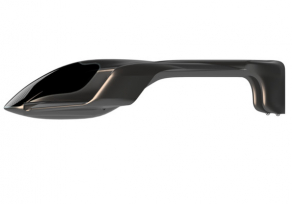

Wind Craft Aviation

Developing a hydrogen-powered eVTOL aircraft that is scheduled for its first flight test this year

Developing a hydrogen-powered eVTOL aircraft that is scheduled for its first flight test this year