CLOSED

GET A PIECE OF SECURLINX

Security Begins With Identity

Show more

$185,974.78 Raised

TEAM

Barry Hodge • CEO & Sole Director

Read More

Reasons to Invest

- Securlinx has created the BioTOKEN, a form of identity verification that is owned by the user, securely compiles their information, and builds a trail of where that information has been used.

- The global biometrics market reached a value of $ 27.97 billion in 2021, with a CAGR of 17.5% during its 2022-2027 forecast period (source).

- The applicability of the BioTOKEN crosses several billion dollar industries, from healthcare to education.

Overview

Know who’s knocking at your door

Identity theft and lack of privacy are two unfortunate side effects of the digital age. While it’s great that the world is more connected than ever, there are an unprecedented amount of security threats that the average person must deal with nowadays. To combat this problem, we have developed a “digital peephole” to recognize anyone knocking on your “network door:” the BioTOKEN.

We believe our BioTOKEN technology is the next step in the evolution of biometric verification. With a BioTOKEN, users can enjoy a level of certainty with the security of their identity that is nearly unmatched. Based on our internal observations, the proprietary biometric middleware we have developed at Securlinx is thriving in the medical and educational forums. We are confident that this technology will benefit enterprises across virtually all verticals.

THE Problem

Current identity verification technology is expensive, clunky, and time consuming

It’s not a secret that, in today’s day and age, keeping your identity secure is more important than ever. The recent flux in the work-from-home population, as well as

an uptick in services being delivered remotely, and enterprises hiring individuals remotely, has created an unprecedented need for identity assurance. Unfortunately, many current identity verification platforms are either expensive or rely on a myriad of firewalls, which are clunky and time-consuming.

Additionally, the COVID-19 pandemic has created a higher demand for efficient and secure identity verification in the medical and educational arenas. Hospitals must ensure the higher influx of patients don’t get misidentified or mismatched with the incorrect medical records. For education, teachers must ensure they are releasing kids to their parents or guardians, despite not having met them due to remote learning. In an age of uncertainty, enterprises throughout the country need a simple, secure way of verifying an individual’s identity.

The Solution

With BioTOKENs, you can own your identity in a digital age

We believe the BioTOKEN is a simple, cost-effective, and full-proof way of verifying an individual’s identity. We have developed a software that authenticates a person’s government ID to their biometrics, creating a bulletproof identity token. Customers with BioTOKENs not only have unrivaled security with their identity, but also, they are able to grant access to other sensitive information they may have, like medical records. For school purposes, BioTOKENs have the potential to perform near perfectly for ensuring that preschoolers go home to their authorized guardian.

By verifying an individual’s identity with BioTOKENs, enterprises can do away with expensive and time-consuming firewalls with minimal to no changes in their workflow. Moreover, we plan on having companies that are using BioTOKEN verification to be able to assign rights and privileges to store a complete audit trail of activities. This transparency ensures that every person with a BioTOKEN can see a comprehensive breakdown of every time their information has been accessed.

We generate revenue by offering our middleware as a subscription-based service. Customers have no upfront costs and can immediately use our verification systems upon initiating our services. Pricing for our services is flexible, depending on whether the transaction is for an individual or an enterprise.

THE market

High-end security meets seamless applicability

From the moment we created the concept of BioTOKENs, we understood that it had the potential to revolutionize biometric verification. We believe Securlinx separates ourselves from our competitors by creating streamlined, airtight forms of identity that can be applied across virtually every vertical. With BioTOKENs, we hope clients will save stress and anxiety knowing their identity is secure, while enterprises can potentially save time and money through our reasonably priced, streamlined technology.

In hospitals that use our technology, BioTOKENs have allowed healthcare providers to identify patients’ appointments and pull their medical records with ease. Preschools have benefitted from the use of BioTOKENs by using them to biometrically identify a child’s guardian to ensure they’re being picked up safely. We believe that hospitals and schools are just two of dozens of industries where BioTOKENs can increase staff efficiency and customer identity.

our traction

We have seen that Securlinx is already proving its versatility and reliability

We believe the success of our BioTOKEN technology in the educational and medical field has validated our product’s stellar potential. We have successfully completed alpha testing on both healthcare and education applications and are refining our technology even more. Securlinx has also been working with Head Start, a government program that provides early childhood education and wellness services, to low-income families. This has paved the way for us to install our Beta Site with a Head Start school in Alabama.

why invest

Help us be the gold standard of biometric verification

Our executive team has over a century of experience in technology, business, and security, which is why we believe that our company can revolutionize biometric verification. The BioTOKEN has already shown its potential to verify identity in an efficient, secure, and cost-effective manner. In our opinion, the versatility allows enterprises across several billion dollar verticals to benefit from implementing them. With your investment, Securlinx can continue to move towards becoming the future of biometric verification. Join us today.

ABOUT

HEADQUARTERS

39555 Orchard Hill Place Suite 600

Novi, MI 48375

WEBSITE

View Site

TERMS

Securlinx

Overview

PRICE PER SHARE

$0.25

DEADLINE

Oct. 18, 2022 at 6:59 AM UTC

VALUATION

$13M

FUNDING GOAL

$10K - $1.07M

Breakdown

MIN INVESTMENT

$500

MAX INVESTMENT

$1,069,999.75

MIN NUMBER OF SHARES OFFERED

40,000

MAX NUMBER OF SHARES OFFERED

4,279,999

OFFERING TYPE

Equity

SHARES OFFERED

Common Stock

Maximum Number of Shares Offered subject to adjustment for bonus shares

*Maximum number of shares offered subject to adjustment for bonus shares. See bonus info below.

Investment Incentives and Bonuses*

Time-Based:

Friends and Family Early Birds

Invest within the first 72 hours and receive 15% bonus shares

Super Early Bird Bonus

Invest within the next 72 hours and receive 10% bonus shares

Early Bird Bonus

Invest within the next 7 days and receive 5% bonus shares

Amount-Based:

$500 | Tier 1

Invest $500+ and receive access to our Private Investor Group

$2,500+ | Tier 2

Invest $2,500 and receive access to our Private Investor Group + 5% bonus shares.

$5,000+ | Tier 3

Invest $5,000 and receive access to our Private Investor Group + 10% bonus shares.

$10,000+ | Tier 4

Invest $10,000 and receive access to our Private Investor Group + 15% bonus shares.

$15,000+ | Tier 5

Invest $20,000 and receive access to our Private Investor Group + 20% bonus shares.

$20,000+ | Tier 6

Invest $20,000 and receive access to our Private Investor Group + 25% bonus shares + Zoom call with the CEO.

Loyalty-Based:

Previous investors receive 5% bonus shares.

*All perks occur when the offering is completed.

The 10% StartEngine Owners' Bonus

Securlinx Corporation will offer 10% additional bonus shares for all investments that are committed by investors that are eligible for the StartEngine Crowdfunding Inc. OWNer's bonus.

This means eligible StartEngine shareholders will receive a 10% bonus for any shares they purchase in this offering. For example, if you buy 100 shares of Common Stock at $0.25 / share, you will receive 110 shares of Common Stock, meaning you'll own 110 shares for $25. Fractional shares will not be distributed and share bonuses will be determined by rounding down to the nearest whole share.

This 10% Bonus is only valid during the investor's eligibility period. Investors eligible for this bonus will also have priority if they are on a waitlist to invest and the company surpasses its maximum funding goal. They will have the first opportunity to invest should room in the offering become available if prior investments are canceled or fail.

Investors will receive the highest single bonus they are eligible for among the bonuses based on the amount invested and time of offering elapsed (if any). Eligible investors will also receive the Owner’s Bonus and the 5% Loyalty-Based Audience Bonus in addition to the aforementioned bonus.

Irregular Use of Proceeds

PRESS

Securlinx Introduces IDTrac for Healthcare

Aimed primarily at the physician's office, IDTrac addresses the administrative challenges posed by onboarding new patients and scheduling current patients in a post-COVID-19 world. Much of this work is being moved away from the office lobby. By establishing a secure biometric identity for each patie

ALL UPDATES

10.31.24

Q3 2024 Quarterly Report

SECURLINX CORPORATION QUARTERLY REPORT

and

FINANCIAL STATEMENT

(UNAUDITED)

AS OF

September 30, 2024

SECURLINX CORPORATION

Index to Quarterly Report

(unaudited)

Table of Contents

FINANCIAL STATEMENT (UNAUDITED)

MANAGEMENT'S DISCUSSION AND ANALYSIS.

NOTES TO FINANCIAL STATEMENT AS OF SEPTEMBER 30, 2024.

CEO CERTIFICATION..

SECURLINX FINANCIAL STATEMENTS

AS OF June 30, 2024

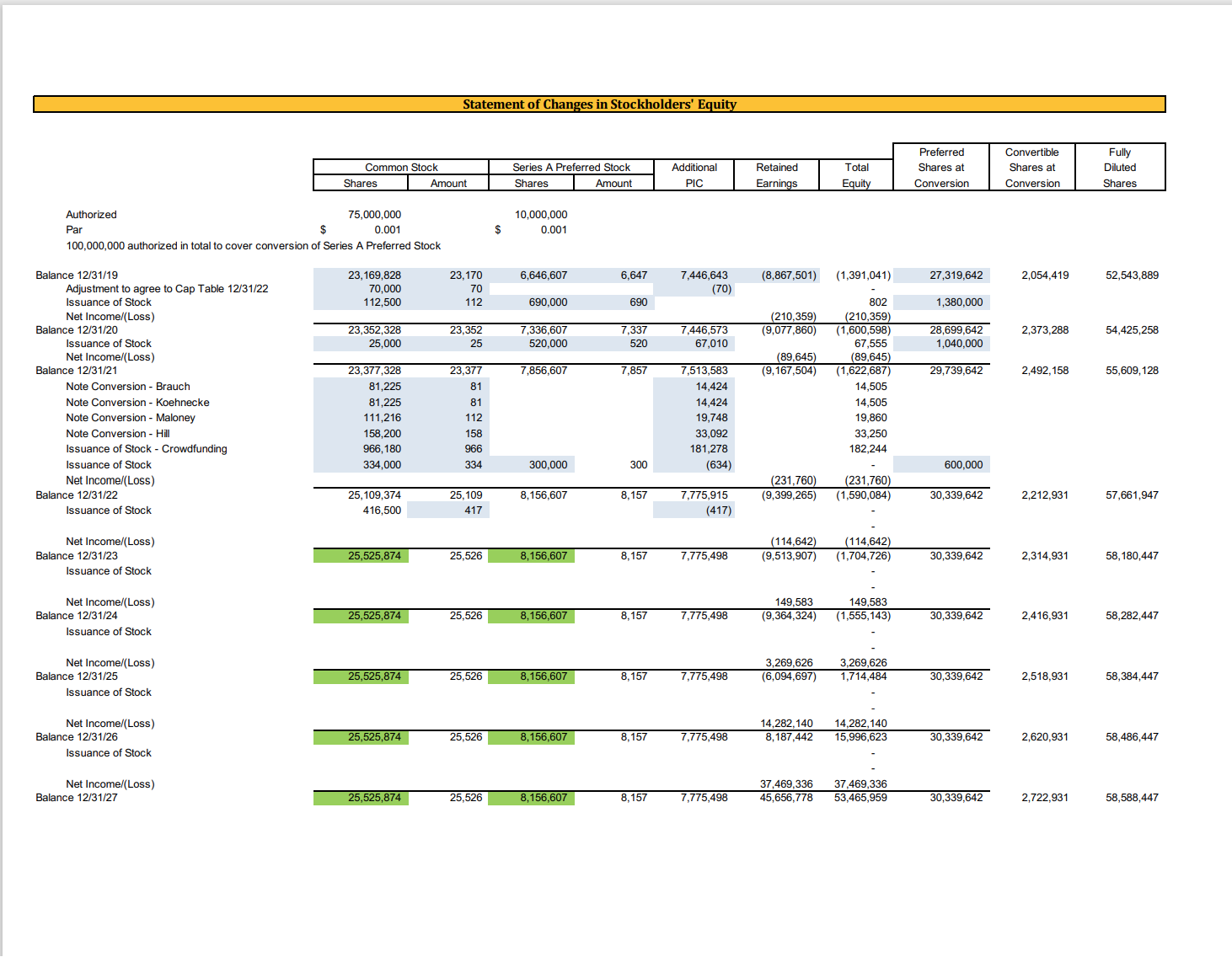

SECURLINX STATEMENT OF EQUITY

AS OF June 30, 2024

MANAGEMENT'S DISCUSSION AND ANALYSIS

This management discussion and analysis provides a detailed analysis of the financial condition, results of operations and historical financial statements for the Company, which consists of the business operated by Securlinx Corporation. The discussion and analysis should be read in conjunction with the Company’s unaudited consolidated financial statements and related notes for the period ended September 30, 2024, with comparatives for the period ending September 30, 2023, which are included in this report.

Summary of Operations

Securlinx is primarily engaged in the development and sale of biometric identity management middleware products with a specialization in facial recognition and vein identification technology. Our software products are used in government, healthcare and other commercial identity management systems to recognize or verify the identity of individuals. Our software is used to allow access to buildings and computer systems and access third party data in a secure environment. Other applications include crowd surveillance to identify persons of interest from a watch list. We offer our software as a service subscribed to and paid for on a transaction basis. These services are used to validate transactions from mobile devices and delivered via cloud computing. We sell our software solutions in North America through a group of manufacturers’ representatives and distributors managed by our own direct sales and marketing employees. Some sales are directly to end-users while other opportunities are addressed through integrators or development partners. Internationally we work through and with OEMs and system integrators who have the capacity to support our software.

As the Company seeks to transition its business from software development to commercialization of its intellectual property it has continued to experience net losses. In previous years the revenues from the Securlinx products have been sporadic ranging from a single order of $132,000 to several smaller orders and projects of $7,000 to $25,000. Many of these were deployed in high profile use models including professional sports venues during high profile events and high security government facilities. Each of these projects has resulted in a successful proof of concept for market acceptance of our base product set. However, they have not generated sufficient revenue to cover the fixed costs of the company. For the first 8 years of the Company’s operations, all available resources were focused on the design and development of IdentiTrac, the Company’s flagship biometric identity management data base. In 2011 through 2020, the Company began to approach customers for the intended purpose of partnering to deploy “beta” site revisions of the core products. These entailed extensive analyses of the customer’s current capabilities and workflow along with an inventory of the current IT environment and use model pre-installation. Most of these pilot projects required significant customization and generally enabled the company to create additional intellectual property suitable for commercialization. Through these efforts the company has acquired a significant amount of experience. We have also developed a stable database platform upon which we can build an almost limitless number of application software packages to meet a wide variety of customer requirements. Our management team and technical resources have established credibility in the marketplace as subject matter experts in biometrics particularly facial recognition.

At the close of fiscal year 2020 management was satisfied that our R&D efforts had proven the readiness of the product set for a full marketing program and rollout. Total investment in our software development and intellectual property is approximately $5 million. The Company made successfully converted IdentiTrac®, an on-premises hardware-based database system to Securport®, a cloud-based Software as a Service (SaaS) platform. That strategy included the development of sales, distribution and support resources to provide the appropriate level of customer support. First deployments have been successfully implemented in the current quarter.

Throughout 2020-Present the Company has begun to train these resources in preparation for our marketing campaign. The Company is emerging from a long period of incubation of leading-edge biometric identity management solutions addressing a rapidly growing industry projected to be $10B by 2025. Our technical development path is now well positioned to meet the demands of biometric identity management market. With products that generate a high profit margin combined with low overhead and operating expenses, the company can be profitable at relatively low revenue rates as demonstrated in the pro forma financial statements included.

Selected Financial Information |

|

|

Nine Months ended September 30, 2024, compared to Nine Months ended September 30, 2023

Revenue and operating income for the first three quarters in 2024 were $70,573 and $41,392, respectively, which compared to revenue and operating income for the same period in 2023 of $59,941 and ($9,478), respectively. With our transition from hardware-based application to our Securport cloud-based platform, we expect this trend to continue. It should be noted that the Company does not have salaried employees in the reported periods. It is expected that salaries will be paid in 2025. Management has also agreed to accept minimal cash compensation until the company attains sufficient earnings.

Research and Development Expense

Research and development expense consists of costs for: i) engineering personnel, including salaries, stock-based compensation, fringe benefits, and facilities; ii) engineering consultants and contractors, and iii) other engineering expenses such as supplies, equipment depreciation, dues and memberships and travel. Engineering costs incurred to develop our technology, and products are classified as research and development expenses. As described in the cost of services section, engineering costs incurred to provide engineering services for customer projects are classified as cost of services and are not included in research and development expense. The Company expects to increase its level of R&D personnel investment in the foreseeable future.

Sales and Marketing Expense

Sales and marketing expense consists of costs for: i) personnel, including salaries, commissions, stock-based compensation, fringe benefits, and facilities; ii) distribution channels and independent contractors, and iii) other sales and marketing expenses such as supplies, demonstration equipment & depreciation, dues and memberships and travel.

General and Administrative Expense

General and administrative expense consists primarily of costs for: i) officers, directors and administrative personnel, including salaries, bonuses, director compensation, stock-based compensation, fringe benefits, and facilities; ii) professional fees, including legal and audit fees; iii) public company expenses; and iv) other administrative expenses. Our primary competitors are public entities and have a wider access to capital at more favorable valuations than is currently available to the Company. At maturity, we expect our G&A to comprise 12-15% of operational costs.

LIQUIDITY AND CAPITAL RESOURCES

The company is dependent upon capital investment to fund its operations. From inception this funding has come from three sources: i) qualified angel investors who have equity or convertible debt investments, ii) direct equity and debt investments from principals in the company and iii) seed funding in the form of early-stage venture capital. In 2022, the company utilized a fourth source of funds through a listing with StartEngine, a crowdfunding organization. The raise was moderately successful and continues to be an option for the Company. The Company continues to depend upon its ability to raise outside investment capital and anticipates this to be the case for the next two years. Although management expects a positive net income from operations in fiscal 2025, it will not be sufficient to fund the growth necessary to compete and increase market share in this rapidly expanding market. Management believes the best measures of success in the next three years will be topline growth in revenue and a corresponding increase in earnings per share. Our direct competitors have effectively used a public offering strategy to access sufficient capital to address the commercial markets. We will consider a similar path as we move forward.

The company has completed a funding round raising $185,000 USD from under a Reg CF registration in the United States. With a working capital deficiency of approximately $10,000 per month, it is expected that the Company will continue to depend on investment capital or debt to fund its operations.

The Company has chosen to provide liquidity through a listing on the StartEngine Marketplace. Our shareholders can become members of StartEngine and offer shares for sale or purchase additional shares. The last price on StartEngine was $0.25 per share. With 27,131,745 common shares and 9,236,607 preferred shares convertible to 32,499,642 common shares, the fully diluted number of shares issued and outstanding is 59,631,387. The current market cap of the Company based on the last price on StartEngine is $14,907,846.

NOTES TO FINANCIAL STATEMENT AS OF June 30, 2024

NOTE 1 – NATURE OF OPERATIONS

SECURLINX CORPORATION was formed on April 1, 2004 (“Inception”) in the State of DELAWARE. The balance sheet of SECURLINX CORPORATION (which may be referred to as the "Company,” “Securlinx,” "we," "us," or "our") are prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The Company’s headquarters are located in Ft. Myers, FL.

We design and deploy biometric identity solutions that improve security while reducing complexity, costs and risks. We take an enterprise-wide approach that centralizes the collection and management of all types of biometric information, whether a fingerprint, palm vein, facial image or iris scan.

Our powerful solutions open the way for your organization to drive critical identity verification functions across all your operations and processes from a single platform, integrating your systems, devices and workflow. That translates into a simpler, faster, more reliable way to validate and communicate identity data with confidence.

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The accounting and reporting policies of the Company conform to accounting principles generally accepted in the United States of America (“US GAAP”).

Use of Estimates

The preparation of balance sheet in conformity with US GAAP requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities, and the reported amount of revenues and expenses during the reporting period. Actual results could materially differ from these estimates. It is reasonably possible that changes in estimates will occur in the near term.

Fair Value of Financial Instruments

Fair value is defined as the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants as of the measurement date. Applicable accounting guidance provides an established hierarchy for inputs used in measuring fair value that maximizes the use of observable inputs and minimizes the use of unobservable inputs by requiring that the most observable inputs be used when available. Observable inputs are inputs that market participants would use in valuing the asset or liability and are developed based on market data obtained from sources independent of the Company. Unobservable inputs are inputs that reflect the Company’s assumptions about the factors that market participants would use in valuing the asset or liability. There are three levels of inputs that may be used to measure fair value:

| Level 1 | - Observable inputs that reflect quoted prices (unadjusted) for identical assets or liabilities in active markets. |

| Level 2 | - Include other inputs that are directly or indirectly observable in the marketplace. |

| Level 3 | - Unobservable inputs which are supported by little or no market activity. |

The fair value hierarchy also requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value.

Fair-value estimates discussed herein are based upon certain market assumptions and pertinent information available to management as of Inception. Fair values were assumed to approximate carrying values because of their short term in nature or they are payable on demand.

Risks and Uncertainties

THE COMPANY'S BUSINESS INVOLVES ELEMENTS OF RISK. IN MANY INSTANCES, THESE RISKS ARISE FROM FACTORS OVER WHICH THE COMPANY HAS LITTLE OR NO CONTROL. SOME ADVERSE EVENTS MAY BE MORE LIKELY THAN OTHERS AND THE CONSEQUENCE OF SOME ADVERSE EVENTS MAY BE GREATER THAN OTHERS. NO ATTEMPT HAS BEEN MADE TO RANK RISKS IN THE ORDER OF THEIR LIKELIHOOD OR POTENTIAL HARM. EACH SUBSCRIBER IS URGED AND EXPECTED TO CONSULT WITH SUCH SUBSCRIBER’S OWN ADVISOR OR ADVISORS FOR ASSISTANCE IN EVALUATING THE MERITS AND RISKS OF AN INVESTMENT IN THE UNITS. IN ADDITION TO THOSE RISKS ENUMERATED ELSEWHERE IN THIS MEMORANDUM, SUBSCRIBERS SHOULD ALSO CAREFULLY CONSIDER THE FOLLOWING FACTORS:

The Company cannot reasonably project future gains or losses due to the nature of the operations of the Company.

The Company is principally an intellectual property holding company that anticipates all future revenues shall be due to the efforts of the Company to realize and protect certain intellectual properties, license such intellectual property, and acquire or be acquired by another business entity.

The Company’s investment in the Affiliates could adversely affect the financial condition of the Company.

None of the Affiliates of the Company are profitable nor can the Company provide any assurance of the profitability of any of the Affiliates in the future. As a result, the investments by the Company in the Affiliates could be substantially negatively affected and, as a result, the financial condition could be adversely affected.

Our revenue model may change.

Our success depends on our ability to generate revenue from multiple sources. We may not be able to successfully generate revenue. If we do not generate such revenue, our business, financial condition and operating results will be materially adversely affected.

Efforts to patent critical technologies and maximize registration of intellectual property may not be successful.

New patent activity from other companies could affect and alter the ability to obtain and license proprietary properties. Additionally, the possibility exists that our efforts could infringe on the proprietary rights of other persons or parties. Competitive patent activity is always a risk, and U.S. patent applications are unpublished for one year. Although the Company intends to protect its rights with respect to intellectual property, the Company cannot provide any assurance that such activities will be successful or that the Company’s efforts will not adversely affect the operations of the Company.

There is no minimum offering, and additional financing may be required.

The Company may sell some or all of the Units offered hereby at different times over the term of this Memorandum. There is no minimum amount required for the Company to close on any subscriptions. If less than the maximum number of Units are sold in this Offering and the Company is unable to obtain alternative sources of financing, the operations of the Company would be constrained and would require an even greater amount of additional financing than would be required if the maximum number of Units were sold. In such event, the investors in this Offering will be subject to greater risk than would be the case if the maximum number of Units were sold. The Company anticipates that it may require additional financing immediately after the termination of this Offering to meet the demands of its expected growth.

The Company cannot ensure that an investor will qualify for favorable tax benefits as a result of an investment in the Company.

Each investor in the Company is urged to consult with his or her tax advisor regarding the applicability of any and all tax effects from investing in the Company.

The Company’s market is subject to rapid change and advancements in new technology.

The market in which the Company competes is characterized by rapid technological change. Existing products become obsolete and unmarketable when products using new technologies are introduced and new industry standards emerge.

The Company is subject to personnel risks.

Continued success of the Company is dependent upon its ability, in a competitive environment, to attract and retain qualified personnel. For example, the Company is dependent upon the services of its researchers and managers. The Company’s operations could be adversely affected if, for any reason, any key personnel cease to be active with the Company’s management. To meet our growth projections will require the recruitment, retention, and integration of additional highly qualified individuals. Even if such personnel can be hired, the projected growth in staff could present further management risks. The market for qualified personnel is highly competitive and there can be no assurances that these critical positions can be filled on a timely basis.

Shares available for future issuance may dilute your investment.

In the aggregate, and assuming this Offering is fully subscribed, the Company will have sixty million (60,000,000) shares issued and outstanding, on a fully diluted basis. The Company may authorize the issuance of additional shares in the future. Except as otherwise set forth in this Memorandum, its attachments and exhibits, or as set forth in the Company’s Operating Agreement, the availability of these shares and their potential future issuance may be dilutive and could adversely affect the value per Share of the Stock. The Company could also issue shares at a later date at less than the Offering price set forth in this Memorandum.

The offering price was arbitrarily determined.

The Offering price for the Units has been arbitrarily determined by the Company and may not necessarily bear any relationship to the assets, book value, potential earnings or net worth of the Company or any other recognized criteria of value and should not be considered to be an indication of the actual value of the Company or the Units offered herein.

Restricted Securities; Lack of Public Market.

The sale of the Units offered hereby has not been registered under the Securities Act or any state securities laws and, accordingly, the Units will constitute “restricted securities” as defined in Rule 144 promulgated under the Securities Act. The Units may not be offered, sold or otherwise transferred, encumbered or hypothecated unless registered under the Securities Act and any applicable state securities laws or unless exempt from such registration. The holders of the Units will have no rights to require the Company to register the Units under the Securities Act. Potential investors, therefore, may find it difficult or impossible to liquidate their investment at a time when they desire to do so and, consequently, must be prepared to hold the Units for an indefinite period of time.

New market entrants pose a threat to our business.

Existing or future competitors may develop or offer services that are comparable or superior to ours. Such a scenario would have a material adverse effect on our business, results of operations, and financial condition.

Our business may require us to develop certain strategic alliances for commercialization of certain research and development.

We expect that we may need to forge strategic alliances with other companies. We may never be able to develop these alliances, or if we do, we may not be able to continue them on favorable commercial or licensing terms. Our inability to develop new strategic alliances could have a material adverse effect on our business, results of operations and financial condition.

The operations of the Company are speculative, may be unprofitable, and may result in the total loss of your investment.

The operations of the Company and their related operations are speculative and involve the possibility of a total loss of investment. The Company’s operations and activities may be unprofitable due to any number of considerations. Investment is suitable only for individuals who are financially able to withstand a total loss of their investment.

Market conditions may make raising future capital difficult.

A significant downturn in the national or global economy may cause a general disinclination to invest in companies such Securlinx Corporation. Consequently, investors may be reluctant to invest in us in further rounds of financing. Further, commercial banks and other sources of debt financing are often reluctant to lend money to entities whose assets and potential revenue generation are difficult to value or to predict. As a result, we may not be able to obtain necessary levels of financing as a going concern.

Interest rates could adversely affect the Company making debt service and borrowing more difficult or financially unsustainable.

Market conditions could substantially affect interest rates and thereby affect the ability of the Company to borrow necessary funds or to enter into certain debt instruments. The ability of the Company to borrow necessary funds could adversely affect the ability of the Company to respond to certain market conditions or business opportunities.

Our business could grow too rapidly for us to effectively manage the growth.

Our ability to successfully implement our business plan requires an effective planning and growth-management process. If we are unable to manage our growth, we may not be able to implement our business plan, and our business may suffer as a result. We expect that we will have to expand our business to address potential growth in the number of customers, to expand our product and service offerings and to pursue other market opportunities. We expect that we will need to continue to improve our operational, financial and inventory systems, procedures and controls, and will need to expand, train and manage our workforce. We can give no guarantee that we will be successful in these efforts.

These adverse conditions could affect the Company's financial condition and the results of its operations.

Cash and Cash Equivalents

For the purpose of the statement of cash flows, the Company considers all highly liquid debt instruments purchased with an original maturity of three months or less to be cash equivalents.

Revenue Recognition

The Company will recognize revenues from our middleware platform transactions when (a) pervasive evidence that an agreement exists, (b) the product or service has been delivered, (c) the prices are fixed and determinable and not subject to refund or adjustment, and (d) collection of the amounts due are reasonably assured.

Income Taxes

The Company applies ASC 740 Income Taxes (“ASC 740”). Deferred income taxes are recognized for the tax consequences in future years of differences between the tax bases of assets and liabilities and their financial statement reported amounts at each period end, based on enacted tax laws and statutory tax rates applicable to the periods in which the differences are expected to affect taxable income. Valuation allowances are established, when necessary, to reduce deferred tax assets to the amount expected to be realized. The provision for income taxes represents the tax expense for the period, if any, and the change during the period in deferred tax assets and liabilities.

ASC 740 also provides criteria for the recognition, measurement, presentation and disclosure of uncertain tax positions. A tax benefit from an uncertain position is recognized only if it is “more likely than not” that the position is sustainable upon examination by the relevant taxing authority based on its technical merit.

Concentration of Credit Risk

The Company maintains its cash with a major financial institution located in the United States of America, which it believes to be creditworthy. The Federal Deposit Insurance Corporation insures balances up to $250,000. At times, the Company may maintain balances in excess of the federally insured limits.

Recent Accounting Pronouncements

The FASB issues ASUs to amend the authoritative literature in ASC. There have been a number of ASUs to date, that amend the original text of ASC. Management believes that those issued to date either (i) provide supplemental guidance, (ii) are technical corrections, (iii) are not applicable to us or (iv) are not expected to have a significant impact on our balance sheet.

NOTE 3 – COMMITMENTS AND CONTINGENCIES

The Company is not currently involved with and does not know of any pending or threatening litigation against the Company or its members.

NOTE 4 – STOCKHOLDERS’ EQUITY

Common Stock

We have authorized the issuance of 75,000,000 shares of our common stock with a par value of $0.001.

Preferred Stock

We have authorized the issuance of 10,000,000 shares of our preferred stock with par value of $0.001.

SECURLINX CORPORATION

CEO CERTIFICATION

I, Barry Hodge, the Chief Executive Officer of Securlinx Corporation, hereby certify that the financial statements of Securlinx Corporation and notes thereto for the period ending September 30, 2024 included in this Form C offering statement are true and complete in all material respects.

IN WITNESS THEREOF, this Principal Executive Officer's Financial Statement Certification has been executed as of the January 17, 2024

_______________________ (Signature)

October 24, 2024

05.08.24

Q1 2024 Financial Report

SECURLINX CORPORATION QUARTERLY REPORT

and

FINANCIAL STATEMENT

(UNAUDITED)

AS OF

March 31, 2024

SECURLINX CORPORATION

Index to Report

(unaudited)

FINANCIAL STATEMENT.. 3

NOTES TO FINANCIAL STATEMENT AS OF MARCH 31, 2024. 5

CEO CERTIFICATION AS OF MARCH 31, 2024. 10

NOTES TO FINANCIAL STATEMENT AS OF MARCH 31, 2024

(unaudited)

NOTE 1 – NATURE OF OPERATIONS

SECURLINX CORPORATION was formed on April 1, 2004 (“Inception”) in the State of DELAWARE. The balance sheet of SECURLINX CORPORATION (which may be referred to as the "Company,” “Securlinx,” "we," "us," or "our") are prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The Company’s headquarters are located in Ft. Myers, FL.

We design and deploy biometric identity solutions that improve security while reducing complexity, costs and risks. We take an enterprise-wide approach that centralizes the collection and management of all types of biometric, whether a fingerprint, palm vein, facial image or iris scan.

Our powerful solutions open the way for your organization to drive critical identity verification functions across all your operations and processes from a single platform, integrating your systems, devices and workflow. That translates into a simpler, faster, more reliable way to validate and communicate identity data with confidence.

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The accounting and reporting policies of the Company conform to accounting principles generally accepted in the United States of America (“US GAAP”).

Use of Estimates

The preparation of balance sheet in conformity with US GAAP requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities, and the reported amount of revenues and expenses during the reporting period. Actual results could materially differ from these estimates. It is reasonably possible that changes in estimates will occur in the near term.

Fair Value of Financial Instruments

Fair value is defined as the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants as of the measurement date. Applicable accounting guidance provides an established hierarchy for inputs used in measuring fair value that maximizes the use of observable inputs and minimizes the use of unobservable inputs by requiring that the most observable inputs be used when available. Observable inputs are inputs that market participants would use in valuing the asset or liability and are developed based on market data obtained from sources independent of the Company. Unobservable inputs are inputs that reflect the Company’s assumptions about the factors that market participants would use in valuing the asset or liability. There are three levels of inputs that may be used to measure fair value:

| Level 1 | - Observable inputs that reflect quoted prices (unadjusted) for identical assets or liabilities in active markets. |

| Level 2 | - Include other inputs that are directly or indirectly observable in the marketplace. |

| Level 3 | - Unobservable inputs which are supported by little or no market activity. |

The fair value hierarchy also requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value.

Fair-value estimates discussed herein are based upon certain market assumptions and pertinent information available to management as of Inception. Fair values were assumed to approximate carrying values because of their short term in nature or they are payable on demand.

Risks and Uncertainties

THE COMPANY'S BUSINESS INVOLVES ELEMENTS OF RISK. IN MANY INSTANCES, THESE RISKS ARISE FROM FACTORS OVER WHICH THE COMPANY HAS LITTLE OR NO CONTROL. SOME ADVERSE EVENTS MAY BE MORE LIKELY THAN OTHERS AND THE CONSEQUENCE OF SOME ADVERSE EVENTS MAY BE GREATER THAN OTHERS. NO ATTEMPT HAS BEEN MADE TO RANK RISKS IN THE ORDER OF THEIR LIKELIHOOD OR POTENTIAL HARM. EACH SUBSCRIBER IS URGED AND EXPECTED TO CONSULT WITH SUCH SUBSCRIBER’S OWN ADVISOR OR ADVISORS FOR ASSISTANCE IN EVALUATING THE MERITS AND RISKS OF AN INVESTMENT IN THE UNITS. IN ADDITION TO THOSE RISKS ENUMERATED ELSEWHERE IN THIS MEMORANDUM, SUBSCRIBERS SHOULD ALSO CAREFULLY CONSIDER THE FOLLOWING FACTORS:

The Company cannot reasonably project future gains or losses due to the nature of the operations of the Company.

The Company is principally an intellectual property holding company that anticipates all future revenues shall be due to the efforts of the Company to realize and protect certain intellectual properties, license such intellectual property, and acquire or be acquired by another business entity.

The Company’s investment in the Affiliates could adversely affect the financial condition of the Company.

None of the Affiliates of the Company are profitable nor can the Company provide any assurance of the profitability of any of the Affiliates in the future. As a result, the investments by the Company in the Affiliates could be substantially negatively affected and, as a result, the financial condition could be adversely affected.

Our revenue model may change.

Our success depends on our ability to generate revenue from multiple sources. We may not be able to successfully generate revenue. If we do not generate such revenue, our business, financial condition and operating results will be materially adversely affected.

Efforts to patent critical technologies and maximize registration of intellectual property may not be successful.

New patent activity from other companies could affect and alter the ability to obtain and license proprietary properties. Additionally, the possibility exists that our efforts could infringe on the proprietary rights of other persons or parties. Competitive patent activity is always a risk, and U.S. patent applications are unpublished for one year. Although the Company intends to protect its rights with respect to intellectual property, the Company cannot provide any assurance that such activities will be successful or that the Company’s efforts will not adversely affect the operations of the Company.

There is no minimum offering and additional financing may be required.

The Company may sell some or all of the Units offered hereby at different times over the term of this Memorandum. There is no minimum amount required for the Company to close on any subscriptions. If less than the maximum number of Units are sold in this Offering and the Company is unable to obtain alternative sources of financing, the operations of the Company would be constrained and would require an even greater amount of additional financing than would be required if the maximum number of Units were sold. In such event, the investors in this Offering will be subject to greater risk than would be the case if the maximum number of Units were sold. The Company anticipates that it may require additional financing immediately after the termination of this Offering to meet the demands of its expected growth.

The Company cannot ensure that an investor will qualify for favorable tax benefits as a result of an investment in the Company.

Each investor in the Company is urged to consult with his or her tax advisor regarding the applicability of any and all tax effects from investing in the Company.

The Company’s market is subject to rapid change and advancements in new technology.

The market in which the Company competes is characterized by rapid technological change. Existing products become obsolete and unmarketable when products using new technologies are introduced and new industry standards emerge.

The Company is subject to personnel risks.

Continued success of the Company is dependent upon its ability, in a competitive environment, to attract and retain qualified personnel. For example, the Company is dependent upon the services of its researchers and managers. The Company’s operations could be adversely affected if, for any reason, any key personnel cease to be active with such respective Company’s management. To meet our growth projections will require the recruitment, retention, and integration of additional highly qualified individuals. Even if such personnel can be hired, the projected growth in staff could present further management risks. The market for qualified personnel is highly competitive and there can be no assurances that these critical positions can be filled on a timely basis.

Shares available for future issuance may dilute your investment.

In the aggregate, and assuming this Offering is fully subscribed, the Company will have sixty million (60,000,000) shares issued and outstanding, on a fully diluted basis. The Company may authorize the issuance of additional shares in the future. Except as otherwise set forth in this Memorandum, its attachments and exhibits, or as set forth in the Company’s Operating Agreement, the availability of these shares and their potential future issuance may be dilutive and could adversely affect the value per Share of the Stock. The Company could also issue shares at a later date at less than the Offering price set forth in this Memorandum.

The offering price was arbitrarily determined.

The Offering price for the Units has been arbitrarily determined by the Company and may not necessarily bear any relationship to the assets, book value, potential earnings or net worth of the Company or any other recognized criteria of value and should not be considered to be an indication of the actual value of the Company or the Units offered herein.

Restricted Securities; Lack of Public Market.

The sale of the Units offered hereby has not been registered under the Securities Act or any state securities laws and, accordingly, the Units will constitute “restricted securities” as defined in Rule 144 promulgated under the Securities Act. The Units may not be offered, sold or otherwise transferred, encumbered or hypothecated unless registered under the Securities Act and any applicable state securities laws or unless exempt from such registration. The holders of the Units will have no rights to require the Company to register the Units under the Securities Act. Potential investors, therefore, may find it difficult or impossible to liquidate their investment at a time when they desire to do so and, consequently, must be prepared to hold the Units for an indefinite period of time.

New market entrants pose a threat to our business.

Existing or future competitors may develop or offer services that are comparable or superior to ours. Such a scenario would have a material adverse effect on our business, results of operations, and financial condition.

Our business may require us to develop certain strategic alliances for commercialization of certain research and development.

We expect that we may need to forge strategic alliances with other companies. We may never be able to develop these alliances, or if we do, we may not be able to continue them on favorable commercial or licensing terms. Our inability to develop new strategic alliances could have a material adverse affect on our business, results of operations and financial condition.

The operations of the Company are speculative, may be unprofitable, and may result in the total loss of your investment.

The operations of the Company and their related operations are speculative and involve the possibility of a total loss of investment. The Company’s operations and activities may be unprofitable due to any number of considerations. Investment is suitable only for individuals who are financially able to withstand a total loss of their investment.

Market conditions may make raising future capital difficult.

A significant downturn in the national or global economy may cause a general disinclination to invest in companies such SecurLinx Holding. Consequently, investors may be reluctant to invest in us in further rounds of financing. Further, commercial banks and other sources of debt financing are often reluctant to lend money to entities whose assets and potential revenue generation are difficult to value or to predict. As a result, we may not be able to obtain necessary levels of financing as a going concern.

Interest rates could adversely affect the Company making debt service and borrowing more difficult or financially unsustainable.

Market conditions could substantially affect interest rates and thereby affect the ability of the Company to borrow necessary funds or to enter into certain debt instruments. The ability of the Company to borrow necessary funds could adversely affect the ability of the Company to respond to certain market conditions or business opportunities.

Our business could grow too rapidly for us to effectively manage the growth.

Our ability to successfully implement our business plan requires an effective planning and growth-management process. If we are unable to manage our growth, we may not be able to implement our business plan, and our business may suffer as a result. We expect that we will have to expand our business to address potential growth in the number of customers, to expand our product and service offerings and to pursue other market opportunities. We expect that we will need to continue to improve our operational, financial and inventory systems, procedures and controls, and will need to expand, train and manage our workforce. We can give no guarantee that we will be successful in these efforts.

These adverse conditions could affect the Company's financial condition and the results of its operations.

Cash and Cash Equivalents

For purpose of the statement of cash flows, the Company considers all highly liquid debt instruments purchased with an original maturity of three months or less to be cash equivalents.

Revenue Recognition

The Company will recognize revenues from our middleware platform transactions when (a) pervasive evidence that an agreement exists, (b) the product or service has been delivered, (c) the prices are fixed and determinable and not subject to refund or adjustment, and (d) collection of the amounts due are reasonably assured.

Income Taxes

The Company applies ASC 740 Income Taxes (“ASC 740”). Deferred income taxes are recognized for the tax consequences in future years of differences between the tax bases of assets and liabilities and their financial statement reported amounts at each period end, based on enacted tax laws and statutory tax rates applicable to the periods in which the differences are expected to affect taxable income. Valuation allowances are established, when necessary, to reduce deferred tax assets to the amount expected to be realized. The provision for income taxes represents the tax expense for the period, if any and the change during the period in deferred tax assets and liabilities.

ASC 740 also provides criteria for the recognition, measurement, presentation and disclosure of uncertain tax positions. A tax benefit from an uncertain position is recognized only if it is “more likely than not” that the position is sustainable upon examination by the relevant taxing authority based on its technical merit.

Concentration of Credit Risk

The Company maintains its cash with a major financial institution located in the United States of America, which it believes to be creditworthy. The Federal Deposit Insurance Corporation insures balances up to $250,000. At times, the Company may maintain balances in excess of the federally insured limits.

Recent Accounting Pronouncements

The FASB issues ASUs to amend the authoritative literature in ASC. There have been a number of ASUs to date, that amend the original text of ASC. Management believes that those issued to date either (i) provide supplemental guidance, (ii) are technical corrections, (iii) are not applicable to us or (iv) are not expected to have a significant impact our balance sheet.

NOTE 3 – COMMITMENTS AND CONTINGENCIES

The Company is not currently involved with and does not know of any pending or threatening litigation against the Company or its member.

NOTE 4 – STOCKHOLDERS’ EQUITY

Common Stock

We have authorized the issuance of 75,000,000 shares of our common stock with par value of $0.001.

We have authorized the issuance of 10,000,000 shares of our common stock with par value of $0.001.

SECURLINX CORPORATION

CEO CERTIFICATION AS OF MARCH 31, 2024

I, Barry Hodge, the Chief Executive Officer of Securlinx Corporation, hereby certify that the financial statements of Securlinx Corporation and notes thereto for the period ending December 31, 2023 included in this Form C offering statement are true and complete in all material respects.

IN WITNESS THEREOF, this Principal Executive Officer's Financial Statement Certification has been executed as of the January 17, 2024

_______________________ (Signature)

CEO

MAY 8, 2024

10.18.22

Campaign Closed

We have closed our campaign and wish to welcome our new investors. We will be providing quarterly updates on our progress in the month following the close of the quarter. We will not receive a list of the new email addresses for 60 days so you should look for your first update at the close of Q1 2023. The year-end update will be available here. You may contact us at mail.securlinx.com any time. Thank you for your support.

Regards,

Barry

10.17.22

Thank You

With one day left in our campaign, I would like to thank each investor who has chosen to join us and invite those who are still considering an investment to take advantage of the remaining bonus offers. Welcome aboard!

10.11.22

Less Than a Week To Go!

Thank you to all of the new investors who have chosen to join us on our journey. Welcome to the Securlinx family. It is still not too late to become a part of the team. 6 days remain in our campaign.

10.07.22

Beta Site Update

We now have our primary beta sites for healthcare and education in production. The healthcare site is installed at an insulin therapy clinic in Clearwater, FL. As I previously mentioned, the start date for the first patient usage was delayed by the hurricane and now scheduled for October 24. The education site has received training. Functionality is demonstrated in these explainer videos.

Securport for Healthcare – Securlinx

Securport for Education - Securlinx

10.03.22

Only Two Weeks Remaining

We are down to the last 14 days of our offering! Tier bonuses and Start Engine Owner's bonus are still available. Please join us before the clock strikes midnight.

09.29.22

Recovery from Ian

We have had both key customers and key employees affected by hurricane Ian in SW and Central Florida. The good news is everyone has emerged safely from the devastation. Our beta site may be delayed in engaging their first patients by a week or so, but we do not expect the impact to be long term. Florida has a history of these events, and their agencies were prepared for the aftermath. The next few days will be hectic and complete recovery is months if not years away for those whose property and civil infrastructure have been damaged. For Securlinx, with the exceptions listed above we consider ourselves fortunate. It could have been much worse. Our thoughts and prayers go out to those who have suffered irreparable loss. Onward and upward.

09.20.22

Who Are We?

Securlinx is a biometric middleware company. But that is what we do, not who we are. Who we are is hinted in our name. We believe every individual should have access to a unique digital ID that securely links them to their personal information. That may be connecting you and your healthcare provider to your medical record or assuring your children are only dismissed to a person you have authorized to pick them up. Paramount in our passion is each of us should have control of that identity in cyberspace. Committed to providing trusted secure digital identity for you is who we are.

09.15.22

Securlinx and Region IV Head Start Association

Securport for Early Childhood Education Securlinx will be presenting at the Region IV Head Start Association Conference on Wednesday, September 21. Our Securport for Early Childhood Education platform will be demonstrated to prospective beta users. The presentation will include a live demonstration of our production system.

REWARDS

10%

Stack Venture Club & Rewards!

Members get an extra 10% shares in addition to rewards below!

Venture Club

Venture Club Members earn 10% bonus shares on top of this and all eligible investments for an entire year. Not a member? Sign up at checkout ($275/year).

$500

$500 | Tier 1

Invest $500+ and receive access to our Private Investor Group

$2,500

$2,500+ | Tier 2

Invest $2,500 and receive access to our Private Investor Group + 5% bonus shares.

$5,000

$5,000+ | Tier 3

Invest $5,000 and receive access to our Private Investor Group + 10% bonus shares.

$10,000

$10,000+ | Tier 4

Invest $10,000 and receive access to our Private Investor Group + 15% bonus shares.

$15,000

$15,000+ | Tier 5

Invest $15,000 and receive access to our Private Investor Group + 20% bonus shares.

$20,000

$20,000+ | Tier 6

Invest $20,000 and receive access to our Private Investor Group + 25% bonus shares + Zoom call with the CEO.

JOIN THE DISCUSSION

0/2500

Joanem Michel

3 years ago

Too expensive !!!

0

0

Donald Mader

3 years ago

Nice Concept, My wife and I are interested in investing in this company. Have concerns about your revenue projections also will like to have more information on your past year financials, interested in investing with significant amount. Thank you in advance for this information

Show more

6

0

Vilem Fruhbauer

3 years ago

Hello, it seems like the revenues are kind of flat over the past three years. Some questions please: 1) What is the source of revenue? 2) Is there any hope to achieve an explosive growth with what you have and how? For the past six months the unaudited revenues are $293K 3) What was your churn during the same six months and if everything stays constant how much runway do you currently have? Thank you, V.

Show more

1

0

elliott sofidiya

3 years ago

I'd like to know the following: 1) Is this based on blockchain technology? 2) Can this be used by the government to protect individuals information such as social security number? 3) Can the government use it as an ID Token to protect individuals? Thanks. Elliott Sofidiya (SE Investor)

Show more

1

0

Vishal Ohri

3 years ago

Hello, #1) What the revenue YTD? #2) How is this technology better than competitors? Thanks!

Show more

4

0

W Kim Colich

3 years ago

Hi, Do you own any patents for your technology? Thanks.

1

0

HOW INVESTING WORKS

Cancel anytime before 48 hours before a rolling close or the offering end date.

WHY STARTENGINE?

REWARDS

We want you to succeed and get the most out of your money by offering rewards and memberships!

SECURE

Your info is your info. We take pride in keeping it that way!

DIVERSE INVESTMENTS

Invest in over 200 start-ups and collectibles!

FAQS

With Regulation A+, a non-accredited investor can only invest a maximum of 10% of their annual income or 10% of their net worth per year, whichever is greater. There are no restrictions for accredited investors.

With Regulation Crowdfunding, non-accredited investors with an annual income or net worth less than $124,000 are limited to invest a maximum of 5% of the greater of those two amounts. For those with an annual income and net worth greater than $124,000, they are limited to investing 10% of the greater of the two amounts.

At the close of an offering, all investors whose funds have “cleared” by this time will be included in the disbursement. At this time, each investor will receive an email from StartEngine with their Countersigned Subscription Agreement, which will serve as their proof of purchase moving forward.

Please keep in mind that a company can conduct a series of “closes” or withdrawals of funds throughout the duration of the campaign. If you are included in that withdrawal period, you will be emailed your countersigned subscription agreement and proof of purchase immediately following that withdrawal.

StartEngine assists companies in raising capital, and once the offering is closed, we are no longer involved with whether the company chooses to list shares on a secondary market or what occurs thereafter. Therefore, StartEngine has no control or insight into your investment after the close of the live offering. In addition, we are not permitted to provide financial advice. You may want to contact a financial professional to discuss possible investment outcomes.

For Regulation Crowdfunding, investors are able to cancel their investment at any point throughout the campaign up until 48 hours before the closing of the offering. Note: If the company does a rolling close, they will post an update to their current investors, giving them the opportunity to cancel during this timeframe. If you do not cancel within this 5-day timeframe, your funds will be invested in the company, and you will no longer be able to cancel the investment. If your funds show as ‘Invested’ on your account dashboard, your investment can no longer be canceled.

For Regulation A+, StartEngine allows for a four-hour cancellation period. Once the four-hour window has passed, it is up to each company to set their own cancellation policy. You may find the company’s cancellation policy in the company’s offering circular.

Once your investment is canceled, there is a 10-day clearing period (from the date your investment was submitted). After your funds have cleared the bank, you will receive your refund within 10 business days.

Refunds that are made through ACH payments can take up to 10 business days to clear. Unfortunately, we are at the mercy of the bank, but we will do everything we can to get you your refund as soon as possible. However, every investment needs to go through the clearing process in order to be sent back to the account associated with the investment.

Both Title III (Regulation Crowdfunding) and Title IV (Reg A+) help entrepreneurs crowdfund capital investments from unaccredited and accredited investors. The differences between these regulations are related to the investor limitations, the differing amounts of money companies are permitted to raise, and differing disclosure and filing requirements. To learn more about Regulation Crowdfunding, click here, and for Regulation A+, click here.

Courtney Andrews

3 years ago

Good day to you, Who does Securelinx consider to be their competitors? Also, how does Securelinx differentiate itself from TrustStamp?

Show more

1

0