CLOSED

GET A PIECE OF GREEN NINJA

Climate solutions through education

Show more

$567,289.59 Raised

TEAM

Eugene Cordero • CEO, Director, Secretary, Founder

Eugene splits his time between Green Ninja and teaching, however, his majority focus is on Green Ninja. Currently, Eugene's primary salary comes from teaching and he does not have any future plans to leave teaching. As Green Ninja grows, the company may buy out a portion of Eugene's teaching load (e.g. reduce course load at $25k/year) however, this will depend on the growth of the company. Currently, Eugene finds a value and synergy between his active teaching and the work developed for education at Green Ninja as he keeps an active research program.

Read More

Leah Tremblay • CFO

Read More

Huong Cheng • Creative Director

Read More

Reasons to Invest

- Proven track record: We have demonstrated a product market fit in California with over $1M in annual sales and over 10,000 students using our materials every single day.

- Now is the time: The educational trajectory of 20 million U.S. students will be decided over the next four years as school districts around the country are purchasing new science textbooks and materials to match the updated state standards. (Source)

- Responding to climate change: Our research shows that education can be as impactful in reducing carbon emissions as solar panels or electric vehicles. The impact of investing in climate change education is real, and Green Ninja is a leader in developing highly effective educational experiences.

OVERVIEW

Education is the solution for creating a sustainable future

Green Ninja is one of the only U.S. publishers to have climate and environmental stewardship as core themes within a comprehensive science curriculum. The curriculum framework was developed through academic research at San José State University and demonstrates the impact that education can have on student success and carbon emissions.

Green Ninja has developed a product and customer base in California over the last three years and now is positioned to move into the markets of other states. School districts around the country will be updating their science textbooks in the next four years to satisfy new state standards, but most textbook publishers are just repackaging their old materials and aren’t making the transformations we need. Green Ninja is seeking investment to expand the team to launch competitive sales campaigns in other states, and we expect rapid revenue growth in our company over the next four years.

Hear our story:

THE PROBLEM

America is getting an F in Climate Education

We need education to develop the climate change problem-solvers of the future, and our current system is not doing that. Mainstream curriculum publishers are adding brief and non-controversial climate change sections to their existing offerings, but environmental problem-solving needs to be the focus of the curriculum, not an add-on.

(Source)

THE SOLUTION

Green Ninja provides the answer to, “Why do we have to learn this?”

Our standards-aligned curriculum teaches life, earth, and physical science through a project-based approach. Students apply what they’ve learned towards making a difference in their own community.

Here is how it works

A decade of research uncovered an educational framework that yielded long-term increases in student motivation and engagement—critical elements to student learning.

Designed for the next generation science standards, here’s a look at our pipeline of educational tools

g

g

g

A proven method that works

The chart below shows data from a school district where large shifts in student attitudes were observed over the course of a school year. Imagine what this would look like over three years of middle school science instruction.

*This data was based on our own internal and unpublished research using a pre and post survey over an academic year conducted within a school district who was using our program.

OUR TRACTION

More than 10,000 students from all over California use Green Ninja as their middle school science curriculum each and every day

Partnerships support our growth

From integrating sensor technology into our lessons to helping us efficiently package and ship supplies for our classroom science kits, our partners support us as we grow.

THE MARKET

Entering a billion dollar market where the future of education matters

(Source)

Green Ninja will use investment funds to grow our education programs across the country

The investment will be used in three key ways

We plan to 1) build a national sales team that will lead targeted campaigns across the country, 2) update and refine our curriculum so that it aligns with each state’s standards, and 3) innovate education through effective IT.

How do we make money?

Here is an example of a district sale with 6,000 students and about 100 teachers. The school district purchased an 8-year digital license, science kits, and student and teacher workbooks. The total value of the 8-year contract is $3.2M cost with additional annual revenue of around $150K/year for ongoing teacher training and coaching.

How will the company expand?

One avenue for company expansion is through acquisition or investment, and since 2020, the number of U.S. deals involving education technology companies has more than doubled. Yes, there is an increasing interest in education companies.

(Source)

WHY INVEST

Education is changing, and you can be at the forefront of that change

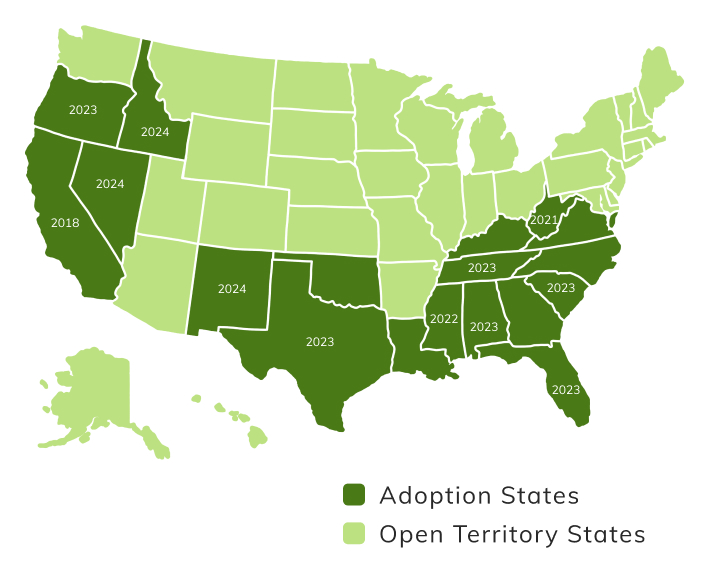

Perfect timing: 18+ states ready to adopt new science curriculum

Over the next four years, we anticipate that all school districts within the 18 adoption states and about 50% of school districts within the open territory states will be purchasing new science textbooks for the first time in over a decade. Timing is critical to build a sales and marketing team in these states to compete for the large number of upcoming science curriculum sales.

Evolving to expand our impact

Our plans over the next few years are to evolve from primarily a content creator into a platform that hosts our content and the content of others. This allows us to offer a wider range of education options for our current customers while also expanding on the type of customers we can serve.

THE VISION

Green Ninja becomes a leader in sustainability education

Embedding climate and sustainability as core themes in education has already happened in some countries (e.g., Italy and Mexico), and our plans are to lead the movement here in the U.S. and elsewhere.

Education becomes a key tool in mitigating climate change

Today, our research (see below) quantifying the role of education in reducing carbon emissions is unique, but through future research, education, and corporate partnerships, we plan to demonstrate the value of education so that significant gains in educational funding and policies are realized.

(Source)

(or click)

ABOUT

HEADQUARTERS

421 Loreto St.

Mountain View, CA 94041

WEBSITE

View Site

TERMS

Green Ninja

Overview

PRICE PER SHARE

$0.86

DEADLINE

May. 28, 2022 at 6:59 AM UTC

VALUATION

$9.46M

FUNDING GOAL

$10K - $1.07M

Breakdown

MIN INVESTMENT

$516

MAX INVESTMENT

$855,700

MIN NUMBER OF SHARES OFFERED

11,627

MAX NUMBER OF SHARES OFFERED

1,244,186

OFFERING TYPE

Equity

SHARES OFFERED

Non-voting Common Stock

Maximum Number of Shares Offered subject to adjustment for bonus shares

*Maximum Number of Shares Offered subject to adjustment for bonus shares. See Bonus info below.

Investment Incentives and Bonuses*

Early Bird

Super Early Bird - first 72 hours | 2% bonus shares

Volume

Tier 1 perk - Invest $2500+ and receive Green Ninja Sweatshirt or Long Sleeve T-Shirt

Tier 2 perk - Invest $5000+ and receive 2% bonus shares + Green Ninja Sweatshirt or Long Sleeve T-Shirt

Tier 3 perk - Invest $25,000+ and receive 5% bonus shares + Green Ninja Sweatshirt or Long Sleeve T-Shirt

Tier 4 perk - Invest $100,000+ and receive 7% bonus shares + Green Ninja Sweatshirt or Long Sleeve T-Shirt

*All perks occur when the offering is completed.

The 10% StartEngine Owners' Bonus

Green Ninja will offer 10% additional bonus shares for all investments that are committed by investors that are eligible for the StartEngine Crowdfunding Inc. OWNer's bonus.

This means eligible StartEngine shareholders will receive a 10% bonus for any shares they purchase in this offering. For example, if you buy 100 shares of Non-Voting Common Stock at $0.86 / share, you will receive 110 shares of Non-Voting Common Stock, meaning you'll own 110 shares for $86. Fractional shares will not be distributed and share bonuses will be determined by rounding down to the nearest whole share.

This 10% Bonus is only valid during the investors eligibility period. Investors eligible for this bonus will also have priority if they are on a waitlist to invest and the company surpasses its maximum funding goal. They will have the first opportunity to invest should room in the offering become available if prior investments are canceled or fail.

Investors will only receive a single bonus, which will be the highest bonus rate they are eligible for.

Insider Investment Notice

Officers, directors, executives, and existing owners with a controlling stake in the company (or their immediate family members) may make investments in this offering. Any such investments will be included in the raised amount reflected on the campaign page.

Irregular Use of Proceeds

ALL UPDATES

06.07.22

Thank you!

06.03.22

Our Community Joins In! | Insider Investment Notice

We're excited to see our community come in and invest in Green Ninja!

Our Insiders have invested a total of $79,750.28 into the offering:

Carole d'Alessio Bypass Trust , 55,000 shares, $43,700 invested

Alexander Marquez, 31,977 shares, $25,700.20 invested

Leah Tremblay, 12,790 shares, $10,350.08 invested

Please refer to the Company’s offering materials for further information and refer to the Company’s Risk Factors.

05.27.22

8 Hours Left in Our Campaign

Hello Everyone!

Today is the last day you can invest in Green Ninja and we'd love everyone who wants to make a difference on climate change to be a part of our company. We've got customers, we are growing, and we have a plan for success that creates impact at scale.

Thanks to everyone who has already invested and happy to welcome many more to our team!

Best, Eugene

Founder and CEO

05.26.22

New Customer Announcement!

05.24.22

New Customer Announcement!

05.24.22

Why Teachers Love Green Ninja

Obligatory disclaimer: This testimonial may not be representative of the experience of other customers and is not a guarantee of future performance or success.

05.20.22

$500K Milestone Achieved!

05.16.22

Opportunity Ending Soon! 11 Days Left!

Thank you to everyone who has invested so far! We have a lot of exciting things going on at Green Ninja and want to put 100% of our focus on there.

This is a notice to let you know that our campaign on StartEngine will be closing on Friday May 27th, 2022, so please invest now. The StartEngine site is a little quirky (no offense StartEngine) so DO NOT WAIT until the last day to get on our first round.

Note that an investor may cancel an investment commitment for any reason until 48 hours prior to our close date, unless we have already disbursed your funds previously.

05.12.22

Updated link to the article 'Petroleum & Me'

Please use this link and download the Article published in NSTA’s peer reviewed publication, Science Scope

https://www.nsta.org/science-

REWARDS

Venture Club

Venture Club Members earn 10% bonus shares on top of this and all eligible investments for an entire year. Not a member? Sign up at checkout ($275/year).

$2,500

Tier 1 perk

Invest $2500+ and receive Green Ninja Sweatshirt or Long Sleeve T-Shirt

$5,000

Tier 2 perk

Invest $5000+ and receive 2% bonus shares + Green Ninja Sweatshirt or Long Sleeve T-Shirt

$25,000

Tier 3 perk

Invest $25,000+ and receive 5% bonus shares + Green Ninja Sweatshirt or Long Sleeve T-Shirt

$100,000

Tier 4 perk

Invest $100,000+ and receive 7% bonus shares + Green Ninja Sweatshirt or Long Sleeve T-Shirt

JOIN THE DISCUSSION

0/2500

James Lie

3 years ago

Hello Eugene / Green Ninja team, Congratulations on having a good track record. Can you help me understand the following: * Are the schools contractually required to purchase a certain amount of textbooks / science kit every year? What part of the deal income is committed vs. variable? * Feels that your competition should be able to rather easily create environmentally focused curriculum as well. What's your differentiation and strategy on keeping a competitive edge? Thanks.

Show more

1

0

venkata alapati

3 years ago

With a huge debt of 1 million payable in 2022 how is that you are thinking that the funds raised now would be sufficient for running the company long term?

Show more

1

0

HOW INVESTING WORKS

Cancel anytime before 48 hours before a rolling close or the offering end date.

WHY STARTENGINE?

REWARDS

We want you to succeed and get the most out of your money by offering rewards and memberships!

SECURE

Your info is your info. We take pride in keeping it that way!

DIVERSE INVESTMENTS

Invest in over 200 start-ups and collectibles!

FAQS

With Regulation A+, a non-accredited investor can only invest a maximum of 10% of their annual income or 10% of their net worth per year, whichever is greater. There are no restrictions for accredited investors.

With Regulation Crowdfunding, non-accredited investors with an annual income or net worth less than $124,000 are limited to invest a maximum of 5% of the greater of those two amounts. For those with an annual income and net worth greater than $124,000, they are limited to investing 10% of the greater of the two amounts.

At the close of an offering, all investors whose funds have “cleared” by this time will be included in the disbursement. At this time, each investor will receive an email from StartEngine with their Countersigned Subscription Agreement, which will serve as their proof of purchase moving forward.

Please keep in mind that a company can conduct a series of “closes” or withdrawals of funds throughout the duration of the campaign. If you are included in that withdrawal period, you will be emailed your countersigned subscription agreement and proof of purchase immediately following that withdrawal.

StartEngine assists companies in raising capital, and once the offering is closed, we are no longer involved with whether the company chooses to list shares on a secondary market or what occurs thereafter. Therefore, StartEngine has no control or insight into your investment after the close of the live offering. In addition, we are not permitted to provide financial advice. You may want to contact a financial professional to discuss possible investment outcomes.

For Regulation Crowdfunding, investors are able to cancel their investment at any point throughout the campaign up until 48 hours before the closing of the offering. Note: If the company does a rolling close, they will post an update to their current investors, giving them the opportunity to cancel during this timeframe. If you do not cancel within this 5-day timeframe, your funds will be invested in the company, and you will no longer be able to cancel the investment. If your funds show as ‘Invested’ on your account dashboard, your investment can no longer be canceled.

For Regulation A+, StartEngine allows for a four-hour cancellation period. Once the four-hour window has passed, it is up to each company to set their own cancellation policy. You may find the company’s cancellation policy in the company’s offering circular.

Once your investment is canceled, there is a 10-day clearing period (from the date your investment was submitted). After your funds have cleared the bank, you will receive your refund within 10 business days.

Refunds that are made through ACH payments can take up to 10 business days to clear. Unfortunately, we are at the mercy of the bank, but we will do everything we can to get you your refund as soon as possible. However, every investment needs to go through the clearing process in order to be sent back to the account associated with the investment.

Both Title III (Regulation Crowdfunding) and Title IV (Reg A+) help entrepreneurs crowdfund capital investments from unaccredited and accredited investors. The differences between these regulations are related to the investor limitations, the differing amounts of money companies are permitted to raise, and differing disclosure and filing requirements. To learn more about Regulation Crowdfunding, click here, and for Regulation A+, click here.

James Lie

3 years ago

Hello Eugene & team, It seems that you are focused on middle school levels now (with a plan to target K-5 later per document). if a school district adopts your curriculum, do they typically offer this to just one grade level of students? Or do they offer this to all the grade levels (and perhaps different materials for different grades)? Do you plan to provide periodic business updates to investors going forward? (Something akin to quarterly releases for public companies) Thanks. James

Show more

2

0