DiaspoCare

Invest Now

Raised

$131,500

Days Left

Closed

Business Description

Starting with pharmacies, the DiaspoCare fintech platform now services a broad range of both healthcare and other services, such as life insurance. Onboarding of new service providers and new service offerings has accelerated in 2022, showing the extensibility and flexibility of the platform. As of May 2022, DiaspoCare now connects the Diaspora with pharmacies, clinics, hospitals, medical specialists, telemedicine, second opinion, health insurance, life insurance, and funeral insurance. The business model is two-sided, with commissions and fees being collected on either the service provider side or the consumer side. Furthermore, because of the international currency exchange nature of their financial products, there is additional revenue generated for DiaspoCare as a result of the exchange. Wrapping together their entire portfolio is their Care Management and Concierge services, an additional revenue source, with provides further peace of mind through “high touch” coordination of services for the loved ones that the Diaspora are caring for back home. The short term business plan of DiaspoCare is to continue to accelerate the growth of their user base, both on the service provider side and the consumer side through expansion of their marketing efforts and direct outreach. This business plan expands over time to include more countries in Africa, Asia and Latin America, and more products and services for any of the needs of the world’s diaspora and migrant communities.

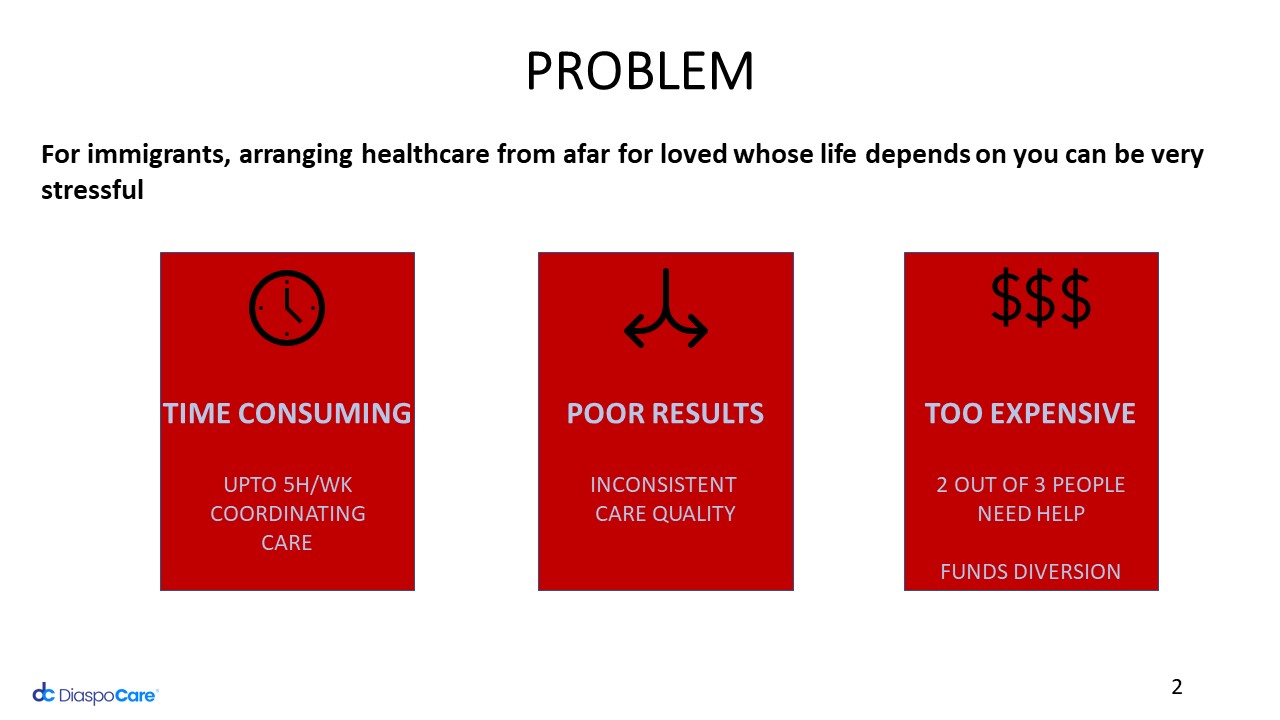

Problem

The founders of DiaspoCare created their platform in 2018 to solve the problems they faced taking care of their loved ones back home. All too often, funds sent to family members to pay for their medical expenses were not used for their intended purpose. Funds might be diverted to other pressing obligations, or spent on sub-standard care, and their health suffers as a result. Transfer fees eat up a large portion of the remittance and the complexities of sending money encourages sending large sums, hoping that the money would go a long way. But this only further intensifies the problem of diverted funds.

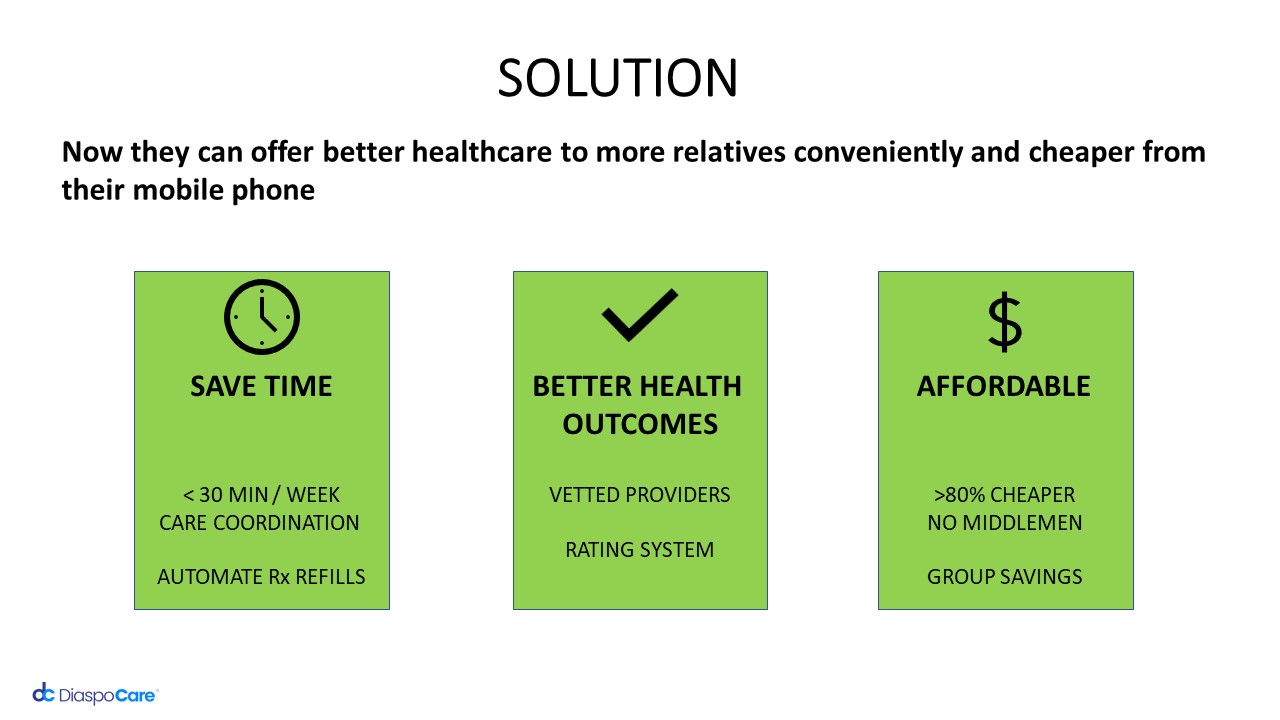

Solution

The DiaspoCare founders created a fintech platform where they could provide micropayments directly from the Diaspora to the healthcare service providers, insuring that remitted funds were spent as intended. This gives complete transparency and control, while saving considerably on fees and time delays. The DiaspoCre fintech platform is fully integrated with the latest mobile money systems very common in Africa, meaning that from the smallest to the largest, healthcare service providers can use the financial tools they are comfortable with. As a solution created by the African Diaspora, for the African Diaspora, it also provides “shared funding” wallets that emulate how large family groups have traditionally pooled their funds for shared benefit. Originally built for pharmacies and clinics, the DiaspoCare fintech platform has proven its flexibility by quickly expanding into many aspects of caring for family members remotely. It now provides a marketplace where the Diaspora can get telemedicine, expert second healthcare opinion, purchase life insurance and other forms of insurance.

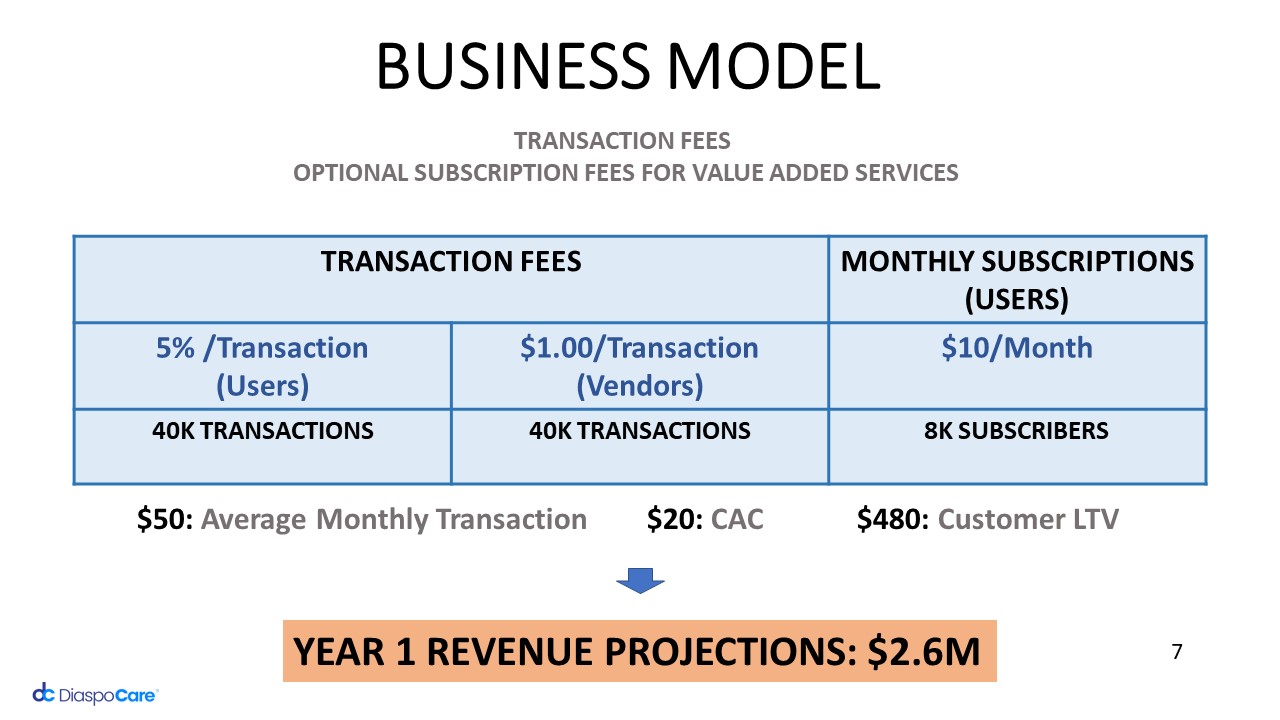

Business Model

The business model is two-sided, with commissions and fees being collected on either the service provider side or the consumer side. This is similar to other “Fintech” platforms (like Uber or VRBO) where buyers can advertise their services and sellers can purchase those services directly. Furthermore, because of the international currency exchange nature of their financial products, there is additional revenue generated for DiaspoCare as a result of the exchange. Wrapping together their entire portfolio is their Care Coordination and Concierge services, an additional revenue source, with provides further peace of mind through “high touch” coordination of services for the loved ones that the Diaspora are caring for back home. The short term business plan of DiaspoCare is to continue to accelerate the growth of their user base, both on the service provider side and the consumer side through expansion of their marketing efforts and direct outreach. The DiaspoCare business is focused on an underserved and untapped market in the African Diaspora living abroad, but is also in high demand in-country and in-region, wherever workers migrate away from their families. This business plan expands over time to include more countries in Africa, Asia and Latin America, and more products and services for any of the needs of the world’s diaspora and migrant communities.

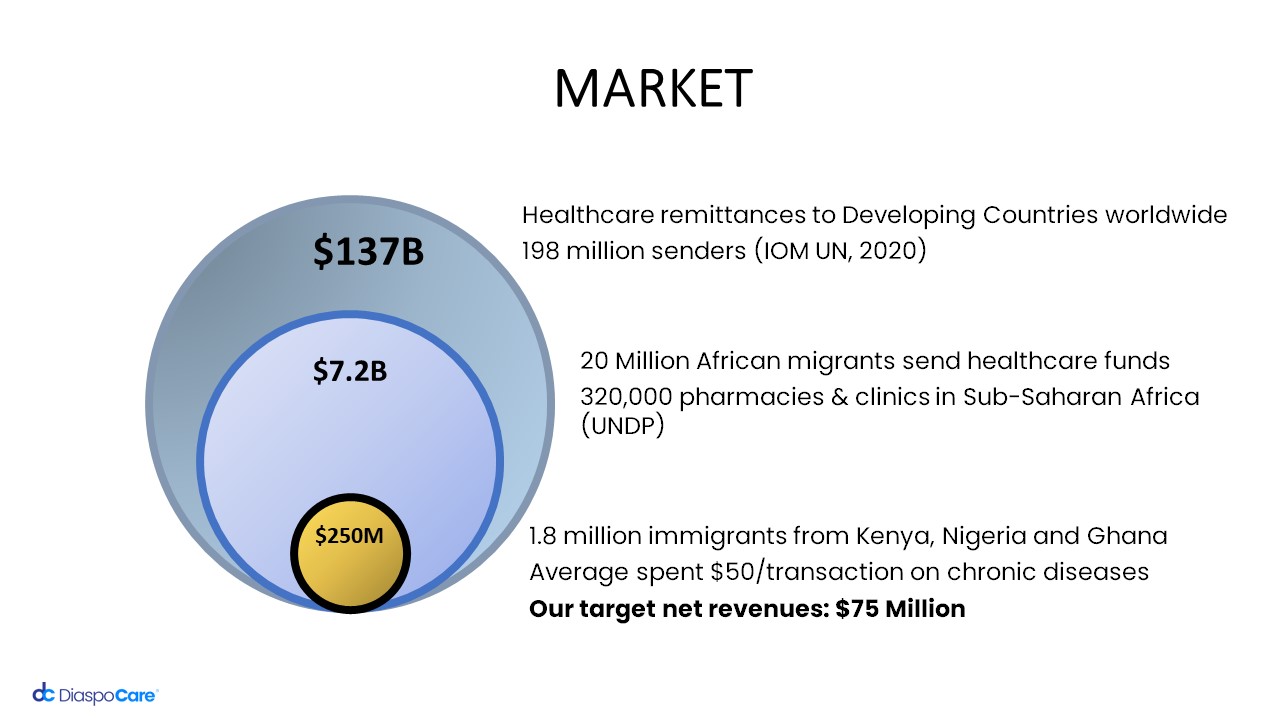

Market Projection

The target market for the initial launch of DiaspoCare focuses on healthcare remittances in Kenya, Nigeria and Ghana. In these three countries alone, 20 million African migrants send $7.2b in healthcare remittances. DiaspoCare’s initial focus is on the management of chronic disease. With the average spend of $50 per transaction, our target net revenue for chronic disease maintenance is $75m.

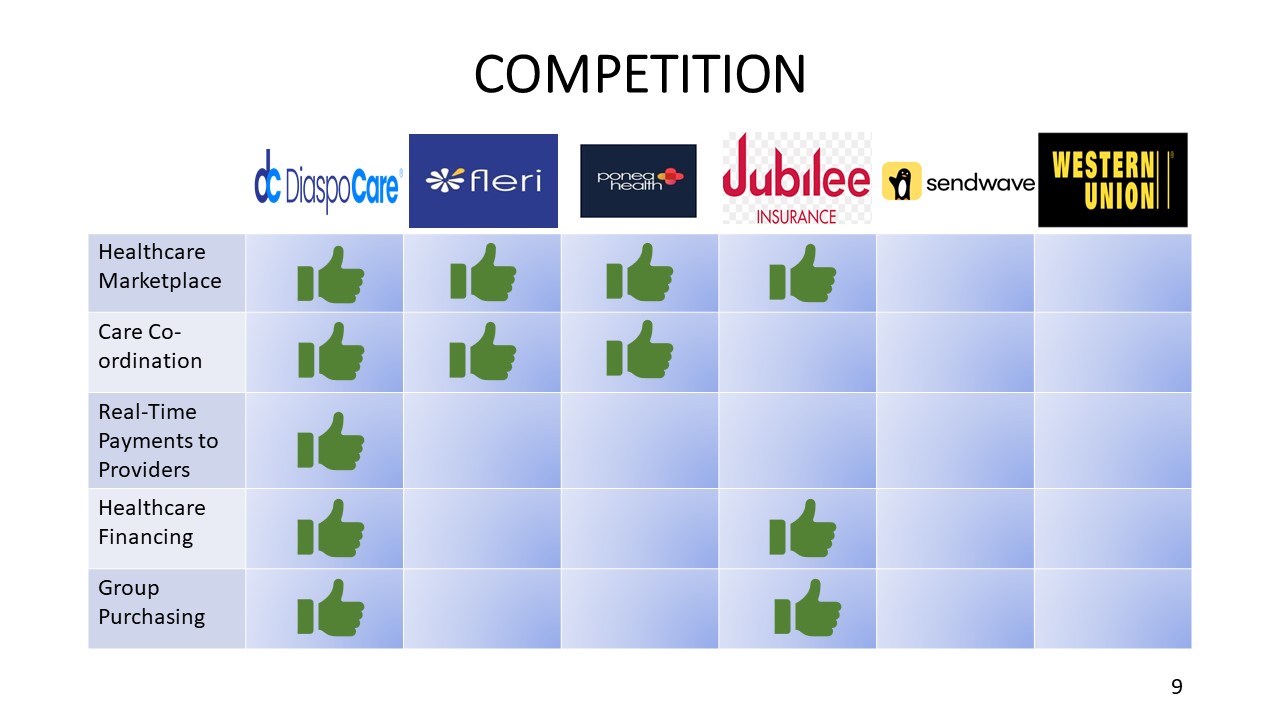

Competition

DiaspoCare provides services in an ecosystem with well established, niche players that provide aspects of the DiaspoCare solution. For example, Moneygram and Western Union are remittance companies, Fleri and My Dawa are healthcare coordination companies, Miesha Meds provides pharmacy services and Jubilee offers insurance. But no company exists that offers an extensible, flexible fintech platform for any accredited healthcare service providers to sell their services directly to the Diaspora. Our two-sided business model is also unique, which allows us to spread our costs and capture revenue from both service providers and consumers. Rather than compete on point solutions, the DiaspoCare platform approach turns competitors into business partners, driving down costs across the ecosystem and connecting previously disconnected consumers with service providers.

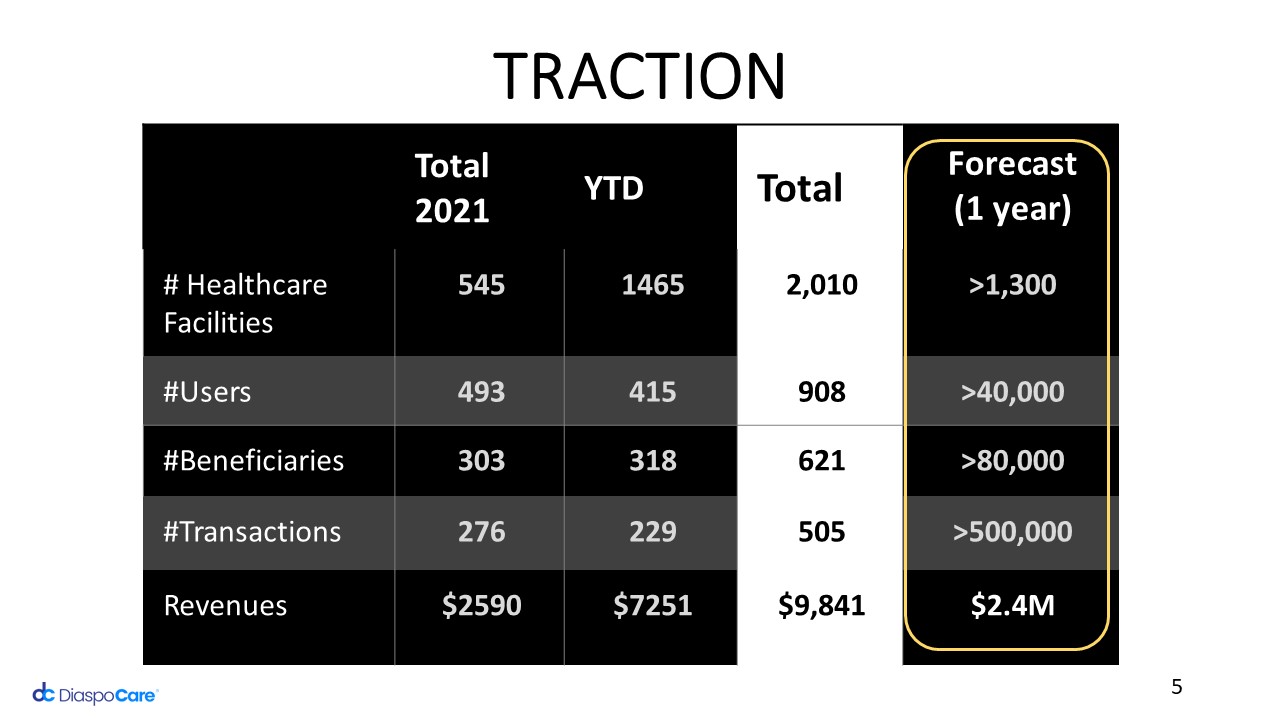

Traction & Customers

The DiaspoCare fintech platform has been in full public operation since May, 2021. After incorporating in May 2018, DiaspoCare began development of our technology platform, which went into limited pilot operations the following year as we continued to test, refine and enhance our offering. For the following two years, DiaspoCare expanded into three countries: Kenya, Ghana and Nigeria. Our service provider network has expanded to over 600 pharmacies and 230 clinics and hospital systems. Because our technology platform allows for quick onboarding of new service offerings, we now offer access to telemedicine, second medical opinion, health insurance and life insurance, in addition to our initial capabilities for pharmacy and clinic services. In the first four months of 2022, DiaspoCare’s operations have accelerated significantly. Transaction counts increased 60%, user accounts grew 50%, beneficiaries on the platform increased 70%, pharmacies increased 20% and clinics have over tripled in number. This rapid acceleration in traction demonstrates the maturity of the DiaspoCare technology platform. New service providers are quickly added to the platform with minimal overhead. As a leading indicator of the excitement of our service delivery partners, DiaspoCare now has seven co-branding / co-marketing MOUs (Memo of Understanding) signed across the healthcare delivery ecosystem. These partnerships are exceptionally valuable, as they bring outside funding for DiaspoCare marketing.

Investors

The DiaspoCare founders have directly funded the development of the fintech platform and the creation of local operations teams in Kenya, Ghana and Nigeria. Building the platform has required many iterations, as the team tested their product in the real world, adjusted and adapted to fit a challenging market. This has required significant investment over the last four years, including technology and business development as well as operations expenses during that period. These investments have allowed DiaspoCare to integrate with major banking and mobile payment companies in Kenya, Nigeria and Ghana. This has required significant technology development investment for both the DiaspoCare operations platform and mobile apps.

Terms

This is an offering of a SAFE, under registration exemption 4(a)(6), in DCare Inc. with a discount rate of 80%. This offering must raise at least $10,000 by April 1st, 2024 at 11:59 pm ET. If this offering doesn’t reach its target, then your money will be refunded. DCare Inc. may raise up to $1,234,000, the offering’s maximum.

Risks

See Offering Statement; A crowdfunding investment involves risk. You should not invest any funds in this offering unless you can afford to lose your entire investment.

In making an investment decision, investors must rely on their examination of the issuer and the terms of the offering, including the merits and risks involved. These securities have not been recommended or approved by any federal or state securities commission or regulatory authority. The U.S. Securities and Exchange Commission does not pass upon the merits of any securities offered or the terms of the offering, nor does it pass upon the accuracy or completeness of any offering document or literature.

These securities are offered under an exemption from registration; however, the U.S. Securities and Exchange Commission has not made an independent determination that these securities are exempt from registration.

Neither PicMii Crowdfunding nor any of its directors, officers, employees, representatives, affiliates, or agents shall have any liability whatsoever arising from any error or incompleteness of fact or opinion in, or lack of care in the preparation or publication of, the materials and communication herein or the terms or valuation of any securities offering.

The information contained herein includes forward-looking statements. These statements relate to future events or future financial performance and involve known and unknown risks, uncertainties, and other factors that may cause actual results to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by these forward-looking statements. You should not place undue reliance on forward-looking statements since they involve known and unknown risks, uncertainties, and other factors, which are, in some cases, beyond the company’s control and which could, and likely will materially affect actual results, levels of activity, performance, or achievements. Any forward-looking statement reflects the current views with respect to future events and is subject to these and other risks, uncertainties, and assumptions relating to operations, results of operations, growth strategy, and liquidity. No obligation exists to publicly update or revise these forward-looking statements for any reason or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

Security Type:

SAFE

Discount Rate

80%

Post Money Valuation:

N/A – SAFE

Investment Bonuses!

None

Regulatory Exemption:

Regulation Crowdfunding – Section 4(a)(6)

Deadline:

April 1, 2024

Minimum Investment Amount:

$1000

Target Offering Range:

$10,000-$1,234,000

*If the sum of the investment commitments does not equal or exceed the minimum offering amount at the offering deadline, no securities will be sold and investment commitments will be cancelled returned to investors.