CLOSED

GET A PIECE OF CADI, INC.

Combining autonomous retail and ecommerce to revolutionize golf

$483,889.45 Raised

TEAM

Tyler Gottstein • Chief Executive Officer & Director

Matt Ahrens • Chief Operating Officer

Reasons to Invest

- Our retail technology platform has proven market fit and will lead the transition to autonomous retail in the $126B sporting goods market.

- Community focused marketplace offering a one-of-a-kind product fitting by data. Cadi’s community have access to try before you buy on all products and the largest cash back rewards membership model in golf.

- With approximately $1.5M+ in pilot testing sales, Cadi has signed letters of intent from 63 golf courses unlocking significant revenue and access to over 250,000 golfers.

- Cadi’s management teams are leading experts in autonomous retail leading to strong partnerships with the biggest brands in golf.

- Cadi’s autonomous technology combines patent-pending proprietary technology in kiosks, warehousing, and data club fitting that leads to a one-of-a-kind retail experience for users.

- Cadi has already raised approximately $1.5M from over 1650 investors. Cadi has investments from people from all 50 states.

Overview

Leading the autonomous future of golf retail

Cadi is transforming the traditional golf industry with an autonomous solution built for golfers. You can now demo clubs right on the course whenever you want. When you find the perfect club, it can be purchased instantly through our self-service kiosk and e-commerce platform. There are no salespeople and no hassles, just golfers with freedom to play the newest equipment. Our team and technology are paving the way for a new hybrid omnichannel that changes how golf products are sold and distributed for years to come.

Currently, Cadi's Application, eCommerce platform, and physical Cadi Kiosk are in development phases.

Cadi makes it extremely simple to purchase when you are ready. Whether online or in-person, Cadi leverages golf courses to create micro fulfillment centers that fulfill on-demand orders and expedite shipping for online orders. It is instant gratification like the golf industry has never had before.

*Image of Cadi Kiosk, which is not currently on the market.

problem

Evolving retail changes the way people shop and leaves golfers behind

Today, the only two options to purchase products are visiting a traditional retail store or buying online. Now we are seeing the world change as the COVID-19 pandemic accelerates the shift to more online shopping than ever before. This shift significantly threatens sporting goods because many products, such as golf clubs, we believe are not best sold online.

Golfers need to feel and demo products they wish to buy online. Unfortunately, the majority of golf courses do not effectively sell golf products. The current retail experience only offers unrealistic indoor trials or infrequent demo days. It is no surprise that 90% of golfers prefer to demo products on a golf course or driving range before buying equipment. The result is two-thirds of customers are unhappy with their purchase within 14 days with no option for money back.

Solution

An innovative, retail automation platform that merges physical kiosks and online shopping

*Image of Cadi Kiosk, which is not currently on the market.

Cadi’s platform is the combination of an autonomous, patent-pending kiosk and an integrated online marketplace. We combine the best of online shopping with the benefits of traditional retail stores. Currently, Cadi's Application and eCommerce platform are in development phases. The physical Cadi Kiosk is available on the market.

Our technology leverages a golfer’s most desired location, golf courses, to create a network of kiosks. Our kiosks give golfers the freedom to demo, compare, and purchase products at their convenience. Cadi uses Big Data and Artificial Intelligence to curate product selection and create a personalized experience for each customer.

*Image of Cadi Application, which is not currently on the market.

Cadi’s online marketplace gives golfers 24/7 access to our platform. A fully connected omnichannel means golfers can interact using any device from any location.

Innovation

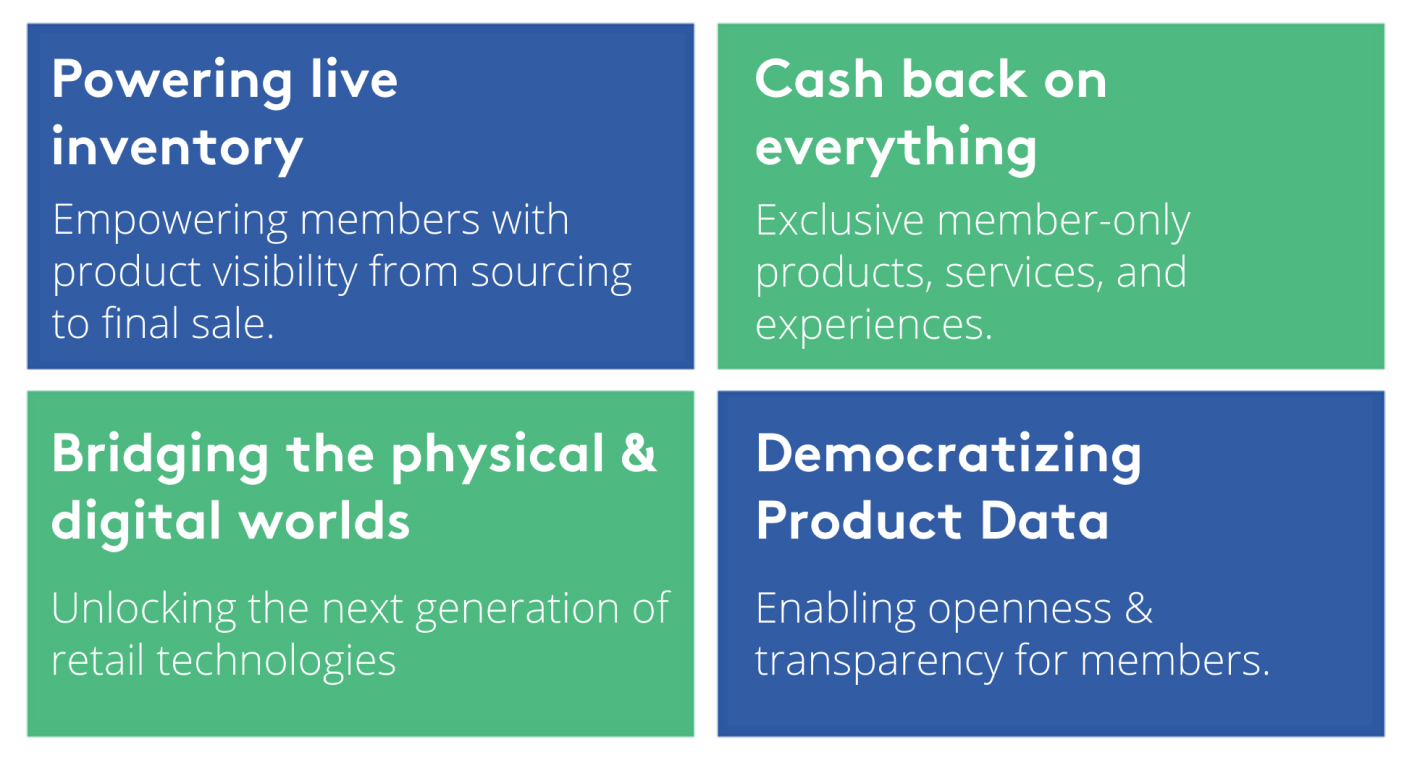

Cadi Technology stack enables game-changing customer experiences.

*Image of Cadi Application, which is not currently on the market.

Cadi's digital community is at the root of Cadi's success. Cadi's marketplace has three key features. First, every user has a custom experience using Cadi's data analytics. Cadi's database connects golfer attributes to curated product attributes. Second, Cadi offers a try before you buy program on all products. Finally, Cadi's industry-first cashback membership program incentives purchases and other essential data collecting actions. CadiCash can be used on traditional products and limited edition products, services, and one-of-a-kind experiences.

Market

Cadi’s innovative technology brings convenience from the screen to the green

We recognized that the golf industry is heavily concentrated with little innovation for the past 20 years. Top retailers are either traditional brick and mortar or exclusively e-commerce. No clear leader in the market is seamlessly integrating physical and virtual shopping. This is a large and fast-growing opportunity. Cadi has significant advantages with patent-pending technology and a first-to-market strategy.

Our target kiosk locations are high-traffic public courses in areas with low seasonality and a high density of courses. 80% of all golf courses in the U.S. are public golf facilities, the industry’s “forgotten retail channel” where we aim to expand. We are also pursuing opportunities at entertainment venues, driving ranges, and new-age shopping malls. With the popularity of venues such as TopGolf, golf is seeing record rounds of play and increasing participation at all levels.

(or click)

(or click)

(or click)

ABOUT

HEADQUARTERS

2032 Convent Place

Nashville, TN 37212

WEBSITE

View Site

TERMS

Cadi, Inc.

Overview

PRICE PER SHARE

$1.40

DEADLINE

May. 1, 2022 at 6:59 AM UTC

VALUATION

$41.99M

FUNDING GOAL

$10K - $3.52M

Breakdown

MIN INVESTMENT

$249.20

MAX INVESTMENT

$3,518,508

MIN NUMBER OF SHARES OFFERED

7,142

MAX NUMBER OF SHARES OFFERED

2,513,220

OFFERING TYPE

Equity

SHARES OFFERED

Class B Common Stock

Maximum Number of Shares Offered subject to adjustment for bonus shares

Investment Incentives*

Early Bird

Cadi Community, Investors, and VIPs - First 15 days | 25% bonus shares

Super Early Bird - Next 21 days | 10% bonus shares

Early Bird Bonus - Next 21 days | 5% bonus shares

Volume

Tier 1 perk ($500+) - Join the team: Receive a $25 Gift card to Cadi's Merch Store. Welcome to Cadi.

Tier 2 perk ($1,000+) - Cadi Champions Member: $50 gift card in Cadi's merch plus a one-year subscription to Cadi Premium membership (valued at an estimated $240).

Tier 3 perk ($6,000+) - FREE 2022 Driver from any top Brand available on the Cadi marketplace. The perk will be redeemed on Cadi new Marketplace. Includes a Cadi premium membership and all perks associated with that membership level. Driver credit will be applied at the close of the current campaign for the Cadi Marketplace.

Tier 4 perk ($12,500+) - 5% bonus shares + FULL ACCESS Golf Weekend in San Diego with the Cadi Founders. Cadi will host you and a partner to Carlsbad, CA to Cadi’s Headquarters. Meet the Cadi team, firsthand experience Cadi’s prototype kiosk, warehousing technology, and other projects the team is working on. Stay in San Diego and play the best championship courses in San Diego. Enjoy quality time with the Cadi team and other members of the Cadi community. PERK includes a one-night stay near Cadi headquarters and a $250 Southwest gift Card towards airfare.

Perk 5: Golf with PGA Golfer Paul Casey plus 20% BONUS SHARES. Invest $25,000 or more and you will be invited to join Matt and Tyler in Scottsdale, AZ for a lesson and round of golf with PGA Professional Paul Casey. Included in the cost is $500 airfare credit, a one-night hotel stay, and round of golf. This event is scheduled to occur before 12/31/22. You will have the option to choose between perk 4 and perk 5 if you choose. This also includes everything listed in PERK 2.

Perk 6 -- EVEN MORE BONUS SHARES. Increased Bonus Shares. Invest $50,000 or more and receive 30% bonus shares. This is not common for companies to offer this big of an incentive. Additionally, you will be invited to choose between Cadi PERK 3 or PERK 4. This also includes everything listed in PERK 2.

*All perks occur when the offering is completed.

The 10% StartEngine Owners' Bonus

Cadi, Inc. will offer 10% additional bonus shares for all investments that are committed by investors that are eligible for the StartEngine Crowdfunding Inc. OWNer's bonus.

This means eligible StartEngine shareholders will receive a 10% bonus for any shares they purchase in this offering. For example, if you buy 100 shares of Class B Common Stock at $1.40 / share, you will receive 110 shares of Class B Common Stock, meaning you'll own 110 shares for $140. Fractional shares will not be distributed and share bonuses will be determined by rounding down to the nearest whole share.

This 10% Bonus is only valid during the investor's eligibility period. Investors eligible for this bonus will also have priority if they are on a waitlist to invest and the company surpasses its maximum funding goal. They will have the first opportunity to invest should room in the offering become available if prior investments are canceled or fail.

Investors will only receive a single bonus, which will be the highest bonus rate they are eligible for.

Insider Investment Notice

Officers, directors, executives, and existing owners with a controlling stake in the company (or their immediate family members) may make investments in this offering. Any such investments will be included in the raised amount reflected on the campaign page.

Irregular Use of Proceeds

PRESS

ALL UPDATES

REWARDS

Venture Club

Venture Club Members earn 10% bonus shares on top of this and all eligible investments for an entire year. Not a member? Sign up at checkout ($275/year).

$500

Perk 1: Join the team

Receive a $25 Gift card to Cadi's Merch Store. Welcome to Cadi.

$1,000

Perk 2: Cadi Champions Member

$50 gift card in Cadi's merch plus a one-year subscription to Cadi Premium membership (valued at an estimated $240).

$6,000

Perk 3: 2022 Driver

FREE 2022 Driver from any top Brand available on the Cadi marketplace. The perk will be redeemed on Cadi new Marketplace. Includes a Cadi premium membership and all perks associated with that membership level. See more in terms below.

$12,500

Perk 4: FULL ACCESS SD golf weekend with Cadi

5% bonus shares + FULL ACCESS Golf Weekend in San Diego with the Cadi Founders. Cadi will host you and a partner to Carlsbad, CA to Cadi’s Headquarters. See more in terms below.

$25,000

Perk 5: Golf with Paul Casey plus 20% BONUS SHARES

Invest $25,000 or more and you will be invited to join Matt and Tyler in Scottsdale, AZ for a lesson and round of golf with PGA Professional Paul Casey. See more in terms below.

$50,000

Perk 6: EVEN MORE BONUS SHARES + 30% bonus shares

Increased Bonus Shares. Invest $50,000 or more and receive 30% bonus shares. This is not common for companies to offer this big of an incentive. See more in terms below.

JOIN THE DISCUSSION

0/2500

PINNED BY STARTUP

Marc Russell

3 years ago

Invested last time and looking to add more. I recently came across sparrowup.com that can use an app to analyze your golf swing. Is Cadi looking to partner or integrate their own similar solution as one of the first steps to a full golf swing analysis? Or where do you see Cadi moving forward in helping golfers in swing analysis?

Show more

1

1

Joseph Novak

3 months ago

Any updates on when this investment will hold a value?

0

0

Spencer Blackman

3 years ago

Hey guys - excited to be a new investor in Cadi. Such an exciting new model. Can you point me to how one can redeem the perks that come with investing? Thanks!

Show more

2

0

David Coleman

3 years ago

I qualify for a $50 merchandise card and a year subscription to something, when do i see that because i want to order something from the Cadi store so i can be pro-filing, LOL !!!!!!

Show more

1

0

Samuel Keller

3 years ago

Hello, happy to be an investor here! Excited for what the future holds. Can someone tell me how many shares have been issued so far in this company? I probably overlook it but wasn’t able to find it. Thanks, Sam

Show more

1

0

Mike Ingrassia

3 years ago

Congratulations on Paul Casey especially after a strong showing at The Players!! . you guys have made some impressive strides since I first stumbled on your company just randomly scrolling through Start Engine for the first time. I was immediately drawn to. your company and business model. I have since made 2 investments and really glad I did . Congrats again and keep up the amazing work great job!!

Show more

1

0

Jason Goldie

3 years ago

Hi, I’m looking forward to seeing this take off. Appreciate the opportunity!

1

0

Jeffrey Doyle

3 years ago

Hi, invested 2/17/22, wondering how long until im confirmed as a invester?

1

0

Ajith Potluri

3 years ago

Hi Mr. Tyler Surprised to see Cadi campaign is closing in 22 days, what is the reason for closing in such a short period. Any big investors or VC's ready to pitch in for the rest of the amount. look forward to your reply. Thank you

Show more

1

0

HOW INVESTING WORKS

Cancel anytime before 48 hours before a rolling close or the offering end date.

WHY STARTENGINE?

REWARDS

We want you to succeed and get the most out of your money by offering rewards and memberships!

SECURE

Your info is your info. We take pride in keeping it that way!

DIVERSE INVESTMENTS

Invest in over 200 start-ups and collectibles!

FAQS

With Regulation A+, a non-accredited investor can only invest a maximum of 10% of their annual income or 10% of their net worth per year, whichever is greater. There are no restrictions for accredited investors.

With Regulation Crowdfunding, non-accredited investors with an annual income or net worth less than $124,000 are limited to invest a maximum of 5% of the greater of those two amounts. For those with an annual income and net worth greater than $124,000, they are limited to investing 10% of the greater of the two amounts.

At the close of an offering, all investors whose funds have “cleared” by this time will be included in the disbursement. At this time, each investor will receive an email from StartEngine with their Countersigned Subscription Agreement, which will serve as their proof of purchase moving forward.

Please keep in mind that a company can conduct a series of “closes” or withdrawals of funds throughout the duration of the campaign. If you are included in that withdrawal period, you will be emailed your countersigned subscription agreement and proof of purchase immediately following that withdrawal.

StartEngine assists companies in raising capital, and once the offering is closed, we are no longer involved with whether the company chooses to list shares on a secondary market or what occurs thereafter. Therefore, StartEngine has no control or insight into your investment after the close of the live offering. In addition, we are not permitted to provide financial advice. You may want to contact a financial professional to discuss possible investment outcomes.

For Regulation Crowdfunding, investors are able to cancel their investment at any point throughout the campaign up until 48 hours before the closing of the offering. Note: If the company does a rolling close, they will post an update to their current investors, giving them the opportunity to cancel during this timeframe. If you do not cancel within this 5-day timeframe, your funds will be invested in the company, and you will no longer be able to cancel the investment. If your funds show as ‘Invested’ on your account dashboard, your investment can no longer be canceled.

For Regulation A+, StartEngine allows for a four-hour cancellation period. Once the four-hour window has passed, it is up to each company to set their own cancellation policy. You may find the company’s cancellation policy in the company’s offering circular.

Once your investment is canceled, there is a 10-day clearing period (from the date your investment was submitted). After your funds have cleared the bank, you will receive your refund within 10 business days.

Refunds that are made through ACH payments can take up to 10 business days to clear. Unfortunately, we are at the mercy of the bank, but we will do everything we can to get you your refund as soon as possible. However, every investment needs to go through the clearing process in order to be sent back to the account associated with the investment.

Both Title III (Regulation Crowdfunding) and Title IV (Reg A+) help entrepreneurs crowdfund capital investments from unaccredited and accredited investors. The differences between these regulations are related to the investor limitations, the differing amounts of money companies are permitted to raise, and differing disclosure and filing requirements. To learn more about Regulation Crowdfunding, click here, and for Regulation A+, click here.

PINNED BY STARTUP

Jeremy Hall

3 years ago

I’m excited to watch the overall growth of Cadi and will be jumping in to invest again before this round closes. Was curious why the round is only showing $23k raised now? I checked a few days ago and coulda sworn you were near or over $400k-ish, has something changed with this round?

Show more

1

1