CLOSED

GET A PIECE OF ASOMBROSO TEQUILA

Ultra-Premium Tequila

Show more

$225,653.51 Raised

TEAM

Richard Gamarra • CEO, Treasurer, Board Director

Read More

Andrew Ulmer • CFO/President

Read More

Reasons to Invest

- Achieved 86.6% increase in YTD Sales 2022

- Over 27,000 Cases Sold in the last 12 months

- Sold in 37 U.S. States with 13 New States Launching in Q3 & Q4 this year

- Historial Gross Revenue $27MM

- Signed a National Alliance Agreement with Republic National Distributing Company (RNDC) with a 2023 - 60,000 case national sell through goal

- Currently Sold in National Retail Chains - Total Wine & More, Costco Wholesale, Fine Wine ABC & Spirits, BevMo!, Kroger

- Awarded Top Tequila at San Francisco World Spirits Competition out of 326 Brands

(or click)

ABOUT

HEADQUARTERS

30012 Aventura, Suite A

Rancho Santa Margarita, CA 92688

WEBSITE

View Site

TERMS

Asombroso Tequila

Overview

PRICE PER SHARE

$9.46

DEADLINE

Nov. 8, 2022 at 7:59 AM UTC

VALUATION

$99.11M

FUNDING GOAL

$10K - $5M

Breakdown

MIN INVESTMENT

$473

MAX INVESTMENT

$999,997.68

MIN NUMBER OF SHARES OFFERED

1,057

MAX NUMBER OF SHARES OFFERED

528,541

OFFERING TYPE

Equity

SHARES OFFERED

Class B Non-Voting Common Stock

Maximum Number of Shares Offered subject to adjustment for bonus shares

*Maximum number of shares offered subject to adjustment for bonus shares. See Bonus info below.

Investor Incentives and Investment Bonuses*

Friends and Family Bonuses:

First 10 days – Friends and Family receive 20% Bonus Shares

Audience-Based (Loyalty Bonus): 20% Bonus Shares

As you have previously invested in AsomBroso, you are eligible for additional bonus shares.

Amount-Based Bonuses:

Investments of $1,000.00 or more

Will receive a bottle of 750ml El Platino

Investments of $2,500.00 or more

Will receive a bottle of 750ml La Rosa Reposado and a bottle of 750ml Gran Reserve Extra Anejo

Investments of $5,000 or More

Will receive a bottle of 750ml El Platino, a bottle of 750ml La Rosa Reposado and a bottle of 750ml Gran Reserve Extra Anejo

Investments of $10,000 or More (receive 10% Bonus Shares)

Will receive two bottles of 750ml El Platino, two bottles of 750ml La Rosa Reposado and two bottles of 750ml Gran Reserve Extra Anejo

Investments of $20,000.00 or more (receive 15% Bonus Shares)

Will receive two bottles of 750ml El Platino, two bottles of 750ml La Rosa Reposado, two bottles of 750ml Gran Reserve Extra Anejo and a 750ml bottle of Vintage Extra Anejo

Investments of $50,000 or More (receive 25% Bonus Shares)

Will receive a case (6 bottles) of 750ml El Platino, a case (6 bottles) of 750ml La Rosa Reposado, a case (6 bottles) of 750ml Gran Reserve Extra Anejo and a 750ml bottle of Vintage Extra Anejo

*All perks occur after the offering is completed

The 10% Bonus for StartEngine Shareholders

California Tequila, Inc. will offer 10% additional bonus shares for all investments that are committed by investors that are eligible for the StartEngine Crowdfunding Inc. OWNer's bonus.

This means eligible StartEngine shareholders will receive a 10% bonus for any shares they purchase in this offering. For example, if you buy 100 shares of Class B Non-Voting Common Stock at $9.46 / share, you will receive 110 shares of common stock, meaning you'll own 110 shares for $946. Fractional shares will not be distributed and share bonuses will be determined by rounding down to the nearest whole share.

This 10% Bonus is only valid during the investors' eligibility period. Investors eligible for this bonus will also have priority if they are on a waitlist to invest and the company surpasses its maximum funding goal. They will have the first opportunity to invest should room in the offering become available if prior investments are cancelled or fail.

Investors will receive the highest single bonus they are eligible for among the bonuses based on the amount invested and time of offering elapsed (if any). Eligible investors will also receive the Owner’s Bonus, the Friends and Family Bonus and the Loyalty Bonus.

ALL UPDATES

11.07.22

Today is your last chance to invest in AsombBroso Tequila during the current raise.

Hello AsomBroso Tequila Community,

This is your chance to become an owner of California Tequila, Inc brand owner of AsomBroso Tequila and Knucklenoggin Whiskey brands. We produce one of the true luxury tequila brands and a fun whiskey brand.

Our company has passed a milestone for a spirit’s company shipping over 29,000 cases in the past 12 months. Sales of luxury tequila continue to soar and outpace all other spirit categories.

Knucklenoggin Whiskey is on pace to surpass 84K cases in the next 12 months. As we have orders from the nation’s largest retailers Costco, Total Wine & More, Specs, and Kroger.

Our company’s primary use of funds is increasing on hand inventory to ensure we in a position to capitalize on opportunities and new markets.

11.03.22

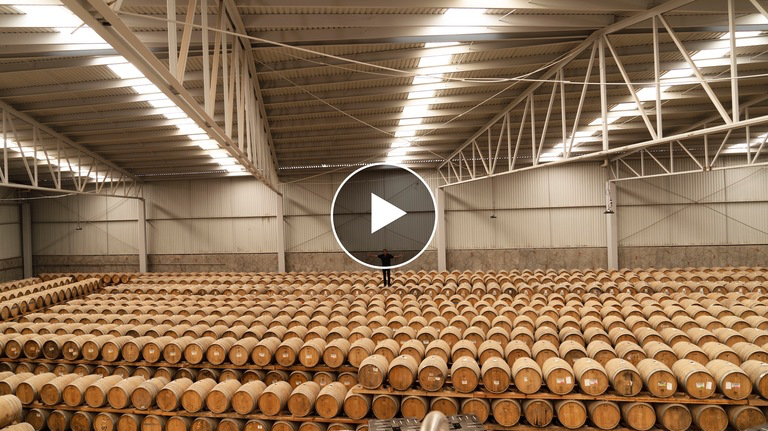

Join us on this Journey!

Come with us as we walk you through the tequila production process.

Key Tequila Industry Insights:

- The global Tequila Market was valued USD 9.7 Billion in 2021 and is all set to surpass USD 13.5 Billion by 2028, exhibiting a CAGR of 5.70% during the forecast period 2022-2028. (Source).

- In terms of revenue, the application segment held the largest revenue share of in 2021 and is estimated to maintain its dominance for the forecast period. (Source).

- In terms of revenue, the product segment held the second largest market share of in 2021 and is estimated to grow rapidly during the forecast period. (Source).

- The growth can be attributed to rapid urbanization, technological advancement, an increase in investment by developing countries. (Source).

- North America captured the lion share in 2021 and is projected to retain its position over the forecast period. This can be attributed to the existence of a significant number of Tequila industry companies and the high adoption rate owing to government measures that stimulate this industry in this region. The growth is primarily due to the increasing collaborations. (Source).

AsomBroso Tequila get a Sip of this Traction

- Historical sales in excess of $28 million

- · Dynamic growth in the Tequila and whiskey categories drove strong sales gains, as the company’s Q3 2022 Revenues up over 376%.

- · Established CEO Rick Gamarra, Founder and CEO of AsomBroso Tequila with over 20 years of experience and innovation in the tequila industry.

- · Awarded multiple honors from the Robb Report’s “Best of the Best” and “Top Tequila” in the San Francisco World Spirits Competition.

- · Available across multiple states in the top US retail wine and spirits chains Costco, Kroger and Total Wine & More.

11.02.22

Last Week to Invest IN ASOMBROSO TEQUILA!

With the holiday's fast approaching be sure to have plenty of AsomBroso Tequila on hand.

AsomBroso Tequila is available to ship directly to you across 40 states. Use discount code startengine at checkout to receive a 15% discount.

Click here to purchase Shop.AsomBrosoTequila

10.27.22

Offering closing don’t Miss Out on Your Perks and Bonus

Check out our perks below

Audience-Based (Loyalty Bonus): 20% Bonus Shares

As you have previously invested in AsomBroso, you are eligible for additional bonus shares.

Amount-Based Bonuses:

Investments of $1,000.00 or more

Will receive a bottle of 750ml El Platino

Investments of $2,500.00 or more

Will receive a bottle of 750ml La Rosa Reposado and a bottle of 750ml Gran Reserve Extra Anejo

Investments of $5,000 or More

Will receive a bottle of 750ml El Platino, a bottle of 750ml La Rosa Reposado and a bottle of 750ml Gran Reserve Extra Anejo

Investments of $10,000 or More (receive 10% Bonus Shares)

Will receive two bottles of 750ml El Platino, two bottles of 750ml La Rosa Reposado and two bottles of 750ml Gran Reserve Extra Anejo

Investments of $20,000.00 or more (receive 15% Bonus Shares)

Will receive two bottles of 750ml El Platino, two bottles of 750ml La Rosa Reposado, two bottles of 750ml Gran Reserve Extra Anejo and a 750ml bottle of Vintage Extra Anejo

Investments of $50,000 or More (receive 25% Bonus Shares)

Will receive a case (6 bottles) of 750ml El Platino, a case (6 bottles) of 750ml La Rosa Reposado, a case (6 bottles) of 750ml Gran Reserve Extra Anejo and a 750ml bottle of Vintage Extra Anejo

*All perks occur after the offering is completed

10.26.22

LAST CALL! Become an exclusive owner of AsomBroso Tequila

Check out our perks below

Audience-Based (Loyalty Bonus): 20% Bonus Shares

As you have previously invested in AsomBroso, you are eligible for additional bonus shares.

Amount-Based Bonuses:

Investments of $1,000.00 or more

Will receive a bottle of 750ml El Platino

Investments of $2,500.00 or more

Will receive a bottle of 750ml La Rosa Reposado and a bottle of 750ml Gran Reserve Extra Anejo

Investments of $5,000 or More

Will receive a bottle of 750ml El Platino, a bottle of 750ml La Rosa Reposado and a bottle of 750ml Gran Reserve Extra Anejo

Investments of $10,000 or More (receive 10% Bonus Shares)

Will receive two bottles of 750ml El Platino, two bottles of 750ml La Rosa Reposado and two bottles of 750ml Gran Reserve Extra Anejo

Investments of $20,000.00 or more (receive 15% Bonus Shares)

Will receive two bottles of 750ml El Platino, two bottles of 750ml La Rosa Reposado, two bottles of 750ml Gran Reserve Extra Anejo and a 750ml bottle of Vintage Extra Anejo

Investments of $50,000 or More (receive 25% Bonus Shares)

Will receive a case (6 bottles) of 750ml El Platino, a case (6 bottles) of 750ml La Rosa Reposado, a case (6 bottles) of 750ml Gran Reserve Extra Anejo and a 750ml bottle of Vintage Extra Anejo

*All perks occur after the offering is completed

10.25.22

Tequila Aficionado Podcast - Legacy Tequila Brand AsomBroso Tequila

Tequila Aficionado Podcast featuring AsomBroso Tequila first Pink Hue Tequila La Rosa Reposado a legacy brand.

10.24.22

Last Chance 14 Days Left to Invest IN ASOMBROSO TEQUILA!

Still on the fence check out our reasons to invest.

AsomBroso Tequila get a Sip of this Traction

Historical sales in excess of $30 million

102% Increase in revenue through Q3

Established CEO Rick Gamarra, Founder and CEO of AsomBroso Tequila with over 20 years of experience and innovation in the tequila industry.

Awarded multiple honors from the Robb Report’s “Best of the Best” and “Top Tequila” in the San Francisco World Spirits Competition.

Available in over 11,000 accounts in 40 States

10.20.22

Shipping directly to your porch across 40 States

Tequila plays a big role in Halloween parties. Shipping directly to your door across 40 states. We have all our tequilas in stock, as well our limited release El Carbonzado Extra Anejo and Especial De Rouge 10 Year Extra Anejo.

What separates AsomBroso Tequila:

· Resting tequila in new French Oak barrels

- Double barrel resting extra anejo tequila

- Resting a 10-year aged tequila in Grand Marnier cognac barrel

- Double barrel resting a 6-year tequila in an Irish Whiskey barrel

- Double barrel resting an 11-year tequila in vintage port barrels

- Rest tequila in new French Oak for 11 years and bring it to market

AsomBroso Tequila is available to ship directly to you across 40 states. Use discount code startengine at checkout to receive a 15% discount.

Click here to purchase Shop.AsomBrosoTequila

10.19.22

AsomBroso Tequila increases production forecast for Q1 2023

Ricardo Gamarra, the Founder of AsomBroso Tequila and his team bottling AsomBroso Gran Reserva Extra Anejo in Amatitan, Jalisco.

We appreciate your continued support.

For more information regarding the Asombroso Tequila line or investment opportunities please visit www.atequila.com or to

REWARDS

10%

Stack Venture Club & Rewards!

Members get an extra 10% shares in addition to rewards below!

Venture Club

Venture Club Members earn 10% bonus shares on top of this and all eligible investments for an entire year. Not a member? Sign up at checkout ($275/year).

$1,000

Investments of $1,000.00 or more

Will receive a bottle of 750ml El Platino

$2,500

Investments of $2,500.00 or more

Will receive a bottle of 750ml La Rosa Reposado and a bottle of 750ml Gran Reserve Extra Anejo

$5,000

Investments of $5,000 or More

Will receive a bottle of 750ml El Platino, a bottle of 750ml La Rosa Reposado and a bottle of 750ml Gran Reserve Extra Anejo

$10,000

Investments of $10,000 or More

10% bonus shares, will receive two bottles of 750ml El Platino, two bottles of 750ml La Rosa Reposado and two bottles of 750ml Gran Reserve Extra Anejo

$20,000

Investments of $20,000.00 or more

15% bonus shares, will receive two bottles of 750ml El Platino, two bottles of 750ml La Rosa Reposado, two bottles of 750ml Gran Reserve Extra Anejo and a 750ml bottle of Vintage Extra Anejo

$50,000

Investments of $50,000 or More

25% bonus shares, will receive a case (6 bottles) of 750ml El Platino, a case (6 bottles) of 750ml La Rosa Reposado, a case (6 bottles) of 750ml Gran Reserve Extra Anejo and a 750ml bottle of Vintage Extra Anejo

JOIN THE DISCUSSION

0/2500

Marcos Donzino

2 years ago

hello, i've investeed in 2022 and still haven't been contacted for the bonus bottle i've got for investing and also, where can we see any updates on the investment?

Show more

0

1

ivan cora

2 years ago

I participated in the bonus round investment and have not heard or received any information

0

0

LUIS MONTALVO

2 years ago

I haven't seen any returns or the Bonus offered or where can I check my investors account. I want my money back!!!

Show more

0

2

Gary EADS

3 years ago

Hi. I also invested into company. How do we buy your products, do investors like myself receive discounts on products bought

Show more

1

0

Ronald Grossman

3 years ago

How can I determine how much my current investment is worth? Is this traded on any of the exchanges?

Show more

1

0

LINDA MCMILLEN

3 years ago

You cotacted me 2 weeks ago on my bonus for the correct address. I still have not recieved it. Is it because I live in Tenneessee?

Show more

1

0

LINDA MCMILLEN

3 years ago

I invested Dec 10 and have not received my bonus. Linda M.

1

0

Roger Alan Gilham

3 years ago

I invested $1,000 over a year ago. So far have not seen anything except my canceled check. How do I sell my shares and recoup my money? I have known Ricki for 40 years and did not expect this.

Show more

1

0

Donald Mader

3 years ago

Hi there,My wife and I are interested in investing in this company. Have concerns about your revenue projections also will like to have more information on your past year financials, interested in investing with significant amount. Thank you in advance for this information.

Show more

1

0

HOW INVESTING WORKS

Cancel anytime before 48 hours before a rolling close or the offering end date.

WHY STARTENGINE?

REWARDS

We want you to succeed and get the most out of your money by offering rewards and memberships!

SECURE

Your info is your info. We take pride in keeping it that way!

DIVERSE INVESTMENTS

Invest in over 200 start-ups and collectibles!

FAQS

With Regulation A+, a non-accredited investor can only invest a maximum of 10% of their annual income or 10% of their net worth per year, whichever is greater. There are no restrictions for accredited investors.

With Regulation Crowdfunding, non-accredited investors with an annual income or net worth less than $124,000 are limited to invest a maximum of 5% of the greater of those two amounts. For those with an annual income and net worth greater than $124,000, they are limited to investing 10% of the greater of the two amounts.

At the close of an offering, all investors whose funds have “cleared” by this time will be included in the disbursement. At this time, each investor will receive an email from StartEngine with their Countersigned Subscription Agreement, which will serve as their proof of purchase moving forward.

Please keep in mind that a company can conduct a series of “closes” or withdrawals of funds throughout the duration of the campaign. If you are included in that withdrawal period, you will be emailed your countersigned subscription agreement and proof of purchase immediately following that withdrawal.

StartEngine assists companies in raising capital, and once the offering is closed, we are no longer involved with whether the company chooses to list shares on a secondary market or what occurs thereafter. Therefore, StartEngine has no control or insight into your investment after the close of the live offering. In addition, we are not permitted to provide financial advice. You may want to contact a financial professional to discuss possible investment outcomes.

For Regulation Crowdfunding, investors are able to cancel their investment at any point throughout the campaign up until 48 hours before the closing of the offering. Note: If the company does a rolling close, they will post an update to their current investors, giving them the opportunity to cancel during this timeframe. If you do not cancel within this 5-day timeframe, your funds will be invested in the company, and you will no longer be able to cancel the investment. If your funds show as ‘Invested’ on your account dashboard, your investment can no longer be canceled.

For Regulation A+, StartEngine allows for a four-hour cancellation period. Once the four-hour window has passed, it is up to each company to set their own cancellation policy. You may find the company’s cancellation policy in the company’s offering circular.

Once your investment is canceled, there is a 10-day clearing period (from the date your investment was submitted). After your funds have cleared the bank, you will receive your refund within 10 business days.

Refunds that are made through ACH payments can take up to 10 business days to clear. Unfortunately, we are at the mercy of the bank, but we will do everything we can to get you your refund as soon as possible. However, every investment needs to go through the clearing process in order to be sent back to the account associated with the investment.

Both Title III (Regulation Crowdfunding) and Title IV (Reg A+) help entrepreneurs crowdfund capital investments from unaccredited and accredited investors. The differences between these regulations are related to the investor limitations, the differing amounts of money companies are permitted to raise, and differing disclosure and filing requirements. To learn more about Regulation Crowdfunding, click here, and for Regulation A+, click here.

Moises Mora

2 years ago

I invested twice and only receieved one bottle.

0

1