a secure archive where you can manage, annotate, and assign them to client files or cases in our web app. Verifying a photo is as easy as entering the unique CertifiedTrue ID on the verification page of our website. When needed for court, simply print out the CertifiedTrue report with the photo and details and provide the file.

The key is that your CertifiedTrue image is indelible, immutable and defensible evidence. Any other photo can be easily doctored and manipulated with critical metadata like geolocation or date stripped away or changed. Artificial Intelligence can now even create photos and videos that have never existed at all. That isn't possible with a CertifiedTrue photo because the cryptographic identity of the photo has been recorded on an immutable registry. If even a single pixel or piece of data is changed, then the image cannot be verified. At the same time, courts and lawyers can confidently share the image with any necessary parties, secure in the knowledge that all are working with the original “proof” and that it has not been surreptitiously altered or edited.

Instead of the near impossible task of detecting fakes, CertifiedTrue provides assurance that you have real proof from the time the shutter snaps.

g

Business Model

Our business model is providing a SaaS product that enables reliable certification, management and verification of digital files. Initial target market is law firms, corporate counsel and law enforcement. We make money by charging a monthly fee based on the number of users as well as how many photos are taken and stored. Our services start at $195 monthly for a solo practitioner and increase in price as customers’ needs scale.

THE MARKET

We are creating our own path

We believe the global market opportunity is enormous for CertifiedTrue to provide trustworthy independent third-party certification and verification of digital images. As one of the early first movers, however, the market segment has not yet been well defined.

While CertifiedTrue can be tagged as a prepackaged software, B2B SaaS, blockchain, legaltech, insurtech or govtech company, our primary value proposition best aligns with the Testing, Inspection and Certification (TIC) industry. Conceptually, our application is essentially the certifiable capture of an image as an integrated part of an inspection/documentation process and verification that the created digital object and its provenance meets a certain standard of reliability. The TIC market stretches across almost every industry, is valued over $200 Billion annually and is expected to grow to $349 Billion by 2030 (CAGR of 5.3%), with the most exciting growth trends in the digital transformation of services and tools enabling in-house services. (Source)

While our early competition in the space is focused on other submarkets, namely insurance, CertifiedTrue’s technology best addresses the needs of reliable evidence for court purposes for the civil and criminal legal market as well as police and prosecutor’s offices. Our market plan has an inherent viral component that will give us a major advantage in growth and brand awareness that our competitors cannot match. Moreover, our team has a greater vision of how the technology integrates through multiple industries and a better path to adoption than other companies in this space.

Another substantial differentiating factor from our competitors is the underlying technology of our core platforms, especially their reliance upon public blockchains. The previous generation of digital certification software could not easily provide a trustworthy “proof of origin” and chain of custody of the file creation. The advent of Blockchain technology solved the problem but has been plagued with issues related to scaling, variable cost structures and security holes. Our proprietary technology is a further refinement of blockchain technology, specifically tailored to certification, registry and verification of particular types of digital files.

Advancements in technology have enabled our solution to solve the problem of origin proofs, which has the ability to work across several, billion-dollar industries. The initial use case is for digital photographs but our technology can also cover other file types as well where provenance or chain of custody are a priority.

OUR TRACTION

A new application of a blockchain inspired technology

Originally, CertifiedTrue set out to provide a blockchain platform that would address needs across the legal, insurance and real estate industries. In 2018, we were a finalist for Best Blockchain application from the Real Estate Board of New York, for what eventually evolved into our current product, PhotoProof. We labored over 3 years in research and development, to create a provably secure system to capture, store and record data that would not have the problems of scalability, usability, energy consumption, security and regulatory issues inherent with public blockchains.

Indeed, many blockchain applications that were little more than smart contracts raised funds and rushed to market without a real understanding of the real demand for their product by potential clients. Meanwhile, our team spent many hundreds of hours validating our markets to find where the real need was, the operational processes around those needs and which markets were most likely to pay to solve their very real pain points.

All that hard work culminated in the development of CertifiedTrue’s proprietary platform, PhotoProof, built on technology that we are confident will be considered the next iteration of Blockchain. PhotoProof consists of a web based application, an ecommerce enabled admin app, android and IOS mobile apps connecting to the core system’s cloud based immutable ledger and secure storage network. Our most significant milestone to date has been completing the alpha version of this platform, which is now in testing.

WHY INVEST

The gold standard in fraud protection

g

Simply put, law, commerce and government cannot operate without public trust in the visual evidence we rely on. That trust has eroded as technology has made it increasingly difficult to detect when images have been manipulated. CertifiedTrue restores that trust by setting the standard for ensuring accuracy, authenticity and originality of digital images.

Indeed, the future for the legal, government, insurance, and real estate industries can be found in the innovative reimagining and repurposing of the next wave of blockchain style technology. All of those industries have a foundation now dependent on information processing, and our software services are designed to augment and secure the very frameworks they operate on. Our vision is for CertifiedTrue to lead this movement for trust and transparency in a digital world and become the trusted name in digital security while building a company that hopefully generates billions in revenue. Join CertifiedTrue on this potentially massive movement and become a shareholder today.

ABOUT

HEADQUARTERS

220 Mineola Boulevard Ste 10

Mineola, NY 11501

WEBSITE

View Site

TERMS

Overview

PRICE PER SHARE

DEADLINE

Jun. 10, 2025 at 5:50 AM UTC

VALUATION

Breakdown

MIN INVESTMENT

MAX INVESTMENT

OFFERING TYPE

Maximum Number of Shares Offered subject to adjustment for bonus shares

ALL UPDATES

02.08.22

CertifiedTrue getting attention

Our StartEngine campaign has helped CertifiedTrue attract attention on multiple fronts. In January, our team has been busy meeting with angels and VCs whoo have sbown interest in our financing plans. Also, CertifiedTrue has gotten a lot of interest from multiple news sources and our CEO has responded to multiple queries on our technology and our company from various writers from various publications including Tech Times, MarketWatch, Washington Post, CEO World, DecentralizedNow, and the Digital Journal.

As these and other articles are published over the next few weeks, we will be linking to them on our site at https://www.certifiedtrue.com/press-coverage/.

Also, VJ, who heads up our bizdev and used to be the Deputy Superintendent of Insurance for New York State met with the New York Insurance Association. They indicated PhotoProof might fill the need/substitute for the regulatorily mandated photo inspections, invited us to write an article in their quarterly magazine and to attend their annual conference in June. NYIA's membership is comprised of national and regional insurance companies and it is an important trade group for CertifiedTrue.

12.20.21

Notice of Funds Disbursement

[The following is an automated notice from the StartEngine team].

Hello!

As you might know, Certified True, Inc. has exceeded its minimum funding goal. When a company reaches its minimum on StartEngine, it's about to begin withdrawing funds. If you invested in Certified True, Inc. be on the lookout for an email that describes more about the disbursement process.

This campaign will continue to accept investments until its indicated closing date.

Thanks for funding the future.

-StartEngine

REWARDS

Venture Club

Venture Club Members earn 10% bonus shares on top of this and all eligible investments for an entire year. Not a member? Sign up at checkout ($275/year).

$2,500

2500+

10% Bonus Shares

$5,000

$5,000+

12% Bonus Shares

$10,000

$10000+

15% Bonus Shares

$25,000

$25,000+

20% Bonus Shares

$50,000

$50000+

25% Bonus Shares and a video call with the CEO

$100,000

$100000+

30% Bonus Shares and dinner with the CEO (USA location)

JOIN THE DISCUSSION

0/2500

PINNED BY STARTUP

charles Ribando

4 years ago

Charles Ribando - As an experienced licensed private investigator with over 30-years of law enforcement and public safety related experience including leading the Nassau County's District Attorney's Investigative Division and as a Supervisor of Detectives and Federal Agents for the NYPD’s FBI-NYPD Joint Terrorism Taskforce I can tell you that I believe that this technology could be a game-changer for trial lawyers, district attorneys and police departments

Show more

0

1

Varun Gupta

3 years ago

Hi, can you please provide a quarterly update and are you planning to next fund raise? Thanks.

0

0

Varun Gupta

3 years ago

Can you please provide quarterly update? Thanks.

0

0

James Bondulich

3 years ago

Please extend the offering. StartEngine, is about to launch a new raise for themselves and will all the advertising that they will be doing (using the money from the last raise), many new investors will be coming to the platform.

Show more

1

0

Michael Nadler

3 years ago

Stephen, thanks for the quick answers. I really don't like that your funding this round is under $100K (I don't like to invest in anything under $100K). Do you plan to extend the round? What's the use of the funds, how long do believe the funds will last for, and what's your monthly burn rate? Since you have no patent or even product yet, what are you currently spending money on aside from I guess you say salaries or rent? Additionally, why's certified true business/products necessary when you have a notary? Is the argument against a notary is this is a newer and better process? Also although you may be a first mover, what's to stop newer, larger, more resourceful player(s) to come into this space and take over and crush the business? Without the patent you say this business is nothing, so when will you be filing a patent(s)? What's the timeline on this patent process? Please elaborate on this further. Also, back to my point about NFTs and you laughing at NFTs in the article you mentioned- although I agree NFTs are a bubble today and the use of them is currently limited, an NFT and companies/institutions can use NFTs to do EXACTLY what you're doing, no? Lastly, even if that answer is no, how is this different than cryptos along the lines of filecoin/etc? Mind you, all of these questions come from a curious and interested investor trying to find a valid and conclusive reason to invest.

Show more

1

0

Michael Nadler

3 years ago

Also, how far along is the business? No patents filed yet? Any partnerships in place here in the US? If yes, with who?

Show more

0

0

Michael Nadler

3 years ago

In theory this company seems like a win, but in reality seems a little confusing- how is this product/service relevant when we have smart contracts and nfts? Is any of the business cryptography based or as of now 100% traditional saas based? Please elaborate on “4th gen” “blockchain inspired technology”. Thanks. I’m very interested and want to first make sure I understand what I’m getting into.

Show more

1

0

Michael Nadler

3 years ago

Who are or who would you consider as competitors, and how do you believe you're unique or different and what sets you apart from this competition?

Show more

2

0

Marc Pitre

3 years ago

My first thought was... how cool of an idea. My second unfortunately was... what's to stop device manufacturers like Apple from just including certifications right in the handsets? They already have iCloud and complete control over the device. A couple of tweaks to their software and boom... it's done. I ask only to hear your competitive thoughts.

Show more

1

0

HOW INVESTING WORKS

Cancel anytime before 48 hours before a rolling close or the offering end date.

WHY STARTENGINE?

REWARDS

We want you to succeed and get the most out of your money by offering rewards and memberships!

SECURE

Your info is your info. We take pride in keeping it that way!

DIVERSE INVESTMENTS

Invest in over 200 start-ups and collectibles!

FAQS

With Regulation A+, a non-accredited investor can only invest a maximum of 10% of their annual income or 10% of their net worth per year, whichever is greater. There are no restrictions for accredited investors.

With Regulation Crowdfunding, non-accredited investors with an annual income or net worth less than $124,000 are limited to invest a maximum of 5% of the greater of those two amounts. For those with an annual income and net worth greater than $124,000, they are limited to investing 10% of the greater of the two amounts.

At the close of an offering, all investors whose funds have “cleared” by this time will be included in the disbursement. At this time, each investor will receive an email from StartEngine with their Countersigned Subscription Agreement, which will serve as their proof of purchase moving forward.

Please keep in mind that a company can conduct a series of “closes” or withdrawals of funds throughout the duration of the campaign. If you are included in that withdrawal period, you will be emailed your countersigned subscription agreement and proof of purchase immediately following that withdrawal.

StartEngine assists companies in raising capital, and once the offering is closed, we are no longer involved with whether the company chooses to list shares on a secondary market or what occurs thereafter. Therefore, StartEngine has no control or insight into your investment after the close of the live offering. In addition, we are not permitted to provide financial advice. You may want to contact a financial professional to discuss possible investment outcomes.

For Regulation Crowdfunding, investors are able to cancel their investment at any point throughout the campaign up until 48 hours before the closing of the offering. Note: If the company does a rolling close, they will post an update to their current investors, giving them the opportunity to cancel during this timeframe. If you do not cancel within this 5-day timeframe, your funds will be invested in the company, and you will no longer be able to cancel the investment. If your funds show as ‘Invested’ on your account dashboard, your investment can no longer be canceled.

For Regulation A+, StartEngine allows for a four-hour cancellation period. Once the four-hour window has passed, it is up to each company to set their own cancellation policy. You may find the company’s cancellation policy in the company’s offering circular.

Once your investment is canceled, there is a 10-day clearing period (from the date your investment was submitted). After your funds have cleared the bank, you will receive your refund within 10 business days.

Refunds that are made through ACH payments can take up to 10 business days to clear. Unfortunately, we are at the mercy of the bank, but we will do everything we can to get you your refund as soon as possible. However, every investment needs to go through the clearing process in order to be sent back to the account associated with the investment.

Both Title III (Regulation Crowdfunding) and Title IV (Reg A+) help entrepreneurs crowdfund capital investments from unaccredited and accredited investors. The differences between these regulations are related to the investor limitations, the differing amounts of money companies are permitted to raise, and differing disclosure and filing requirements. To learn more about Regulation Crowdfunding, click here, and for Regulation A+, click here.

PINNED BY STARTUP

Randy Kleinman

4 years ago

As an experienced trial and appellate attorney I believe this legal tech innovation is long overdue. When I represented the City of New York as an Assistant Corporate Counsel having this technology at our disposal would have been a world of a difference. The same holds for private practice. The use of digital evidence is so prevalent and so often a deciding factor having CertifiedTrue photographs available helping establish their provenance and admissibility is the kind of competitive edge my clients expect and deserve.

Show more

0

1