CLOSED

GET A PIECE OF MAGNUSS CORP.

Maritime Shipping Clean Technology

Show more

$188,748.30 Raised

REASONS TO INVEST

TEAM

James Rhodes • Chairman / CEO / Co-Founder / Director

Read More

Edward Shergalis • COO, Co-Founder, and Director

Read More

Gerard Condon • Member of the Board of Directors

He brings over 20 years of experience in civil engineering and project management. Mr. Condon retired in 2017 as President of Condon-Johnson & Associates where he shaped CJA’s strategy, finance, and operations, resulting in many years of stable growth. After spending six years on the Board of Directors, Mr. Condon joined Condon-Johnson & Associates as President in 2002 and operated the company whose influence was felt in ten Western States from four regional offices. Mr. Condon oversaw CJA’s day-to-day operations, finance, strategic planning, and implementation functions.

Mr. Condon has a Bachelor of Arts degree from Fordham University, and a Bachelor of Science degree in Civil Engineering from San Diego State University.

Read More

Maritime shipping represents an investment opportunity with global impact

International shipping transports 90% of all goods, vital for world trade and the economy. Without it, the bulk transportation of raw materials and the import/export of food and goods would not be possible. The shipping industry has reached a substantial tipping point regarding energy consumption. Fuel costs consume a meaningful fraction of the industry’s revenue. And while the lifeblood of the global economy, shipping is a significant source of air pollution. So, there is an economic and environmental problem to be solved.

*Rendering of Magnuss VOSS. Images are computer-generated demo versions. The product is currently under development.

THE PROBLEM

Shipping is costly and takes a major toll on the environment

With high fuel costs, and air pollution under ever-increasing scrutiny and regulation, the shipping industry faces economic and environmental challenges:

- Economic - costly fuel represents a high percentage of bulk cargo shipping expense.

- Environmental - the shipping industry is among the highest CO2 emitters worldwide, ranking sixth on a list of nations, between Germany and Japan. Today, shipping is responsible for one billion tons of CO2 per year; that’s more carbon annually than is produced by all the cars in the US.

The recognized threat that these emissions have for the planet will thus increase an already significant fuel cost.

THE SOLUTION

Harness the wind to power ships – thereby increasing fuel economy and reducing harmful CO2 emissions

At Magnuss, we have developed and patented a solution that increases fuel economy and reduces harmful emissions, by harnessing the wind. This addresses major problems facing the global shipping industry in terms of energy consumption and environmental impact. The idea is to augment ship propulsion with sails and supplement a ship’s installed engine power with a wind-based propulsion system, to deliver three benefits:

- predictable, repeatable, industry acknowledged fuel savings up to 50% for an industry breaking its back to save 2-4%,

- a substantial and differentiated means to reduce carbon emissions in the face of tightening regulations, and

- an industry and class-approved design that meets the needs of today’s global oceanic shipping industry.

Our solution aims to dramatically reduce a ship’s fuel consumption and carbon footprint, predicated on a proven technology, re-engineered to fit today’s global shipping infrastructure.

*Rendering of Magnuss VOSS. Images are computer-generated demo versions. The product is currently under development.

WHAT WE DO

Game-changing tech, delivering wind power to the world’s shipping fleet

Inspired by past ingenuity, Magnuss re-imagined sail technology, called the Flettner rotor, first sea-trialed in the 1920’s by aviation engineer Anton Flettner. At Magnuss, we improved the Flettner rotor design by making it transformable. Introducing the Magnuss VOSS or Vertically-variable Ocean Sail System, a wind-based propulsion system embedded in a cargo ship as a retrofit.

The Magnuss VOSS, is the cutting-edge mechanical sail that can be installed in new and existing vessels with the potential to slash fuel consumption and emissions in half. The Magnuss VOSS augments a ship’s installed engine power with a propulsion system that converts wind into forward thrust. Its game-changing innovation is retractability—allowing the sail to be stowed below deck and free up port operations.

At scale, the VOSS design will be a 100-foot tall spinning, hollow, metal cylinder that propels a ship using the principle of physics called the Magnus effect, which is quite common. It’s the reason a spinning ball curves in mid-air. The Magnus effect is a force produced perpendicular to the wind direction when an axially-symmetric, rotating object is placed in a wind stream. It is worth noting that the VOSS does not create electricity (it is not a wind turbine). It creates thrust. Ideally, four to six VOSS units will be deployed aboard the biggest ships in the world to reduce a ship’s fuel consumption and carbon footprint.

*Rendering of Magnuss VOSS. Images are computer-generated demo versions. The product is currently under development.

HOW WE ARE DIFFERENT

Retractability is key

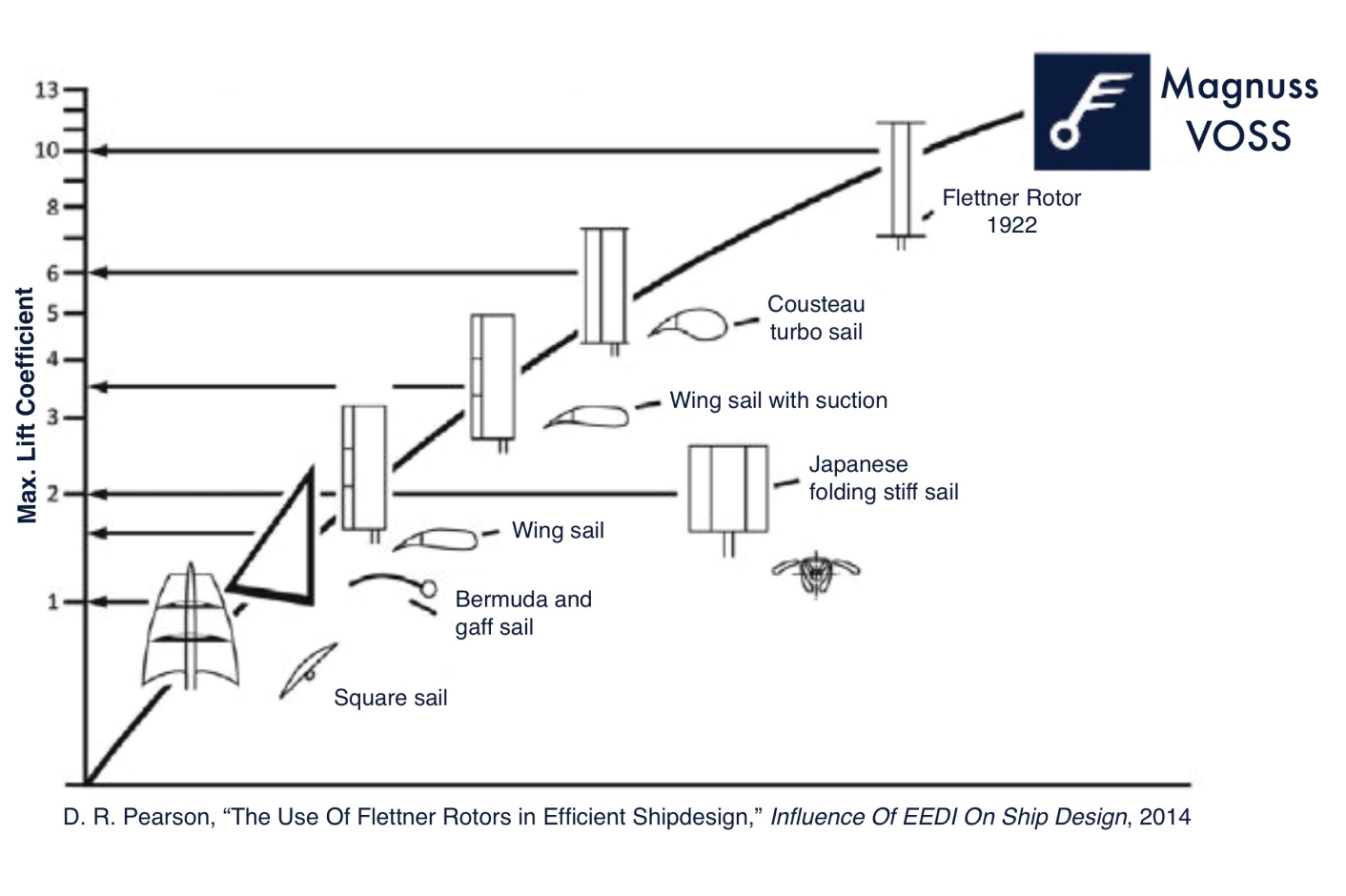

The competitive landscape is lean. Several firms exploring soft sails, rigid sails and kites are inferior to the Flettner rotor-based systems, such as the VOSS, because they exhibit a lower lift coefficient and a higher cost per pound of thrust. A few competitive sail systems have emerged while falling short of delivering a robust high-quality product applicable for modern shipping.

The Magnuss VOSS stands above conventional vertically-fixed, Flettner-based systems in its innovative, patented design features. The key innovation and chief competitive advantage of the Magnuss VOSS is retractability. It can be fully retracted and stowed below deck, out of the way (different from all other current and past fixed Flettner rotor designs). This signature feature is important, especially for dry bulk carriers, when loading/unloading in port and for reducing drag in unsuitable conditions at sea.

The Magnuss VOSS stands above conventional vertically-fixed, Flettner-based systems in its innovative, patented design features. The key innovation and chief competitive advantage of the Magnuss VOSS is retractability. It can be fully retracted and stowed below deck, out of the way (different from all other current and past fixed Flettner rotor designs). This signature feature is important, especially for dry bulk carriers, when loading/unloading in port and for reducing drag in unsuitable conditions at sea.

*Rendering of Magnuss VOSS. Images are computer-generated demo versions. The product is currently under development.

THE MARKET

The market opportunity is large, leading to meaningful economic and environmental benefits

Global shipping has roughly 55,000 ships, which comprise today’s merchant world fleet. More than three-quarters of these ships are cargo ships, tankers, and dry bulk carriers - the total addressable market for Magnuss. Our initial target market is the dry bulk carrier sector comprising 12,258 ships, which are ideally suited for the Magnuss VOSS design. Of these ships, we are focused first on the largest, gearless bulk carriers which typically carry grain and iron ore. From this sector alone, the financial value created annually by reducing fuel consumption and harmful emissions is meaningful.

(Source) The above data is from varying sources including the UN Maritime Transport Review report, and Statista Research.

OUR TRACTION

Magnuss now preparing to cut steel on a full-scale project for dry bulk carriers

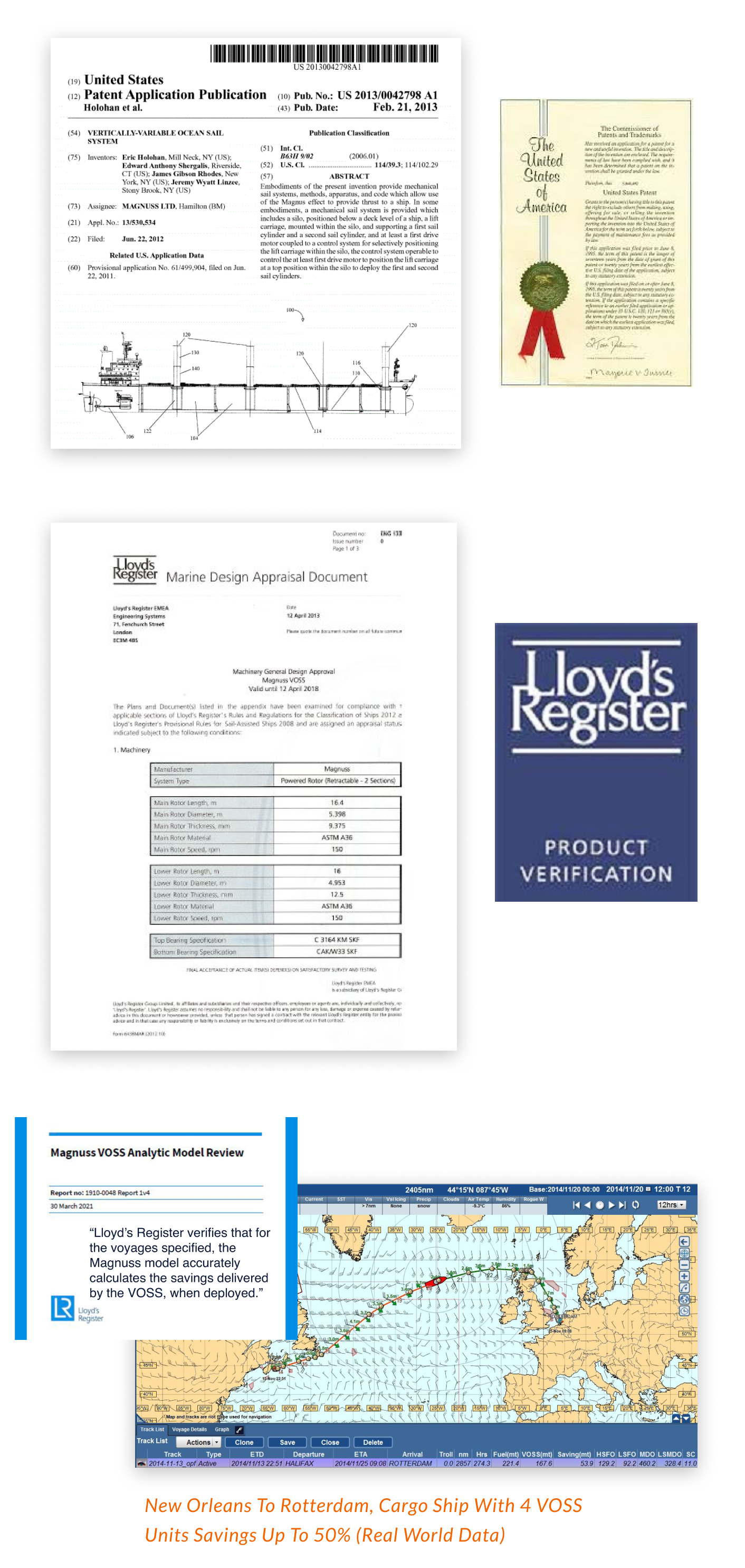

After nearly a decade of extensive investment in design, certification, patents, and customer validation, and drawing on shipping operational and technical expertise and support, Magnuss is ready to expand! Patented across 16 countries, the Magnuss VOSS is approved by Lloyd’s Register, the UK classification society, meaning the design meets the highest standard for quality in global shipping. We have a full- scale ship deployment plan in place, through our joint industry work with ship owners, charterers and shipyards. And our savings and performance analytics have been verified by Lloyd’s Register in its newly released 2021 Report. Today, Magnuss is seeking capital as it continues in collaboration with industry partners, spanning the next 12-18 months to develop one of the largest ever, wind-based propulsion projects and unlock customer demand for more fuel-efficient dry bulk shipping.

THE BUSINESS MODEL

Direct sales and multiple revenue streams to provide ample reach within our industry

Our business model is direct sales to customers and employs several distribution channels. Revenues are generated from selling / financing VOSS units and driven by ship deployments. The Magnuss VOSS units are sold directly to shipowners or may be deployed with 3rd party financing. We provide our customers with value by reducing the need for fuel to propel the vessel and helping them meet the demands of increasing environmental legislation. And our contract manufacturing approach affords capital efficiency, high free cash flow, low-cost production, low overhead and limited inventory.

A unique element of the Magnuss go-to-market strategy is its Save As You Sail project finance model. To scale the business, Magnuss can leverage project finance, fully supported by a share of the savings to accelerate deployment at no cost to the ship owner.

a global impact

Worldwide shipping moving aggressively to prepare for future regulations and a cleaner way to ship

Measures that make shipping economically efficient and environmentally friendly are attracting a lot of attention. Leading industrials and global shipping firms need not be convinced that managing fuel requirements directly result in improved financial performance and reduced regulatory risk. The Sustainable Shipping Initiative (SSI) is a multi-stakeholder collective working to accelerate sustainable development in the shipping industry through cross-sectoral collaboration. SSI members selected Magnuss for a case study resulting in a favorable review.

The past two years have marked a turning point, where an increasing emphasis on combating climate change led to an elevated focus on sustainable solutions among the players in commercial maritime shipping. At a macro level, the industry and the regulators committed to more sustainable practices. Meanwhile, at a micro level, individual organizations answered the bell to curb harmful greenhouse gas emissions. Specifically, ship owners and charterers moved aggressively to prepare for future regulations, support sustainable operations, and manage the environmental impact of their fleets. The main driver continues to be evolving regulation.

The Global Maritime Forum unveiled in 2020 a set of working principles on behalf of charterers that reflect a bias to ships actively reducing their carbon footprint. Coupled with the Poseidon Principles, a self-governing climate alignment agreement amongst financial institutions, the Sea Cargo Charter demonstrates charterers’ commitment, alongside the banks' commitment, to reducing the shipping industry's carbon footprint.

In June, the International Maritime Organization adopted technical and operational measures to reduce the carbon intensity of international shipping, taking effect January 2023. With new regulations and customer driven carbon requirements on the horizon, the sector is set to become increasingly more sustainable. This is good news for emissions reduction technologies such as the Magnuss VOSS.

THE VISION

Providing the number one solution to the shipping industry’s biggest challenges

Magnuss was established to address the major problems facing the global shipping industry, with a focus on energy consumption and environmental impact. Our goal at Magnuss is to transform the world’s cargo fleet into a more efficient, low cost, low polluting, means of ocean transport. We aim to lead the shipping industry in a more cost effective and sustainable direction, capturing a significant market share of today’s commercial fleet.

*Rendering of Magnuss VOSS. Images are computer-generated demo versions. The product is currently under development.

OUR LEADERSHIP

Seasoned, skilled and driven, our senior team has designed a trailblazing product

Bound by history and a singular vision, our senior team has worked together for decades, drawing on deep, hands-on expertise in maritime shipping, clean tech, renewable energy project development, finance, software development, and data analytics. CEO, co-founder and veteran executive, James Rhodes, holds an MBA from Columbia University, a BS in Electrical Engineering from Brown University and has 30+ years of experience in maritime shipping, renewable energy development, project finance, investment banking and management consulting. COO, co-founder and tech entrepreneur, Ted Shergalis, holds a BA from Harvard University and leverages expertise in shipping and early-stage, high-growth business development, software, analytics and operations.

Magnuss is supported by a broad network - - experts from academia and industry. The board of directors and commercial advisors bring extensive experience to drive growth. Magnuss collaborates with industry participants such as ship owners, charterers, shipbuilders and financial institutions. Magnuss continues to forge ties with the strongest, most influential shipping organizations to ensure commercial success at scale.

WHY INVEST

Double bottom line benefit – creating economic and environmental value with global impact

Ship owner/operators are laser-focused on eco efficiency ahead of tighter regulations. Magnuss is set to deliver a reliable, best-in-class technology and an investment opportunity with global impact. Our scalable business model is ready to meet immediate customer demand, delivering customers significant and quantifiable fuel savings affording a short payback period. Bottom line savings are meaningful, especially on a line item that represents a large fraction of a ship’s annual operating expense. In an industry facing increasing regulatory pressure, an important benefit of the VOSS is the degree to which it creates not only economic value, but also large-scale carbon emission reductions.

Magnuss is providing the means for 100% renewable energy-based ocean transportation and charting a course to make global maritime shipping economically efficient and environmentally sustainable. Join us on this journey to bring wind power to the worlds shipping fleet. Invest in Magnuss today.

*Rendering of Magnuss VOSS. Images are computer-generated demo versions. The product is currently under development.

ABOUT

HEADQUARTERS

580 Riverside Ave., #104

Westport, CT 06880

WEBSITE

View Site

TERMS

Magnuss Corp.

Overview

PRICE PER SHARE

$20

DEADLINE

Aug. 2, 2022 at 6:59 AM UTC

VALUATION

$27.12M

FUNDING GOAL

$10K - $1.07M

Breakdown

MIN INVESTMENT

$240

MAX INVESTMENT

$107,000

MIN NUMBER OF SHARES OFFERED

500

MAX NUMBER OF SHARES OFFERED

53,500

OFFERING TYPE

Equity

SHARES OFFERED

Common Stock

Maximum Number of Shares Offered subject to adjustment for bonus shares

Voting Rights of Securities Sold in this Offering

Voting Proxy.

Each Subscriber shall appoint the Chief Executive Officer of the Company (the “CEO”), or his successor, as the Subscriber’s true and lawful proxy and attorney, with the power to act alone and with full power of substitution, to, consistent with this instrument and on behalf of the Subscriber, (i) vote all Securities, (ii) give and receive notices and communications, (iii) execute any instrument or document that the CEO determines is necessary or appropriate in the exercise of his authority under this instrument, and (iv) take all actions necessary or appropriate in the judgment of the CEO for the accomplishment of the foregoing. The proxy and power granted by the Subscriber pursuant to this Section are coupled with an interest. Such proxy and power will be irrevocable. The proxy and power, so long as the Subscriber is an individual, will survive the death, incompetency and disability of the Subscriber and, so long as the Subscriber is an entity, will survive the merger or reorganization of the Subscriber or any other entity holding the Securities. However, the Proxy will terminate upon the closing of a firm-commitment underwritten public offering pursuant to an effective registration statement under the Securities Act of 1933 covering the offer and sale of Common Stock or the effectiveness of a registration statement under the Securities Exchange Act of 1934 covering the Common Stock.

*Maximum Number of Shares Offered subject to adjustment for bonus shares. See Bonus info below.

Investment Incentives and Bonuses*

Time-Based Perks

Friends and Family

Invest in the first 72 hours and receive 15% Bonus Shares.

Super Early Bird

Invest within the first week and receive 10% Bonus Shares.

Early Bird Bonus

Invest within the first two weeks and receive 5% Bonus Shares.

Amount-Based Perks

Tier 1 | $5,000+

Invest $5,000+ and receive 5% Bonus Shares.

Tier 2 | $10,000+

Invest $10,000+ and receive 10% Bonus Shares.

Tier 3 | $20,000+

Invest $20,000+ and receive 20% Bonus Shares.

*All perks occur when the offering is completed.

The 10% StartEngine Owners' Bonus

Magnuss Corp. will offer 10% additional bonus shares for all investments that are committed by investors that are eligible for the StartEngine Crowdfunding Inc. OWNer's bonus.

This means eligible StartEngine shareholders will receive a 10% bonus for any shares they purchase in this offering. For example, if you buy 100 shares of Common Stock at $20.00 / share, you will receive and own 110 shares for $2,000.00. Fractional shares will not be distributed and share bonuses will be determined by rounding down to the nearest whole share.

This 10% Bonus is only valid during the investor's eligibility period. Investors eligible for this bonus will also have priority if they are on a waitlist to invest and the company surpasses its maximum funding goal. They will have the first opportunity to invest should room in the offering become available if prior investments are canceled or fail.

Investors will only receive a single bonus, which will be the highest bonus rate they are eligible for.

Insider Investment Notice

Officers, directors, executives, and existing owners with a controlling stake in the company (or their immediate family members) may make investments in this offering. Any such investments will be included in the raised amount reflected on the campaign page.

Irregular Use of Proceeds

ALL UPDATES

08.03.22

Thank you investors, followers and StartEngine.

Thank you to all who invested in Magnuss. We’re grateful for your support. And to our followers along with our StartEngine partners, we appreciate your engagement during the crowdfunding campaign. Keep in touch as we bring wind power to the world’s shipping fleet.

08.01.22

LAST CALL TO INVEST IN MAGNUSS!

08.01.22

FINAL HOURS TO INVEST IN MAGNUSS!

08.01.22

One day left to invest in Magnuss.

Invest in the company that’s geared to transform global shipping as we know it. Invest with Magnuss today! (www.startengine.com/magnuss).

07.29.22

Our campaign ends on Monday Aug 1st.

There is no better time to invest in Magnuss, the company that aims to slash harmful greenhouse gas emissions with its patented, innovative sail technology. Join us and other investors on this journey to bring wind power to the world’s shipping fleet. If you have not yet finished your investment, make sure to do so while there is still time. Invest with Magnuss today! (www.startengine.com/magnuss).

07.27.22

Cash in on rewards in final days left to invest!

Invest in Magnuss today and support the rollout of the Magnuss VOSS (Vertically-variable Ocean Sail System), an example of a modern technology that offers remarkable fuel savings at a time when minimizing costs, reducing fossil fuel use and complying with regulations are crucial. Only 6 days left to cash in on rewards. Join us.

07.24.22

Make sure to invest while there is still time!

Thank you to all who have invested in our company so far! Welcome. We’re excited to grow the investor community. With hard work, determination and persistence, Magnuss has achieved a great many milestones and we are excited about the future ahead. Today, we see the upside of past efforts buoyed by strong customer demand, carbon price signals and supportive regulations. With just 8 days remaining, let’s make that final push together. Please share our campaign with your friends and family (www.startengine.com/magnuss).

07.22.22

EU wants ETS to include shipping sector. Good sign for Magnuss!

EU Parliament wants to include shipping emissions in the EU ETS. “To incentivise industries to further reduce their emissions and invest in low-carbon technologies, the Emissions Trading System (EU ETS) should be reformed and its scope enlarged,” Members of the European Parliament said. Learn more: https://www.offshore-energy.biz/eu-parliament-wants-to-include-shipping-emissions-in-the-eu-ets/. This is good news for Magnuss and its Vertically-variable Ocean Sail System (VOSS) technology. Only 10 days left! Invest in Magnuss today.

07.21.22

With new regulations, customers need low carbon shipping. Great news for Magnuss!

The shipping sector is increasingly more sustainable, with regulations and customer driven carbon requirements, This is great news for Magnuss. The IMO adopted measures to reduce the carbon intensity of international shipping, taking effect January 2023. The Global Maritime Forum unveiled a set of working principles on behalf of charterers that reflect a bias to ships actively reducing their carbon footprint. Coupled with the Poseidon Principles, a self-governing climate alignment agreement amongst financial institutions, the Sea Cargo Charter demonstrates charterers’ commitment, alongside the banks' commitment, to reducing the shipping industry's carbon footprint. And Magnuss is well positioned meet customer demand. Invest now and join us! Only 12 days remain! Click to learn more: https://www.youtube.com/watch?v=DA85oHJqXzg

07.19.22

Only 13 days left! Invest today in the company that’s positioned to deliver a greener tomorrow.

Global shipping emits a billion tons of CO2 per year—more than is produced by all the cars in the US annually. We can solve this problem today by harnessing the power of wind. Wind-based propulsion systems are currently available. And proven to work. The Magnuss VOSS is the cutting-edge hi-tech sail that augments engine power to cut fuel consumption and emissions up to 50%. Click to invest in the company that’s positioned to deliver a greener tomorrow. Don’t miss out. Only 13 days left. Invest in Magnuss today!

REWARDS

Venture Club

Venture Club Members earn 10% bonus shares on top of this and all eligible investments for an entire year. Not a member? Sign up at checkout ($275/year).

$5,000

Tier 1

Invest $5,000+ and receive 5% Bonus Shares.

$10,000

Tier 2

Invest $10,000+ and receive 10% Bonus Shares.

$20,000

Tier 3

Invest $20,000+ and receive 20% Bonus Shares.

JOIN THE DISCUSSION

0/2500

CHANG YE QUAN

3 years ago

1. The Magnuss VOSS Analytic Model Review was done in Year 2021 but the voyages specified was in Year 2014. Obviously the best voyager in history was picked for review. Can you share the best saving, worse saving and average saving? I believe investors and ship builders can get better picture this way. 2. I read an article about Norsepower and it mention "Preparations for the retrofit will take place in November 2019 with the installation scheduled for Q2 2020". Seems like to retrofit vessel it may take over 6 months from planning to completion. How Magnuss can scale up and do it for 500 vessels per year? (Assume Over 10,000 Dry Bulk Carriers/20 Years) 3. What is the expected profit margin? 4. Can Magnuss earn/claim carbon credits? 5. Can you talk more about exit plan or dividend plan?

Show more

1

0

Michael Nadler

3 years ago

Given retractability is a key proponent of your technological strategy, what are ways in which competitors can get around this and replicate your competitive advantage of retractability without infringing upon issued patents?

Show more

1

0

Felix Vayssieres

3 years ago

A couple more questions 1) How much will it cost one ship to have your rotors installed? How long would it take for gas savings to pay for the rotors? How much CO2 emissions are avoided by a ship installing your rotors? 2) Can you talk more about Save As You Sail project financing? Thanks

Show more

1

0

Felix Vayssieres

3 years ago

Hello, 1) Considering the first Flettner rotor ship was made in 1925 why aren't they more common already? 2) What's the advantage of your retractable rotors over Norsepower's tiltable rotors? 3) Since the rotors retract into the boat, what currently inside the area of the boats that would be replaced with the retracted rotors? Thanks

Show more

1

0

Michael Nadler

3 years ago

Can you talk to me about your competitors in the space? How much funding do you think you need to get to production and generate revenues? How do you see wind energy compared to other alternatives like hydro or electric competing against you/the wind energy space?

Show more

1

0

Vickie Rapp

3 years ago

How does this compare to the existing Norsepower Rotor Sails?

1

0

Michael Helm

3 years ago

For any potential investors reading comments and/or looking for additional leads for due diligence, I feel it's important to re-emphasize the fact that international legislation will soon place requirements for ocean freight shippers (some taking effect as soon as January 2023). For example, under international laws, all big vessels will be rated from A to E by how much carbon dioxide flows from their stacks for every mile traveled and ton carried. Even today, at the time of this writing, some ship owners are trying to find exemptions or ways around the legislation without success (AP News article link below). To make this clear: the policy trend is set. With increasing demand for transparent supply chains, these ratings will likely impact contract decisions and awards for shipping companies. And obviously, the Magnuss VOSS can help dry bulk carriers improve efficiency and obtain a competitive advantage. In other words, the Magnuss VOSS is a perfect example of a "triple bottom line" product and offers a solution for a win-win-win. Finally, during the pandemic, shipping companies have seen record profits. They're flush with cash and will be looking to expand fleets or modernize/refit current assets. This presents another opportunity for Magnuss to strike while the iron is hot. With this mentioned, I share in the vision. I like the product and patents (#US8746162B2, #US20160257388A1). I think the timing is right. It's why I'm an investor in Magnuss. https://apnews.com/article/politics-climate-and-environment-pollution-weather-business-f0b5a37148a21fa21dd6ecccea37a2b8

Show more

1

0

Tyler Moss

3 years ago

What is the current timeline from campaign closing? When will the first sails be built, sold and installed?

Show more

1

0

Mahmoud Kouchaji

3 years ago

Hello, I invested in Magnuss because I think it's a great idea, seems simple and elegant enough for anyone to understand and buy into. The hard part is manufacturing the product for an acceptable cost and making sure it works in the real world. But in the meantime you need some funding and it doesn't look like you are getting enough traction here; have you considered being featured in some of those Youtube channels looking into new and disruptive technologies that help solve the Climate crisis? I've heard about your company and tech briefly on one of those channels and then found Magnuss randomly several months later on StartEngine. Some of those channels include Just Have A Think, Disruptive Investing and Undecided With Matt Ferrel. I hope this helps!

Show more

1

1

HOW INVESTING WORKS

Cancel anytime before 48 hours before a rolling close or the offering end date.

WHY STARTENGINE?

REWARDS

We want you to succeed and get the most out of your money by offering rewards and memberships!

SECURE

Your info is your info. We take pride in keeping it that way!

DIVERSE INVESTMENTS

Invest in over 200 start-ups and collectibles!

FAQS

With Regulation A+, a non-accredited investor can only invest a maximum of 10% of their annual income or 10% of their net worth per year, whichever is greater. There are no restrictions for accredited investors.

With Regulation Crowdfunding, non-accredited investors with an annual income or net worth less than $124,000 are limited to invest a maximum of 5% of the greater of those two amounts. For those with an annual income and net worth greater than $124,000, they are limited to investing 10% of the greater of the two amounts.

At the close of an offering, all investors whose funds have “cleared” by this time will be included in the disbursement. At this time, each investor will receive an email from StartEngine with their Countersigned Subscription Agreement, which will serve as their proof of purchase moving forward.

Please keep in mind that a company can conduct a series of “closes” or withdrawals of funds throughout the duration of the campaign. If you are included in that withdrawal period, you will be emailed your countersigned subscription agreement and proof of purchase immediately following that withdrawal.

StartEngine assists companies in raising capital, and once the offering is closed, we are no longer involved with whether the company chooses to list shares on a secondary market or what occurs thereafter. Therefore, StartEngine has no control or insight into your investment after the close of the live offering. In addition, we are not permitted to provide financial advice. You may want to contact a financial professional to discuss possible investment outcomes.

For Regulation Crowdfunding, investors are able to cancel their investment at any point throughout the campaign up until 48 hours before the closing of the offering. Note: If the company does a rolling close, they will post an update to their current investors, giving them the opportunity to cancel during this timeframe. If you do not cancel within this 5-day timeframe, your funds will be invested in the company, and you will no longer be able to cancel the investment. If your funds show as ‘Invested’ on your account dashboard, your investment can no longer be canceled.

For Regulation A+, StartEngine allows for a four-hour cancellation period. Once the four-hour window has passed, it is up to each company to set their own cancellation policy. You may find the company’s cancellation policy in the company’s offering circular.

Once your investment is canceled, there is a 10-day clearing period (from the date your investment was submitted). After your funds have cleared the bank, you will receive your refund within 10 business days.

Refunds that are made through ACH payments can take up to 10 business days to clear. Unfortunately, we are at the mercy of the bank, but we will do everything we can to get you your refund as soon as possible. However, every investment needs to go through the clearing process in order to be sent back to the account associated with the investment.

Both Title III (Regulation Crowdfunding) and Title IV (Reg A+) help entrepreneurs crowdfund capital investments from unaccredited and accredited investors. The differences between these regulations are related to the investor limitations, the differing amounts of money companies are permitted to raise, and differing disclosure and filing requirements. To learn more about Regulation Crowdfunding, click here, and for Regulation A+, click here.

mckenzie johnson

3 years ago

Many transportation companies have reported unprecedented revenues due to the pandemic. They will be eager to increase fleet size or upgrade existing assets because they have plenty of <a href="https://cookieclicker-games.com">cookie clicker</a> cash on hand to do so. Magnuss can now seize yet another opening to act quickly.

Show more

0

0